This version of the form is not currently in use and is provided for reference only. Download this version of

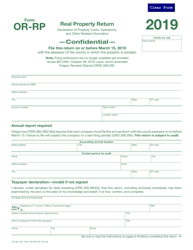

Form OR-RP (150-301-031)

for the current year.

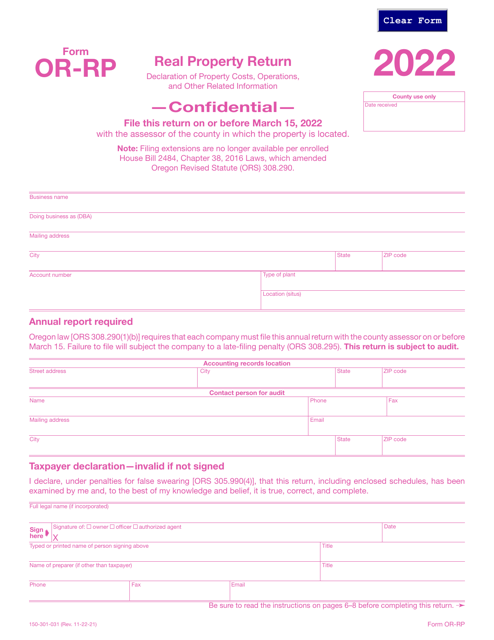

