This version of the form is not currently in use and is provided for reference only. Download this version of

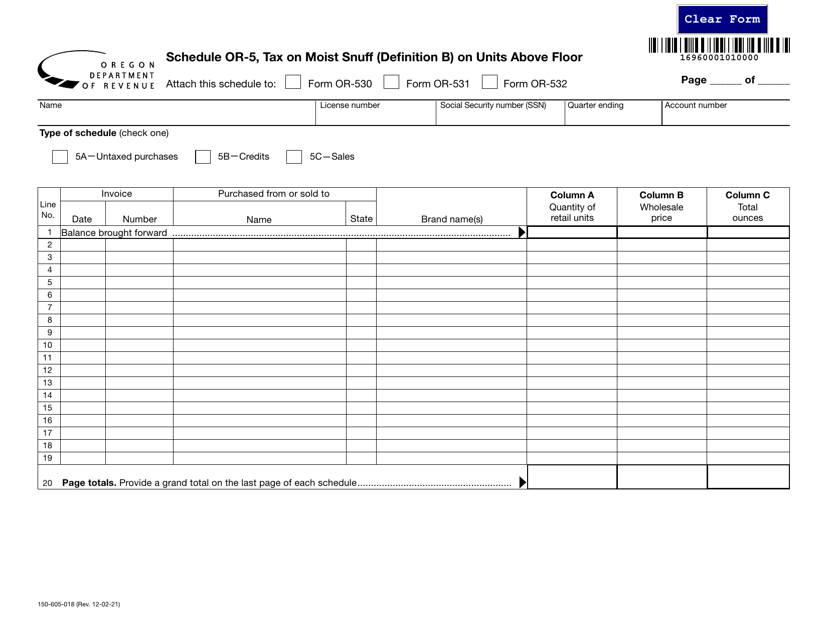

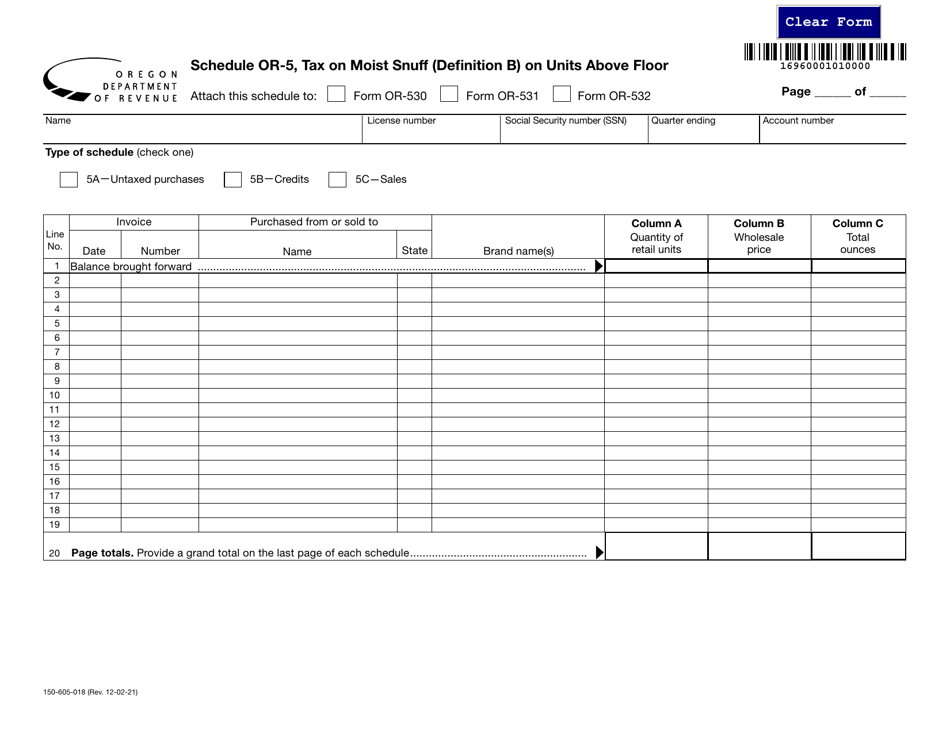

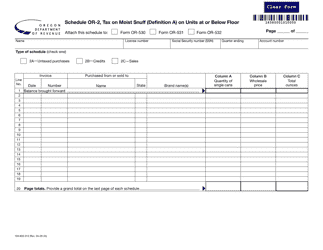

Form 150-605-018 Schedule OR-5

for the current year.

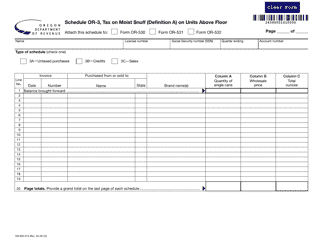

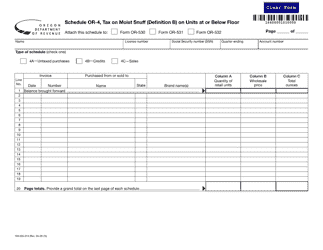

Form 150-605-018 Schedule OR-5 Tax on Moist Snuff (Definition B) on Units Above Floor - Oregon

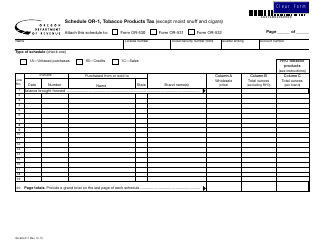

What Is Form 150-605-018 Schedule OR-5?

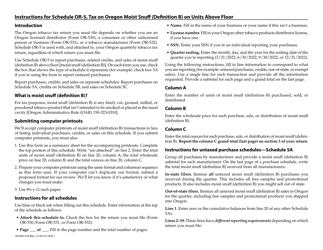

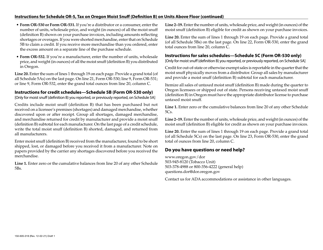

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-605-018?

A: Form 150-605-018 is a tax form used in Oregon to report and pay tax on moist snuff products.

Q: What is Schedule OR-5?

A: Schedule OR-5 is a specific schedule on Form 150-605-018 used to calculate tax on units of moist snuff above the floor.

Q: What is moist snuff?

A: Moist snuff refers to a type of smokeless tobacco that is typically placed between the cheek and gum.

Q: What does Definition B mean in the context of Schedule OR-5?

A: Definition B in Schedule OR-5 refers to the specific criteria used to determine the unit count for calculating the tax on moist snuff.

Q: What is the tax on units above the floor?

A: The tax on units above the floor is the additional tax imposed on the units of moist snuff that exceed a certain threshold.

Form Details:

- Released on December 2, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-605-018 Schedule OR-5 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.