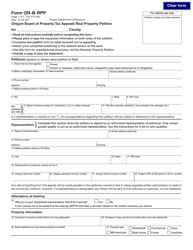

This version of the form is not currently in use and is provided for reference only. Download this version of

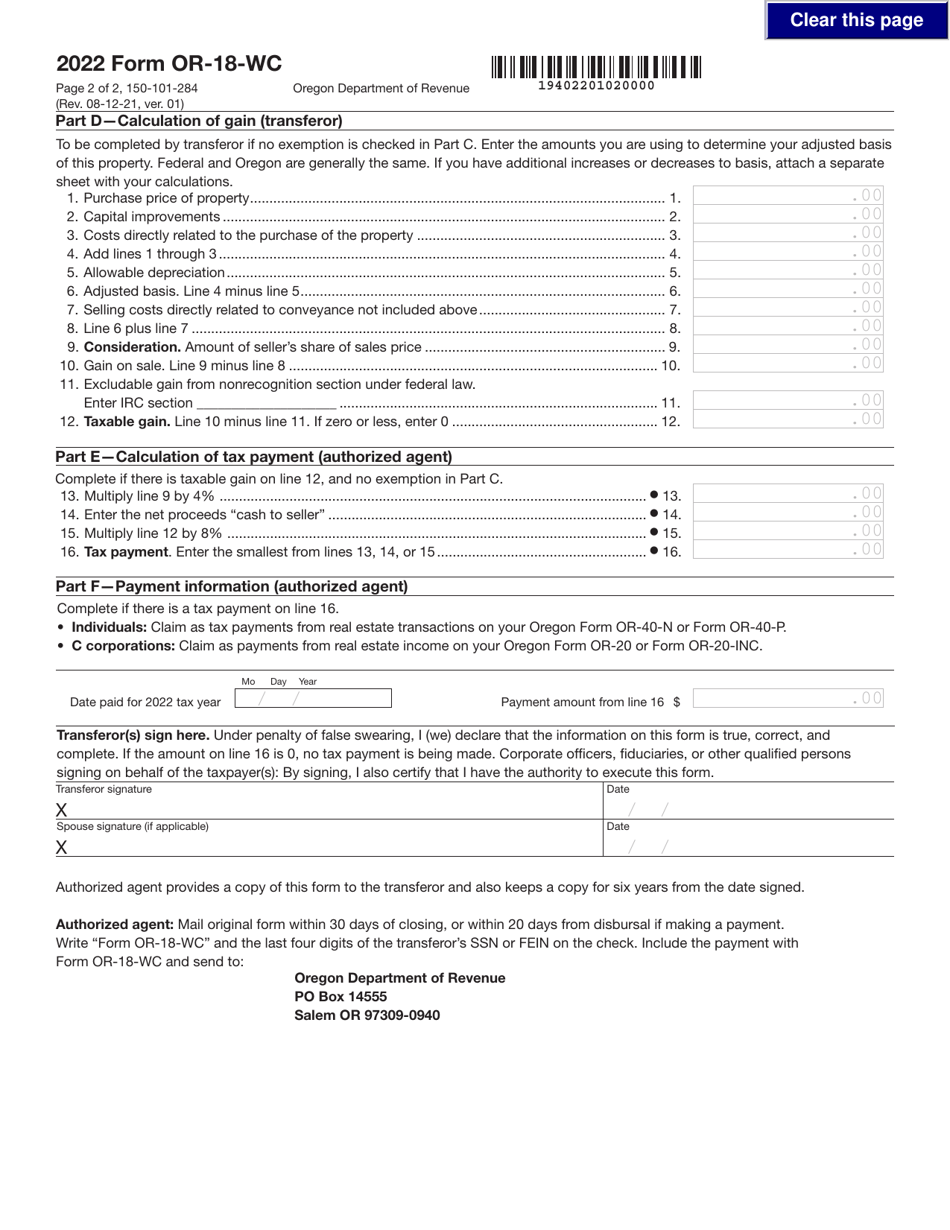

Form OR-18-WC (150-101-284)

for the current year.