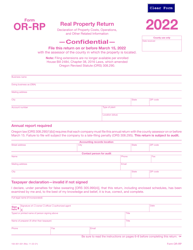

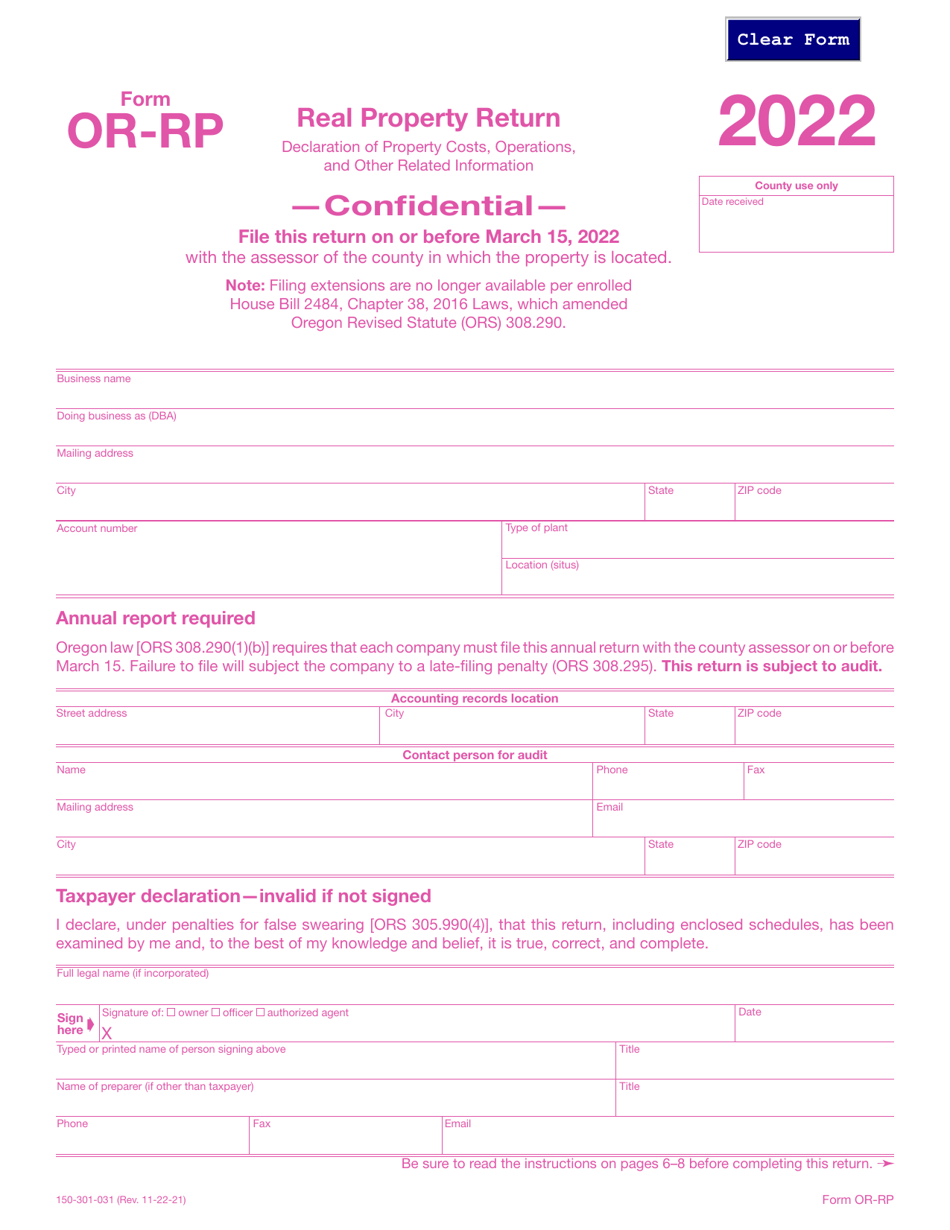

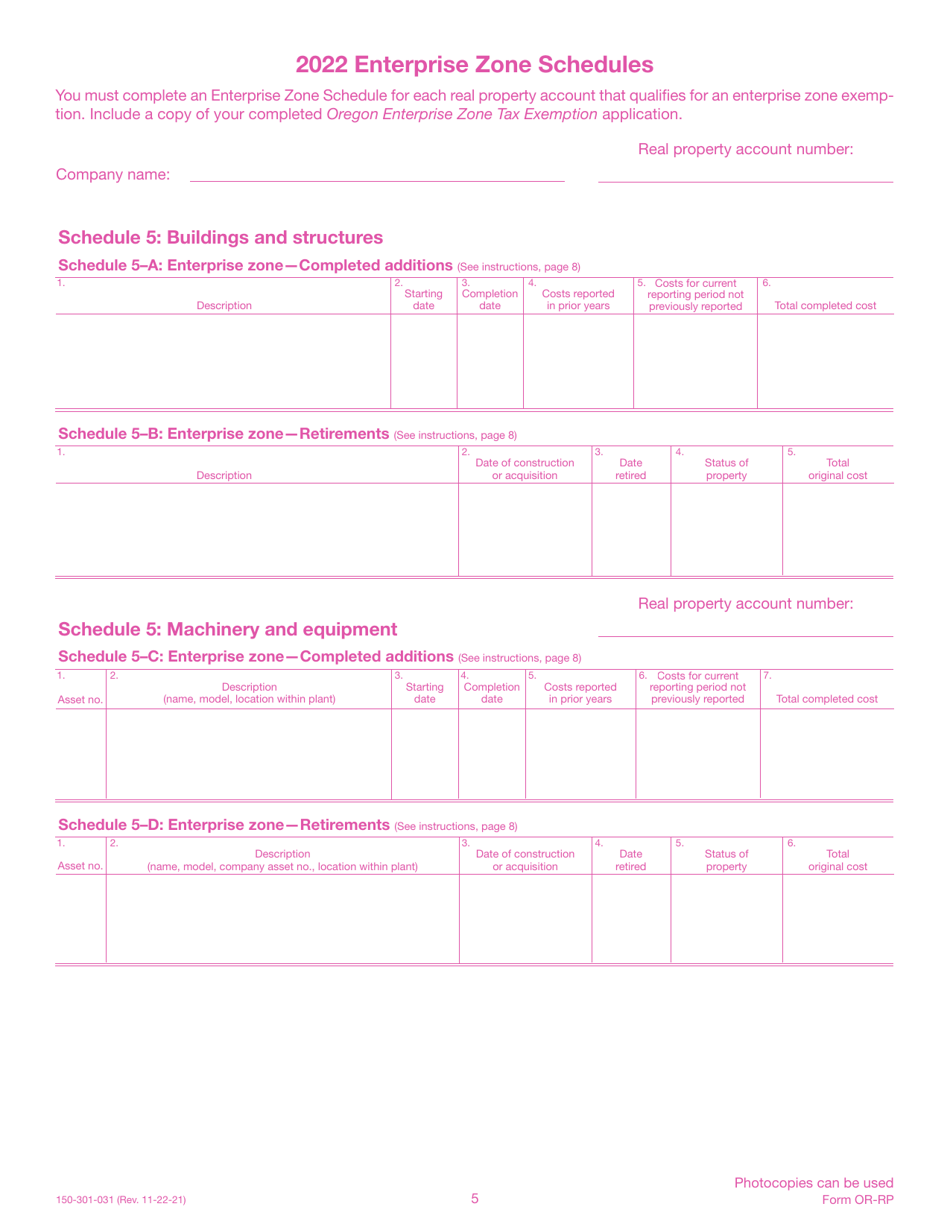

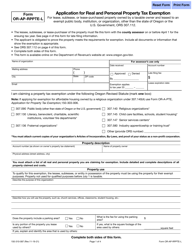

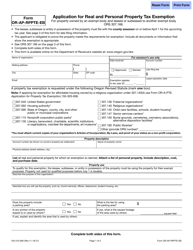

