This version of the form is not currently in use and is provided for reference only. Download this version of

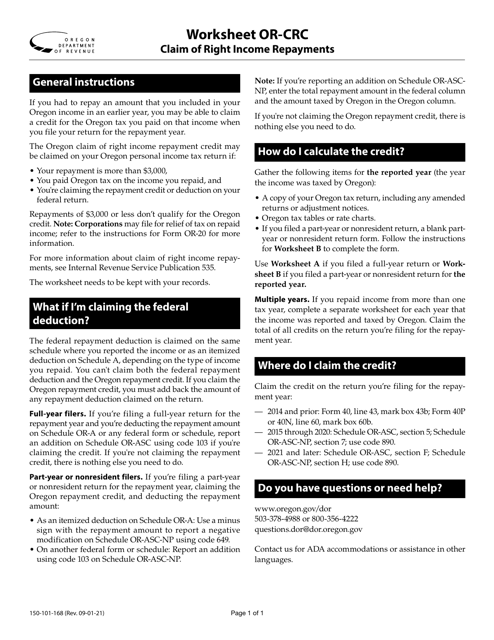

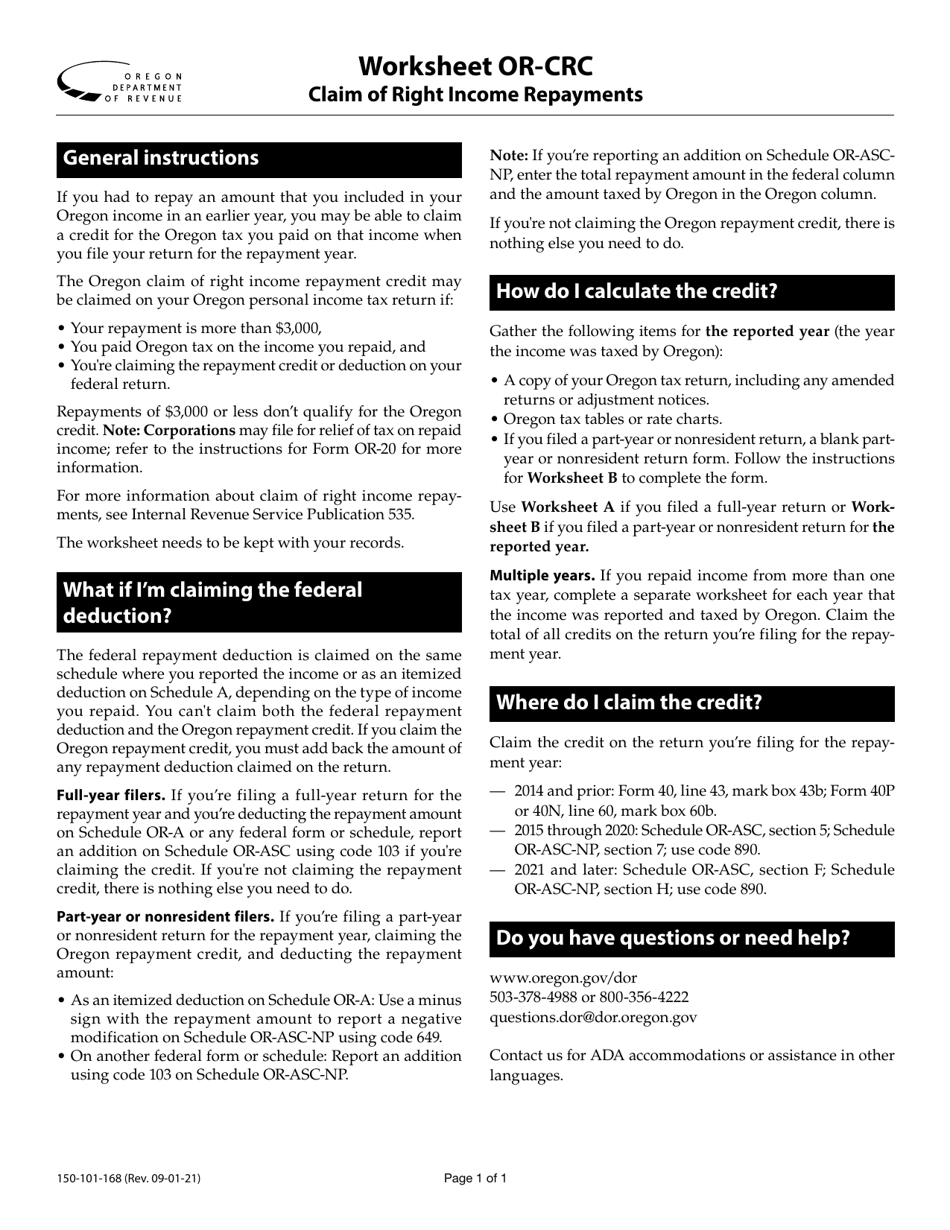

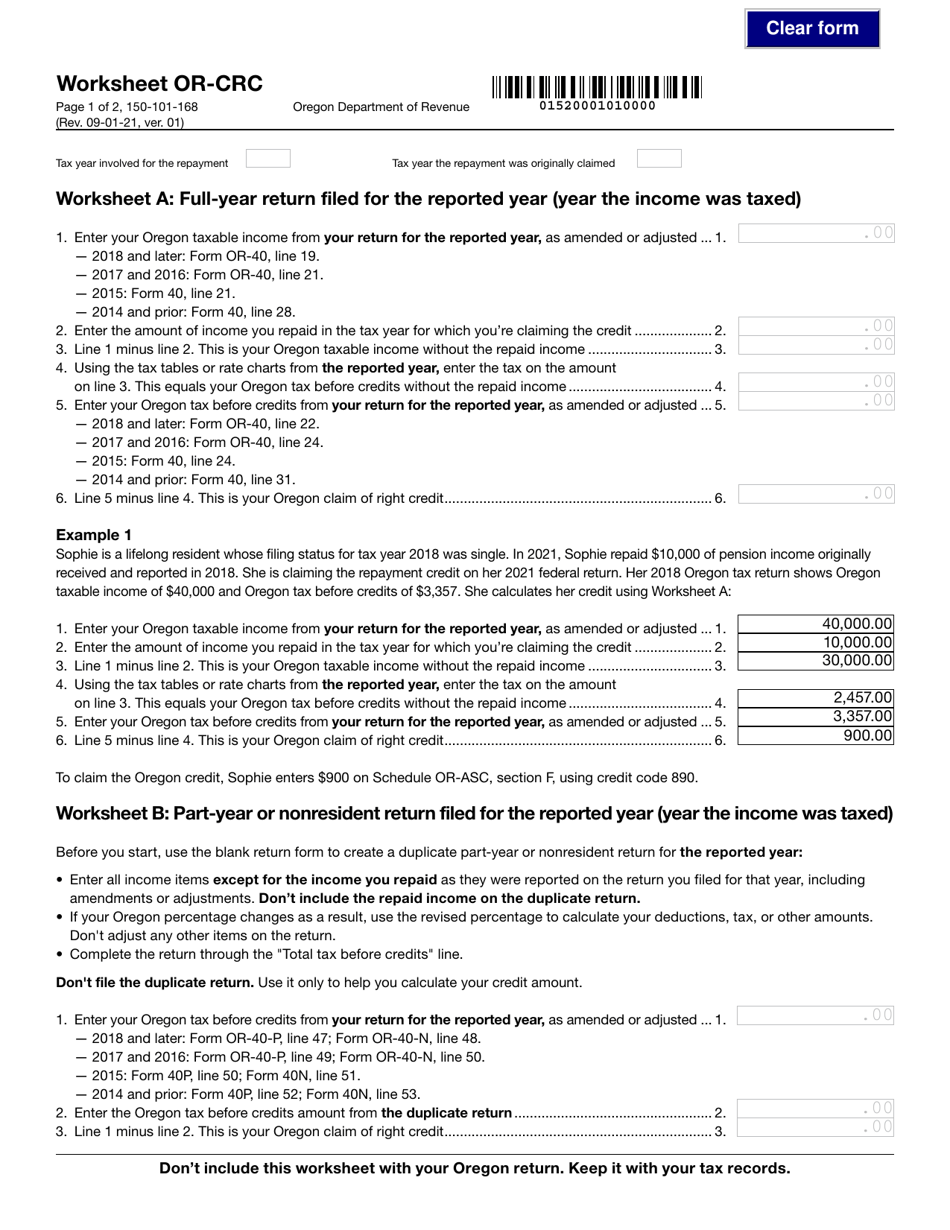

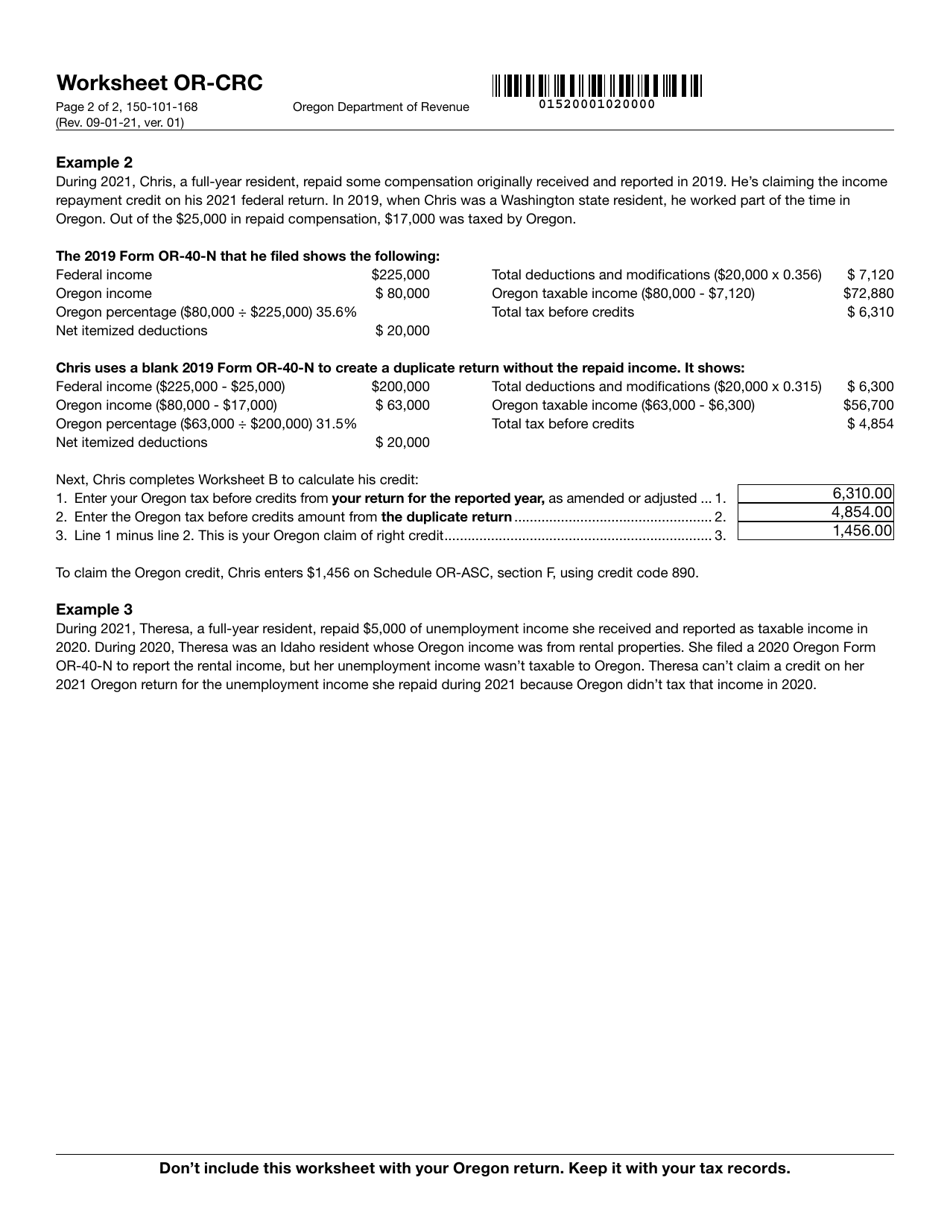

Form 150-101-168 Worksheet OR-CRC

for the current year.

Form 150-101-168 Worksheet OR-CRC Claim of Right Income Repayments - Oregon

What Is Form 150-101-168 Worksheet OR-CRC?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon.The document is a supplement to Form 150-101-168, Worksheet or-Crc - Claim of Right Income Repayments. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-168?

A: Form 150-101-168 is a worksheet used to report Claim of Right Income Repayments in Oregon.

Q: What is Claim of Right Income?

A: Claim of Right Income is income that was previously reported as taxable but is being repaid in the current year.

Q: Who needs to file Form 150-101-168?

A: Individuals or businesses in Oregon who are repaying Claim of Right Income need to file this form.

Q: What information is required on Form 150-101-168?

A: The form requires details about the repayment amount and the tax year in which the income was originally reported.

Q: When is the deadline to file Form 150-101-168?

A: The deadline to file this form is the same as the Oregon income tax return deadline, typically April 15th.

Q: Are there any penalties for not filing Form 150-101-168?

A: Failure to file this form or reporting inaccurate information may result in penalties and interest.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-168 Worksheet OR-CRC by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.