This version of the form is not currently in use and is provided for reference only. Download this version of

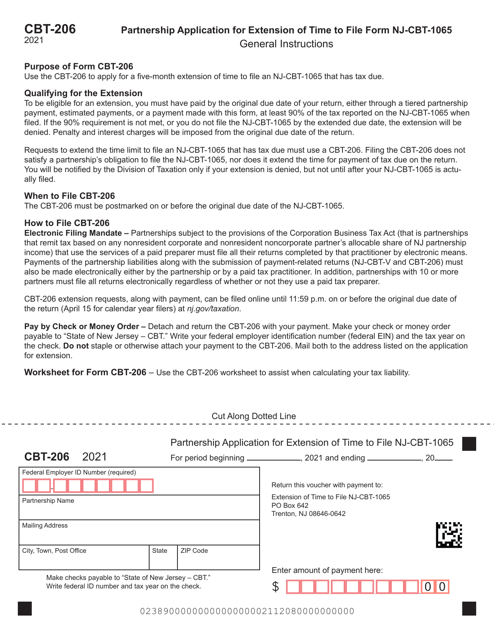

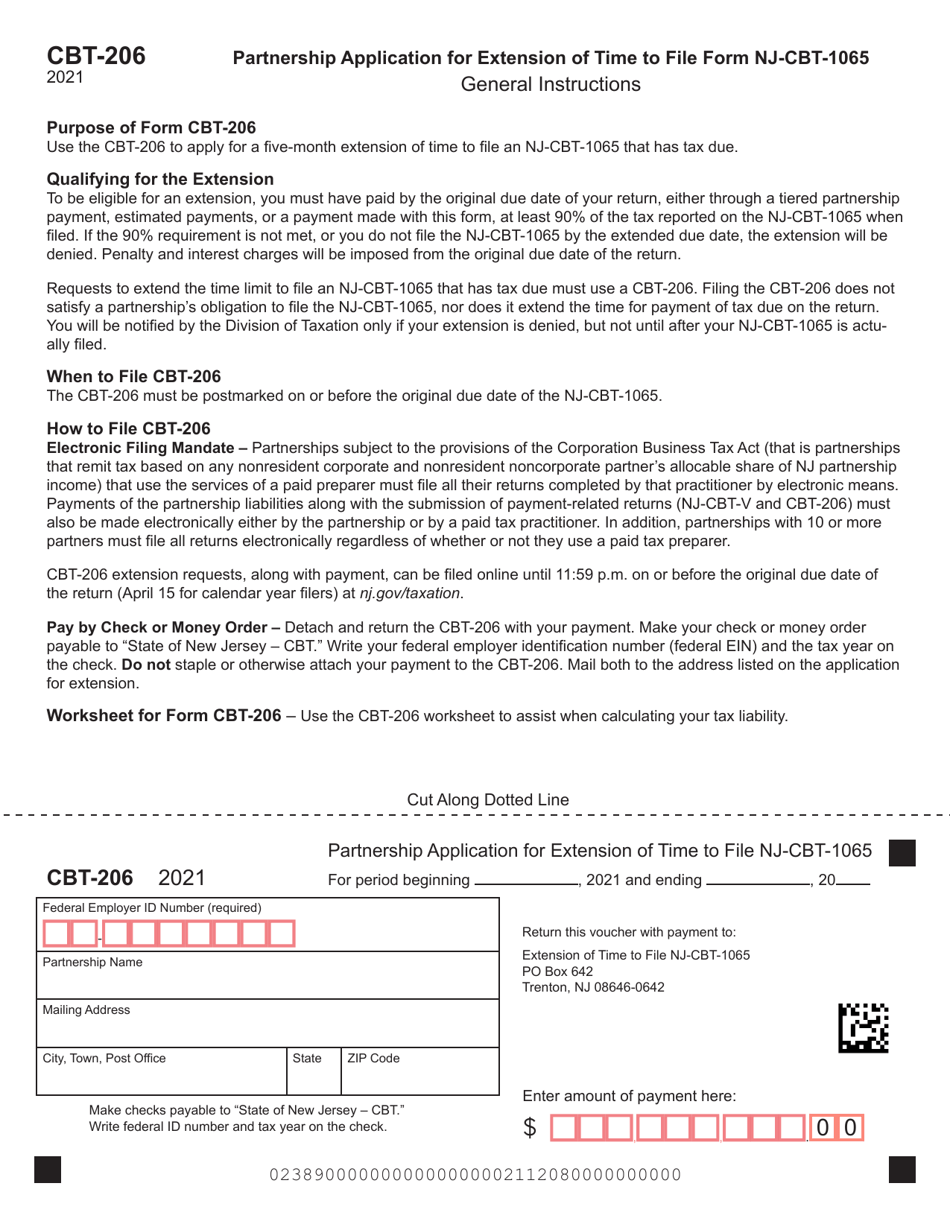

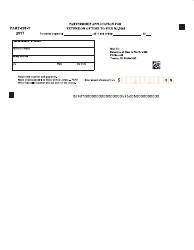

Form CBT-206

for the current year.

