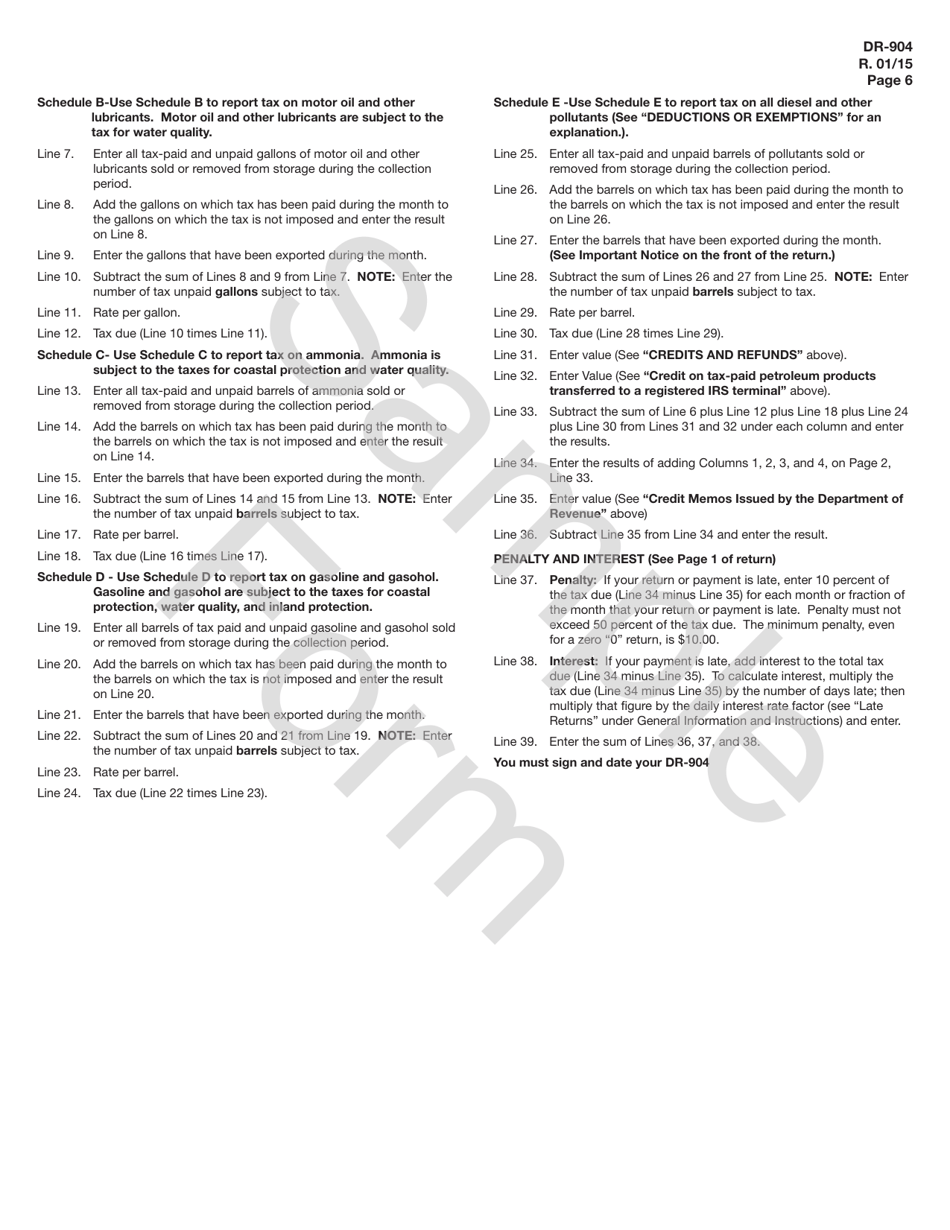

This version of the form is not currently in use and is provided for reference only. Download this version of

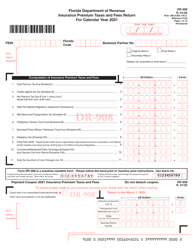

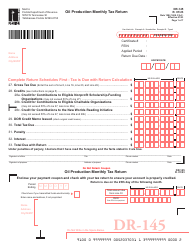

Form DR-904

for the current year.

