This version of the form is not currently in use and is provided for reference only. Download this version of

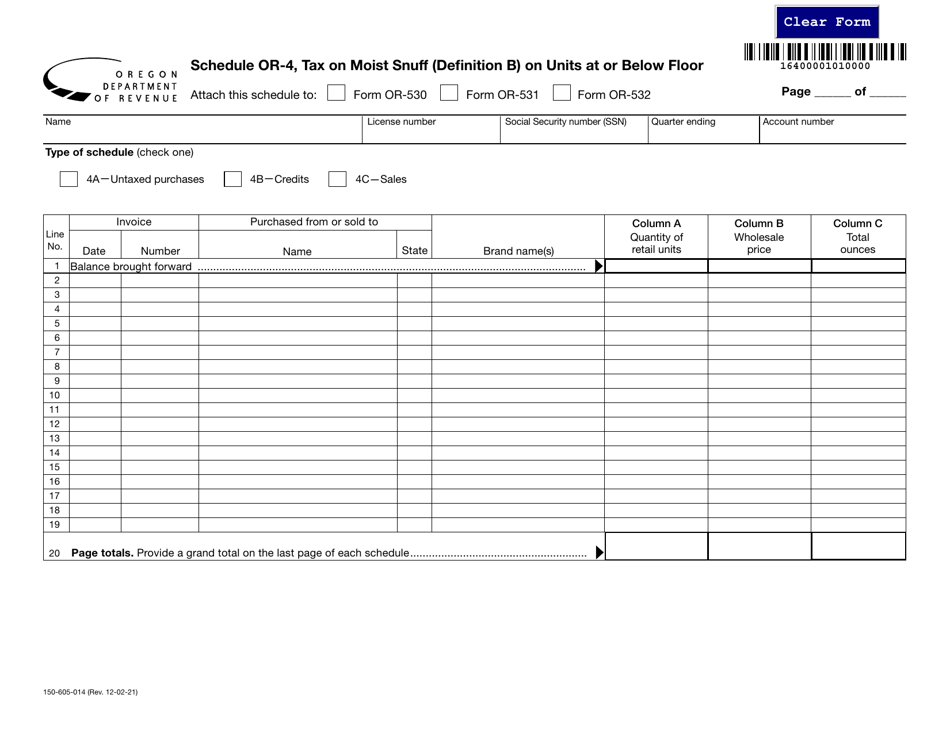

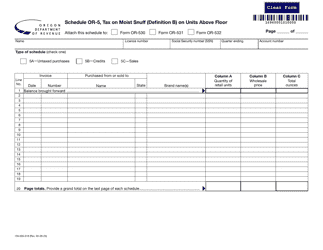

Form 150-605-014 Schedule OR-4

for the current year.

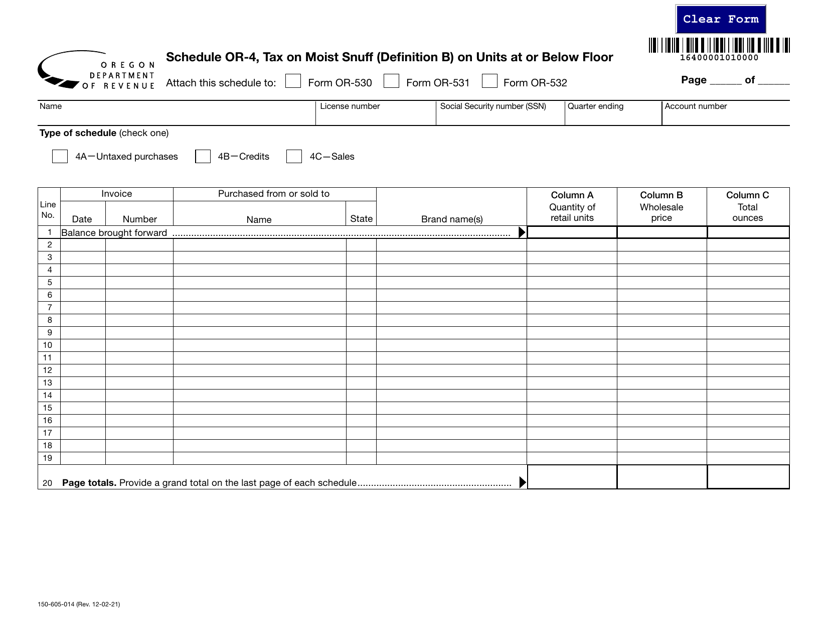

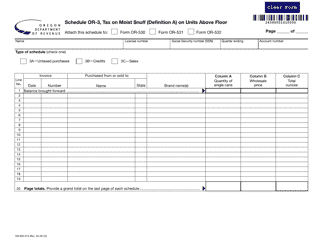

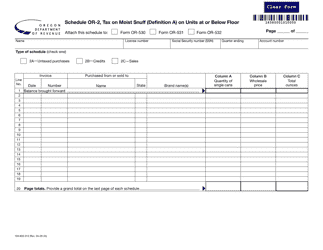

Form 150-605-014 Schedule OR-4 Tax on Moist Snuff (Definition B) on Units at or Below Floor - Oregon

What Is Form 150-605-014 Schedule OR-4?

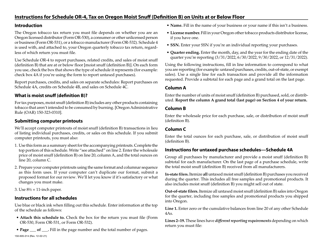

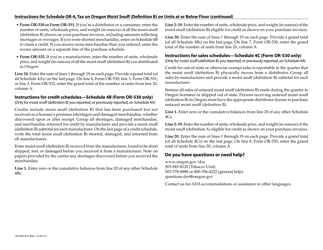

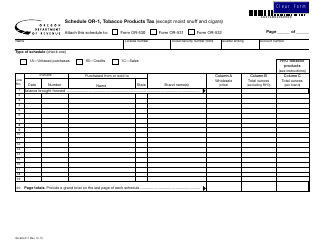

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule OR-4?

A: Schedule OR-4 is a tax form used in Oregon to report and pay tax on moist snuff products.

Q: What is moist snuff?

A: Moist snuff refers to a type of smokeless tobacco product that is usually moist and held in the mouth.

Q: What is Definition B on Schedule OR-4?

A: Definition B on Schedule OR-4 provides the tax rate for units of moist snuff that are at or below the floor level.

Q: What does 'units at or below floor' mean?

A: 'Units at or below floor' refers to the quantity of moist snuff products that are stored at or below a certain level, as determined by the Oregon Department of Revenue.

Q: How is the tax calculated on moist snuff?

A: The tax on moist snuff is calculated based on the quantity of units at or below floor, multiplied by the tax rate provided in Definition B.

Q: Do I need to file Schedule OR-4?

A: If you sell or distribute moist snuff products in Oregon, you are required to file Schedule OR-4 and pay the applicable tax.

Q: Are there any penalties for late filing or non-payment of tax?

A: Yes, there are penalties for late filing or non-payment of tax. It is important to file and pay the tax on time to avoid these penalties.

Q: Can I claim any deductions or exemptions on Schedule OR-4?

A: No, Schedule OR-4 does not provide any deductions or exemptions. It is a form specifically for reporting and paying tax on moist snuff products.

Q: Who should I contact if I have questions about Schedule OR-4?

A: If you have questions about Schedule OR-4 or need assistance, you should contact the Oregon Department of Revenue.

Form Details:

- Released on December 2, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-605-014 Schedule OR-4 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.