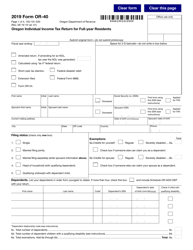

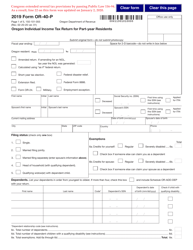

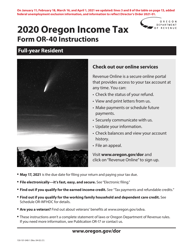

This version of the form is not currently in use and is provided for reference only. Download this version of

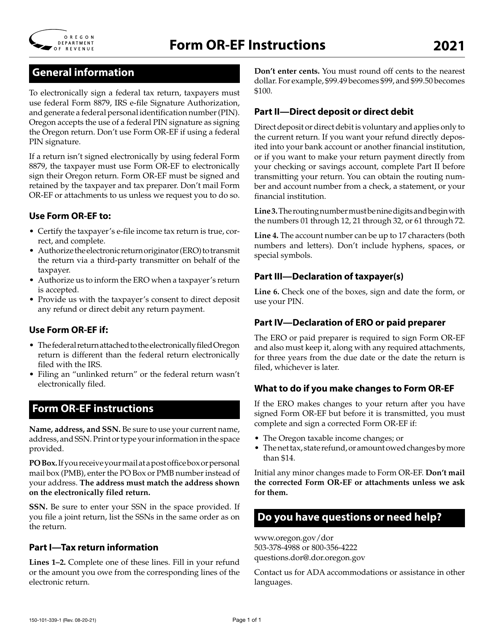

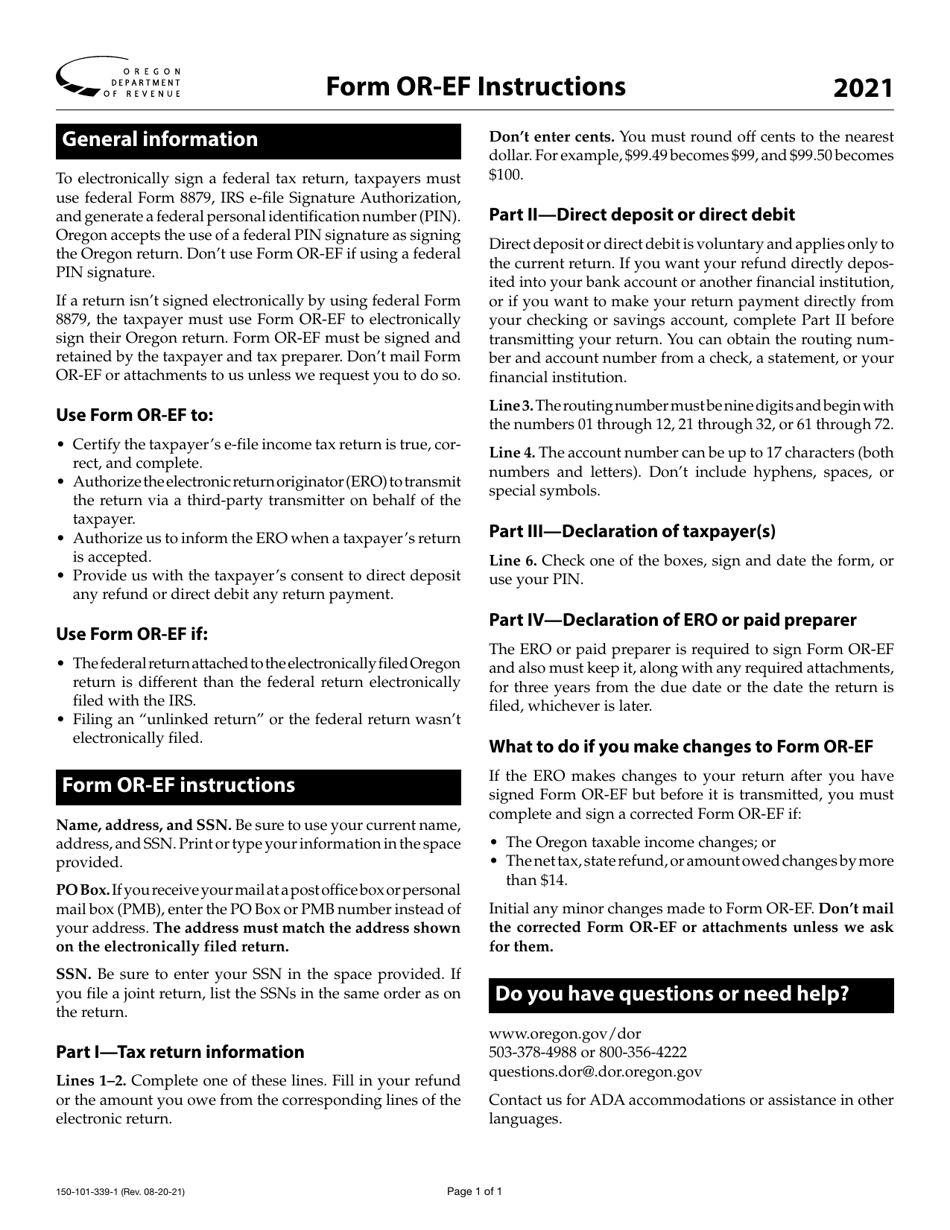

Instructions for Form OR-EF, 150-101-339

for the current year.

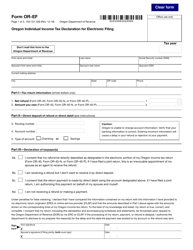

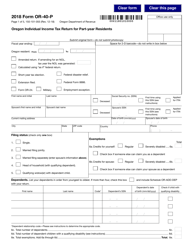

Instructions for Form OR-EF, 150-101-339 Oregon Individual Income Tax Declaration for Electronic Filing - Oregon

This document contains official instructions for Form OR-EF , and Form 150-101-339 . Both forms are released and collected by the Oregon Department of Revenue.

FAQ

Q: What is Form OR-EF?

A: Form OR-EF is the Oregon Individual Income Tax Declaration for Electronic Filing.

Q: Who needs to use Form OR-EF?

A: Anyone who wants to electronically file their Oregon individual income tax return needs to use Form OR-EF.

Q: How do I fill out Form OR-EF?

A: You need to provide your personal information, income details, deductions, and credits on Form OR-EF.

Q: Is there a deadline for filing Form OR-EF?

A: Yes, the deadline for filing Form OR-EF is the same as the deadline for filing your Oregon individual income tax return.

Q: Can I file Form OR-EF if I owe taxes?

A: Yes, you can file Form OR-EF even if you owe taxes. However, you must include payment for the amount owed.

Q: What are the benefits of electronically filing Form OR-EF?

A: Some benefits of electronically filing Form OR-EF include faster processing, increased accuracy, and the option to receive your refund through direct deposit.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.