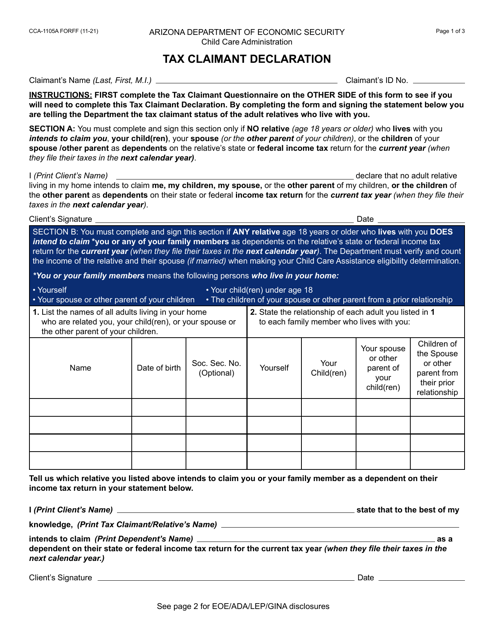

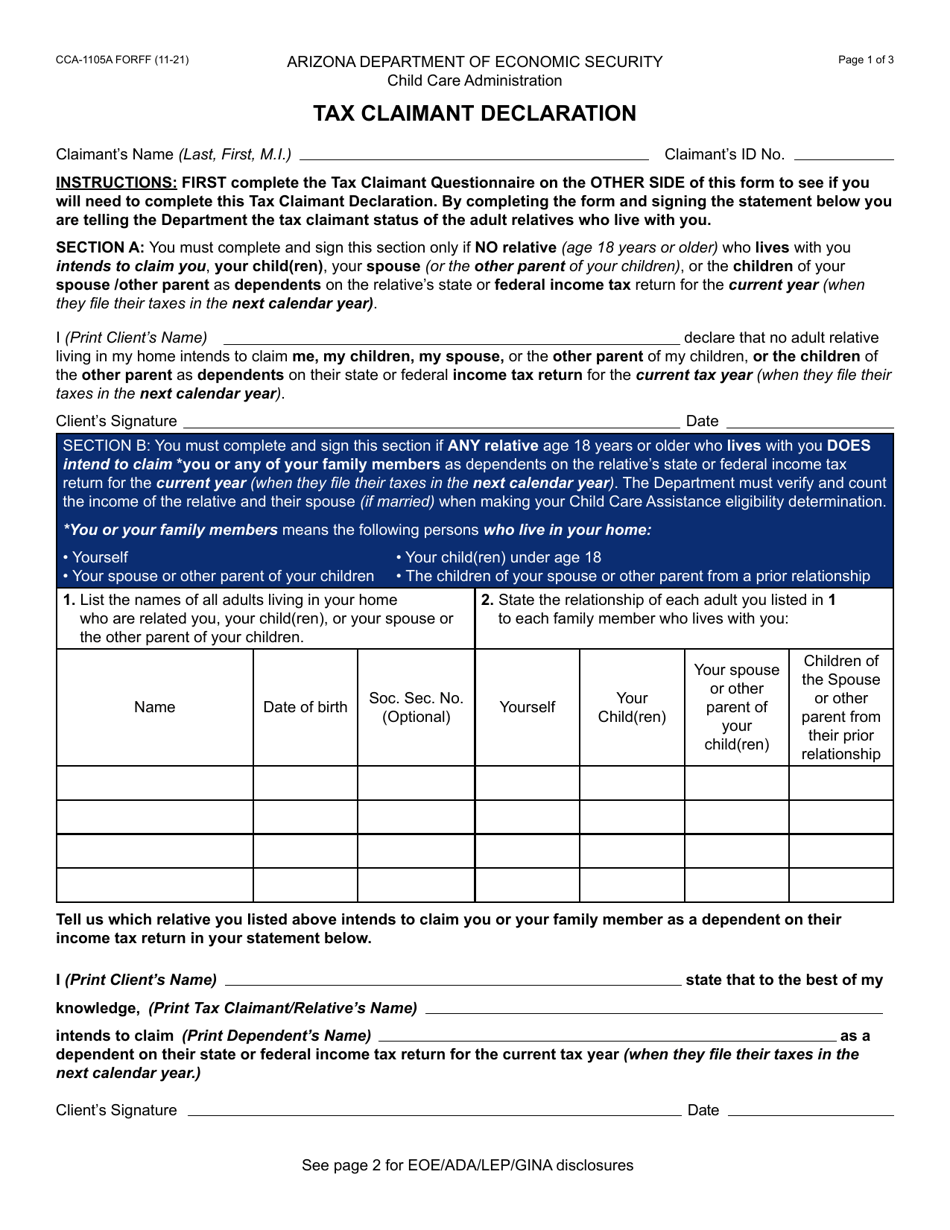

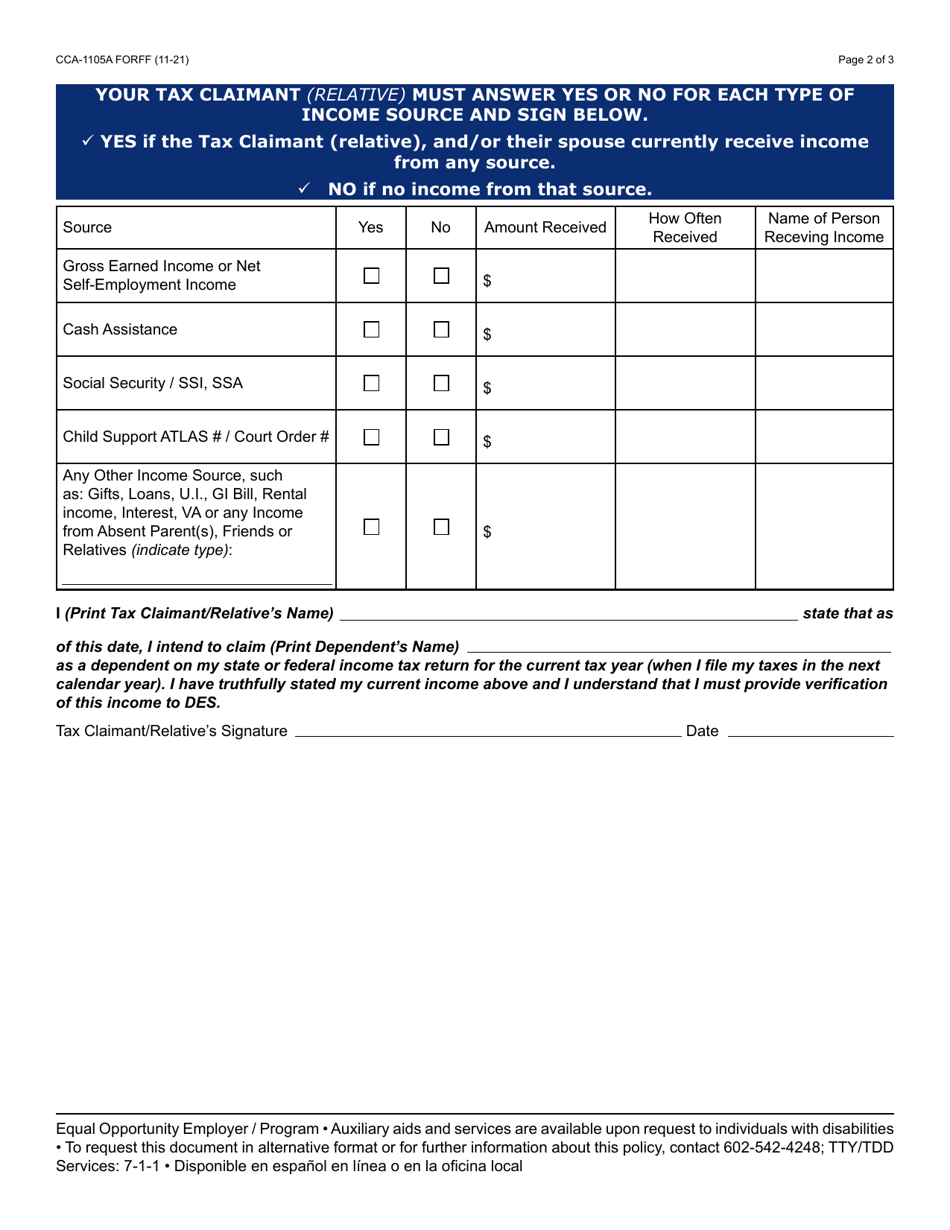

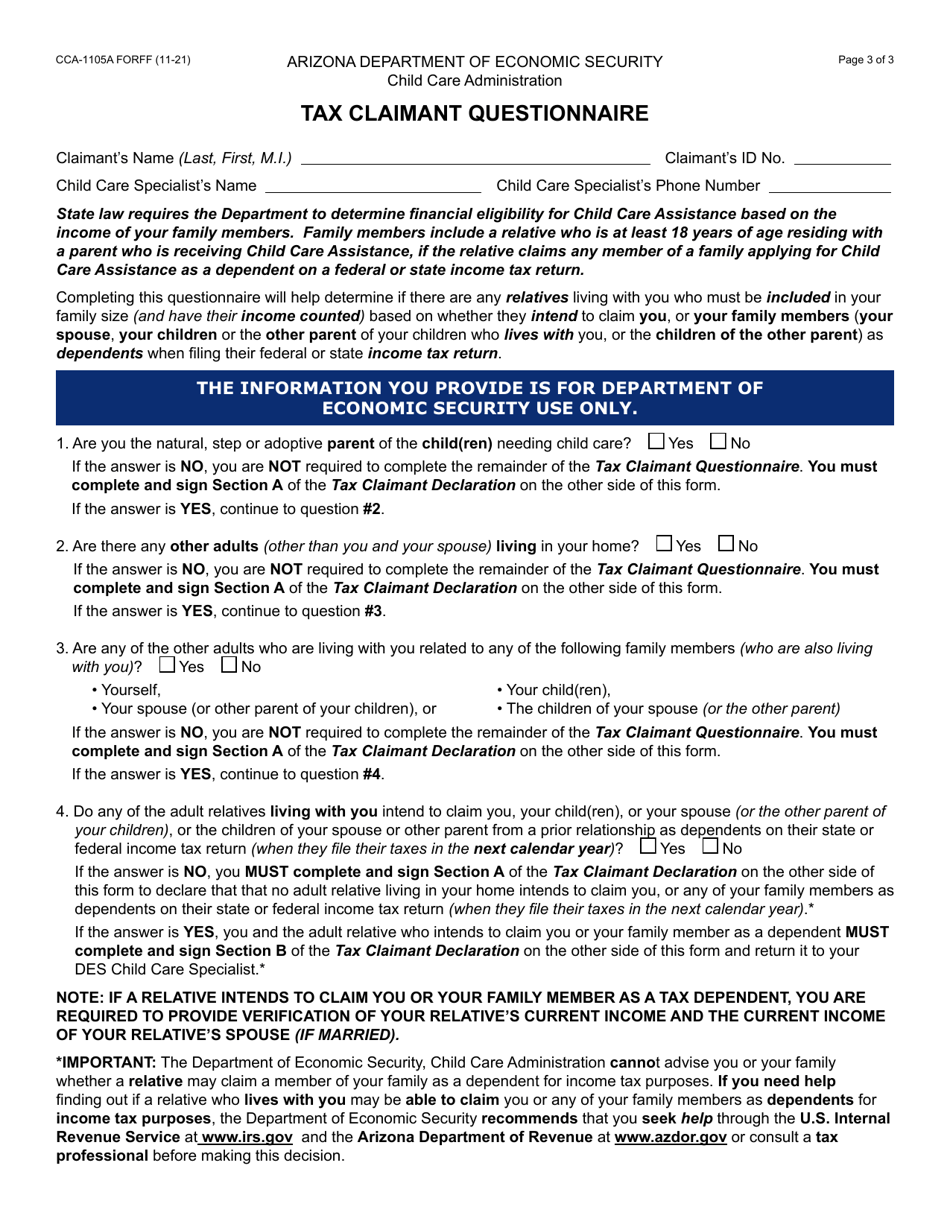

Form CCA-1105A Tax Claimant Declaration - Arizona

What Is Form CCA-1105A?

This is a legal form that was released by the Arizona Department of Economic Security - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CCA-1105A?

A: Form CCA-1105A is the Tax Claimant Declaration used in Arizona.

Q: Who needs to fill out Form CCA-1105A?

A: Tax claimants in Arizona need to fill out Form CCA-1105A.

Q: What is the purpose of Form CCA-1105A?

A: The purpose of Form CCA-1105A is to declare the tax claimant's eligibility for a tax credit or refund.

Q: How do I fill out Form CCA-1105A?

A: Fill out the required personal information and provide details about your eligibility for the tax credit or refund.

Q: Are there any deadlines for submitting Form CCA-1105A?

A: Yes, the deadline for submitting Form CCA-1105A depends on the specific tax credit or refund program. Check the instructions or consult with the Arizona Department of Revenue for deadlines.

Q: Can I file Form CCA-1105A electronically?

A: Yes, you can file Form CCA-1105A electronically through the Arizona Department of Revenue's e-file system.

Q: Are there any fees associated with filing Form CCA-1105A?

A: No, there are no fees associated with filing Form CCA-1105A.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Arizona Department of Economic Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CCA-1105A by clicking the link below or browse more documents and templates provided by the Arizona Department of Economic Security.