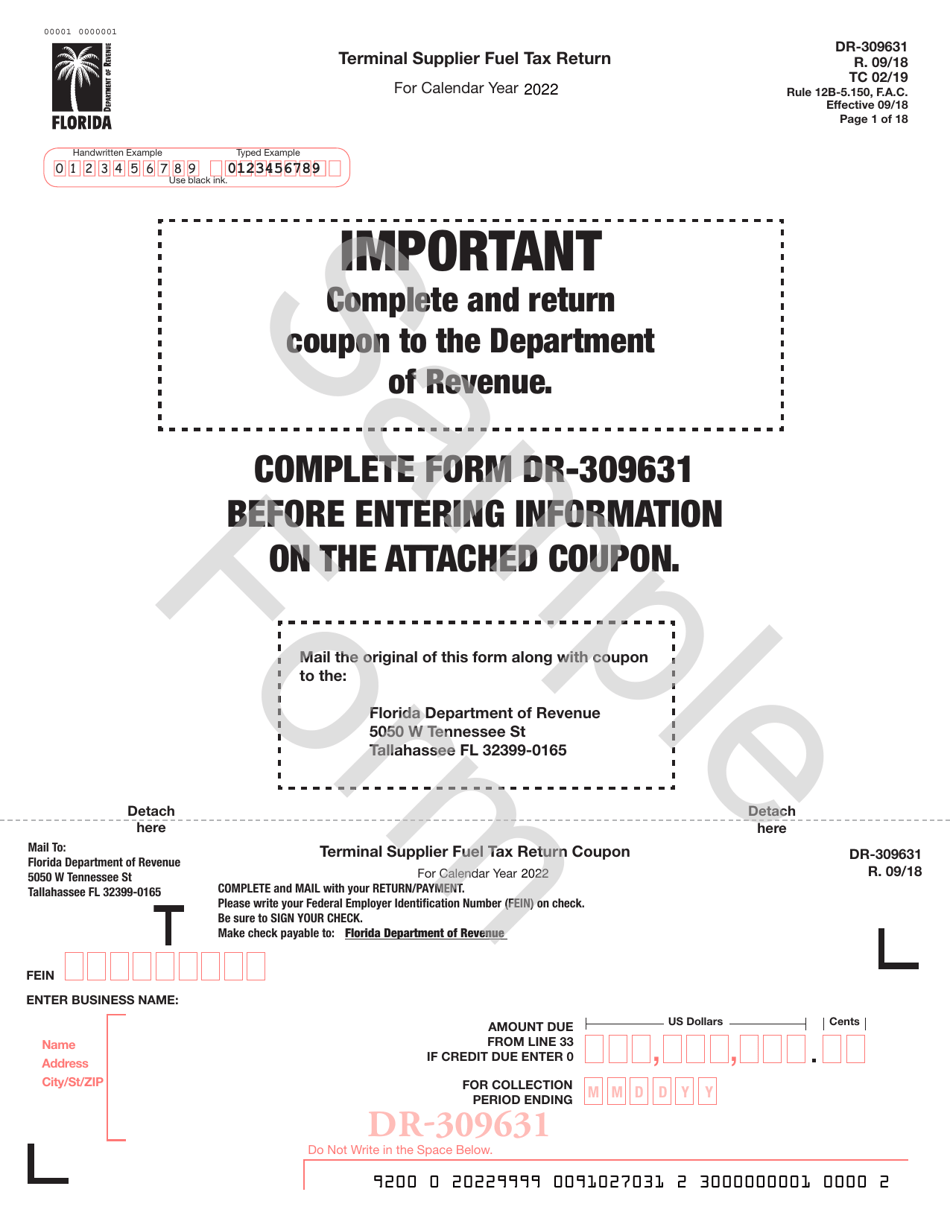

This version of the form is not currently in use and is provided for reference only. Download this version of

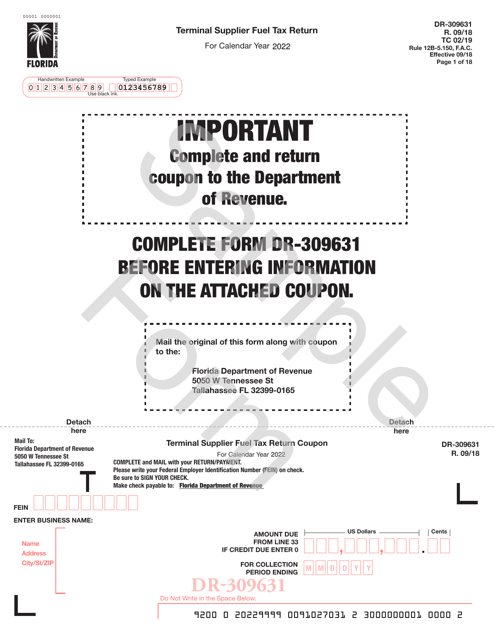

Form DR-309631

for the current year.

