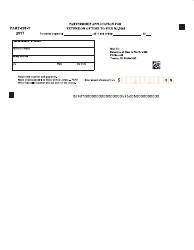

This version of the form is not currently in use and is provided for reference only. Download this version of

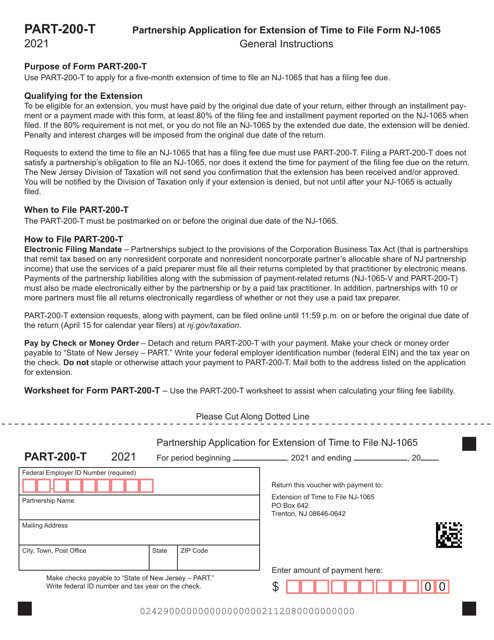

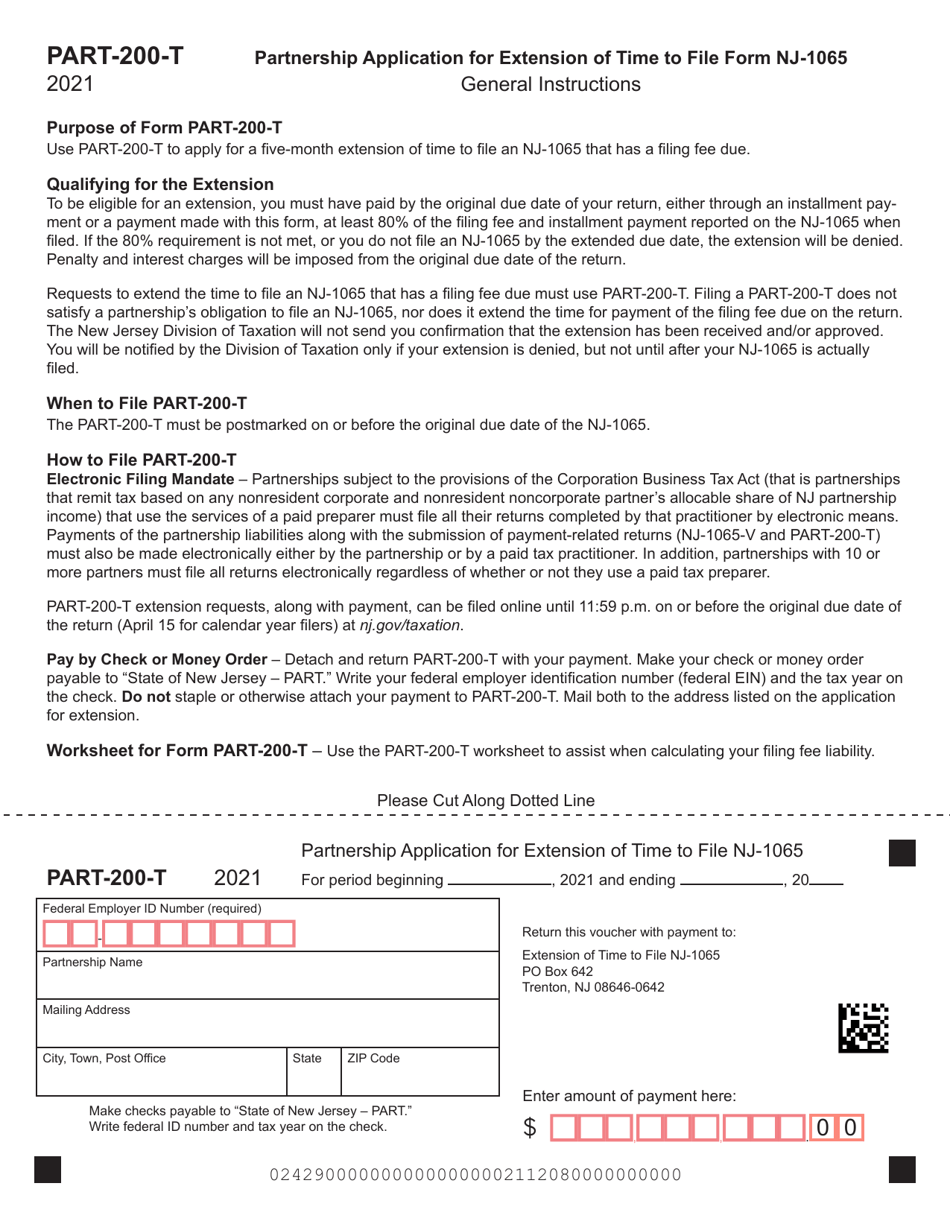

Form PART-200-T

for the current year.

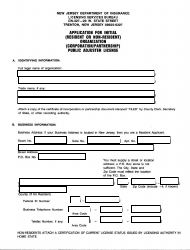

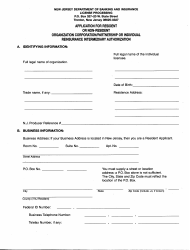

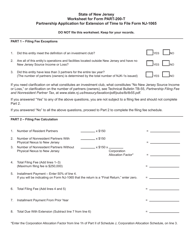

Form PART-200-T Partnership Application for Extension of Time to File Nj-1065 - New Jersey

What Is Form PART-200-T?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

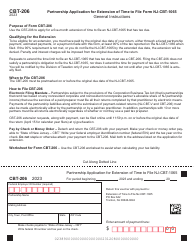

Q: What is PART-200-T?

A: PART-200-T is the form used for filing a Partnership Application for Extension of Time to File NJ-1065 in New Jersey.

Q: What is NJ-1065?

A: NJ-1065 is the tax return form for partnerships in New Jersey.

Q: When is the deadline for filing NJ-1065?

A: The deadline for filing NJ-1065 is usually April 15th, but an extension of time can be requested using PART-200-T.

Q: What is the purpose of the Partnership Application for Extension of Time to File NJ-1065?

A: The purpose of PART-200-T is to request an extension of time to file NJ-1065.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PART-200-T by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.