This version of the form is not currently in use and is provided for reference only. Download this version of

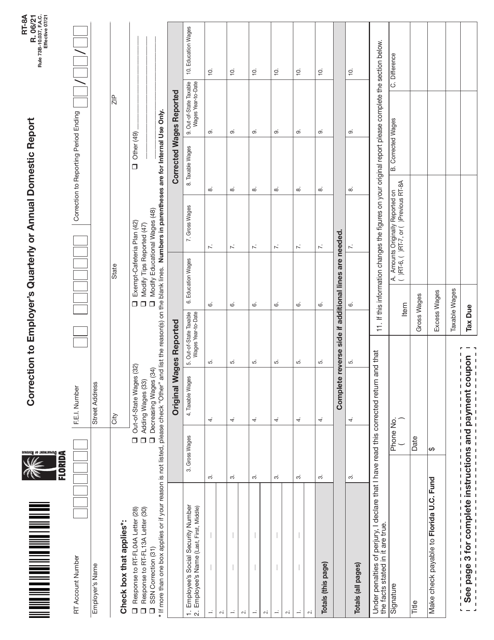

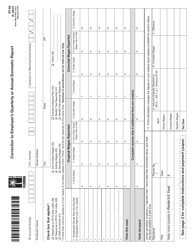

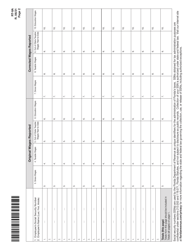

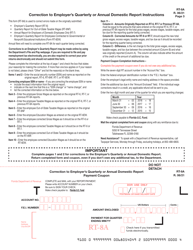

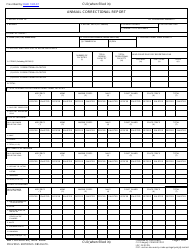

Form RT-8A

for the current year.