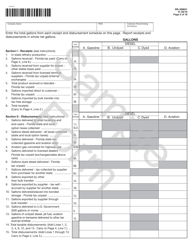

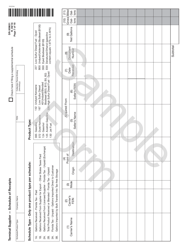

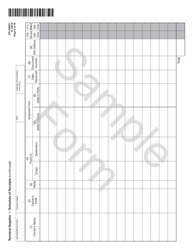

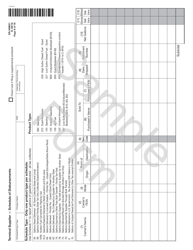

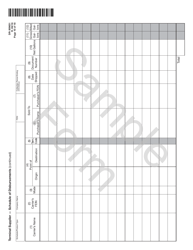

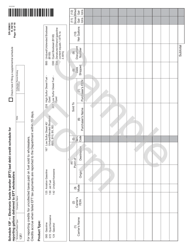

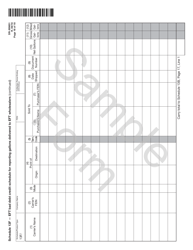

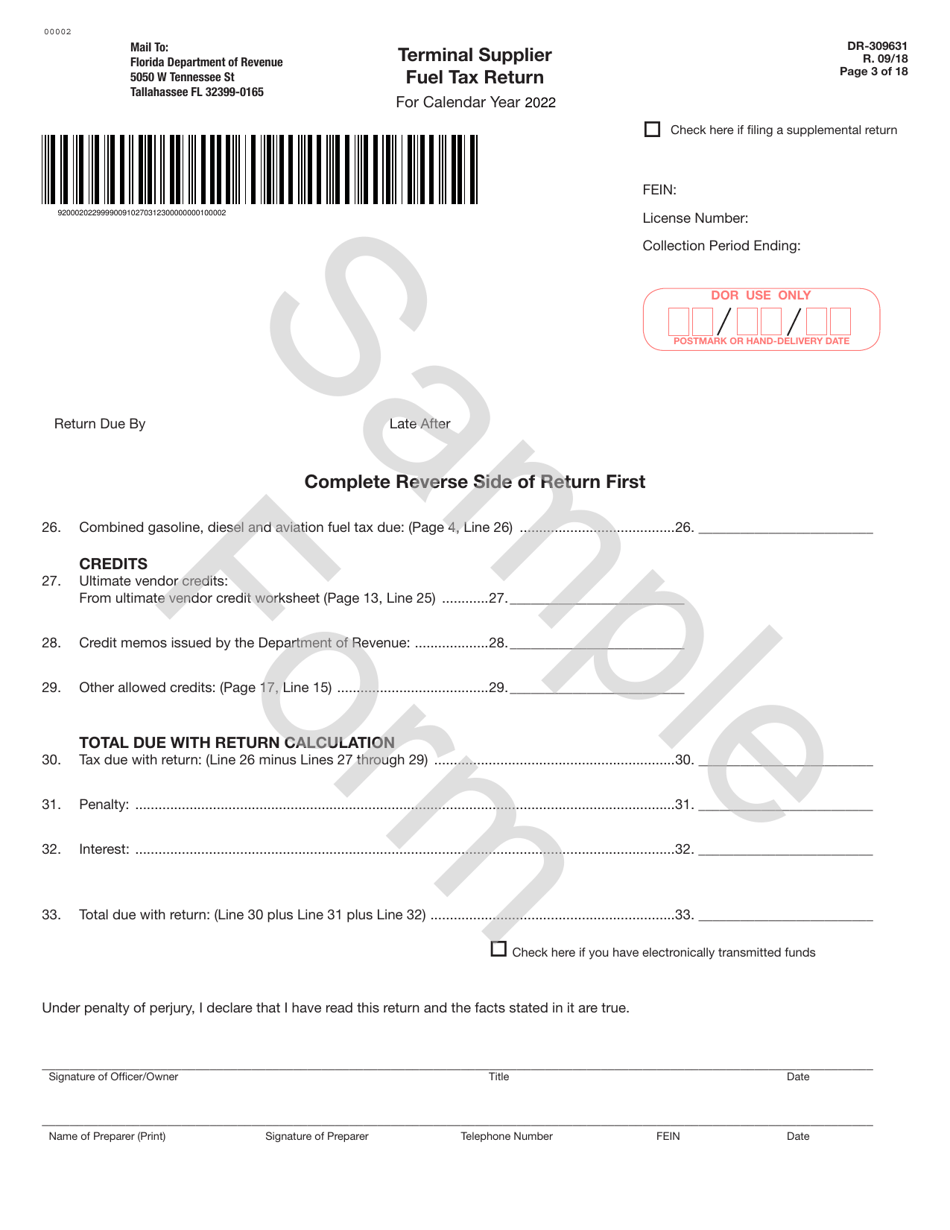

