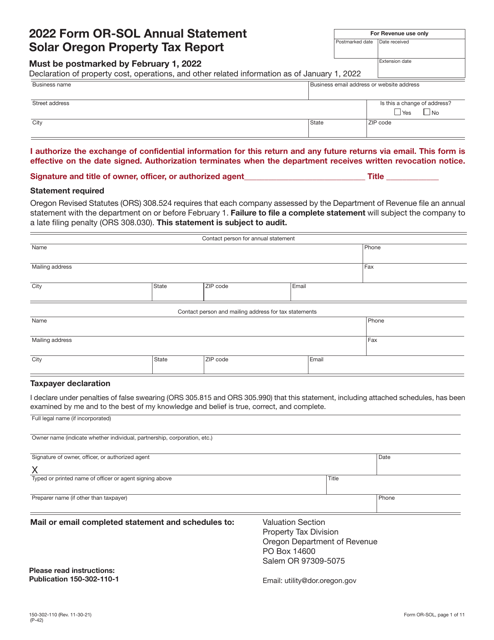

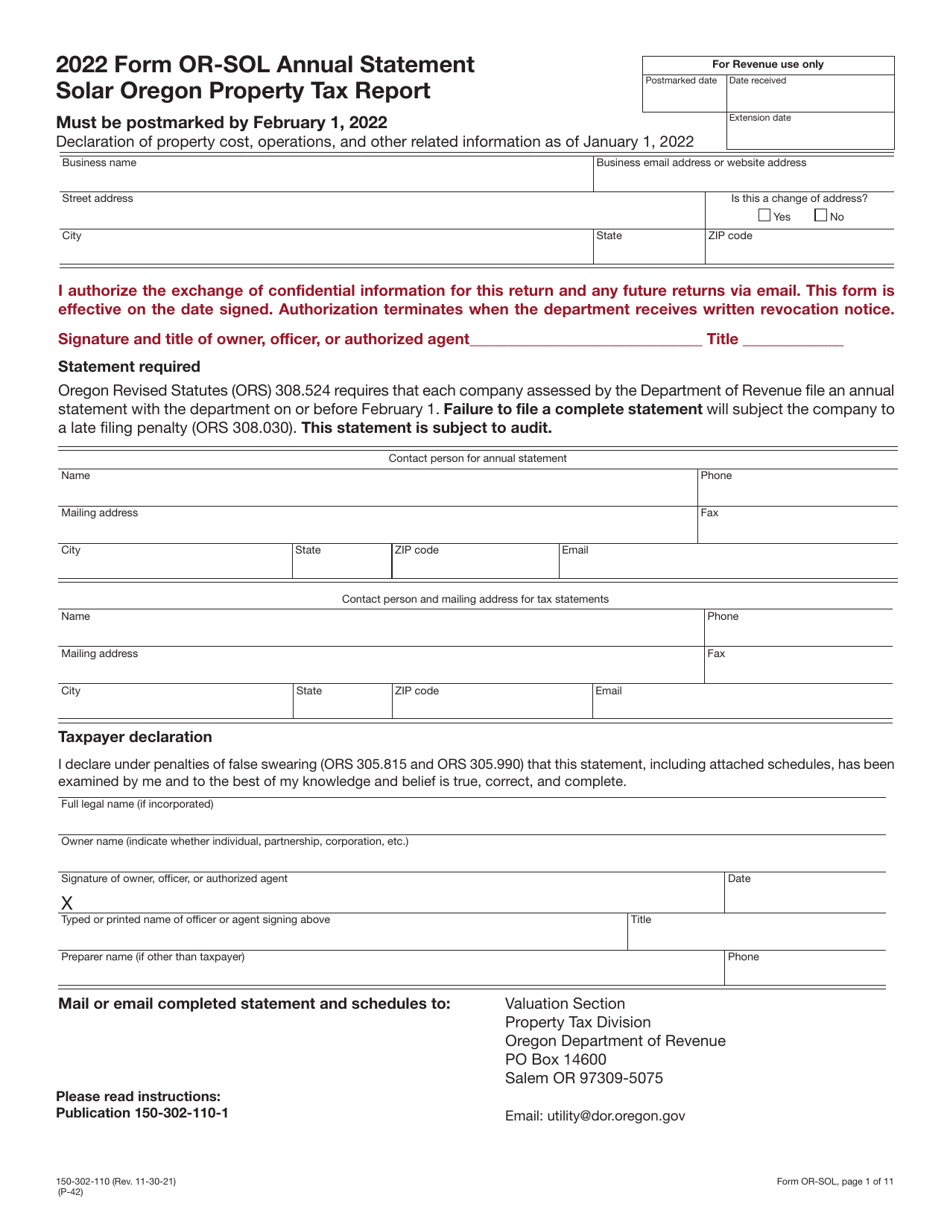

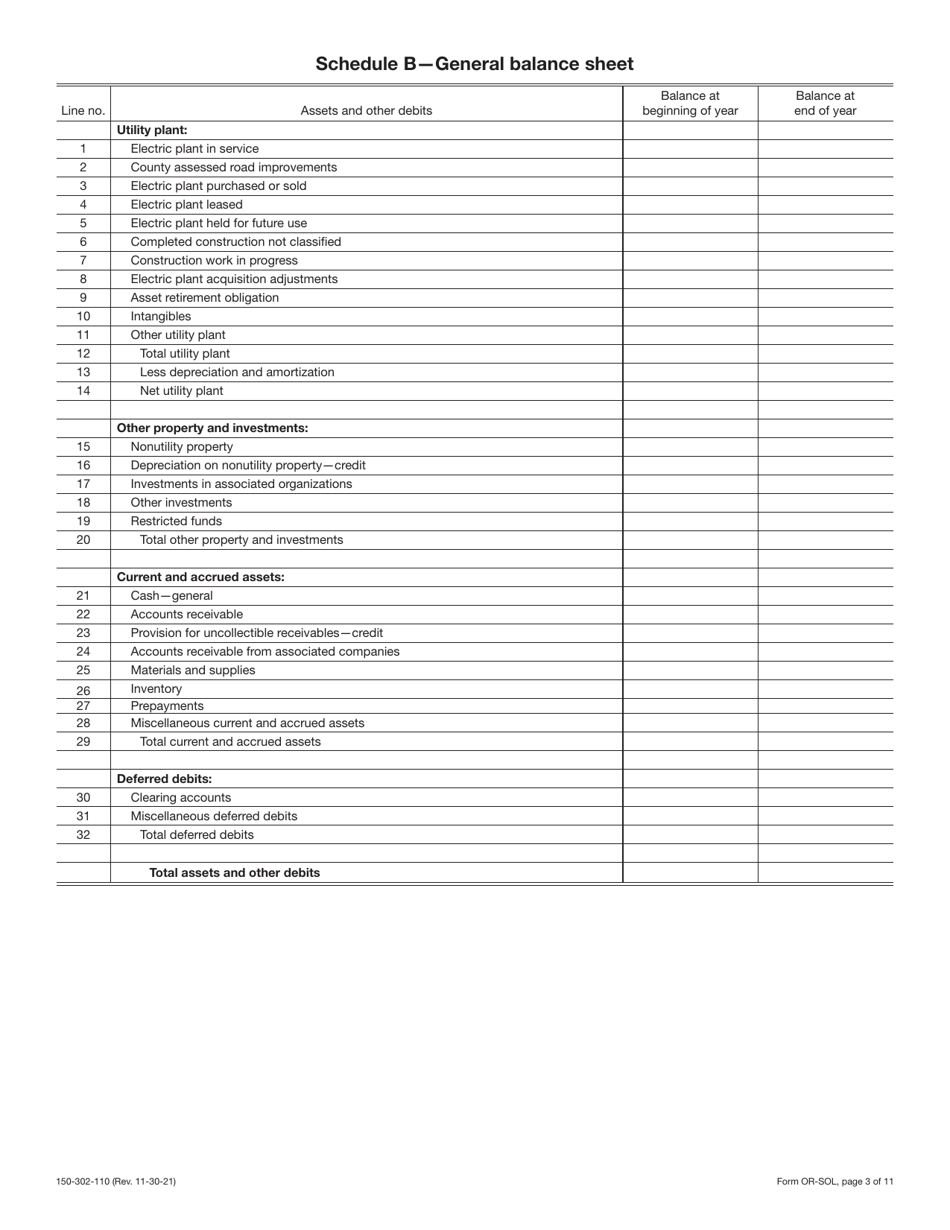

