This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

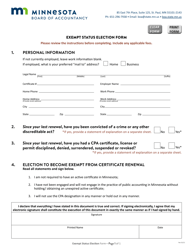

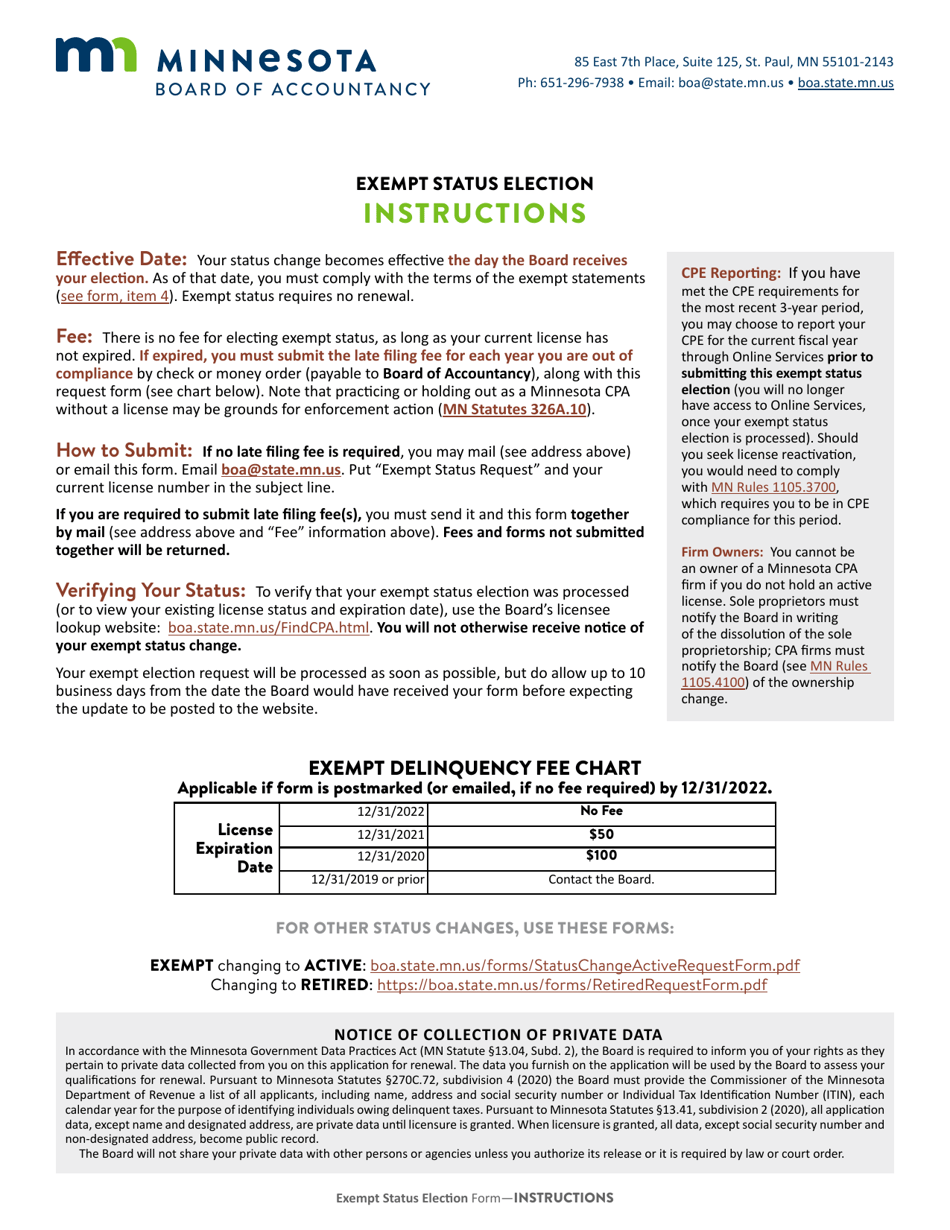

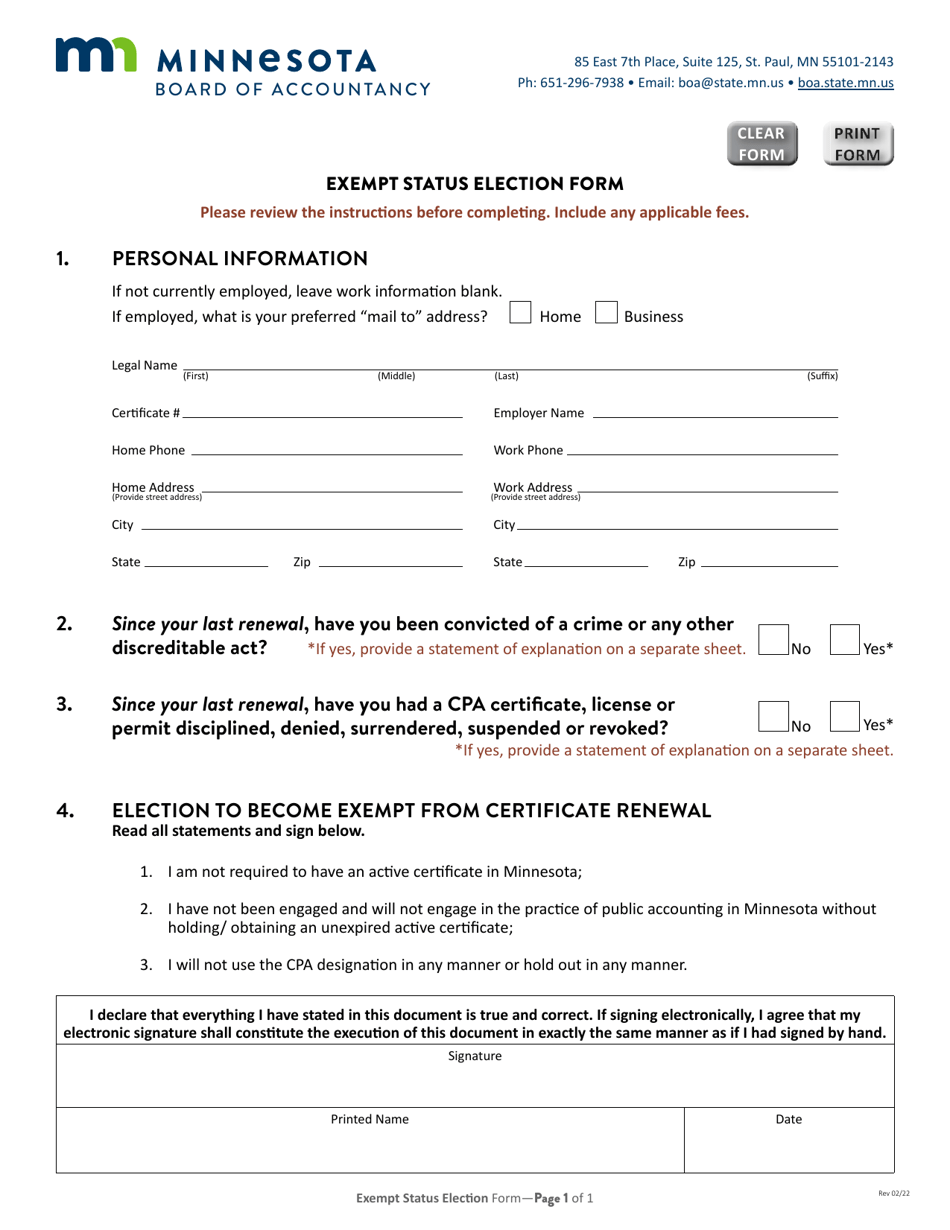

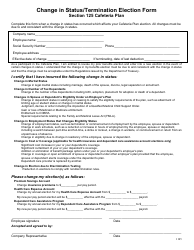

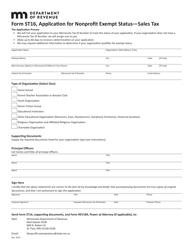

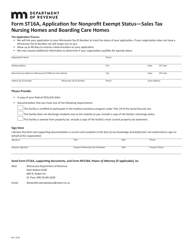

Exempt Status Election Form - Minnesota

Exempt Status Election Form is a legal document that was released by the Minnesota Board of Accountancy - a government authority operating within Minnesota.

FAQ

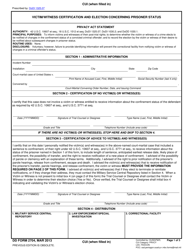

Q: What is an Exempt Status Election Form?

A: An Exempt Status Election Form is a document used in Minnesota to declare your exemption from state income tax withholding.

Q: Why would I need to fill out an Exempt Status Election Form?

A: You would need to fill out an Exempt Status Election Form if you meet certain criteria and wish to be exempt from state income tax withholding.

Q: What are the criteria for being exempt from state income tax withholding in Minnesota?

A: In Minnesota, you can be exempt from state income tax withholding if you meet the criteria set by the Minnesota Department of Revenue.

Q: Can I use the same Exempt Status Election Form for both federal and state income tax withholding exemptions?

A: No, you will need to fill out separate forms for federal and state income tax withholding exemptions. The Exempt Status Election Form is specifically for state income tax withholding.

Form Details:

- Released on February 1, 2022;

- The latest edition currently provided by the Minnesota Board of Accountancy;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Board of Accountancy.