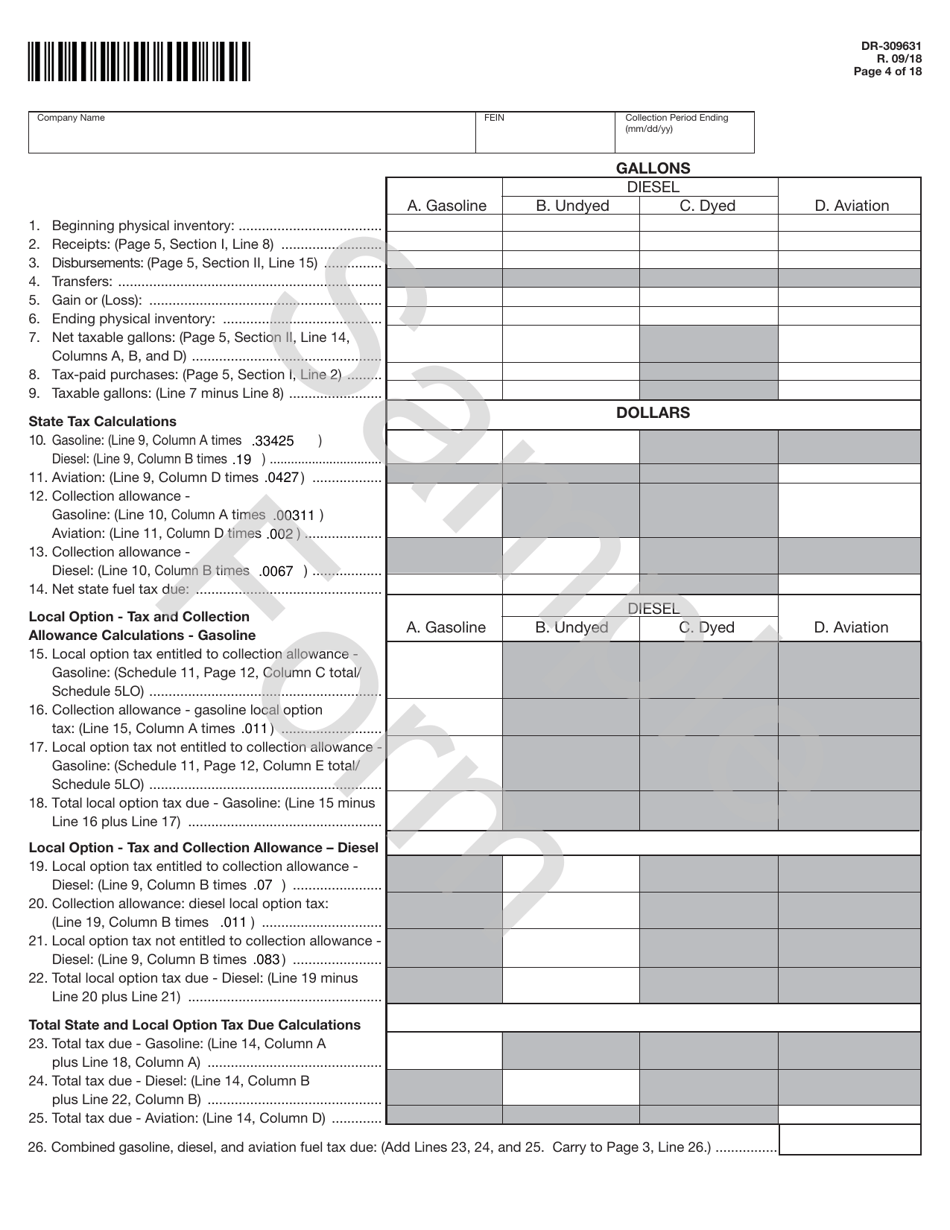

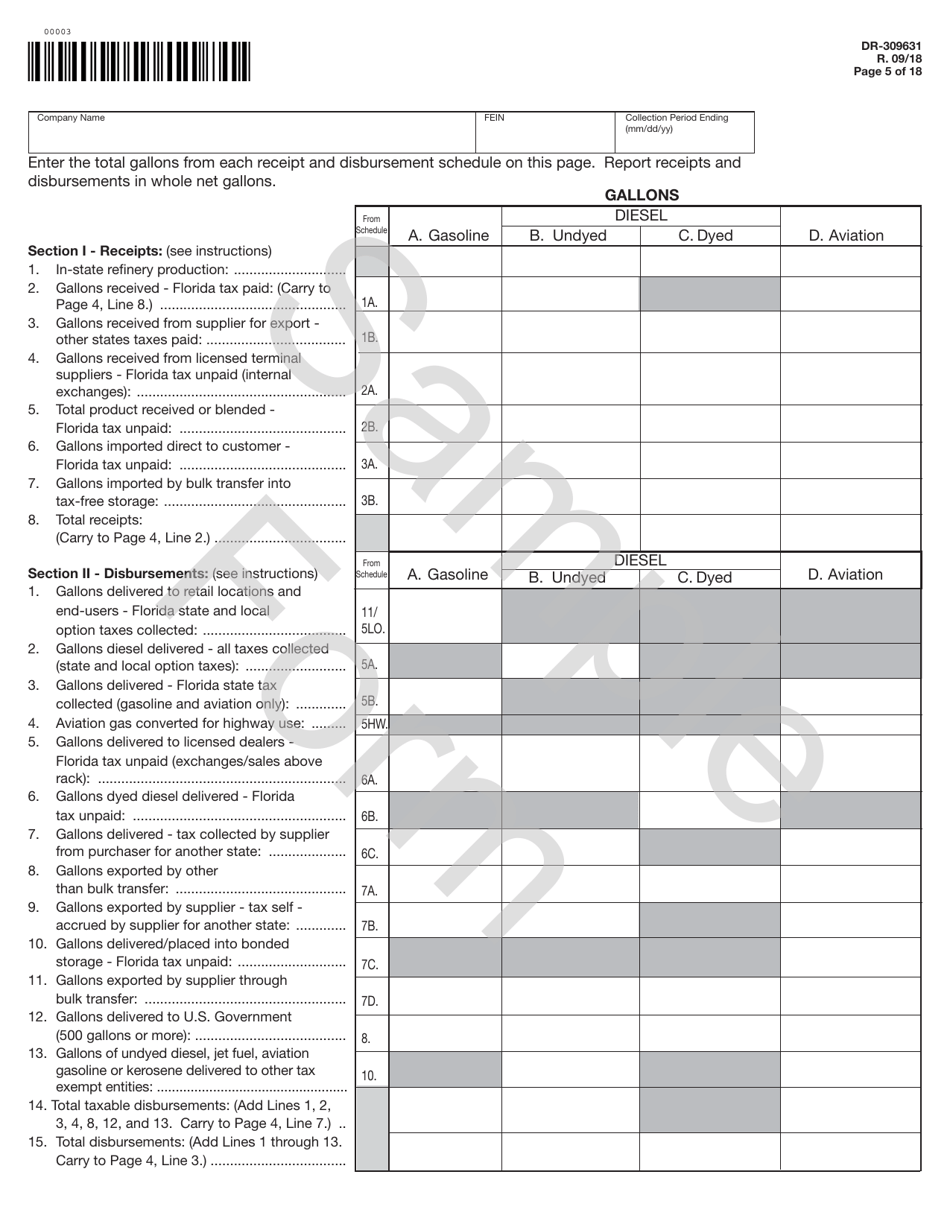

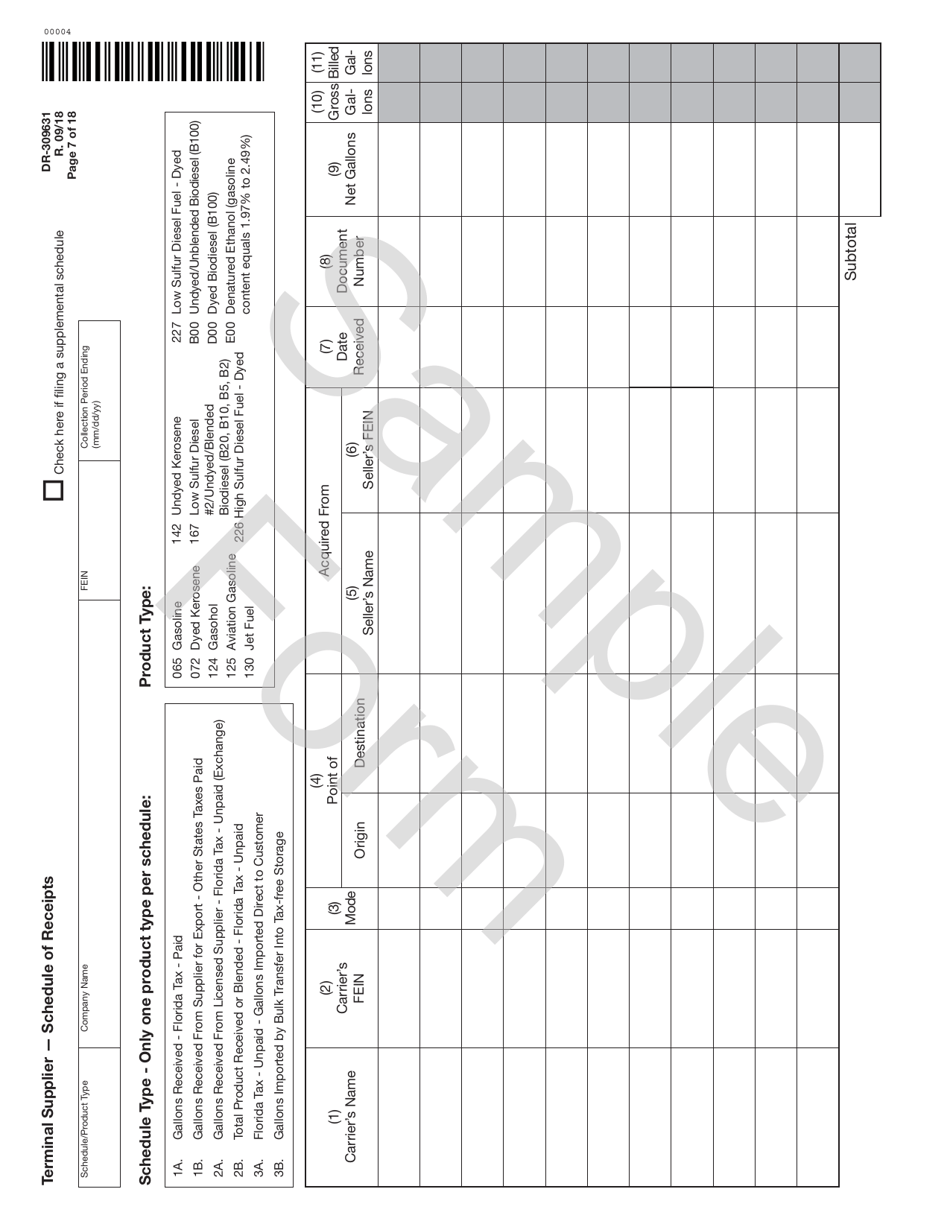

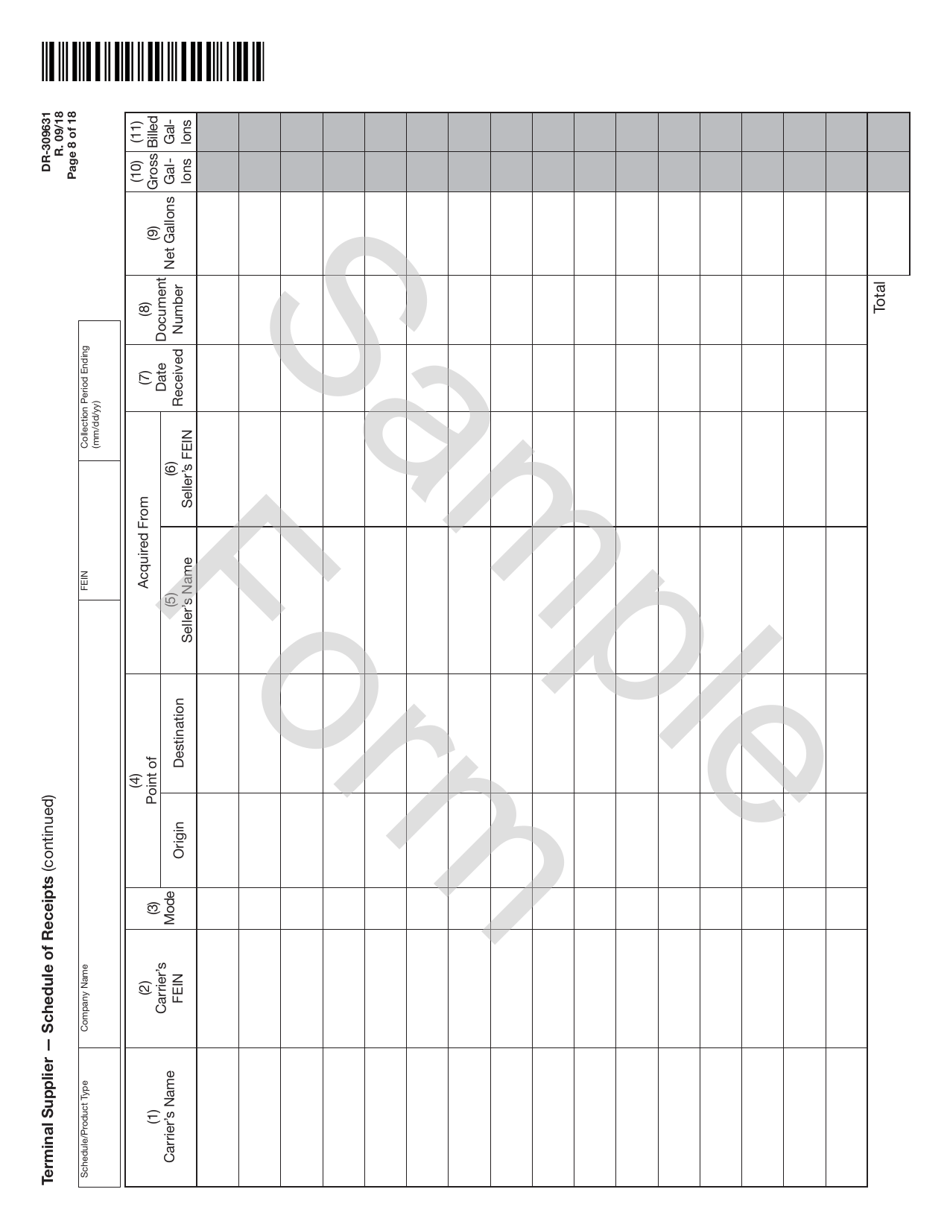

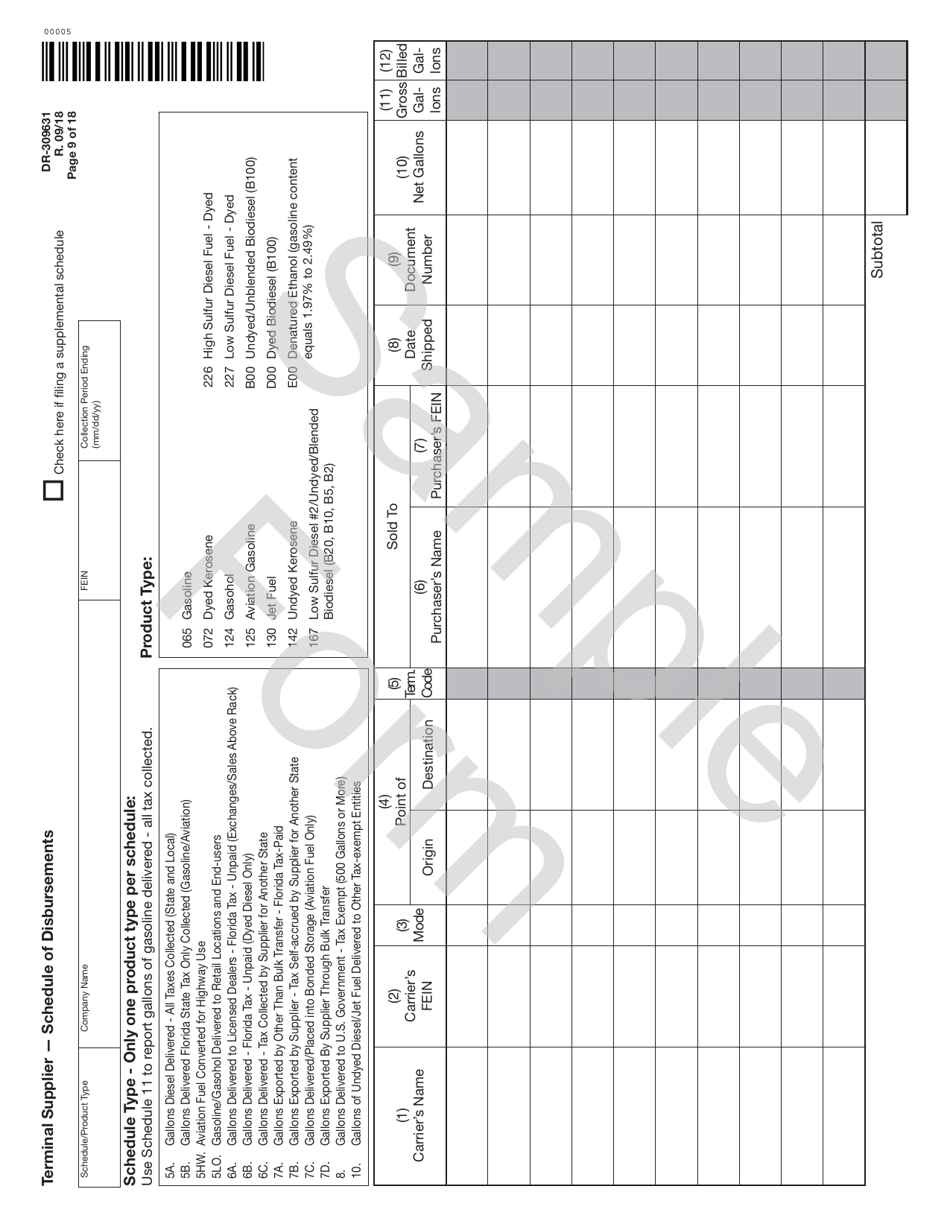

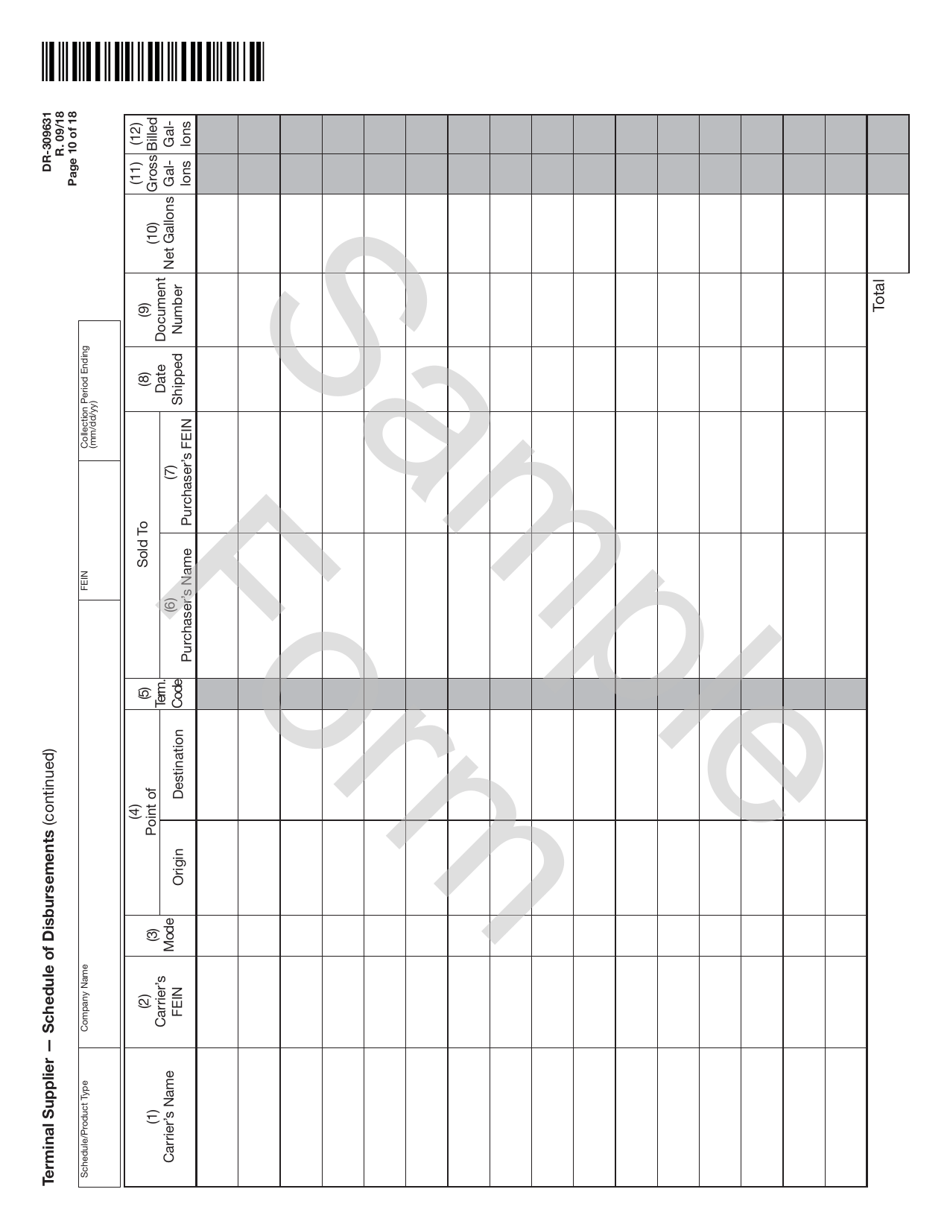

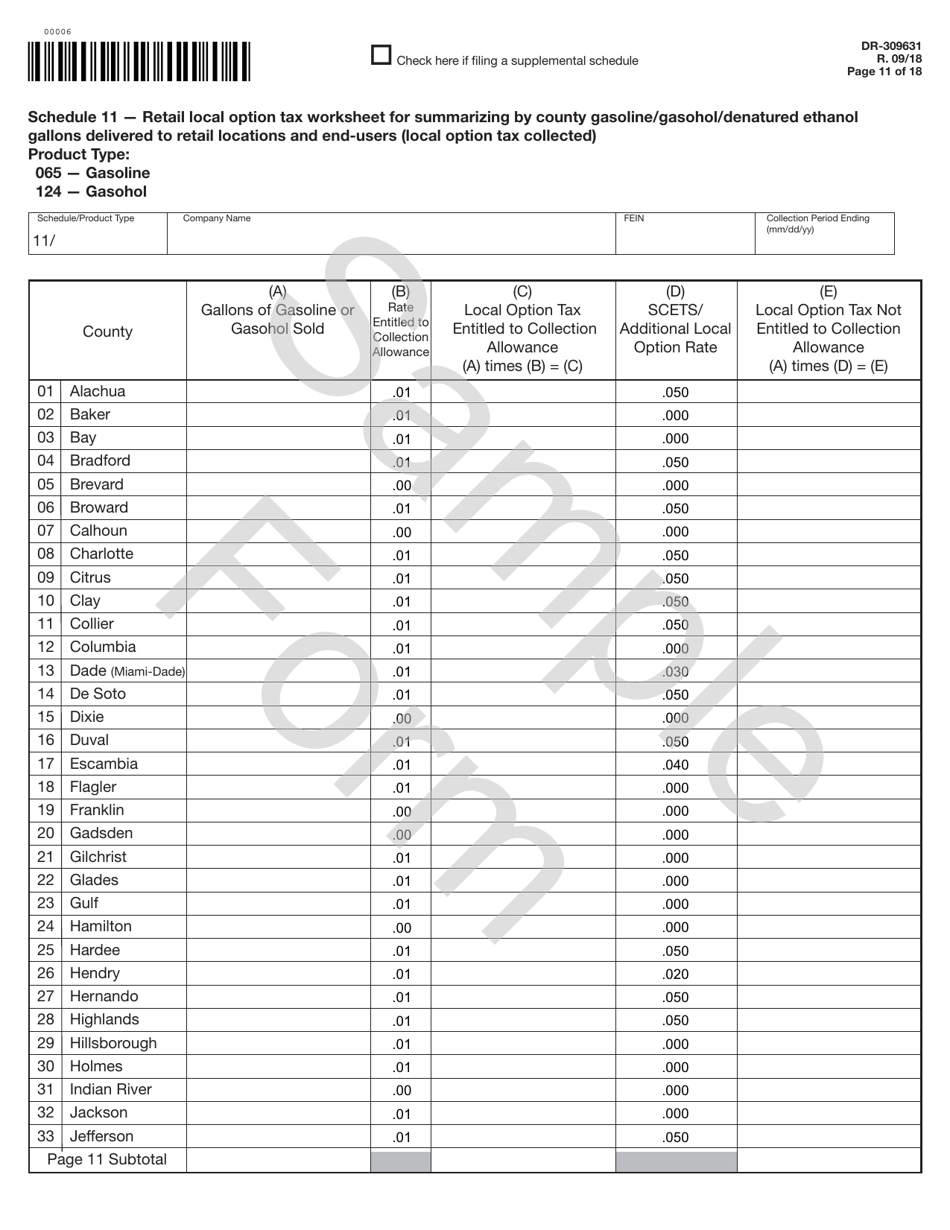

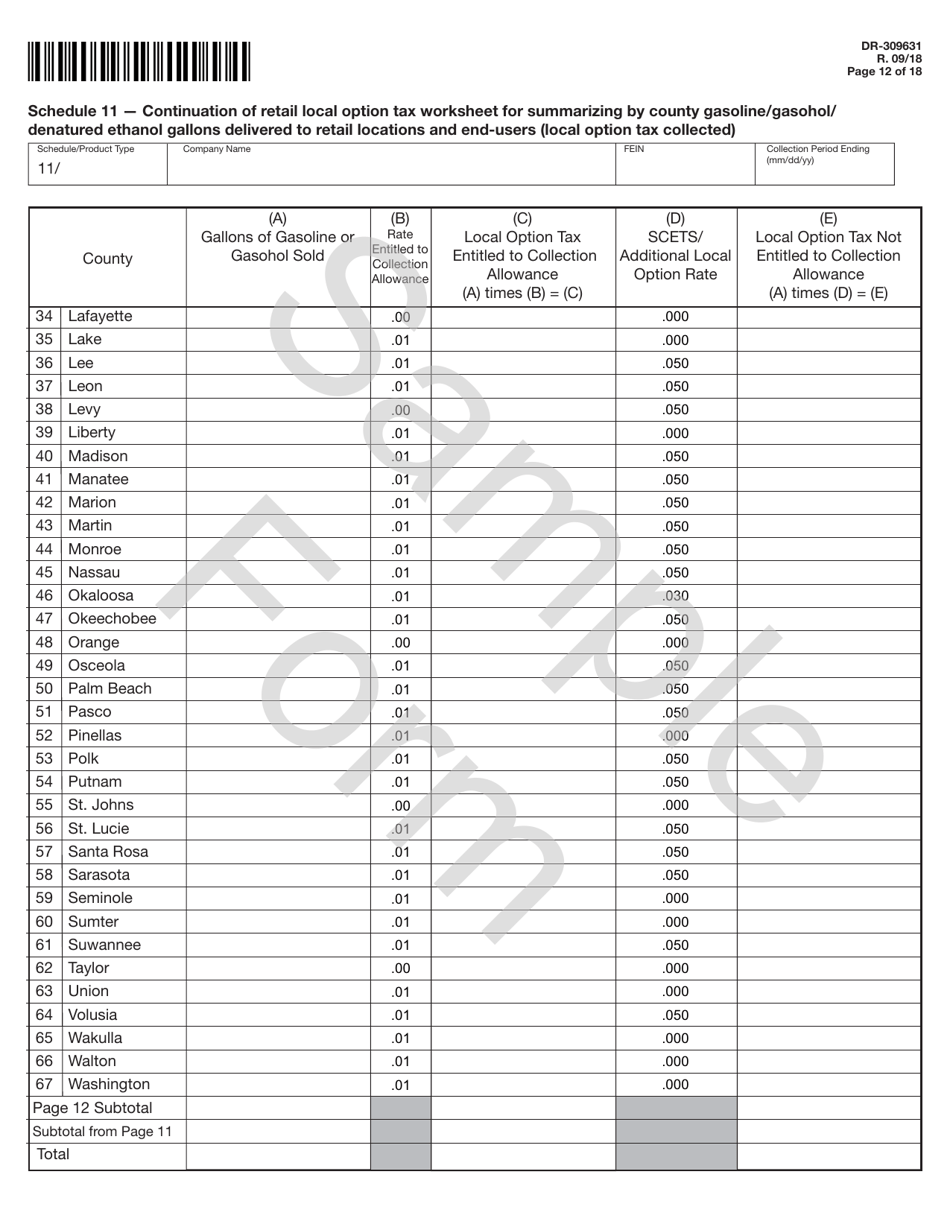

