This version of the form is not currently in use and is provided for reference only. Download this version of

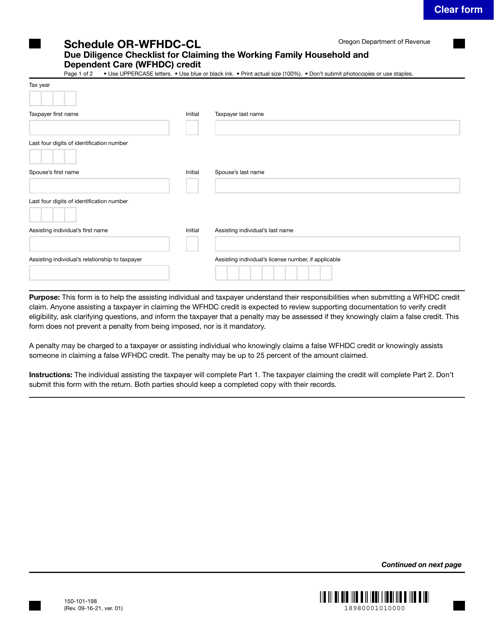

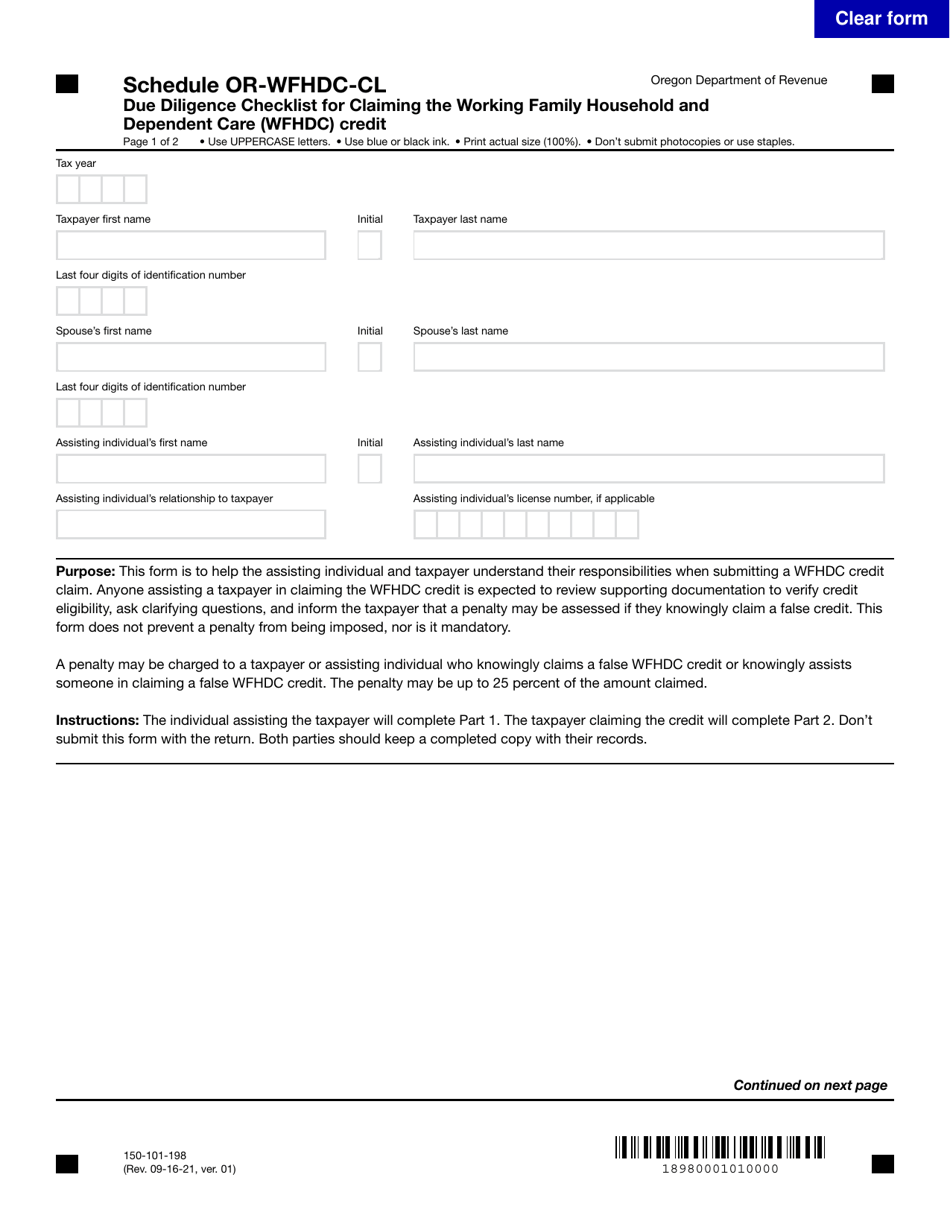

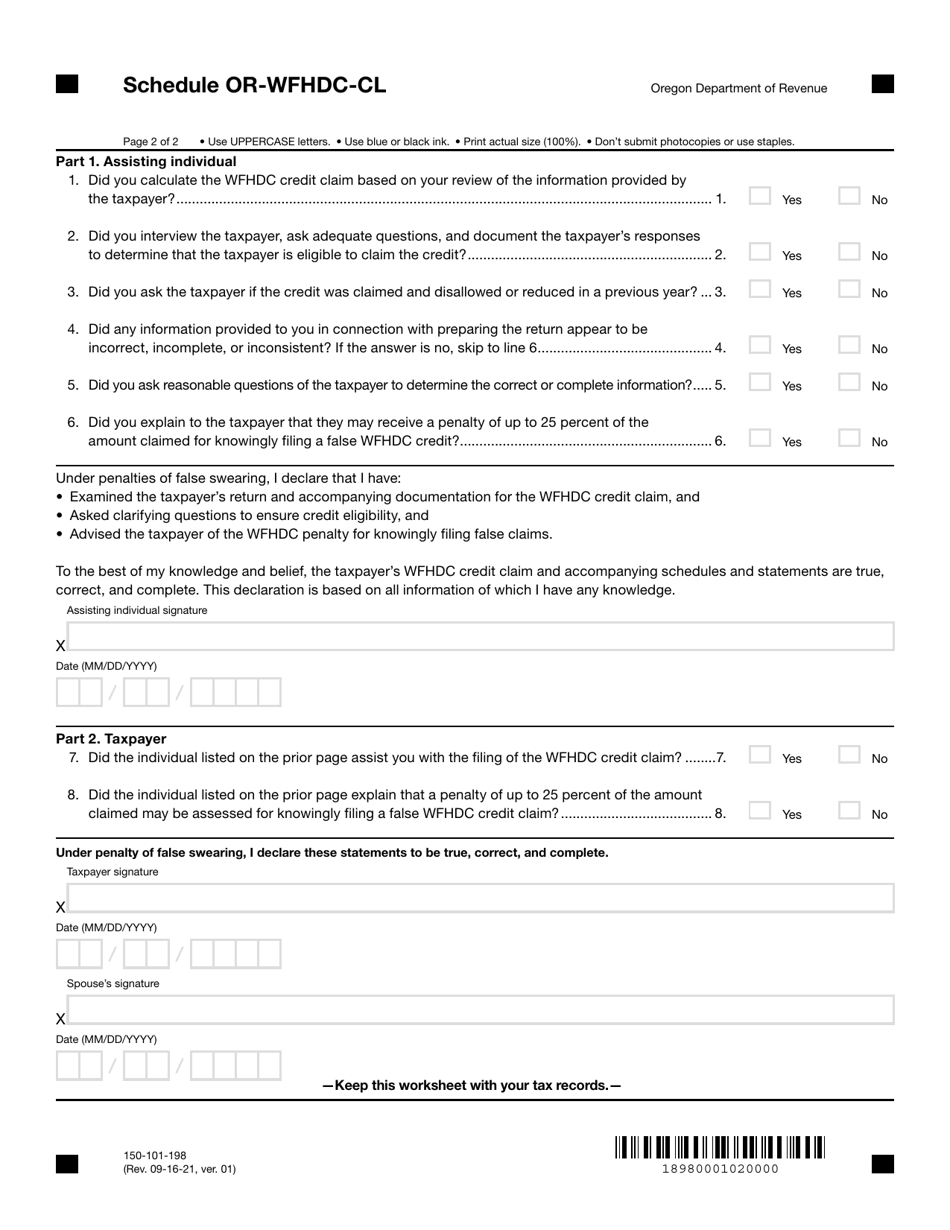

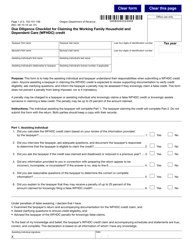

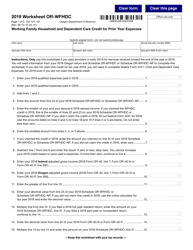

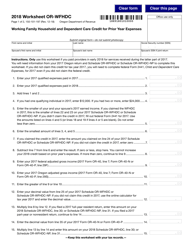

Form 150-101-198 Schedule OR-WFHDC-CL

for the current year.

Form 150-101-198 Schedule OR-WFHDC-CL Due Diligence Checklist for Claiming the Working Family Household and Dependent Care (Wfhdc) Credit - Oregon

What Is Form 150-101-198 Schedule OR-WFHDC-CL?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon.The document is a supplement to Form 150-101-198, Due Diligence Checklist for Claiming the Working Family Household and Dependent Care Credit (Wfhdc). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-198?

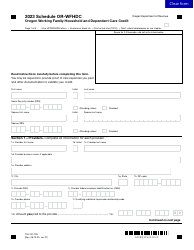

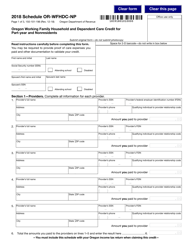

A: Form 150-101-198 is the schedule used in Oregon for claiming the Working Family Household and Dependent Care (WFHDC) Credit.

Q: What is the WFHDC Credit?

A: The WFHDC Credit is a tax credit provided by the state of Oregon to eligible individuals or families for expenses related to dependent care.

Q: Who can claim the WFHDC Credit?

A: Individuals or families in Oregon who meet certain eligibility criteria can claim the WFHDC Credit.

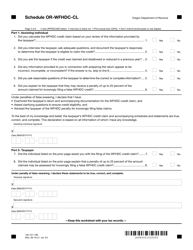

Q: What does the Due Diligence Checklist include?

A: The Due Diligence Checklist for the WFHDC Credit includes questions and requirements that need to be fulfilled in order to claim the credit.

Q: Why is the Due Diligence Checklist important?

A: The Due Diligence Checklist ensures that individuals claiming the WFHDC Credit have met all the necessary conditions and requirements.

Q: What if I have questions or need assistance?

A: If you have questions or need assistance regarding Form 150-101-198 or the WFHDC Credit, you can contact the Oregon Department of Revenue for further guidance.

Form Details:

- Released on September 16, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-198 Schedule OR-WFHDC-CL by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.