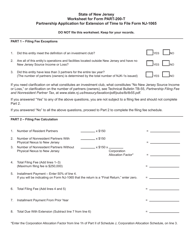

Form CBT-206 Partnership Application for Extension of Time to File Form Nj-Cbt-1065 - New Jersey

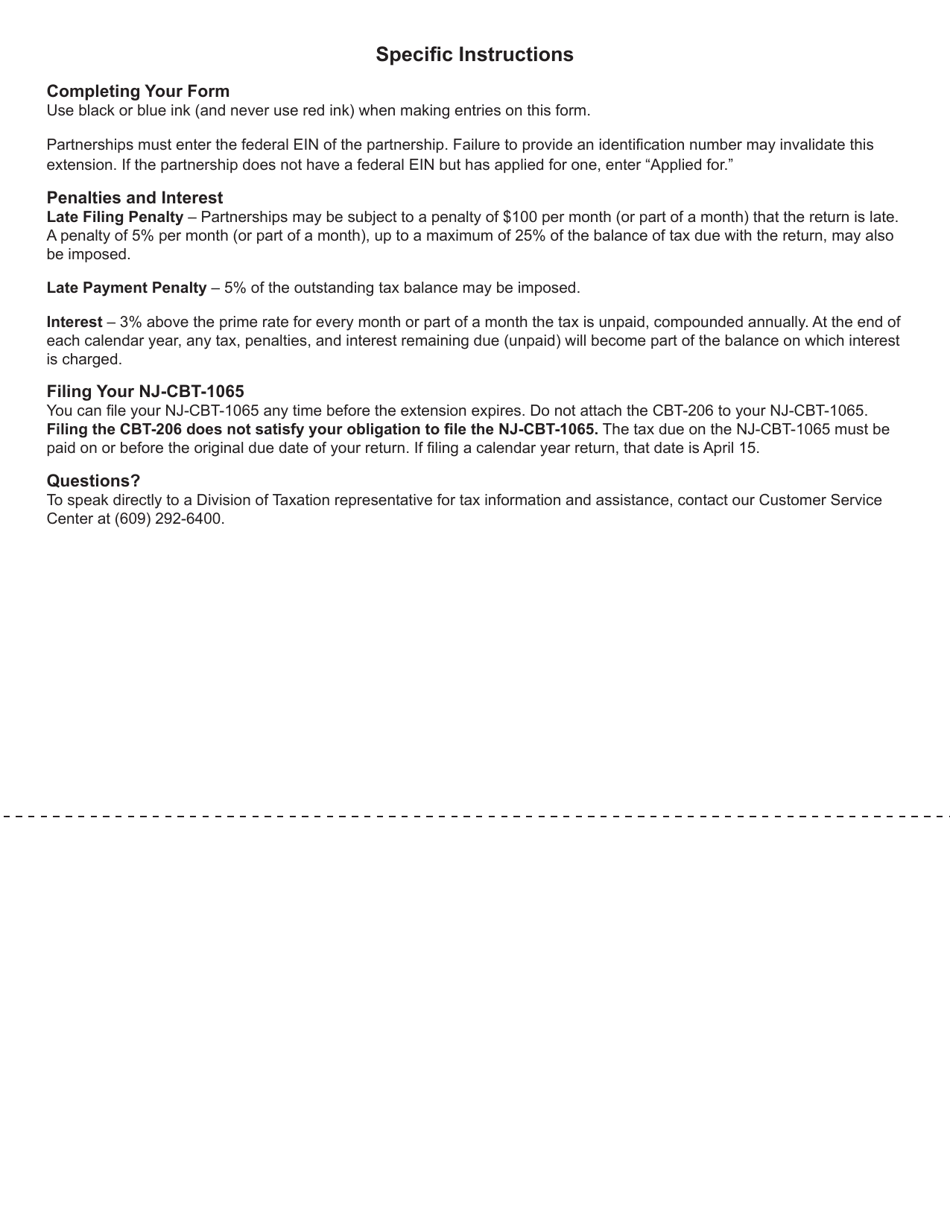

What Is Form CBT-206?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CBT-206?

A: Form CBT-206 is the Partnership Application for Extension of Time to File Form NJ-CBT-1065 in New Jersey.

Q: What is Form NJ-CBT-1065?

A: Form NJ-CBT-1065 is the partnership return form filed in New Jersey.

Q: When is Form NJ-CBT-1065 due?

A: Form NJ-CBT-1065 is generally due on the 15th day of the 4th month following the close of the partnership's tax year.

Q: What is the purpose of Form CBT-206?

A: Form CBT-206 is used to request an extension of time to file Form NJ-CBT-1065.

Q: Who needs to file Form CBT-206?

A: Partnerships in New Jersey that need additional time to file Form NJ-CBT-1065 must file Form CBT-206.

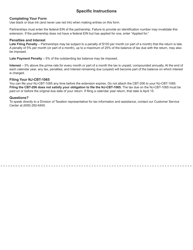

Q: How do I file Form CBT-206?

A: Form CBT-206 can be filed by mail or electronically through the New Jersey Division of Revenue and Enterprise Services.

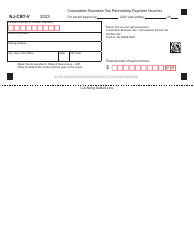

Q: Is there a fee for filing Form CBT-206?

A: Yes, there is a fee for filing Form CBT-206. The fee amount can be found on the form instructions.

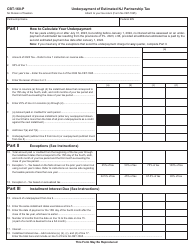

Q: What happens if I don't file Form CBT-206?

A: If you don't file Form CBT-206 and miss the deadline for filing Form NJ-CBT-1065, you may be subject to penalties and interest.

Q: Can I file Form CBT-206 after the due date of Form NJ-CBT-1065?

A: Yes, you can file Form CBT-206 after the due date of Form NJ-CBT-1065, but it must be filed before the extended due date.

Q: Can I get an extension for paying the partnership taxes?

A: No, Form CBT-206 is only for requesting an extension of time to file Form NJ-CBT-1065, not for an extension of time to pay the taxes.

Q: What should I do if I have questions about Form CBT-206?

A: If you have questions about Form CBT-206, you can contact the New Jersey Division of Revenue and Enterprise Services for assistance.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CBT-206 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.