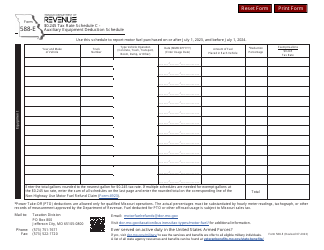

This version of the form is not currently in use and is provided for reference only. Download this version of

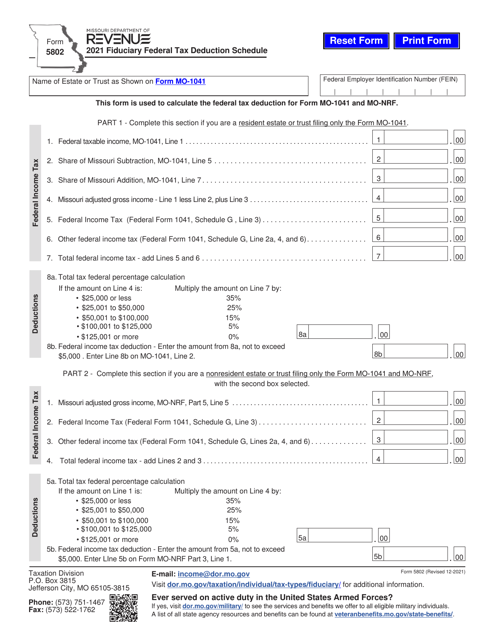

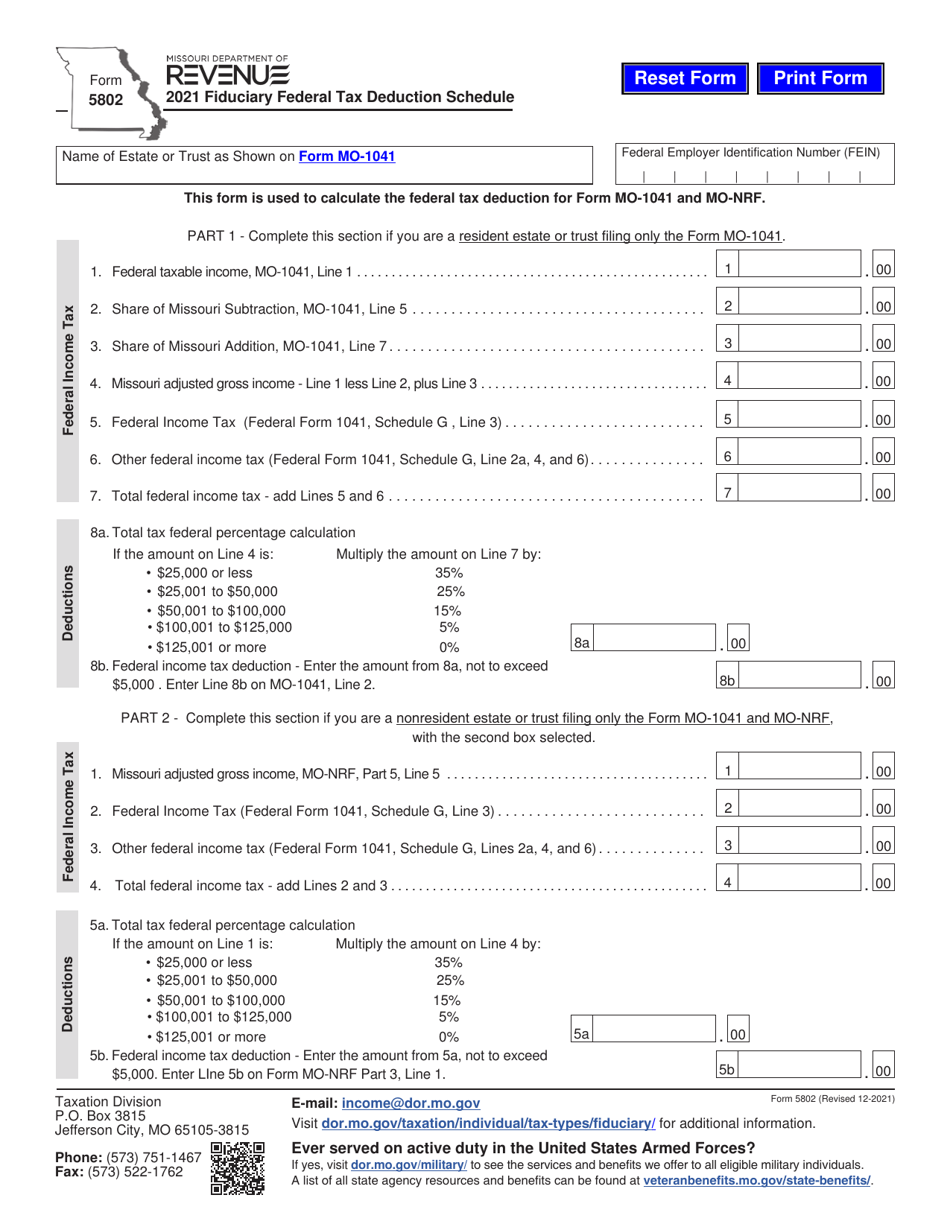

Form 5802

for the current year.

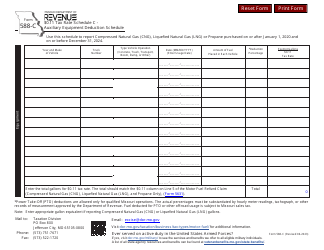

Form 5802 Fiduciary Federal Tax Deduction Schedule - Missouri

What Is Form 5802?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5802?

A: Form 5802 is the Fiduciary Federal Tax Deduction Schedule for Missouri.

Q: Who must file Form 5802?

A: Form 5802 must be filed by fiduciaries in Missouri who are claiming federal tax deductions.

Q: What is a fiduciary?

A: A fiduciary is a person or entity who is responsible for managing and distributing assets on behalf of someone else, such as an executor of an estate or a trustee of a trust.

Q: What is the purpose of Form 5802?

A: The purpose of Form 5802 is to report and claim federal tax deductions for fiduciaries in Missouri.

Q: What information is required on Form 5802?

A: Form 5802 requires the fiduciary to provide information about the estate or trust, the beneficiaries, and the federal tax deductions being claimed.

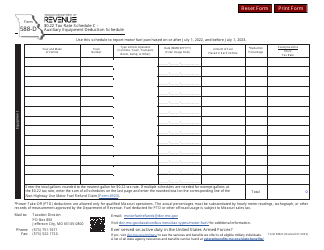

Q: When is Form 5802 due?

A: Form 5802 is due on or before the fifteenth day of the fourth month following the close of the tax year.

Q: Is Form 5802 required for both federal and state tax purposes?

A: No, Form 5802 is only required for state tax purposes in Missouri.

Q: Are there any other forms or schedules that need to be filed along with Form 5802?

A: Depending on the specific circumstances, the fiduciary may need to file other forms or schedules, such as the federal Form 1041 and the Missouri Form MO-1041.

Q: Is there a fee for filing Form 5802?

A: There is no fee for filing Form 5802 in Missouri.

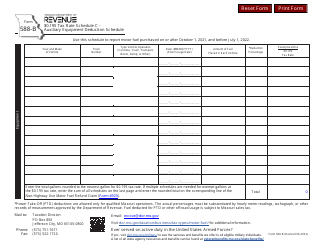

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5802 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.