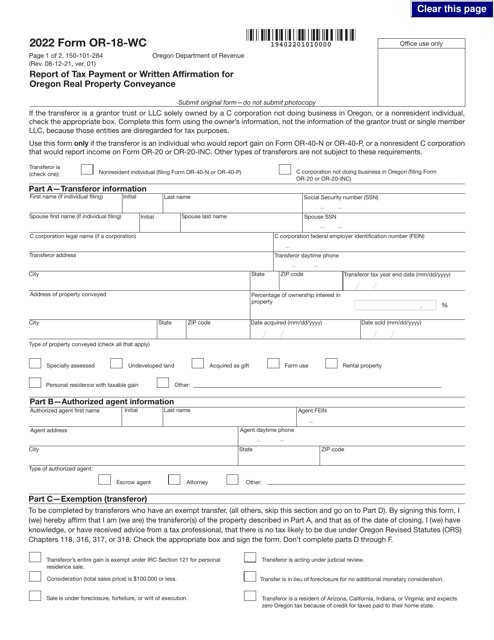

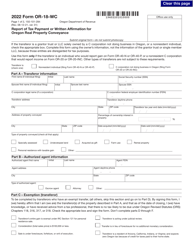

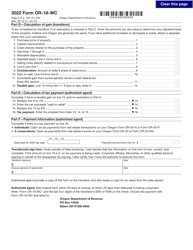

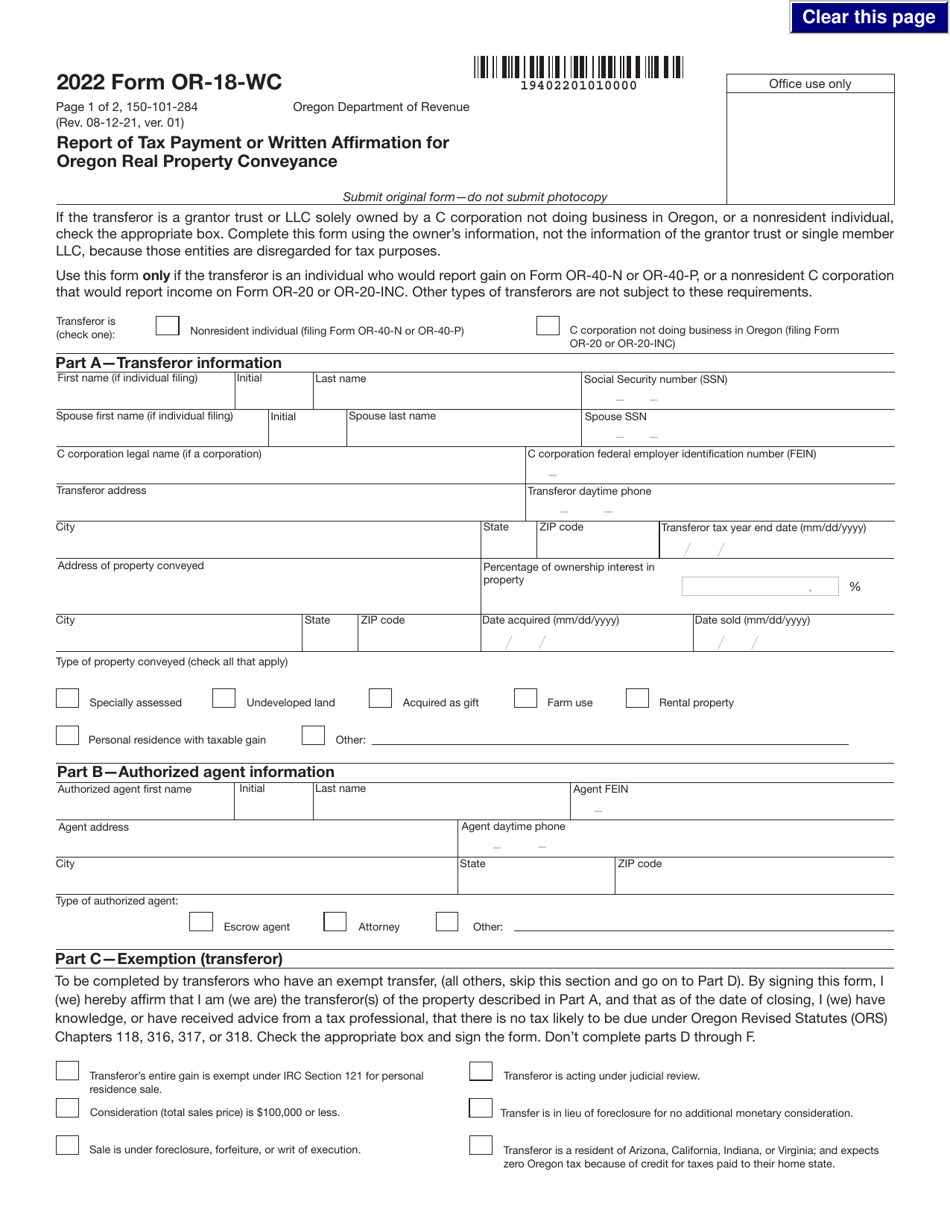

Form OR-18-WC (150-101-284) Report of Tax Payment or Written Affirmation for Oregon Real Property Conveyance - Oregon

What Is Form OR-18-WC (150-101-284)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

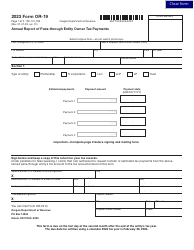

Q: What is Form OR-18-WC?

A: Form OR-18-WC is the Report of Tax Payment or Written Affirmation for Oregon Real Property Conveyance.

Q: What is the purpose of Form OR-18-WC?

A: The purpose of Form OR-18-WC is to report tax payment or provide a written affirmation for the conveyance of real property in Oregon.

Q: Do I need to use Form OR-18-WC for every real property conveyance in Oregon?

A: Yes, Form OR-18-WC is required for every real property conveyance in Oregon.

Q: What information is required on Form OR-18-WC?

A: Form OR-18-WC requires information such as the property address, transferor and transferee details, and payment verification.

Q: When should I submit Form OR-18-WC?

A: Form OR-18-WC should be submitted within 30 days from the date of conveyance.

Form Details:

- Released on August 12, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-18-WC (150-101-284) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.