This version of the form is not currently in use and is provided for reference only. Download this version of

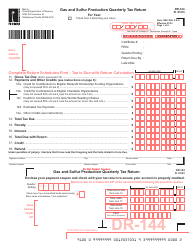

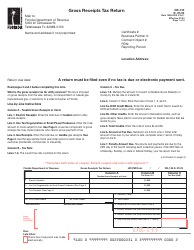

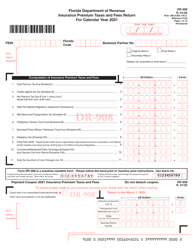

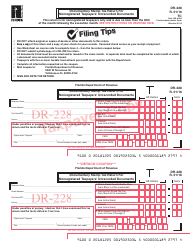

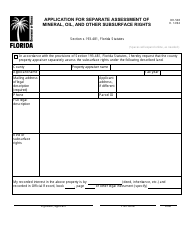

Form DR-145

for the current year.

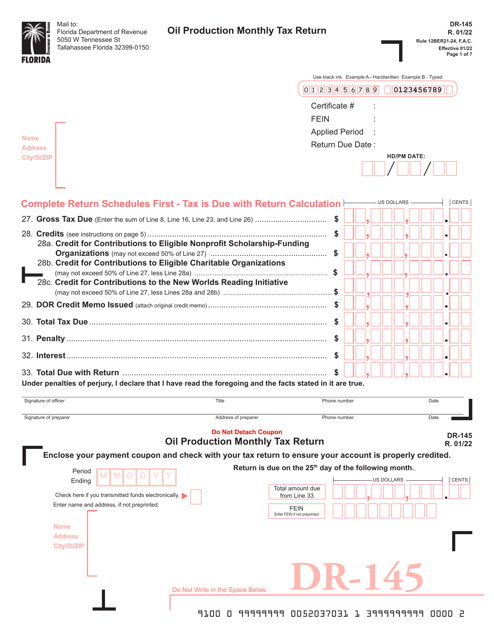

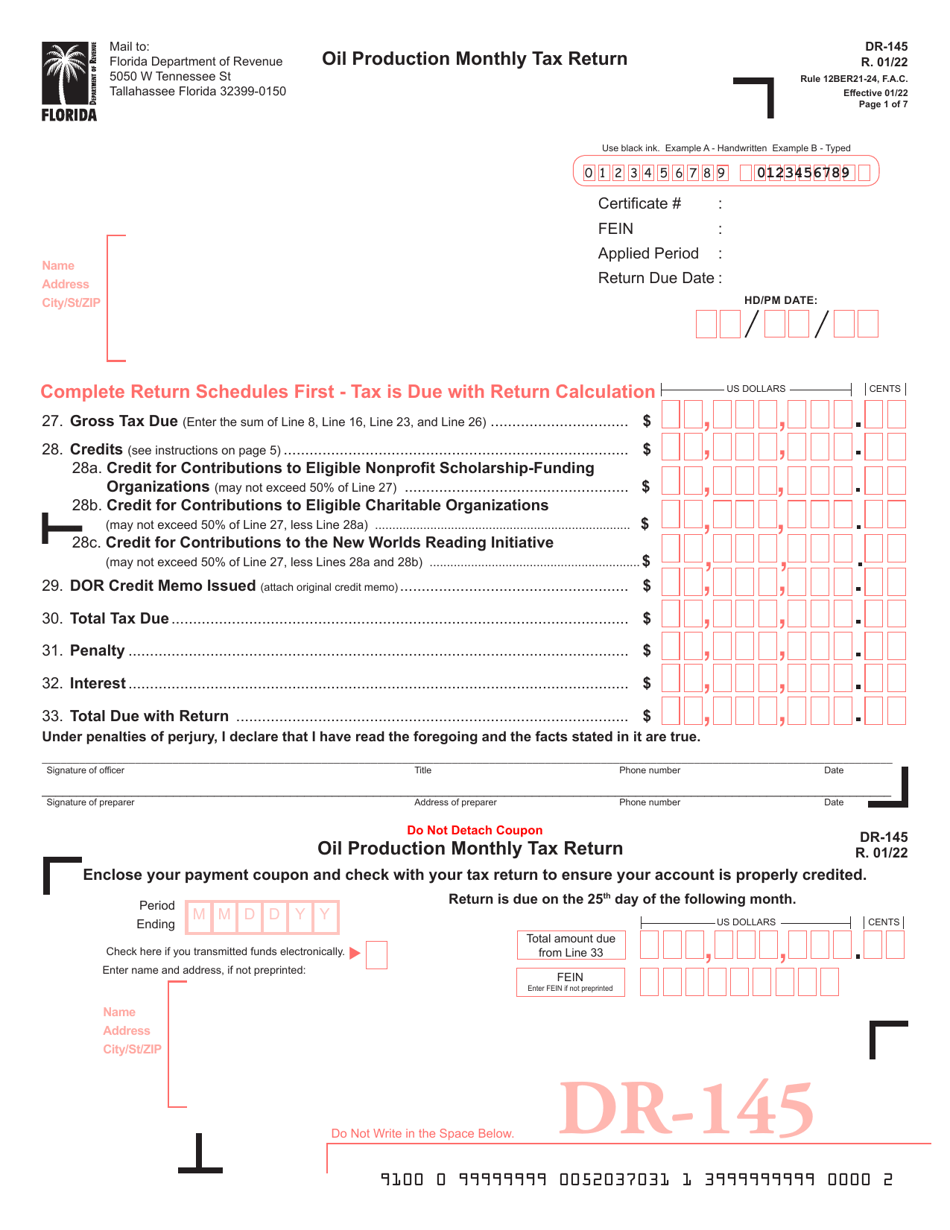

Form DR-145 Oil Production Monthly Tax Return - Florida

What Is Form DR-145?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-145?

A: Form DR-145 is the Oil ProductionMonthly Tax Return for the state of Florida.

Q: Who needs to file Form DR-145?

A: Oil producers in Florida need to file Form DR-145.

Q: What is the purpose of Form DR-145?

A: The purpose of Form DR-145 is to report and pay the monthly oil production tax in Florida.

Q: When is Form DR-145 due?

A: Form DR-145 is due on or before the 20th day of the month following the production month.