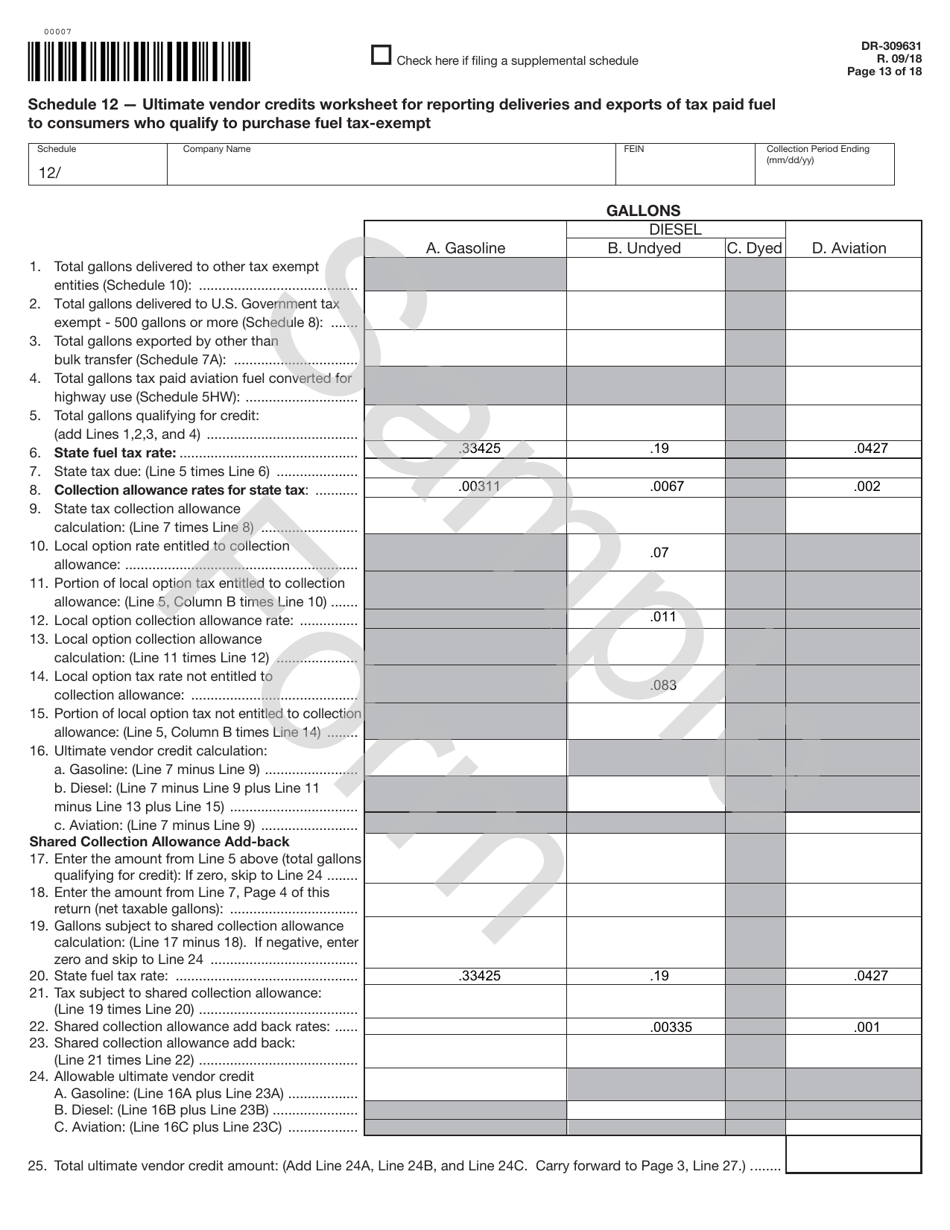

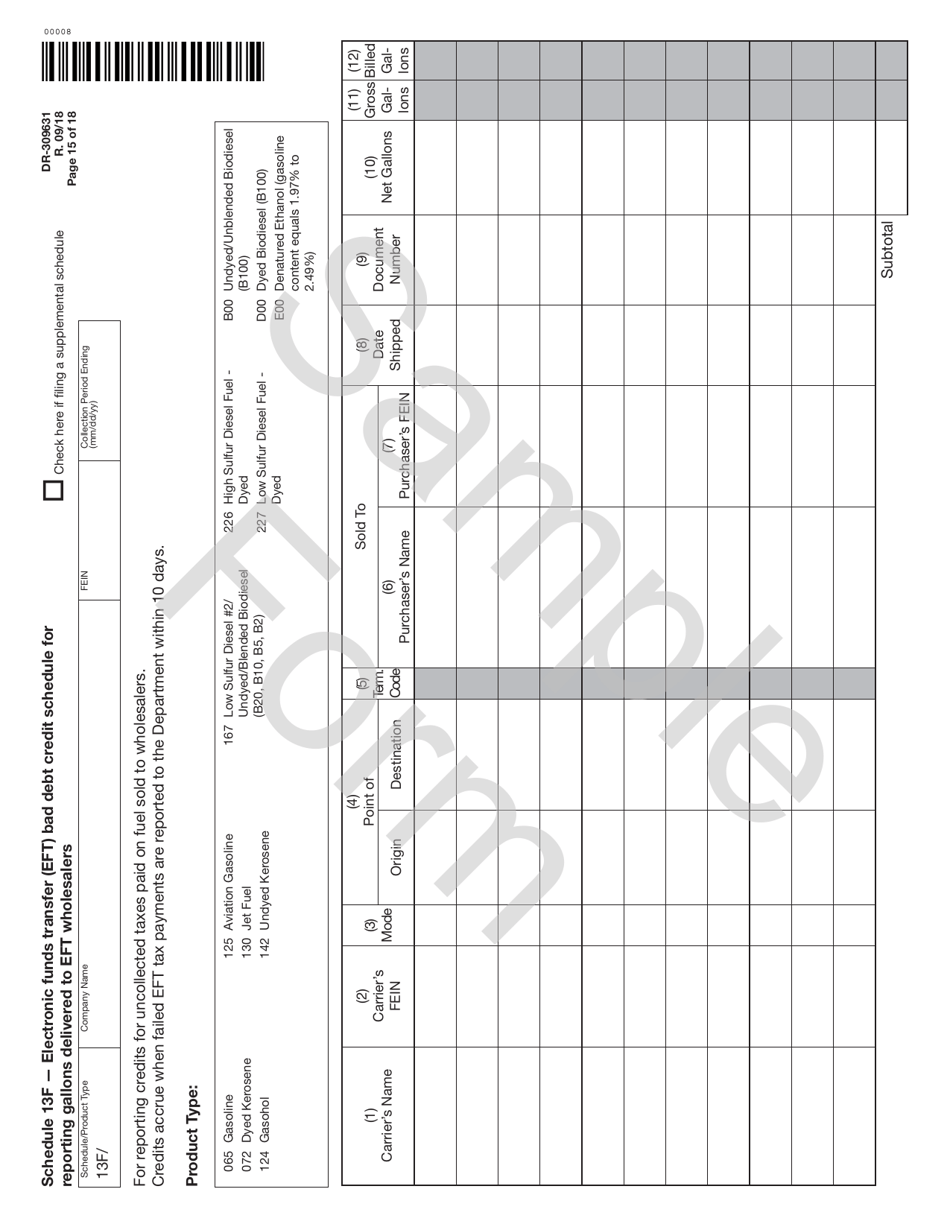

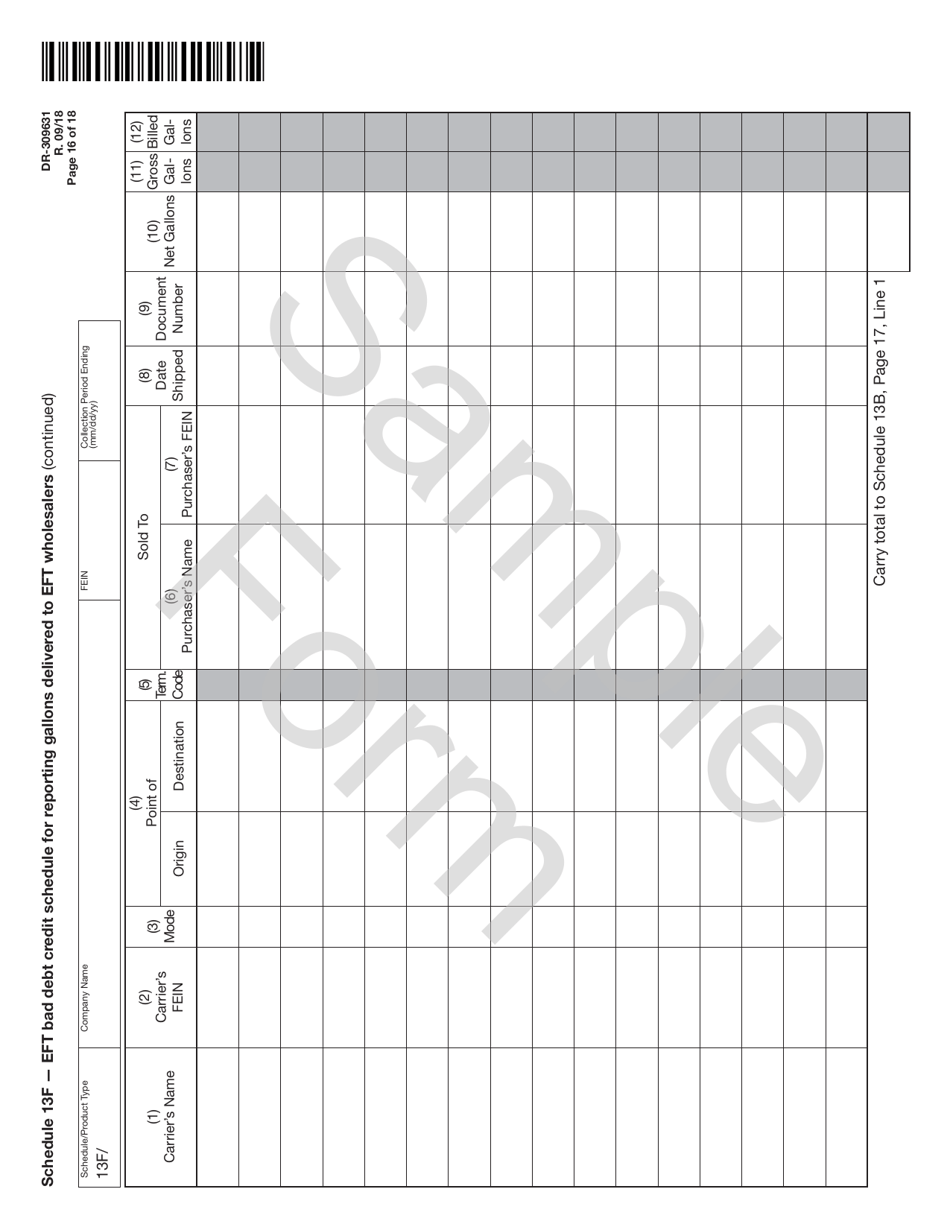

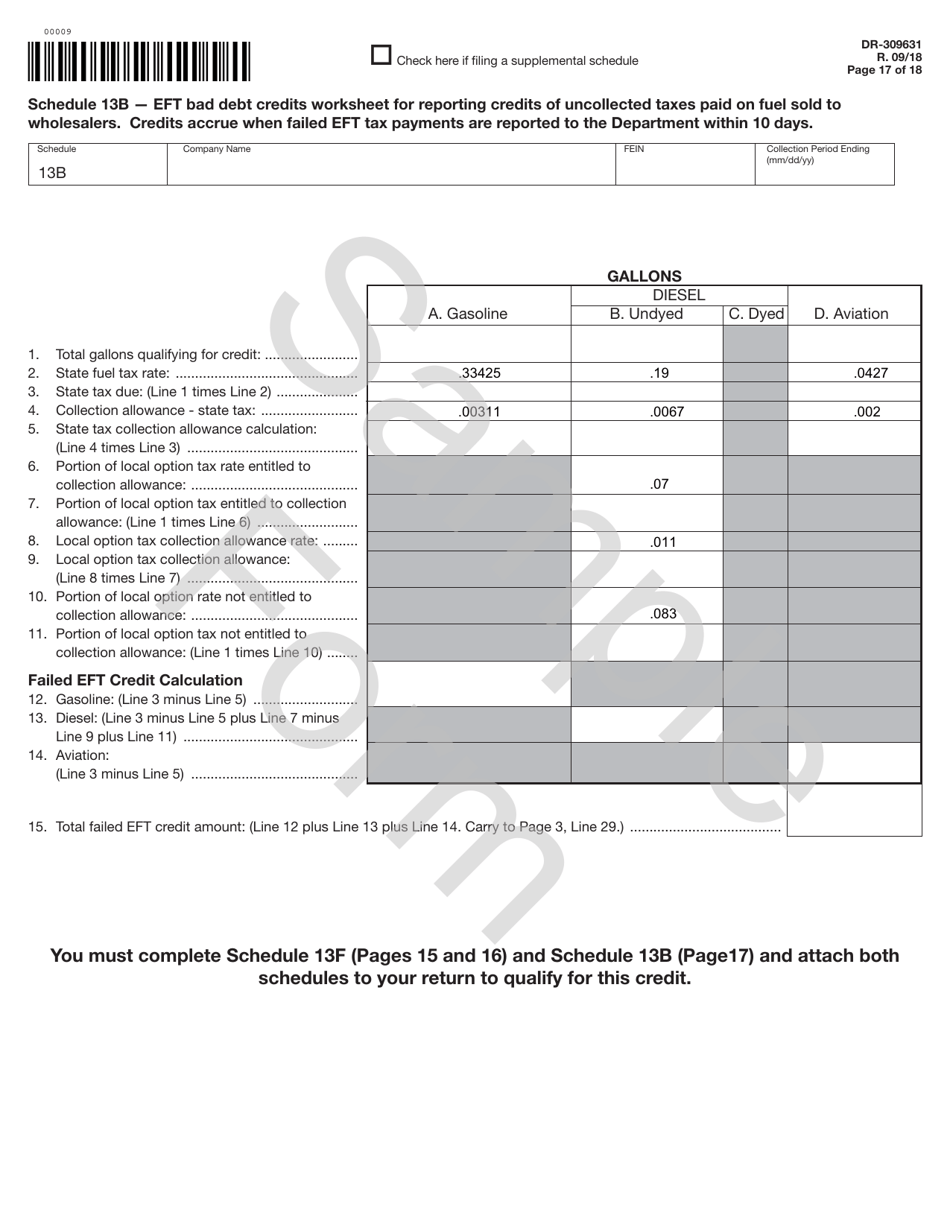

Form DR-309631 Terminal Supplier Fuel Tax Return - Sample - Florida

What Is Form DR-309631?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