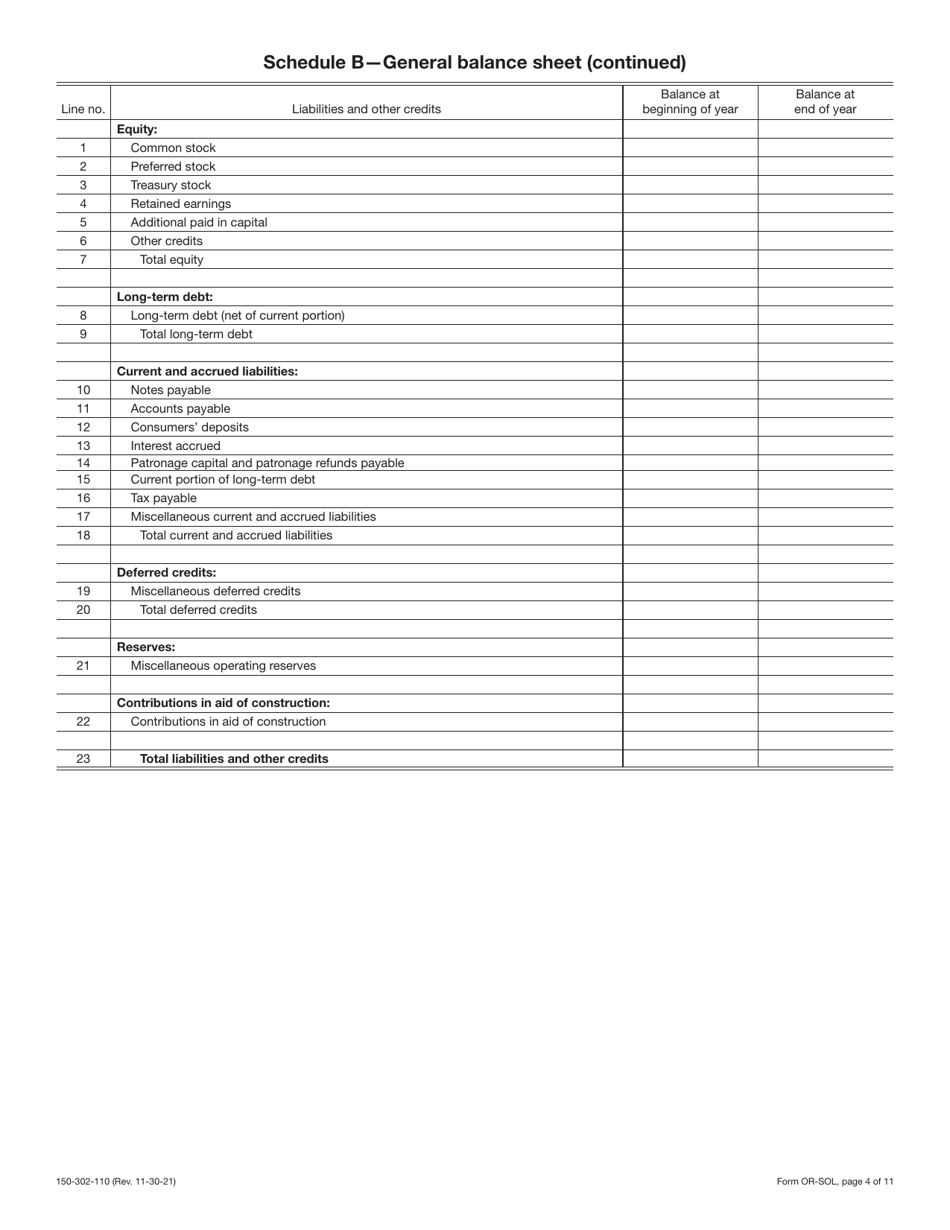

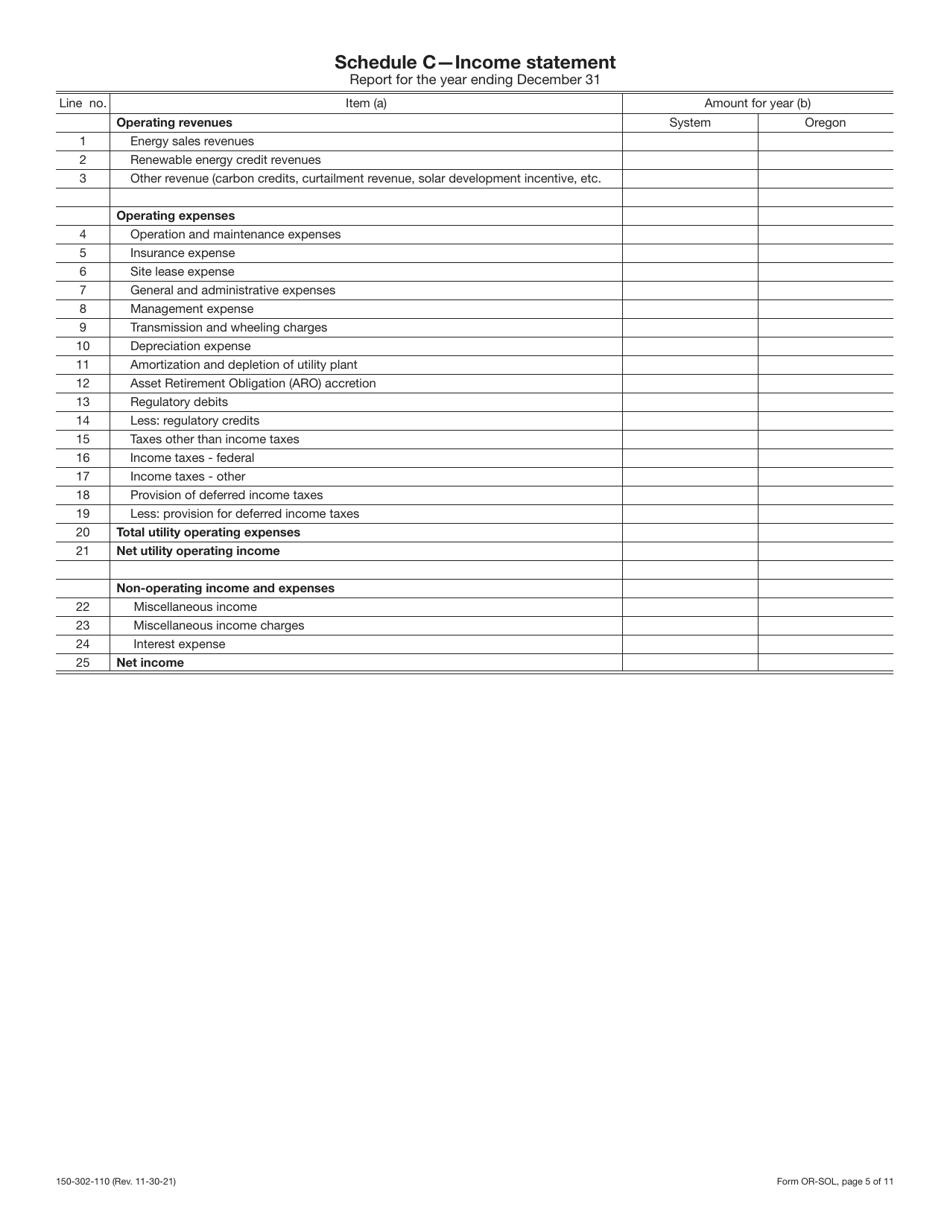

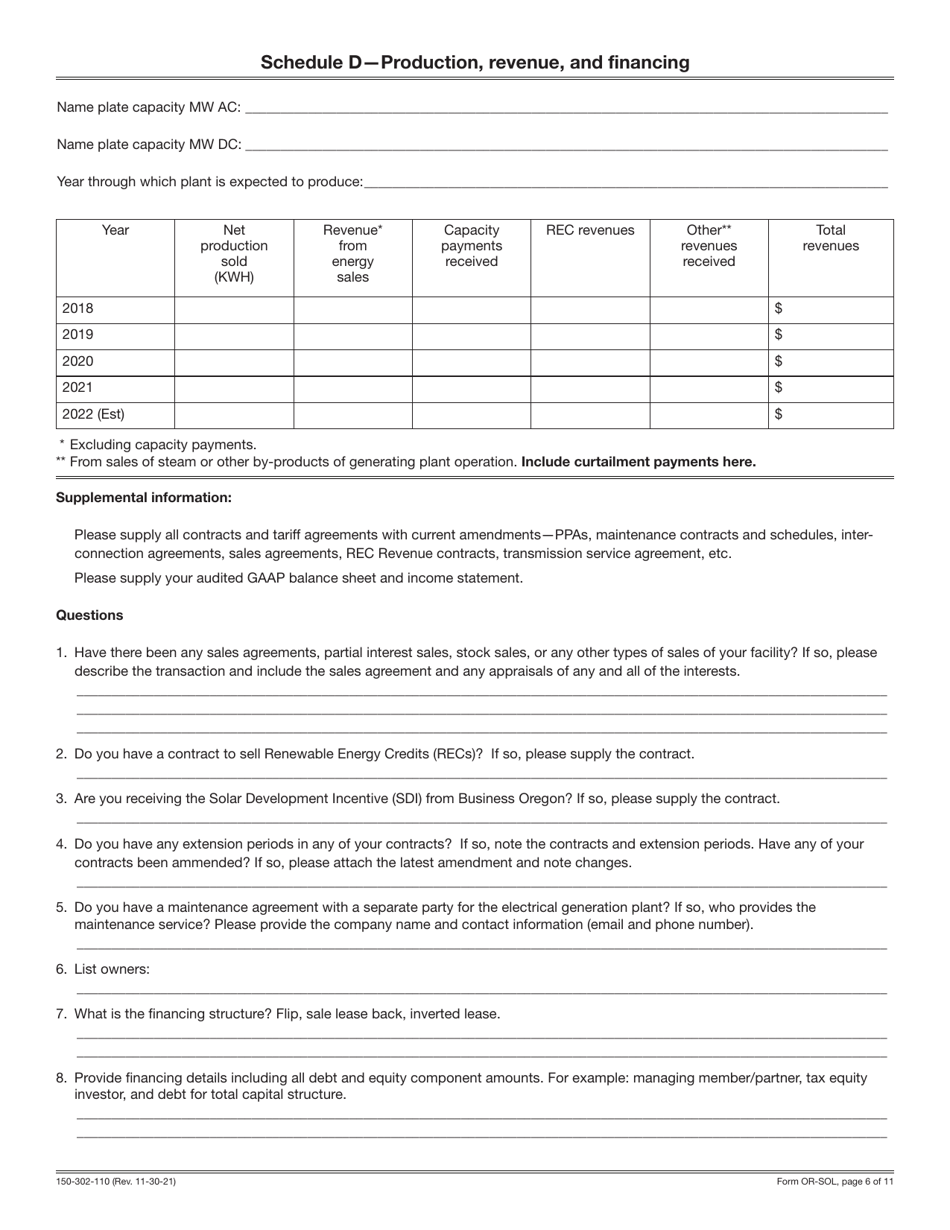

