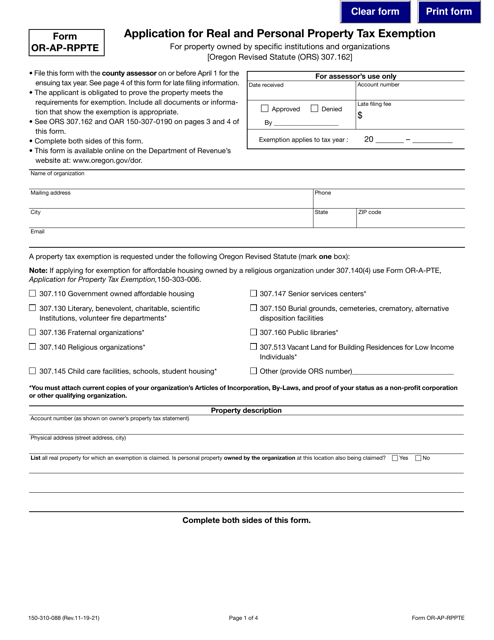

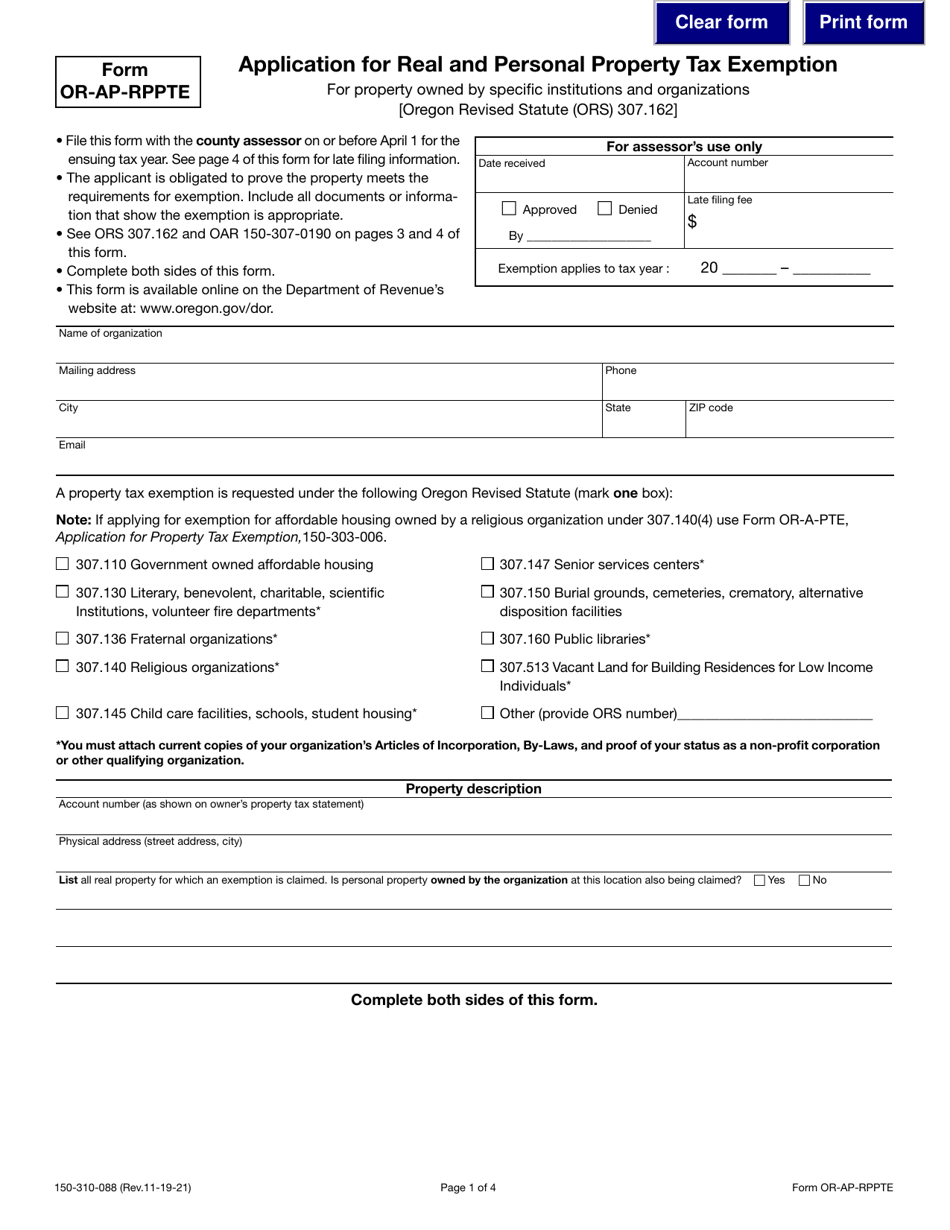

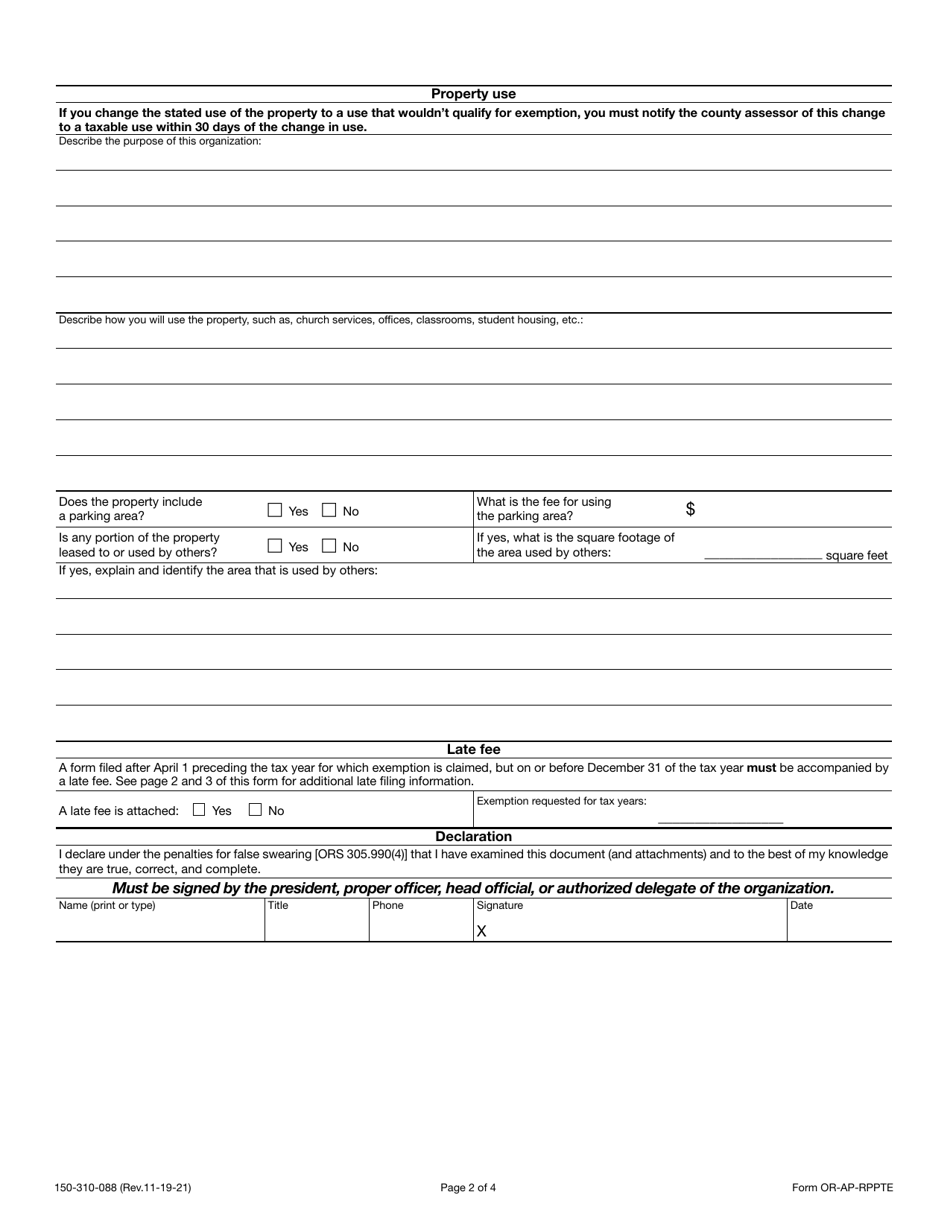

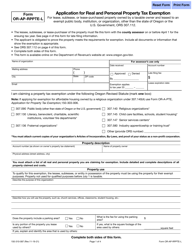

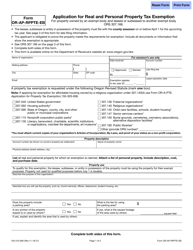

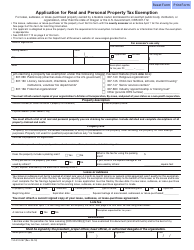

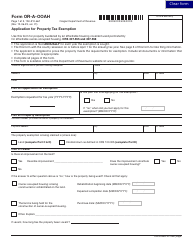

Form OR-AP-RPPTE (150-310-088) Application for Real and Personal Property Tax Exemption for Property Owned by Specific Institutions and Organizations - Oregon

What Is Form OR-AP-RPPTE (150-310-088)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OR-AP-RPPTE (150-310-088)?

A: OR-AP-RPPTE (150-310-088) is an application for real and personal property tax exemption in Oregon for property owned by specific institutions and organizations.

Q: Who can apply for OR-AP-RPPTE (150-310-088)?

A: Specific institutions and organizations can apply for OR-AP-RPPTE (150-310-088) if they meet the eligibility criteria.

