This version of the form is not currently in use and is provided for reference only. Download this version of

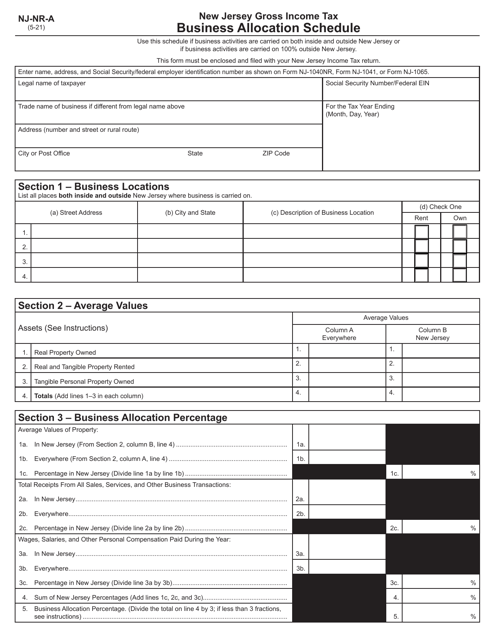

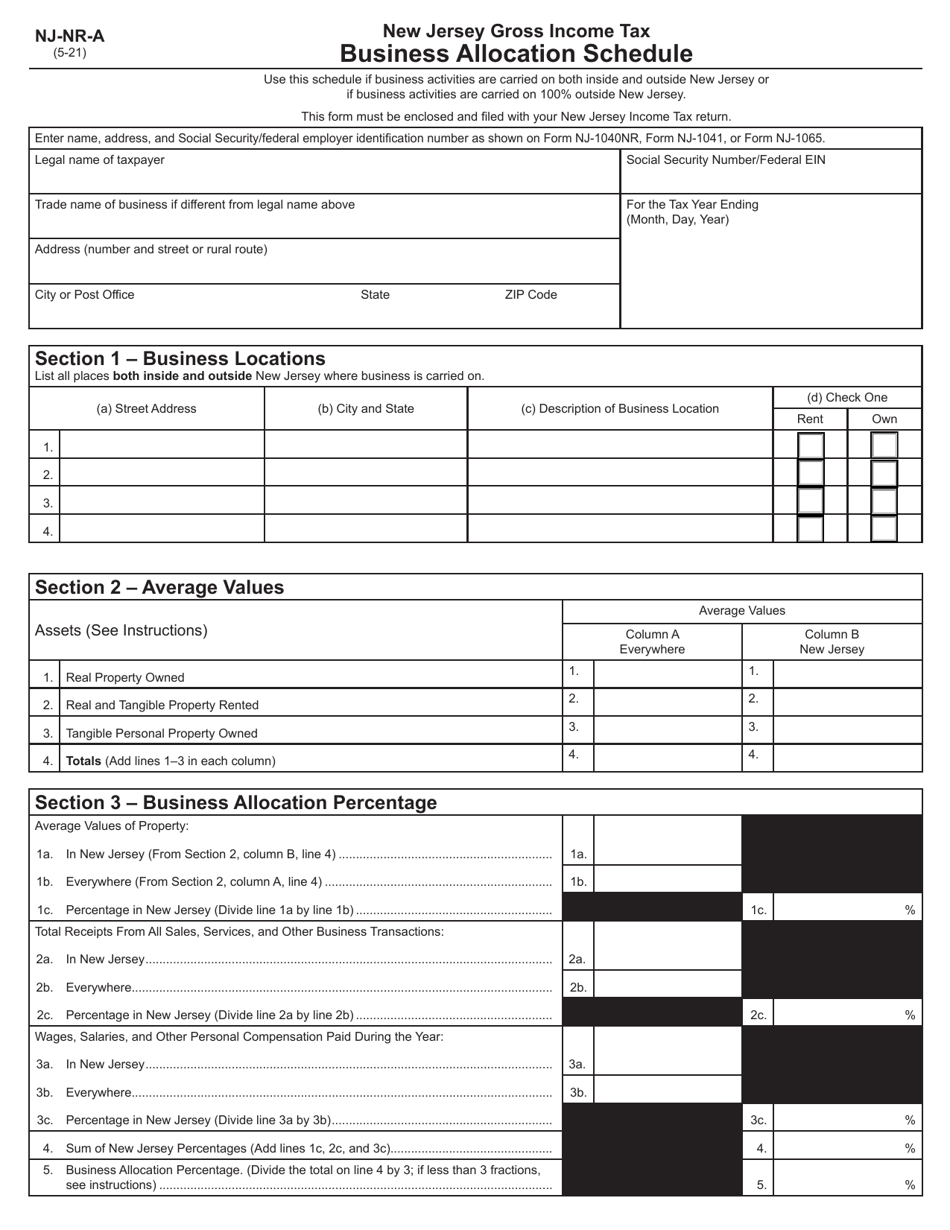

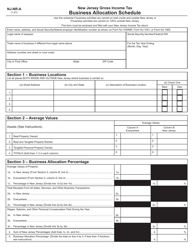

Form NJ-NR-A

for the current year.

Form NJ-NR-A Business Allocation Schedule - New Jersey

What Is Form NJ-NR-A?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

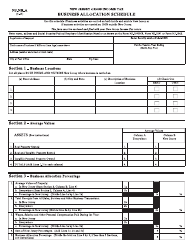

Q: What is the NJ-NR-A Business Allocation Schedule?

A: The NJ-NR-A Business Allocation Schedule is a form used in New Jersey to allocate business income and expenses for non-resident partners or shareholders.

Q: Who is required to file the NJ-NR-A Business Allocation Schedule?

A: Non-resident partners or shareholders who derive income from a New Jersey business are required to file the NJ-NR-A Business Allocation Schedule.

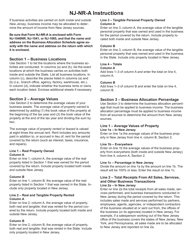

Q: What information will be needed to fill out the NJ-NR-A Business Allocation Schedule?

A: You will need information about the non-resident partner or shareholder, the business they have an interest in, and details about the allocation of income and expenses.

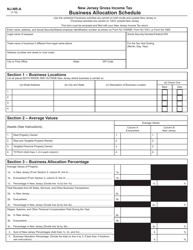

Q: When is the deadline to file the NJ-NR-A Business Allocation Schedule?

A: The deadline to file the NJ-NR-A Business Allocation Schedule is the same as the deadline for filing the New Jersey Partnership Return or the New Jersey Subchapter S Corporation Return, which is generally the 15th day of the fourth month following the close of the tax year.

Q: What happens if I don't file the NJ-NR-A Business Allocation Schedule?

A: Failure to file the NJ-NR-A Business Allocation Schedule may result in penalties and interest.

Q: Are there any exemptions or special rules for filing the NJ-NR-A Business Allocation Schedule?

A: There may be exemptions or special rules for certain types of partnerships or corporations. It is recommended to consult the New Jersey Division of Taxation or a tax professional for specific guidance.

Q: Can I amend the NJ-NR-A Business Allocation Schedule if I make a mistake?

A: Yes, you can file an amended NJ-NR-A Business Allocation Schedule if you discover an error or need to make changes.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-NR-A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.