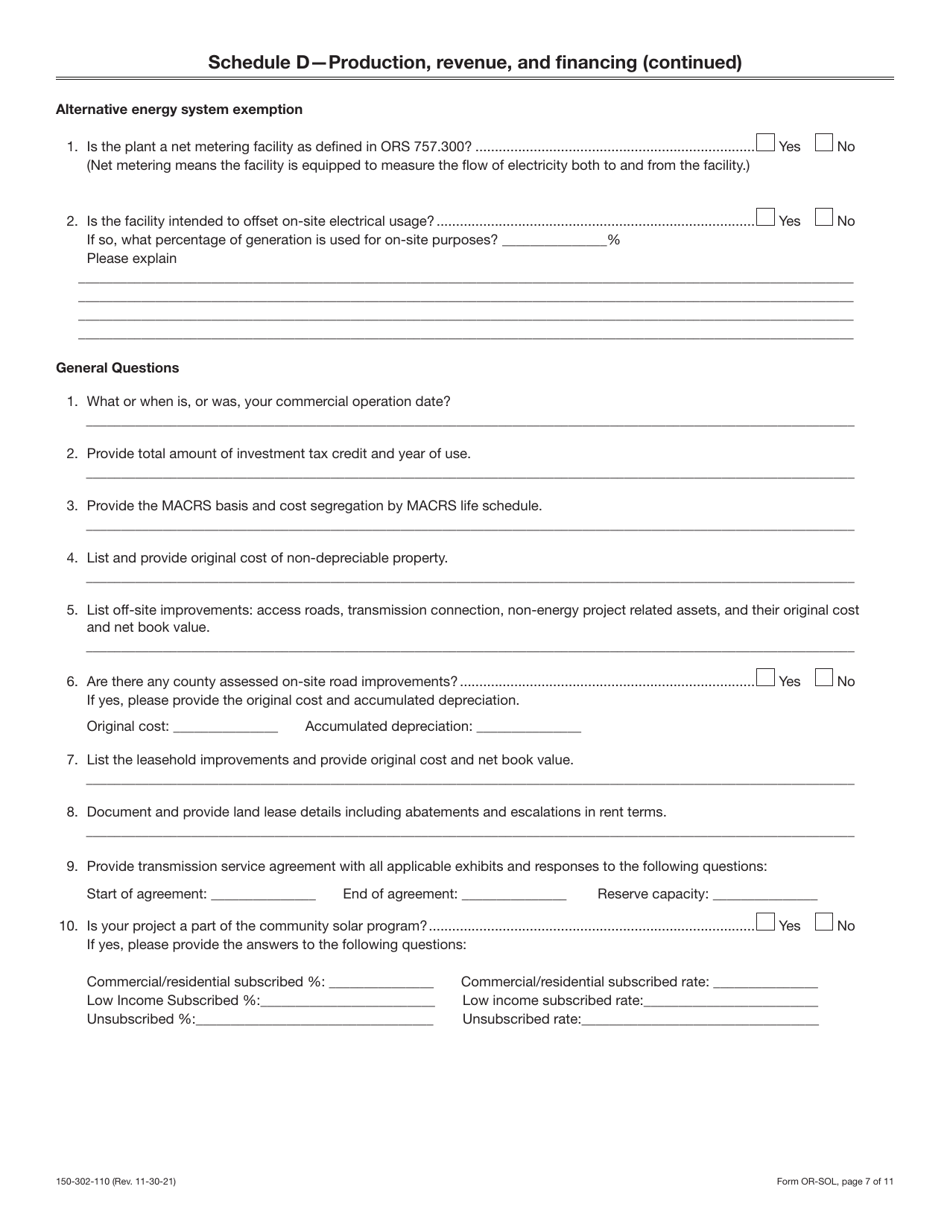

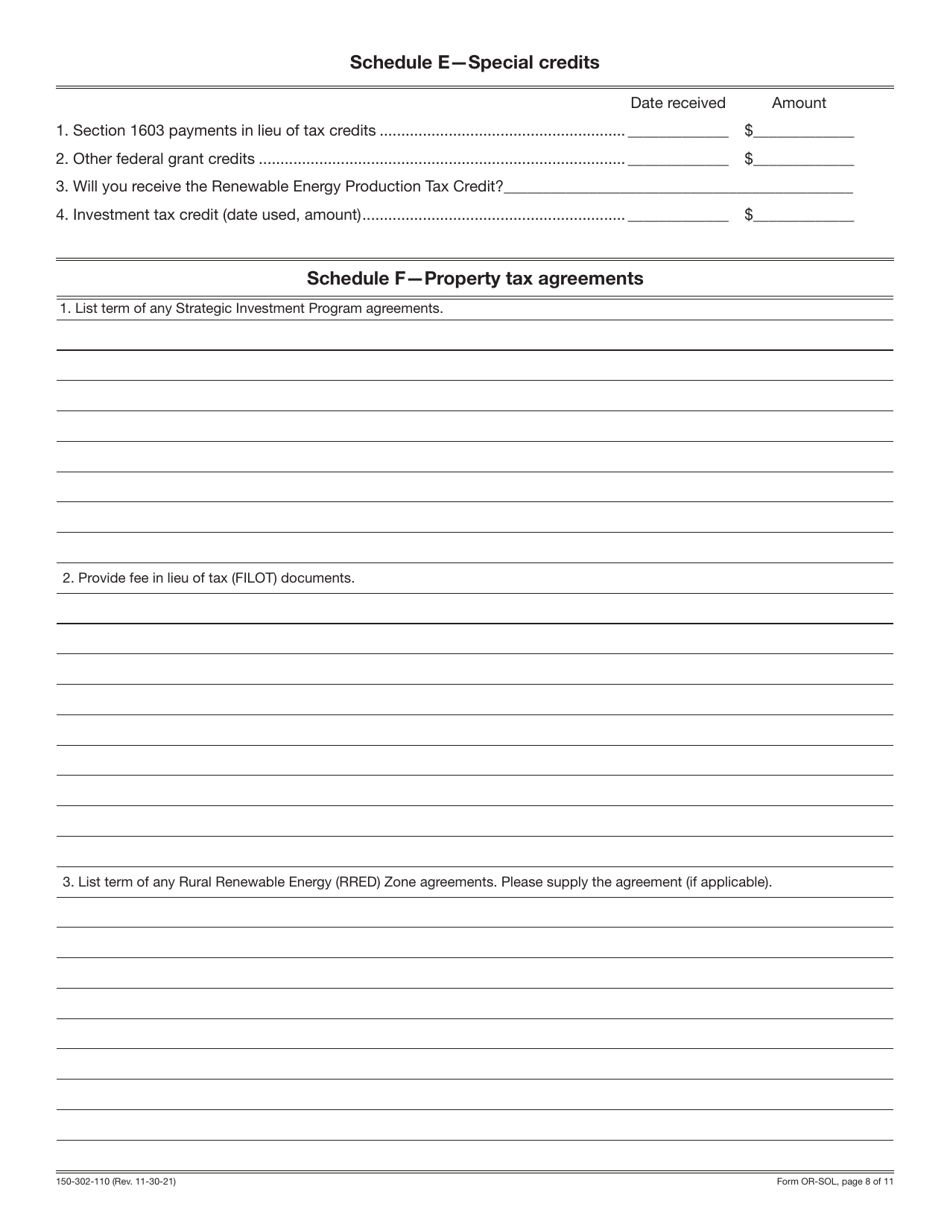

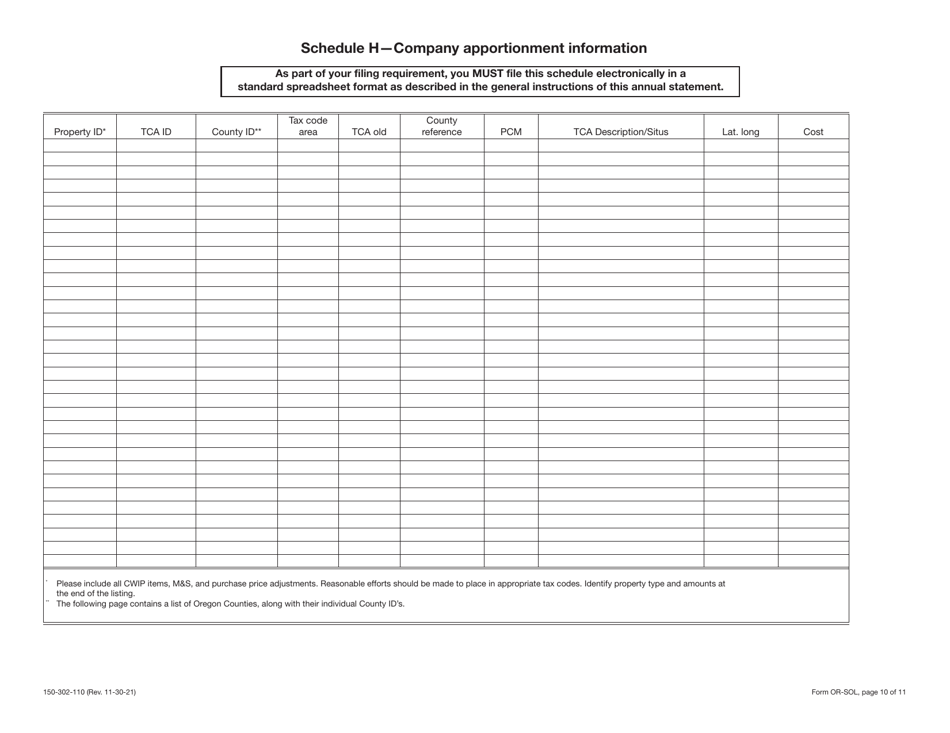