Q: What does OR-AP-RPPTE (150-310-088) provide?

A: OR-AP-RPPTE (150-310-088) provides a tax exemption for real and personal property owned by eligible institutions and organizations in Oregon.

Q: Are there any eligibility criteria for OR-AP-RPPTE (150-310-088)?

A: Yes, there are eligibility criteria that institutions and organizations need to meet in order to qualify for the tax exemption.

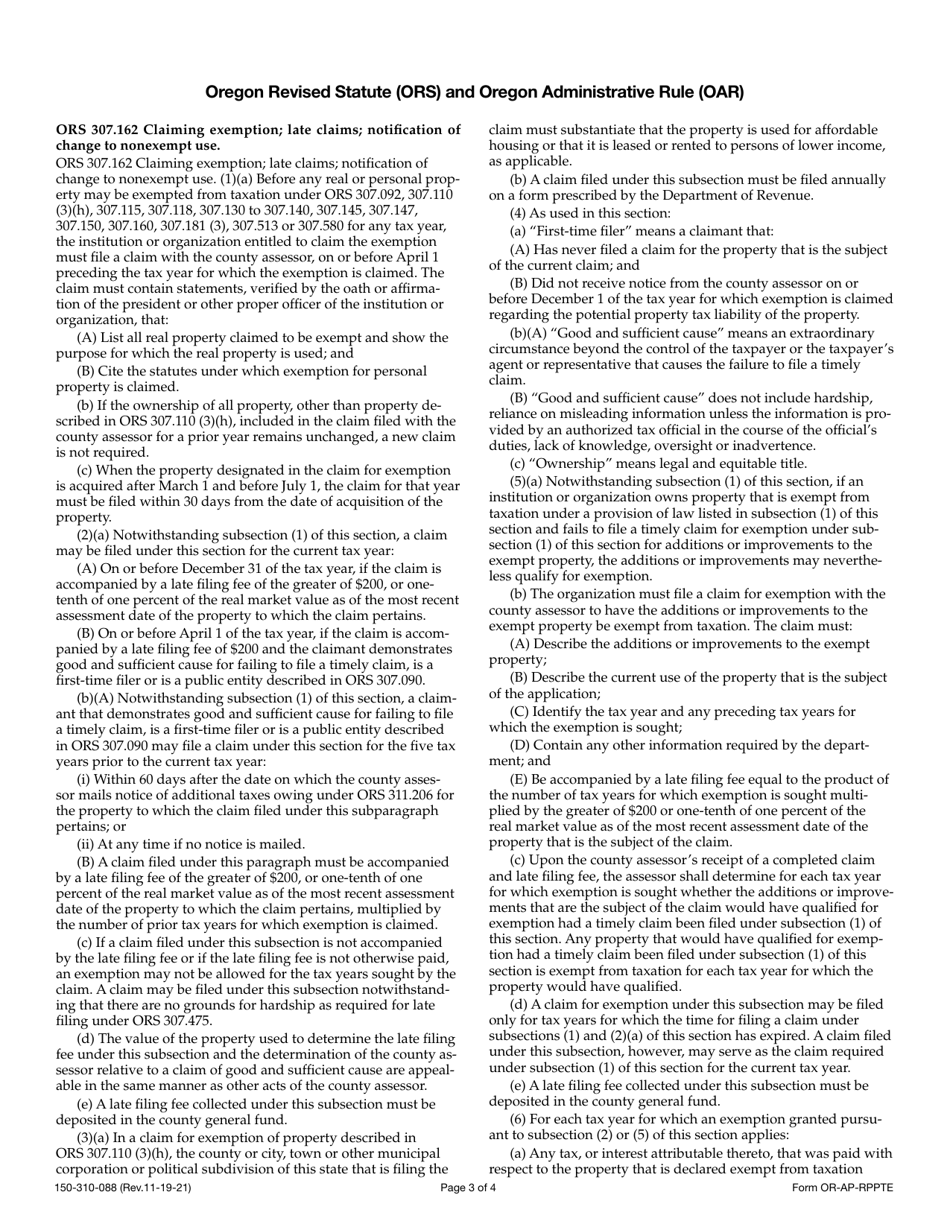

Q: Is there a deadline to submit the OR-AP-RPPTE (150-310-088) application?

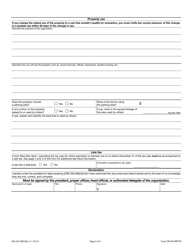

A: Yes, the application should be submitted by April 1st of each year to be considered for the tax exemption.

Q: What are the benefits of OR-AP-RPPTE (150-310-088) tax exemption?

A: The tax exemption provided by OR-AP-RPPTE (150-310-088) can reduce the property tax burden for eligible institutions and organizations.

Q: Is the OR-AP-RPPTE (150-310-088) tax exemption permanent?

A: No, the tax exemption needs to be renewed annually by submitting a new application.

Form Details:

- Released on November 19, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-AP-RPPTE (150-310-088) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.