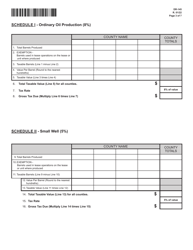

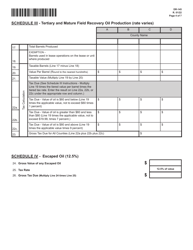

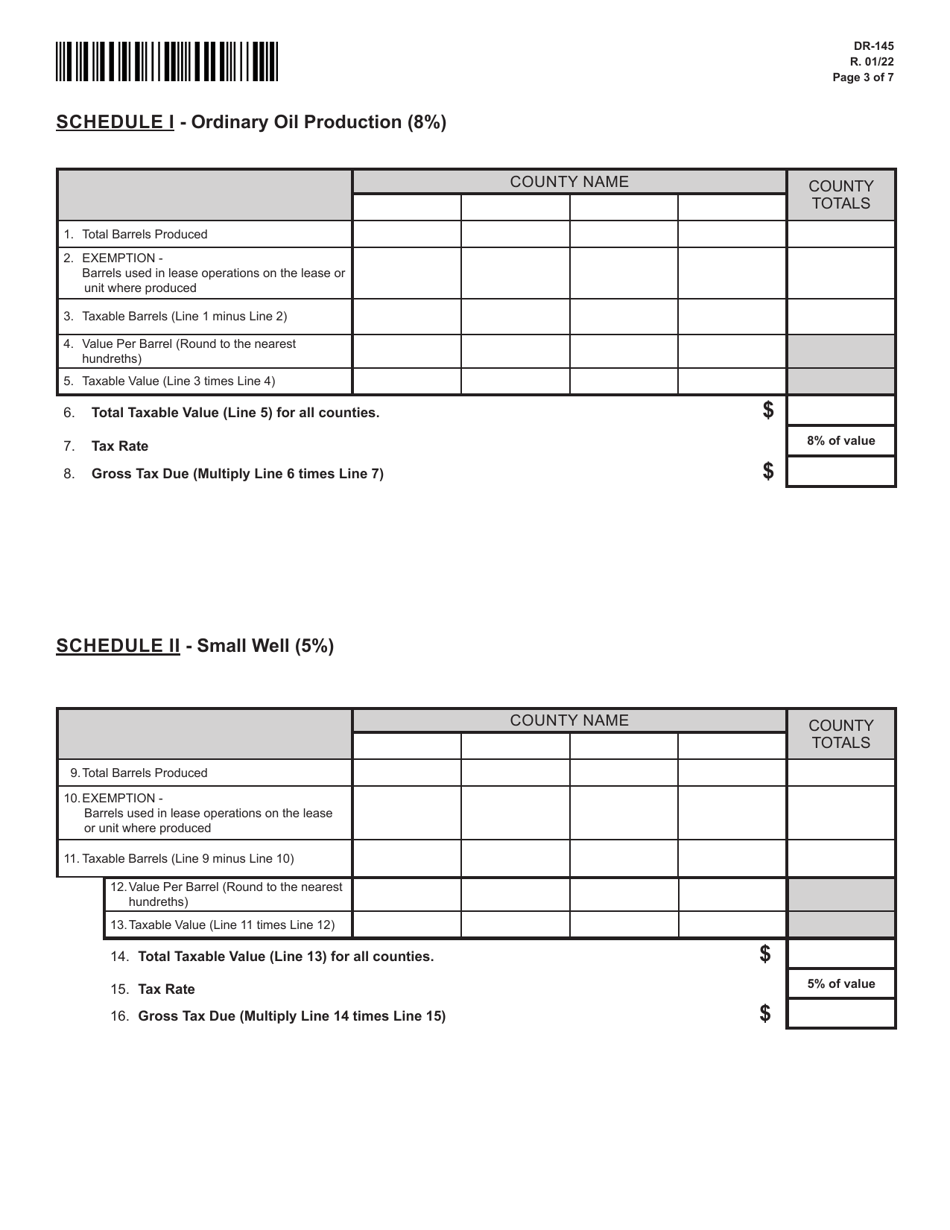

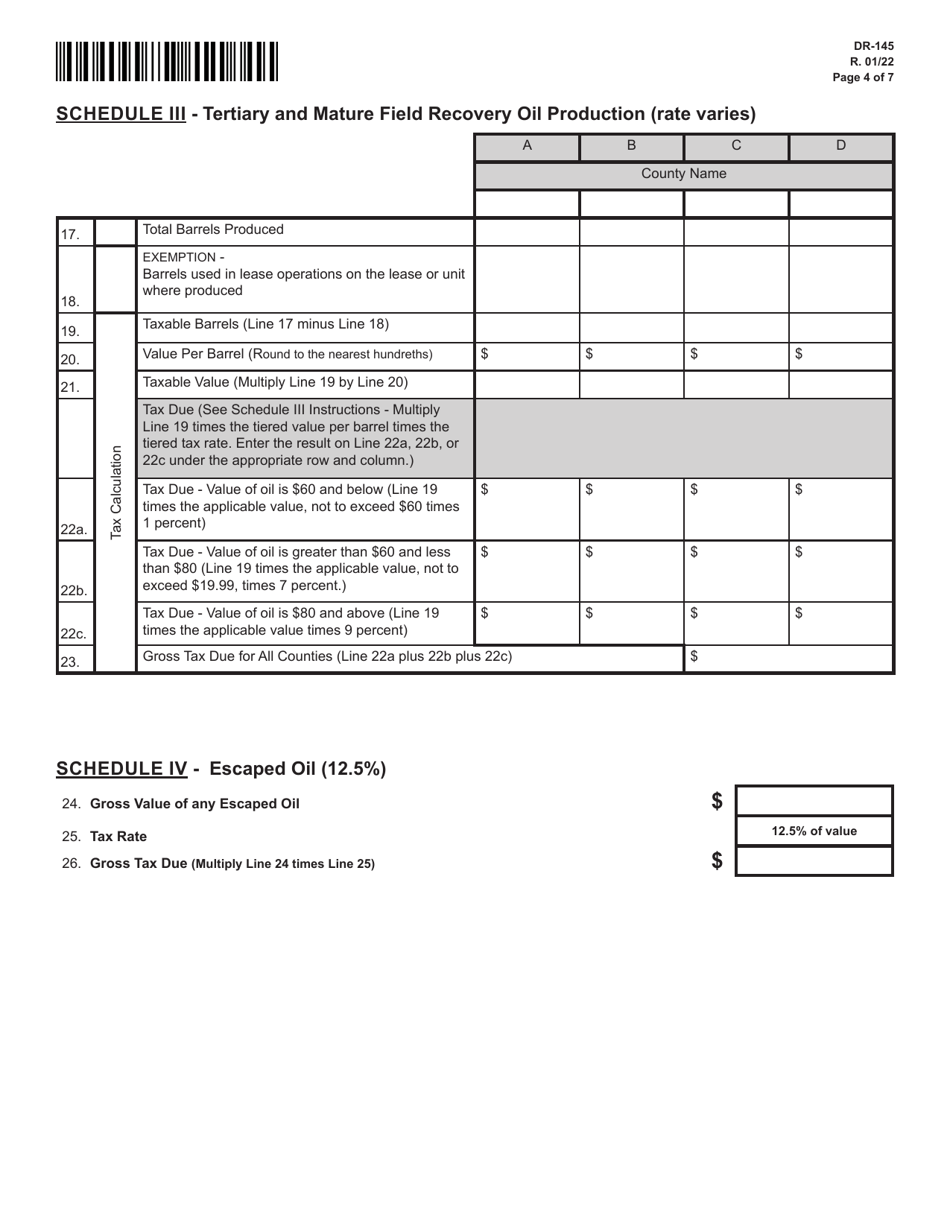

Q: What information do I need to complete Form DR-145?

A: You will need to provide information about the amount of oil produced, the taxable value, and any applicable exemptions.

Q: Are there any penalties for not filing Form DR-145?

A: Yes, there are penalties for late or non-filing of Form DR-145, including interest charges and possible legal actions.

Q: Can I file Form DR-145 electronically?

A: Yes, you can file Form DR-145 electronically through the Florida Department of Revenue's e-Services portal.

Q: Can I make payments electronically for the oil production tax?

A: Yes, you can make payments electronically through the Florida Department of Revenue's e-Services portal or by check.

Q: Who can I contact for assistance with Form DR-145?

A: You can contact the Florida Department of Revenue's Oil and Gas Tax Unit for assistance with Form DR-145.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-145 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.