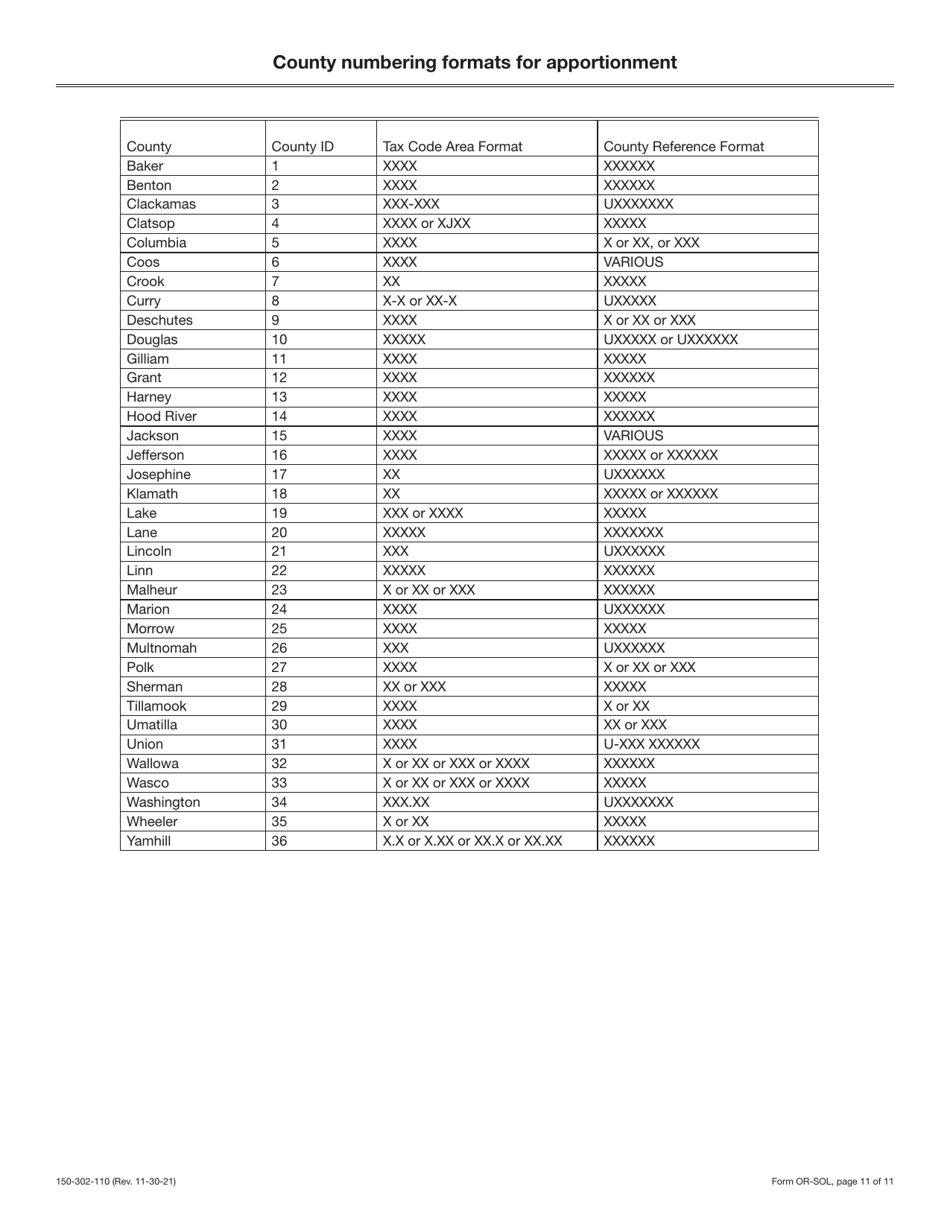

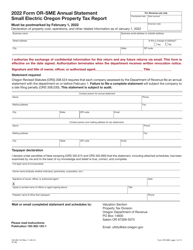

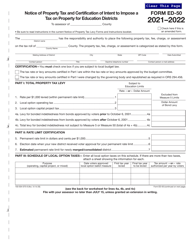

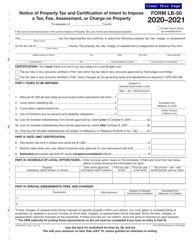

Form OR-SOL (150-302-110) Annual Statement - Solar Oregon Property Tax Report - Oregon

What Is Form OR-SOL (150-302-110)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OR-SOL (150-302-110) form?

A: OR-SOL (150-302-110) form is the Annual Statement Solar Oregon Property Tax Report form in Oregon.

Q: What is the purpose of OR-SOL (150-302-110) form?

