This version of the form is not currently in use and is provided for reference only. Download this version of

Form NJ-1065E

for the current year.

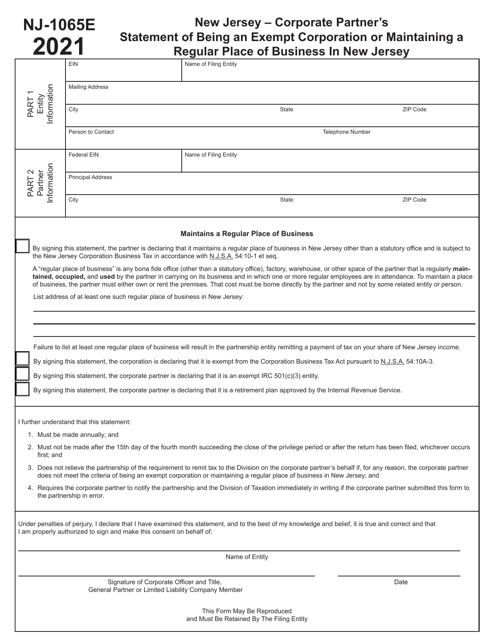

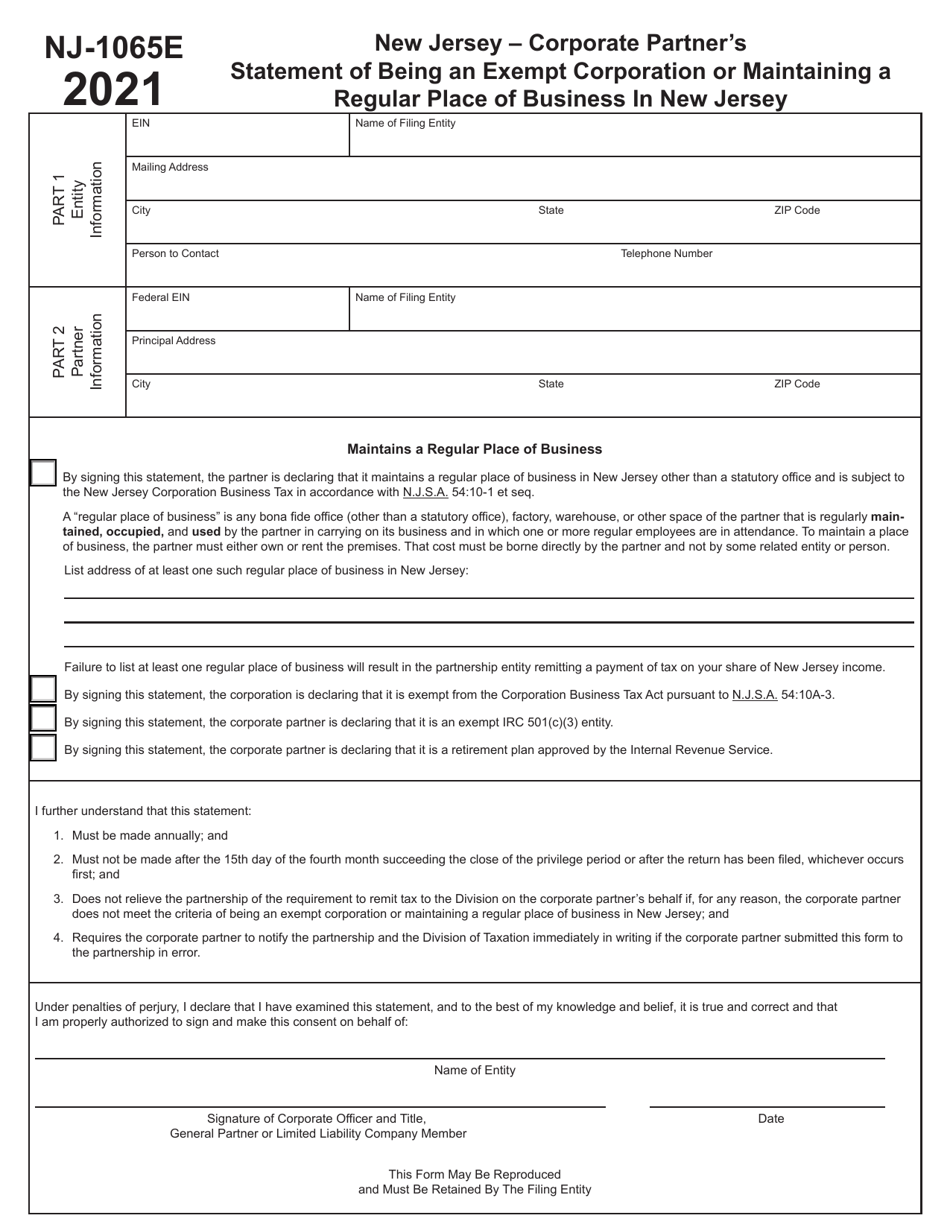

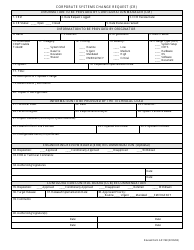

Form NJ-1065E Corporate Partner's Statement of Being an Exempt Corporation or Maintaining a Regular Place of Business in New Jersey - New Jersey

What Is Form NJ-1065E?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1065E?

A: Form NJ-1065E is the Corporate Partner's Statement of Being an Exempt Corporation or Maintaining a Regular Place of Business in New Jersey.

Q: Who needs to file Form NJ-1065E?

A: It should be filed by corporate partners who claim exemption from New Jersey Gross Income Tax or who maintain a regular place of business in New Jersey.

Q: What information is required on Form NJ-1065E?

A: Form NJ-1065E requires the corporation's name, address, federal employer identification number (EIN), and a statement explaining the exemption or the regular place of business.

Q: When is Form NJ-1065E due?

A: Form NJ-1065E is due on or before the 15th day of the fourth month following the close of the corporation's tax year.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1065E by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.