This version of the form is not currently in use and is provided for reference only. Download this version of

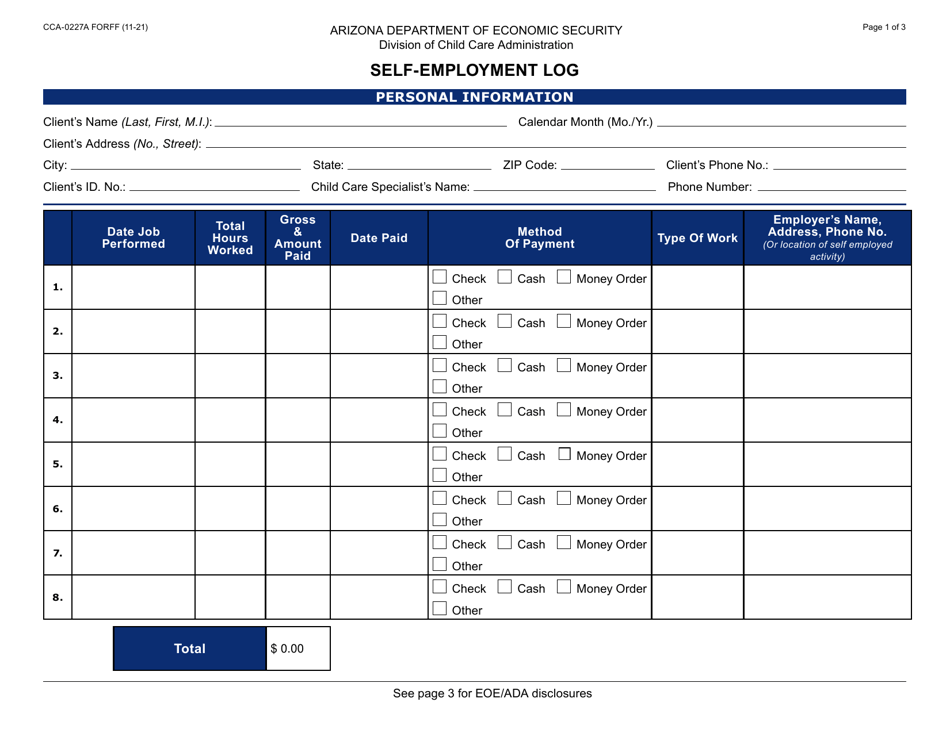