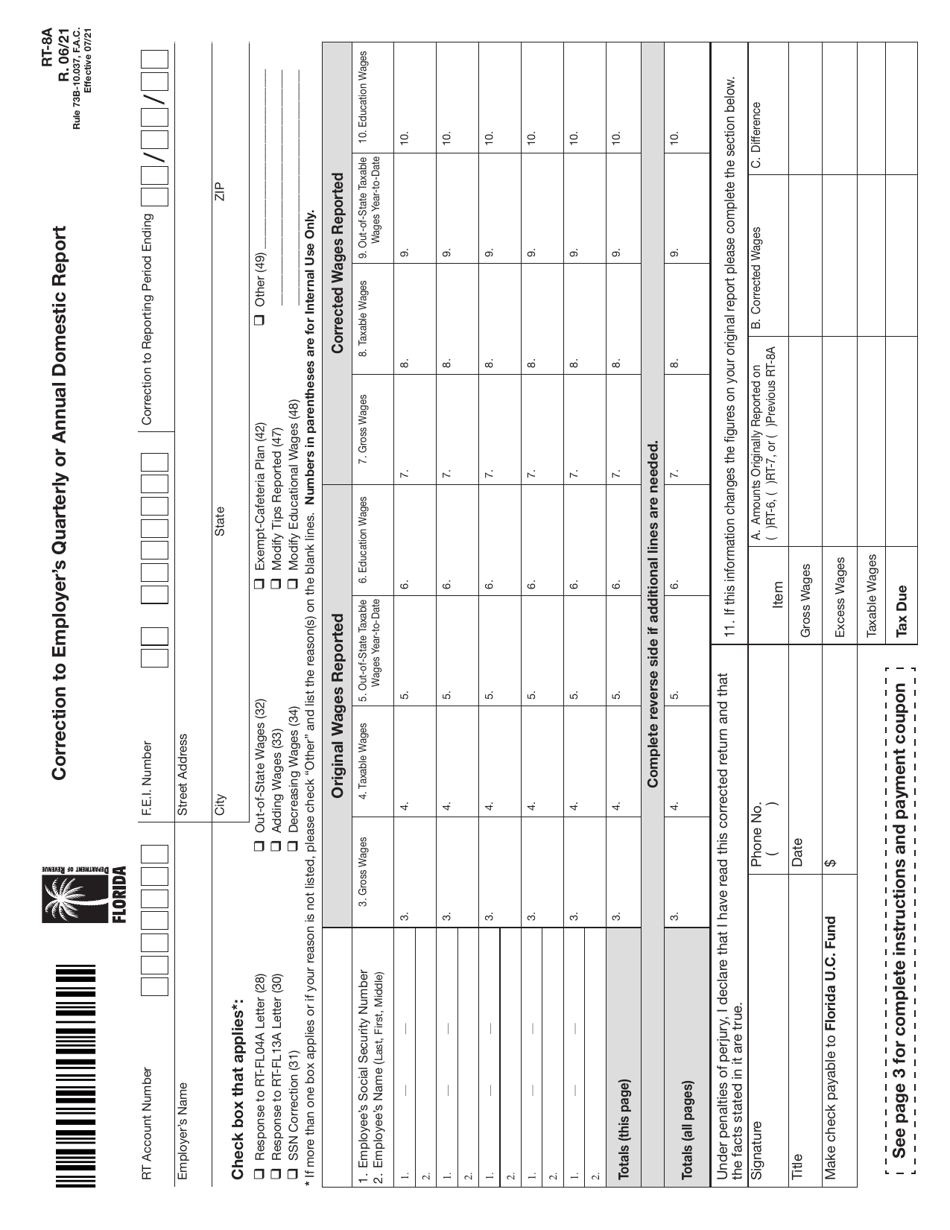

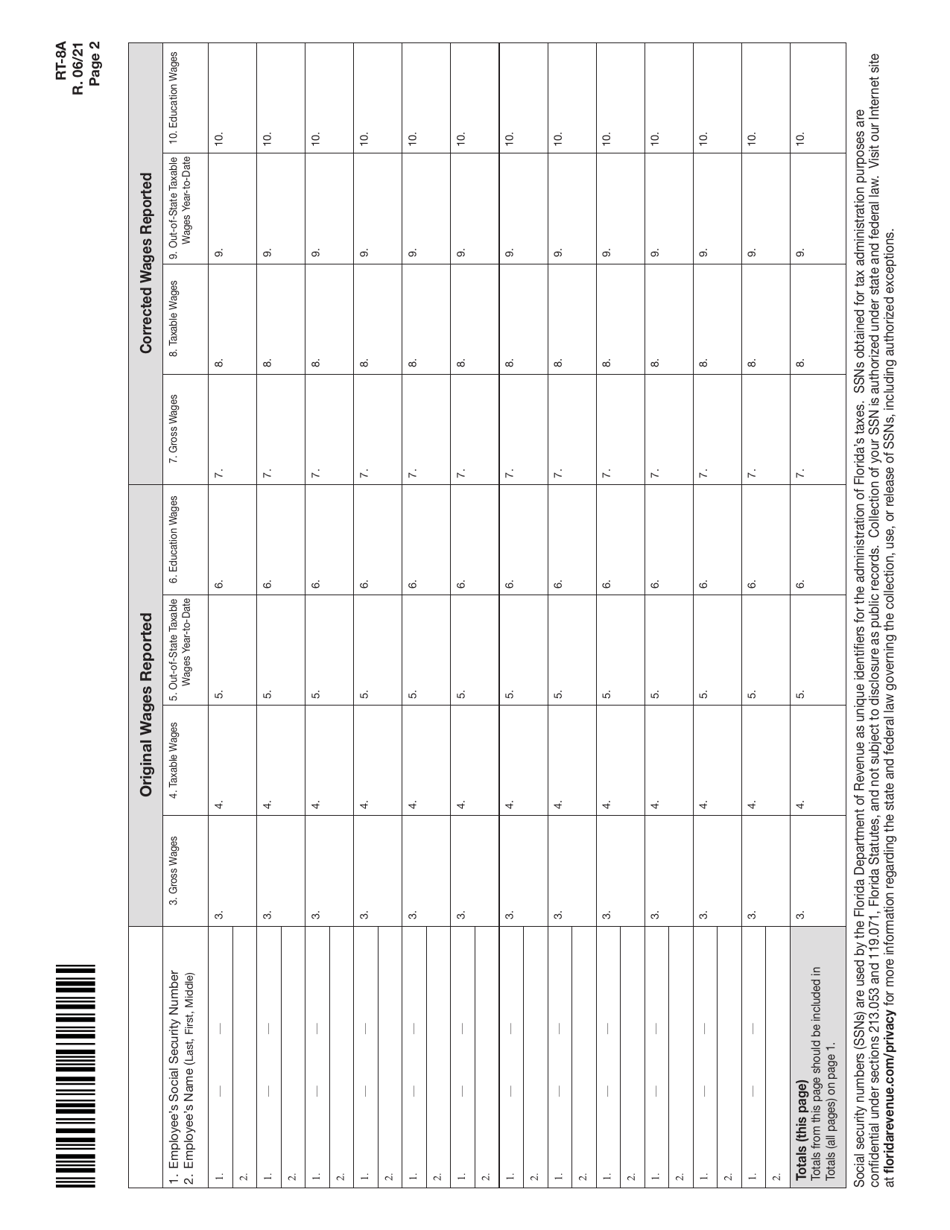

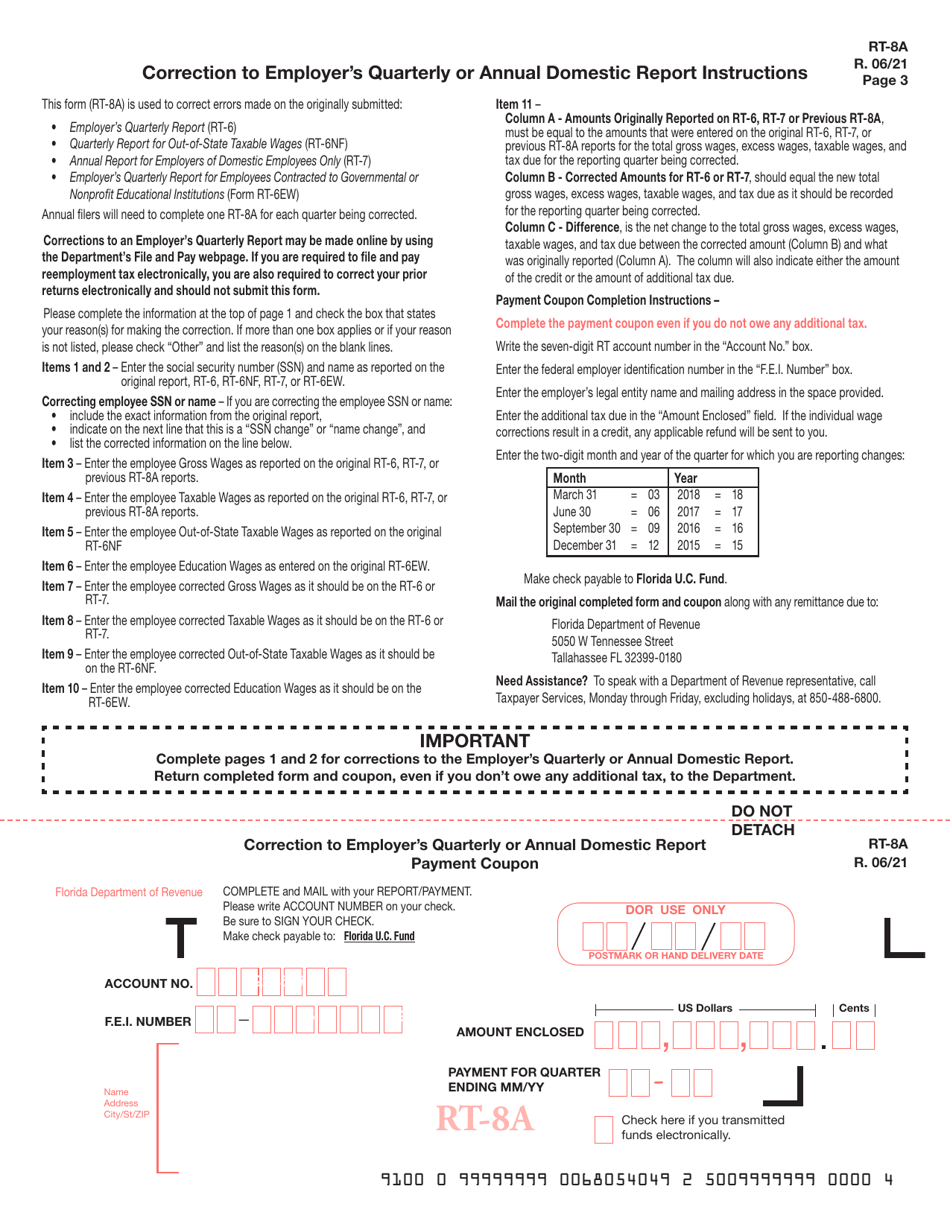

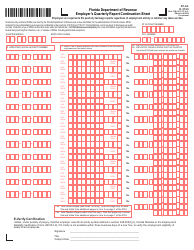

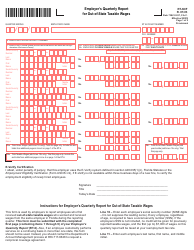

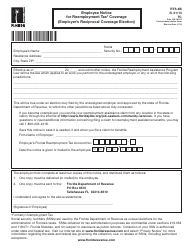

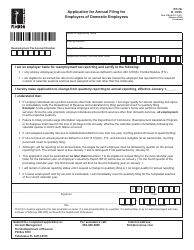

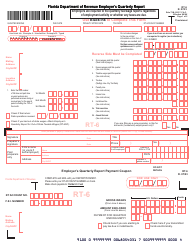

Form RT-8A Correction to Employer's Quarterly or Annual Domestic Report - Florida

What Is Form RT-8A?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RT-8A?

A: Form RT-8A is a Correction to Employer's Quarterly or Annual Domestic Report.

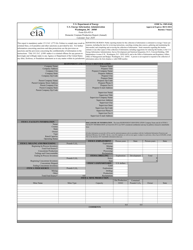

Q: Who is required to use form RT-8A?