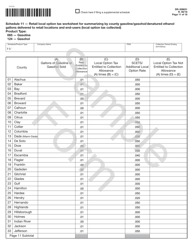

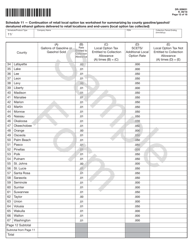

Q: What is the DR-309631 Terminal Supplier Fuel Tax Return?

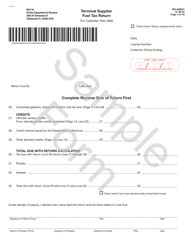

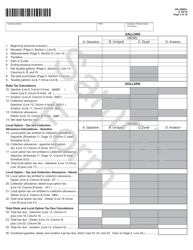

A: The DR-309631 Terminal Supplier Fuel Tax Return is a form used in Florida to report and pay fuel taxes by terminal suppliers.

Q: Who needs to file the DR-309631 Terminal Supplier Fuel Tax Return?

A: Terminal suppliers in Florida who sell or distribute fuel need to file this tax return.

Q: What is the purpose of the DR-309631 Terminal Supplier Fuel Tax Return?

A: The purpose of this tax return is to report and remit fuel taxes owed by terminal suppliers in Florida.

Q: Can I use the DR-309631 Terminal Supplier Fuel Tax Return for other states besides Florida?

A: No, this form is specific to Florida and cannot be used for reporting fuel taxes in other states.

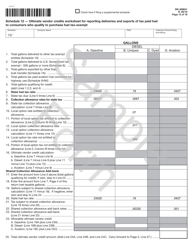

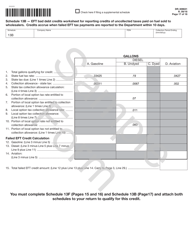

Q: Are there any exemptions or deductions available for terminal suppliers filing this tax return?

A: Yes, there are exemptions and deductions available based on certain criteria, such as sales to tax-exempt entities or sales of certain types of fuel.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-309631 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.