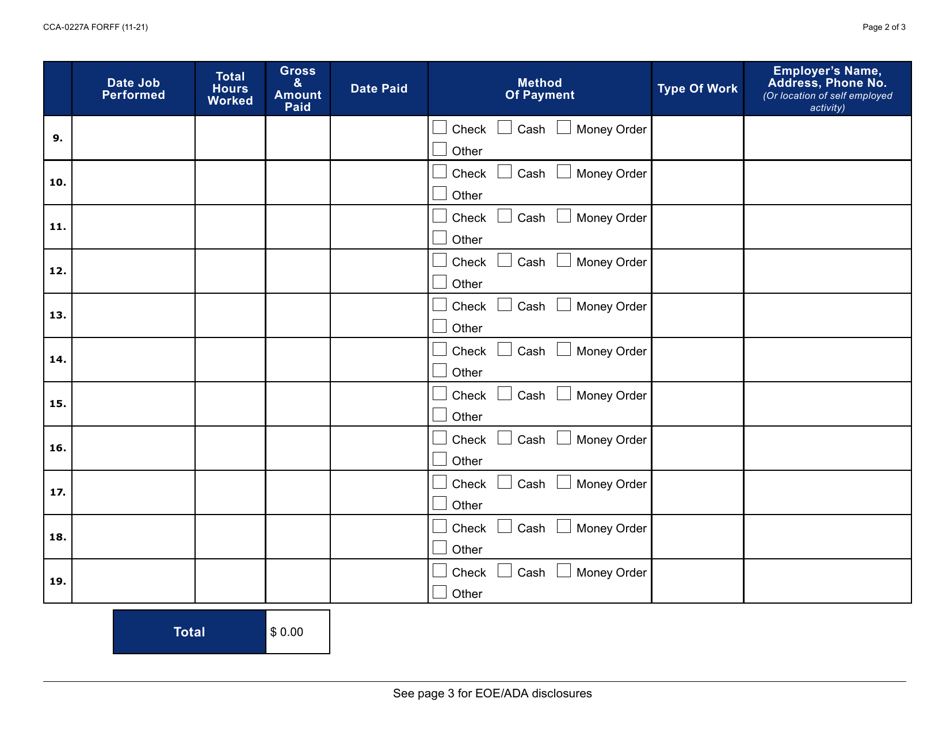

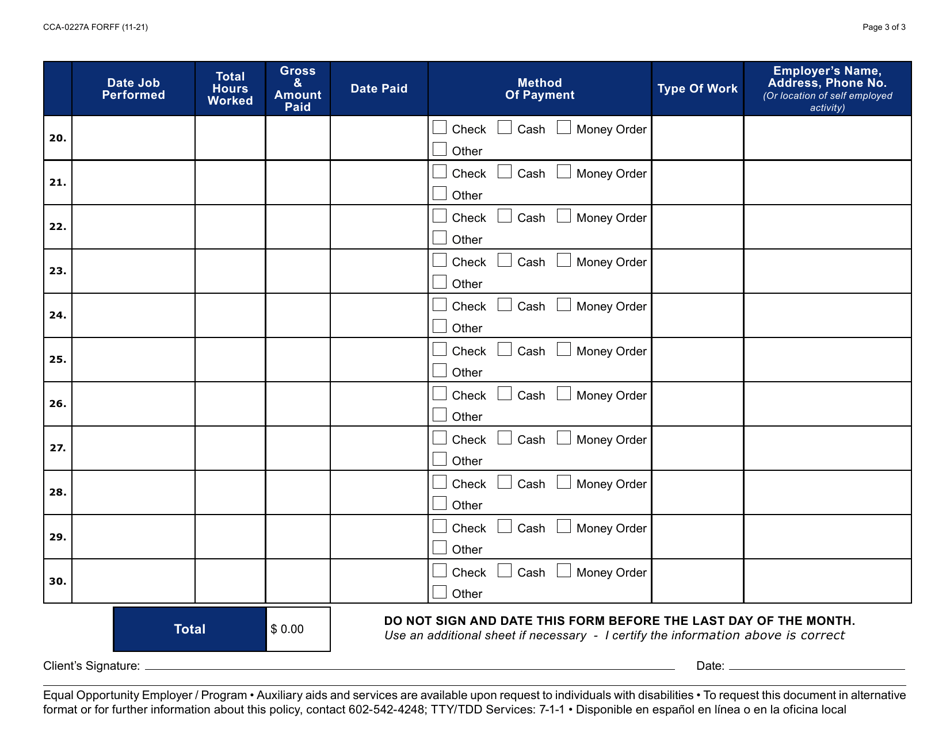

Form CCA-0227A

for the current year.