Form OR-RP (150-301-031) Real Property Return - Oregon

What Is Form OR-RP (150-301-031)?

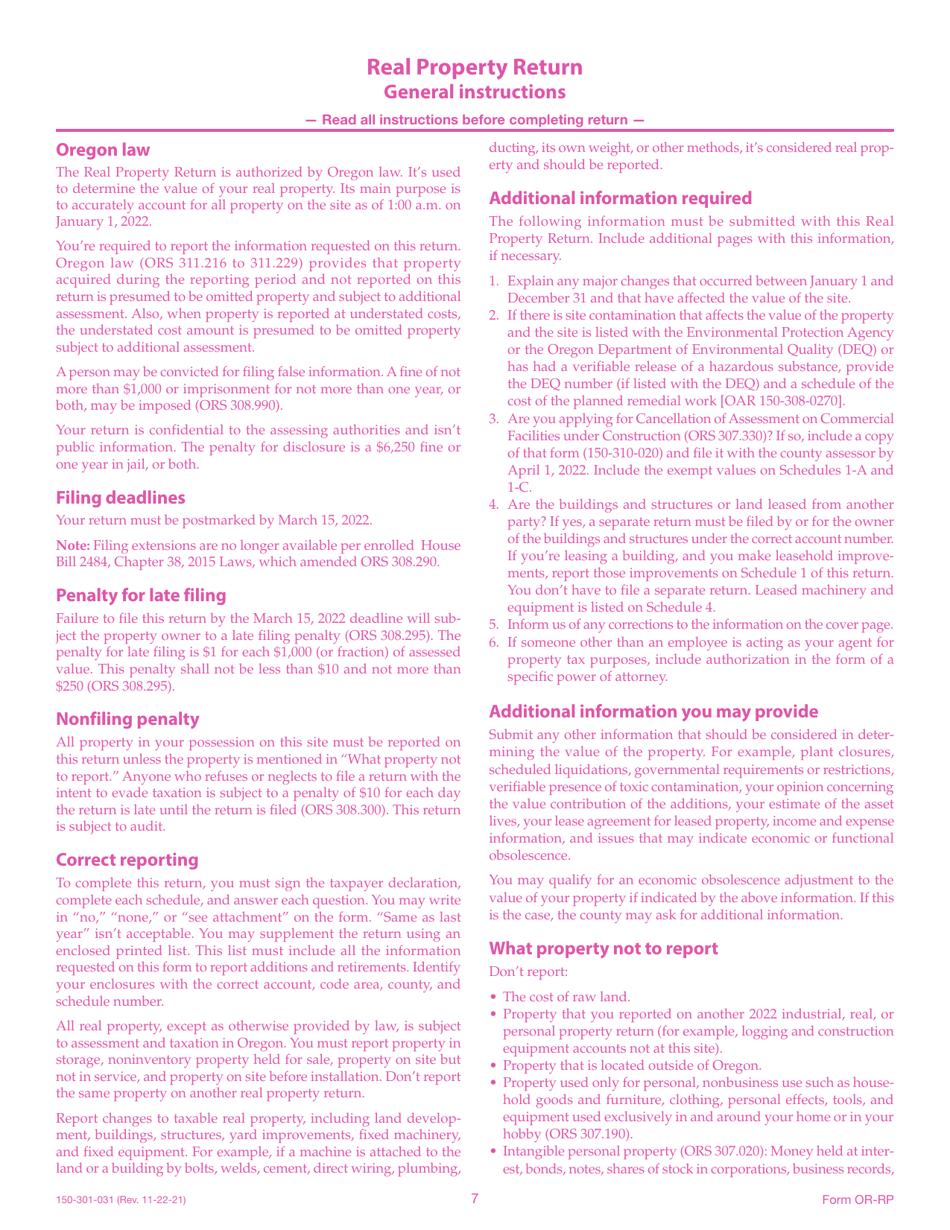

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OR-RP (150-301-031) Real Property Return?

