This version of the form is not currently in use and is provided for reference only. Download this version of

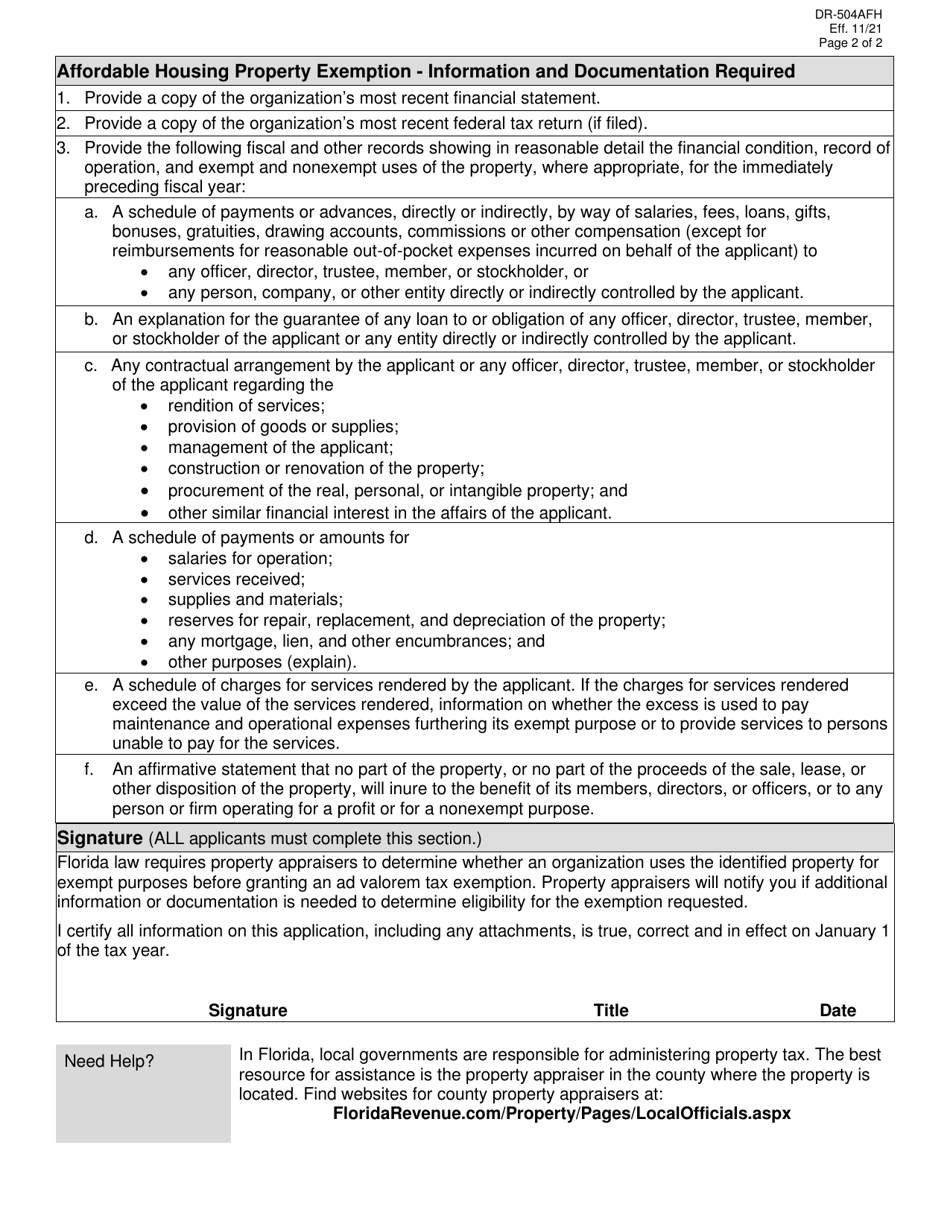

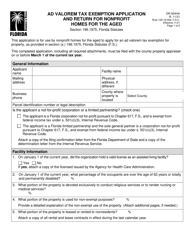

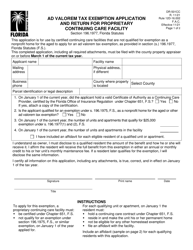

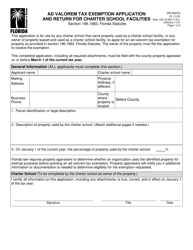

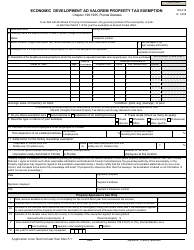

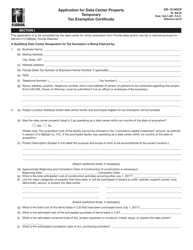

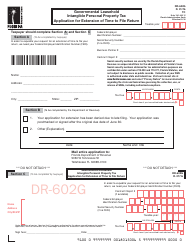

Form DR-504AFH

for the current year.