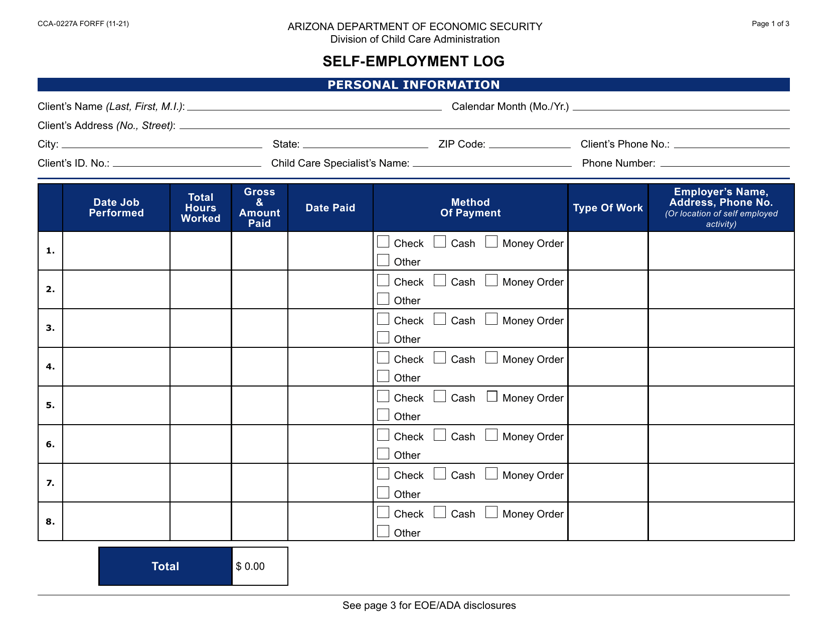

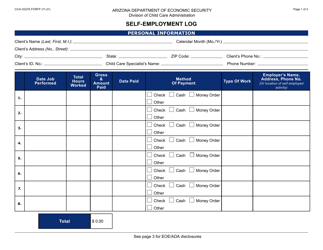

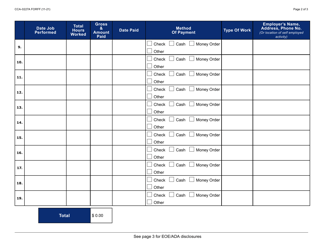

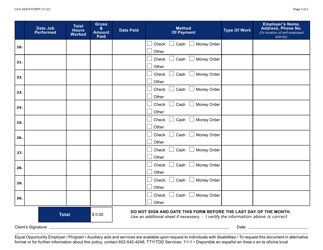

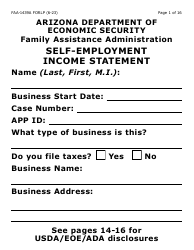

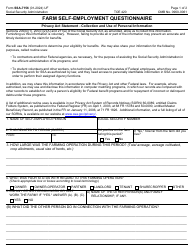

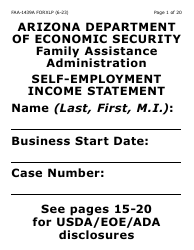

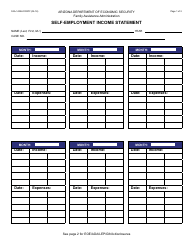

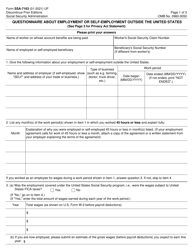

Form CCA-0227A Self-employment Log - Arizona

What Is Form CCA-0227A?

This is a legal form that was released by the Arizona Department of Economic Security - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CCA-0227A?

A: Form CCA-0227A is the Self-employment Log used in Arizona.

Q: Who uses Form CCA-0227A?

A: Form CCA-0227A is used by self-employed individuals in Arizona.

Q: What is the purpose of Form CCA-0227A?

A: The purpose of Form CCA-0227A is to keep a record of self-employment income and expenses in Arizona.

Q: Do I need to file Form CCA-0227A?

A: If you are self-employed in Arizona, you may need to file Form CCA-0227A to report your income and expenses.

Q: When is Form CCA-0227A due?

A: The due date for Form CCA-0227A varies and depends on your individual tax situation. It is best to consult with a tax professional or the Arizona Department of Revenue for specific deadlines.

Q: Is there a fee for filing Form CCA-0227A?

A: No, there is no fee for filing Form CCA-0227A.

Q: Can I file Form CCA-0227A electronically?

A: Yes, Arizona allows electronic filing of Form CCA-0227A.

Q: What should I do if I make a mistake on Form CCA-0227A?

A: If you make a mistake on Form CCA-0227A, you should correct it as soon as possible. Contact the Arizona Department of Revenue for guidance on how to proceed.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Arizona Department of Economic Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CCA-0227A by clicking the link below or browse more documents and templates provided by the Arizona Department of Economic Security.