A: The OR-RP (150-301-031) Real Property Return is a form used in Oregon to report real property information.

Q: Who needs to file the OR-RP (150-301-031) Real Property Return?

A: Property owners in Oregon, including individuals, businesses, and organizations, need to file the OR-RP (150-301-031) Real Property Return.

Q: What is the purpose of filing the OR-RP (150-301-031) Real Property Return?

A: Filing the OR-RP (150-301-031) Real Property Return helps assess the value of real property for tax purposes and determine property taxes.

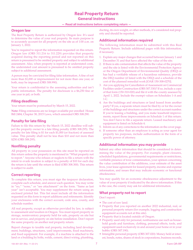

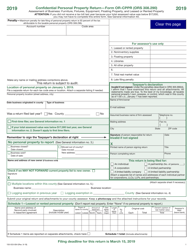

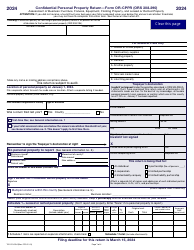

Q: When is the deadline to file the OR-RP (150-301-031) Real Property Return?

A: The deadline to file the OR-RP (150-301-031) Real Property Return is typically on or before March 15th of each year.

Q: Are there any penalties for not filing the OR-RP (150-301-031) Real Property Return?

A: Yes, there may be penalties for not filing the OR-RP (150-301-031) Real Property Return, including late filing fees and potential reassessment of property value.