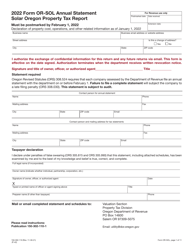

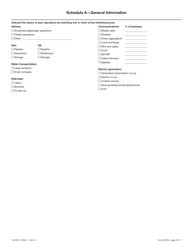

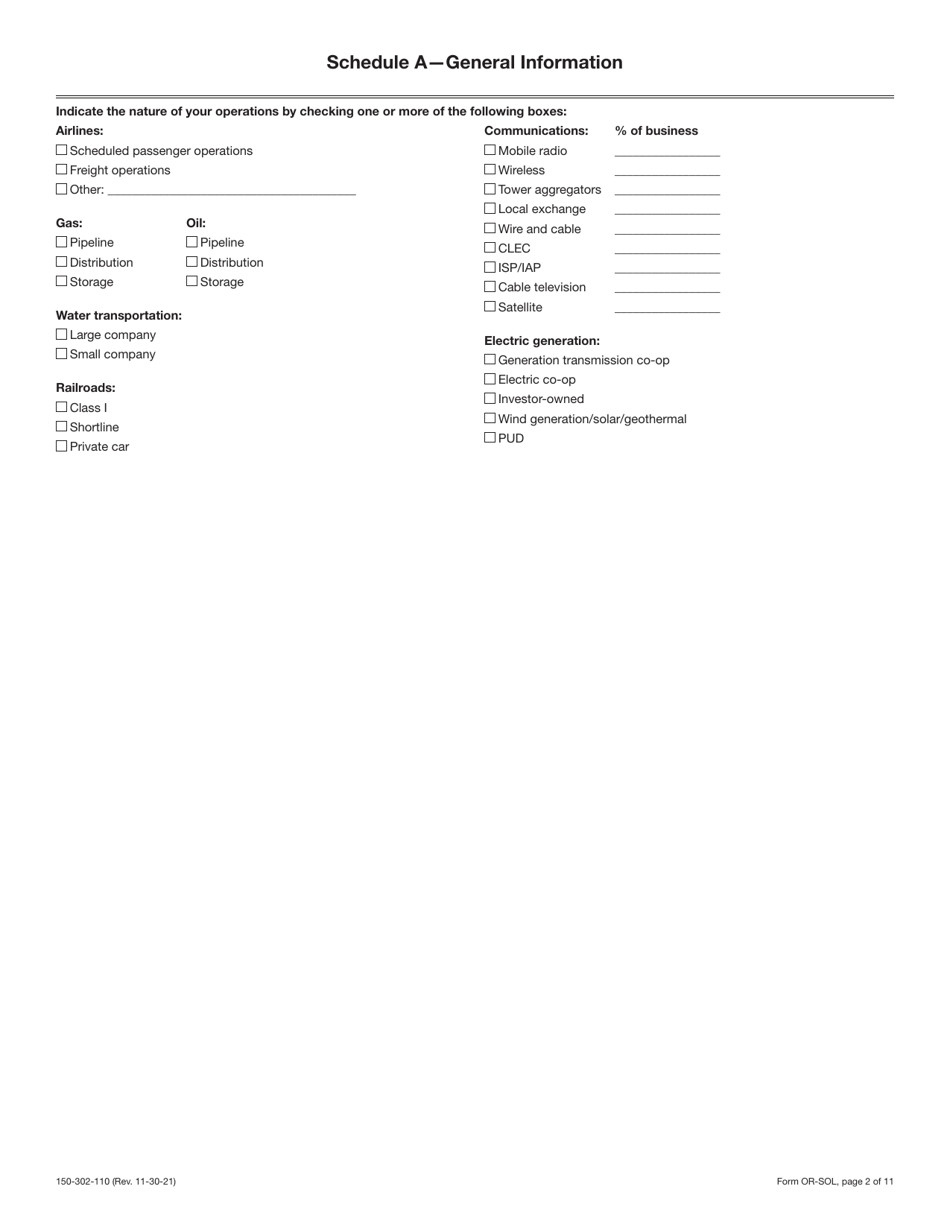

A: The purpose of OR-SOL (150-302-110) form is to report solar energy systems on properties for property tax purposes in Oregon.

Q: Who needs to file OR-SOL (150-302-110) form?

A: Property owners with solar energy systems in Oregon need to file OR-SOL (150-302-110) form.

Q: When is the deadline to file OR-SOL (150-302-110) form?

A: The deadline to file OR-SOL (150-302-110) form is typically on or before March 15th of each year.

Q: Are there any penalties for not filing OR-SOL (150-302-110) form?

A: Yes, there may be penalties for not filing OR-SOL (150-302-110) form, including potential loss of tax exemptions or benefits.

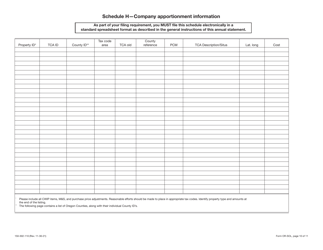

Q: What information is required to complete OR-SOL (150-302-110) form?

A: To complete OR-SOL (150-302-110) form, you will generally need information about your solar energy system, property details, and contact information.

Q: Is there a fee to file OR-SOL (150-302-110) form?

A: No, there is no fee to file OR-SOL (150-302-110) form.

Form Details:

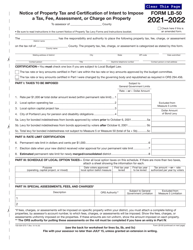

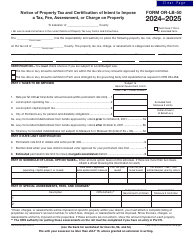

- Released on November 30, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OR-SOL (150-302-110) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.