A: Employers in Florida who need to correct errors on their previously filed Employer's Quarterly or Annual Domestic Report.

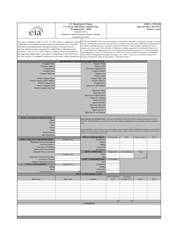

Q: What does form RT-8A correct?

A: Form RT-8A is used to correct errors or make changes to previously reported information, such as employee wages, number of employees, or unemployment compensation.

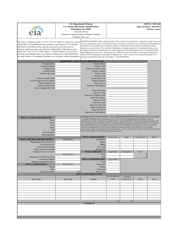

Q: How do I fill out form RT-8A?

A: You will need to provide your employer information, including the correction being made, and any supporting documentation.

Q: When should I file form RT-8A?

A: You should file form RT-8A as soon as you discover an error or need to make a correction to your previously filed Employer's Quarterly or Annual Domestic Report.

Q: What are the consequences of not filing form RT-8A?

A: Failure to file form RT-8A or making false statements can result in penalties, interest, and potential audits.

Q: Is there a fee to file form RT-8A?

A: No, there is no fee to file form RT-8A.

Q: What other forms may be required in addition to form RT-8A?

A: Depending on the nature of the correction, you may also need to file additional forms, such as form RT-8B or form RT-8C.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RT-8A by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.