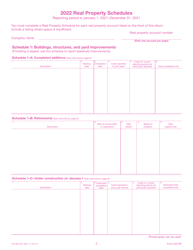

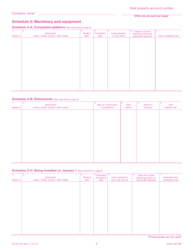

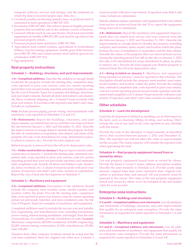

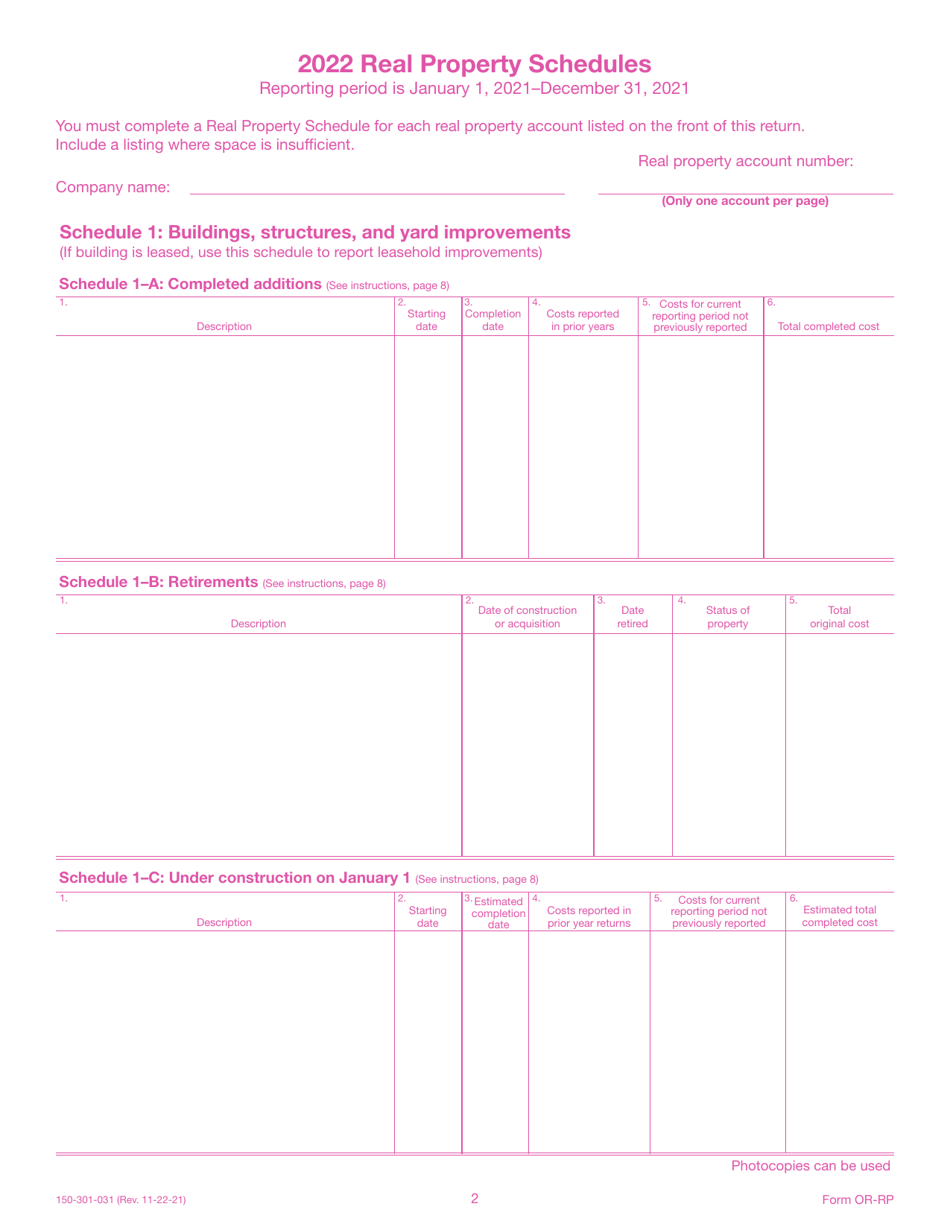

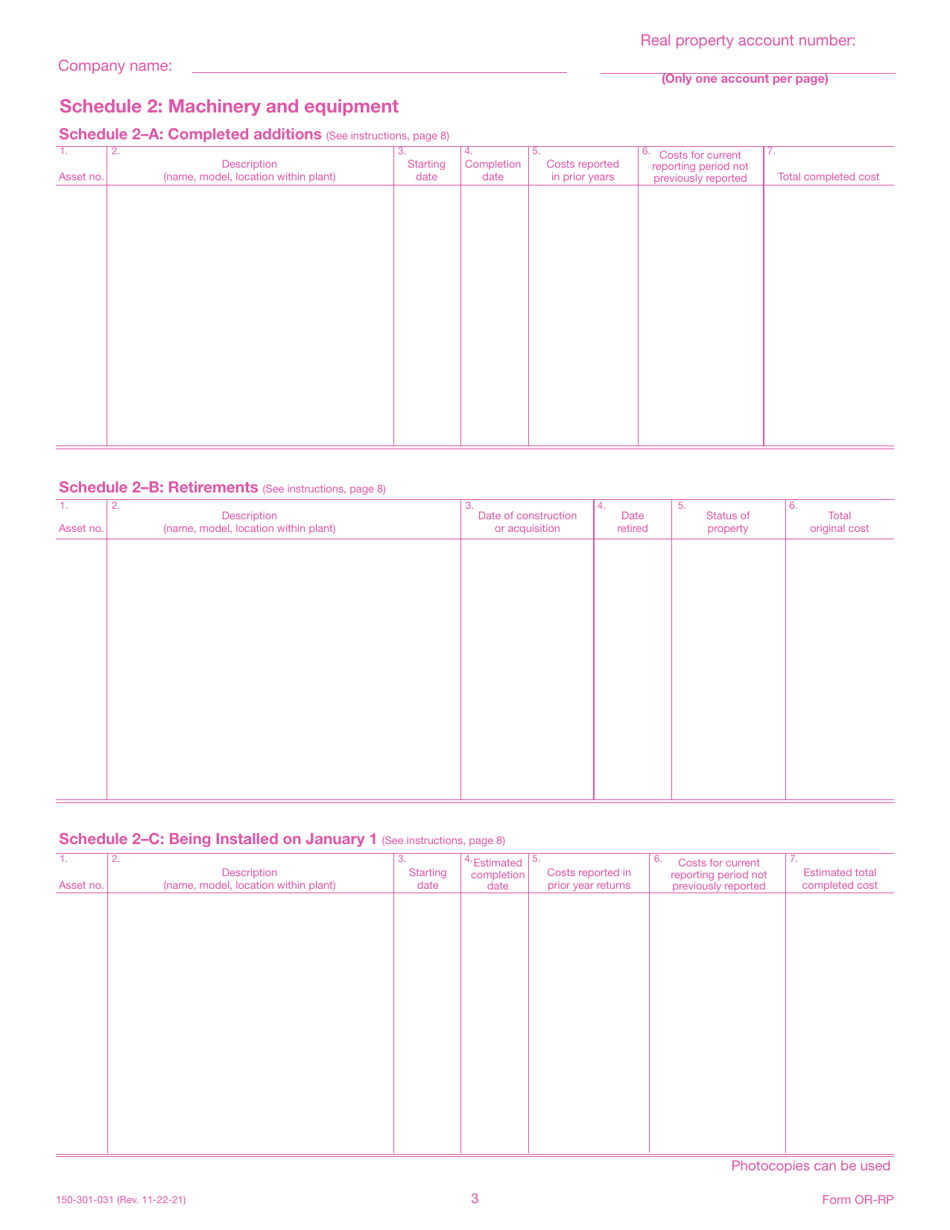

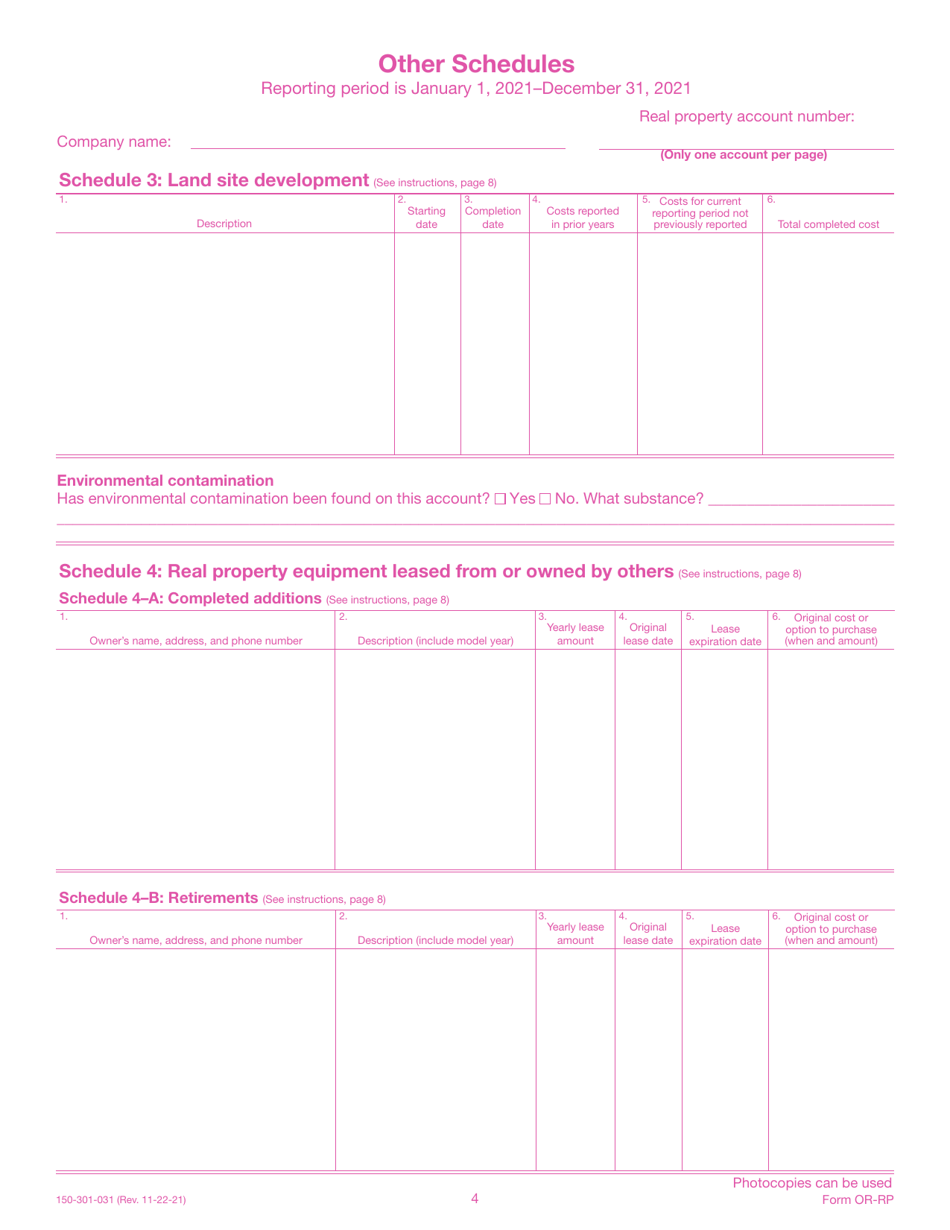