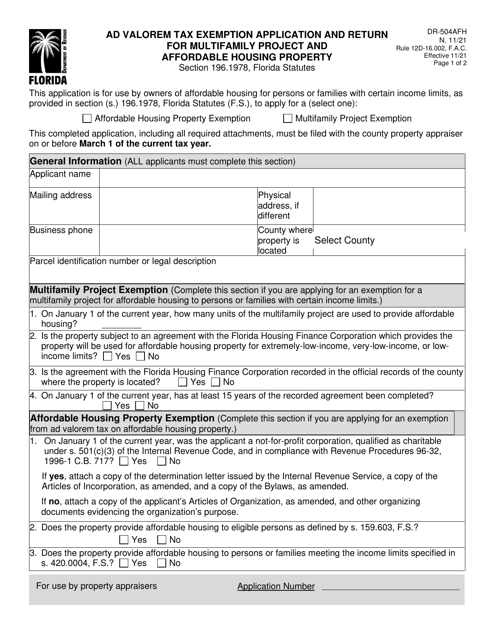

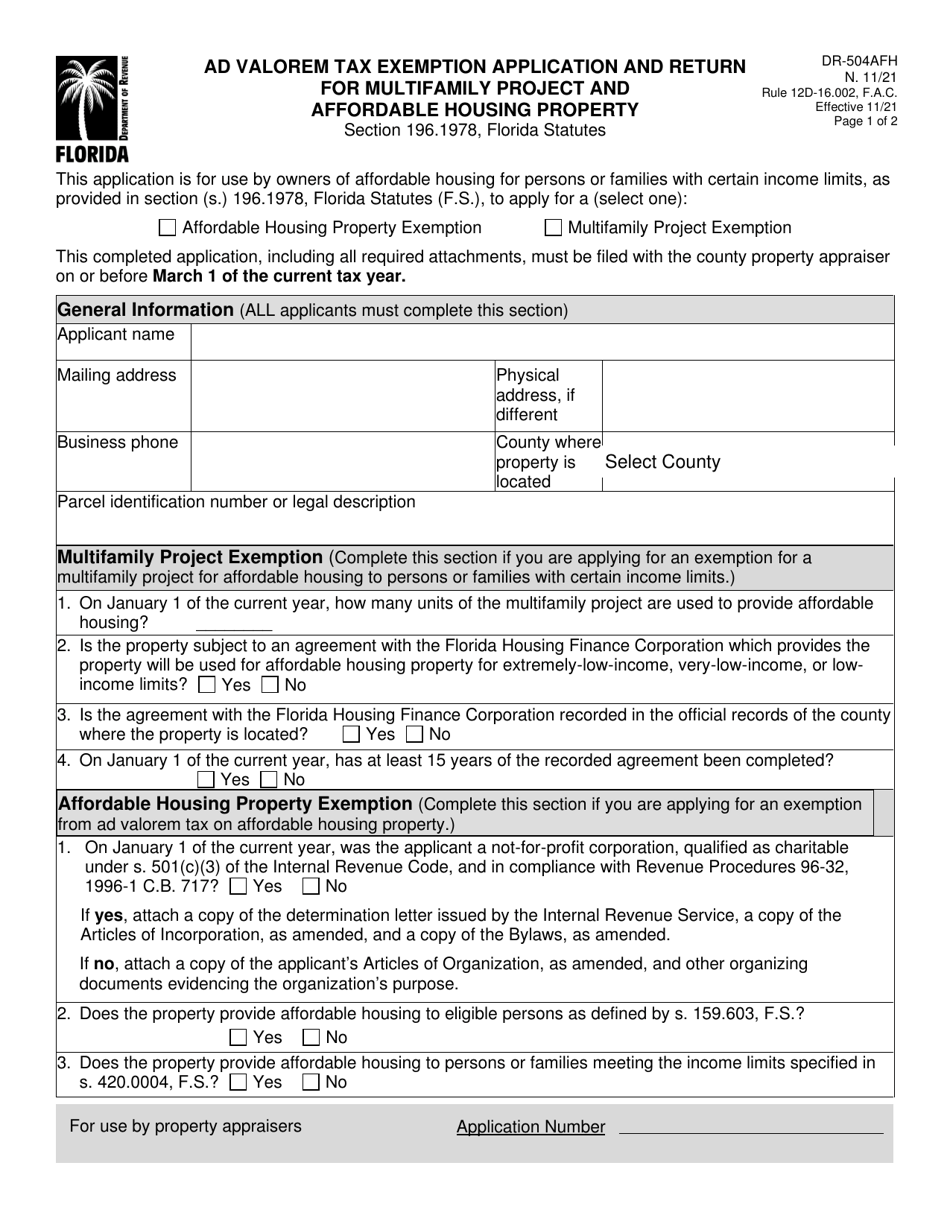

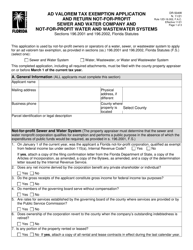

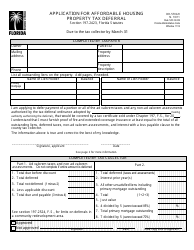

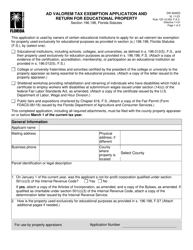

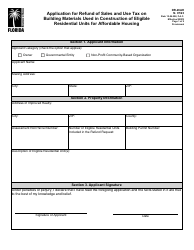

Form DR-504AFH Ad Valorem Tax Exemption Application and Return for Multifamily Project and Affordable Housing Property - Florida

What Is Form DR-504AFH?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-504AFH?

A: Form DR-504AFH is the Ad Valorem Tax Exemption Application and Return for Multifamily Project and Affordable Housing Property in Florida.

Q: Who needs to fill out Form DR-504AFH?

A: Property owners who have multifamily projects and affordable housing properties in Florida need to fill out Form DR-504AFH.

Q: What is the purpose of Form DR-504AFH?

A: The purpose of Form DR-504AFH is to apply for an ad valorem tax exemption for multifamily projects and affordable housing properties in Florida.

Q: Are there any fees associated with Form DR-504AFH?

A: There are no fees associated with Form DR-504AFH.

Q: When is Form DR-504AFH due?

A: Form DR-504AFH is due by March 1st of each year.

Q: What information do I need to provide on Form DR-504AFH?

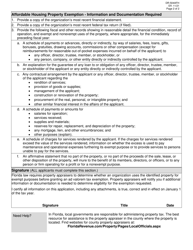

A: You need to provide information about the property, the owner, the project, income limitations, and demographic information.

Q: How do I submit Form DR-504AFH?

A: You can submit Form DR-504AFH by mail or in person to your local county property appraiser's office.

Q: How long does it take to process Form DR-504AFH?

A: The processing time for Form DR-504AFH varies, but it usually takes several weeks to several months.

Q: What happens after I submit Form DR-504AFH?

A: After you submit Form DR-504AFH, the county property appraiser's office will review your application and determine if you qualify for the ad valorem tax exemption.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-504AFH by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.