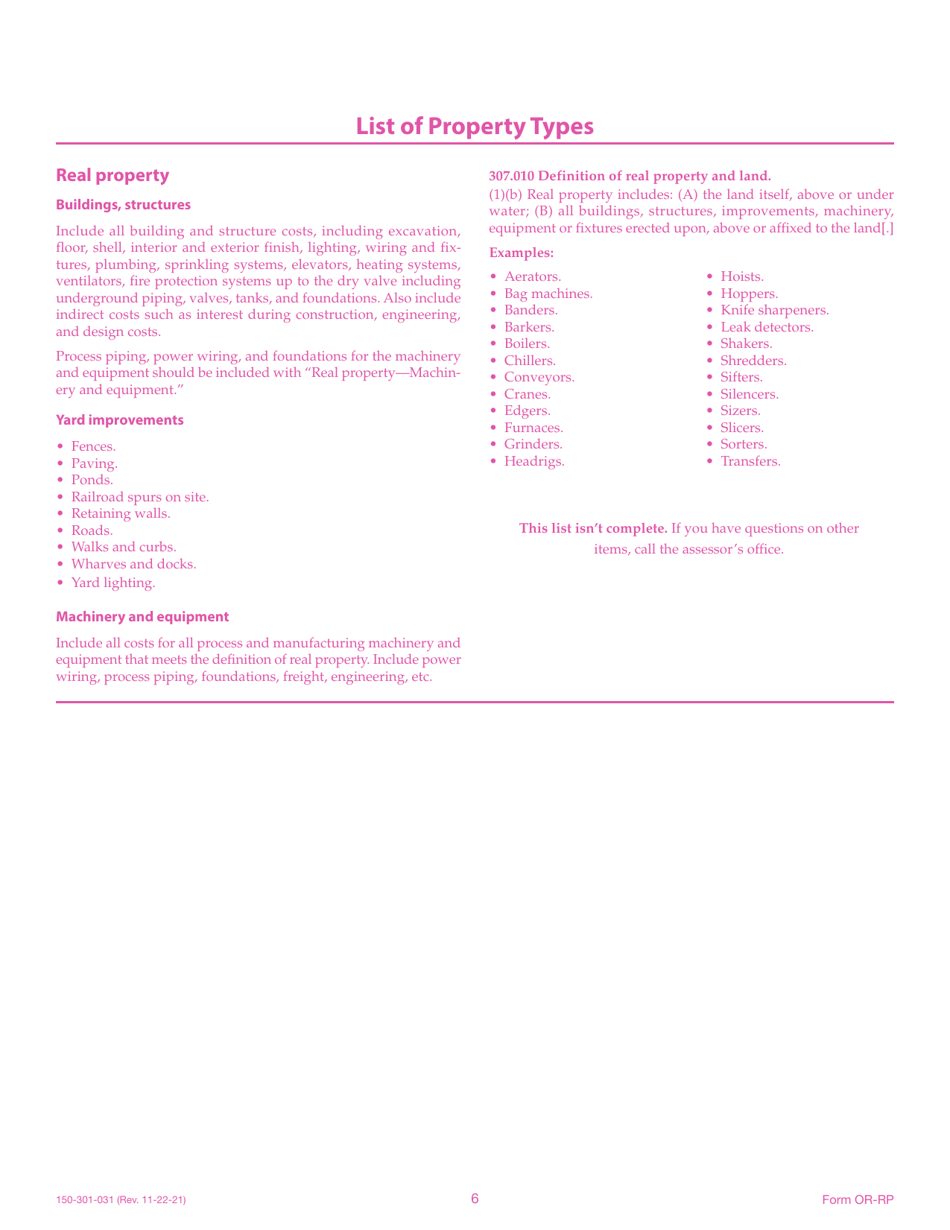

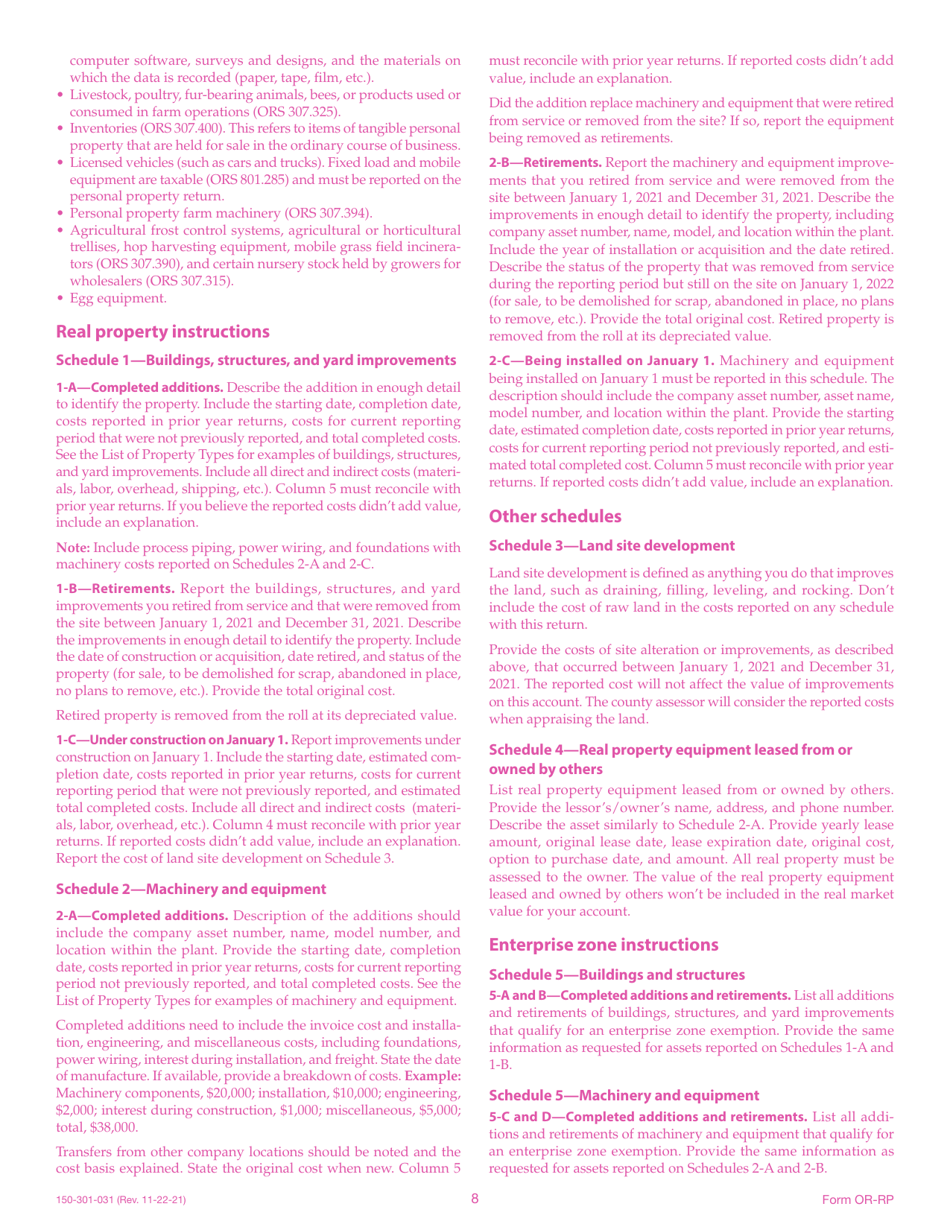

Q: What information do I need to provide on the OR-RP (150-301-031) Real Property Return?

A: You will need to provide details about the property, such as its location, type, size, improvements, and current market value.

Q: Can I make changes to the OR-RP (150-301-031) Real Property Return after filing?

A: Yes, you can make changes to the OR-RP (150-301-031) Real Property Return by filing an amended return if there are errors or updates to the property information.

Form Details:

- Released on November 22, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-RP (150-301-031) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.