Form DR-904 Pollutants Tax Return - Sample - Florida

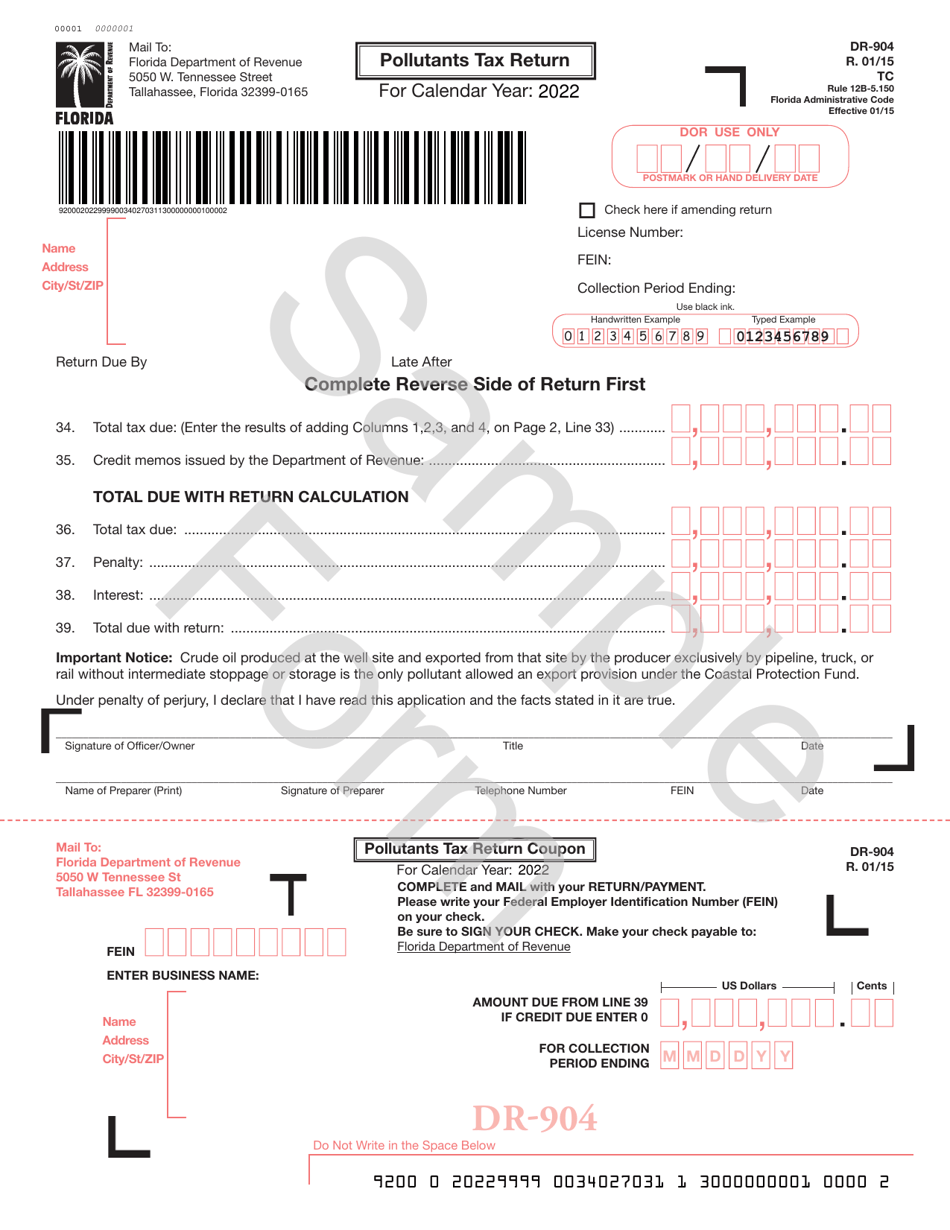

What Is Form DR-904?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

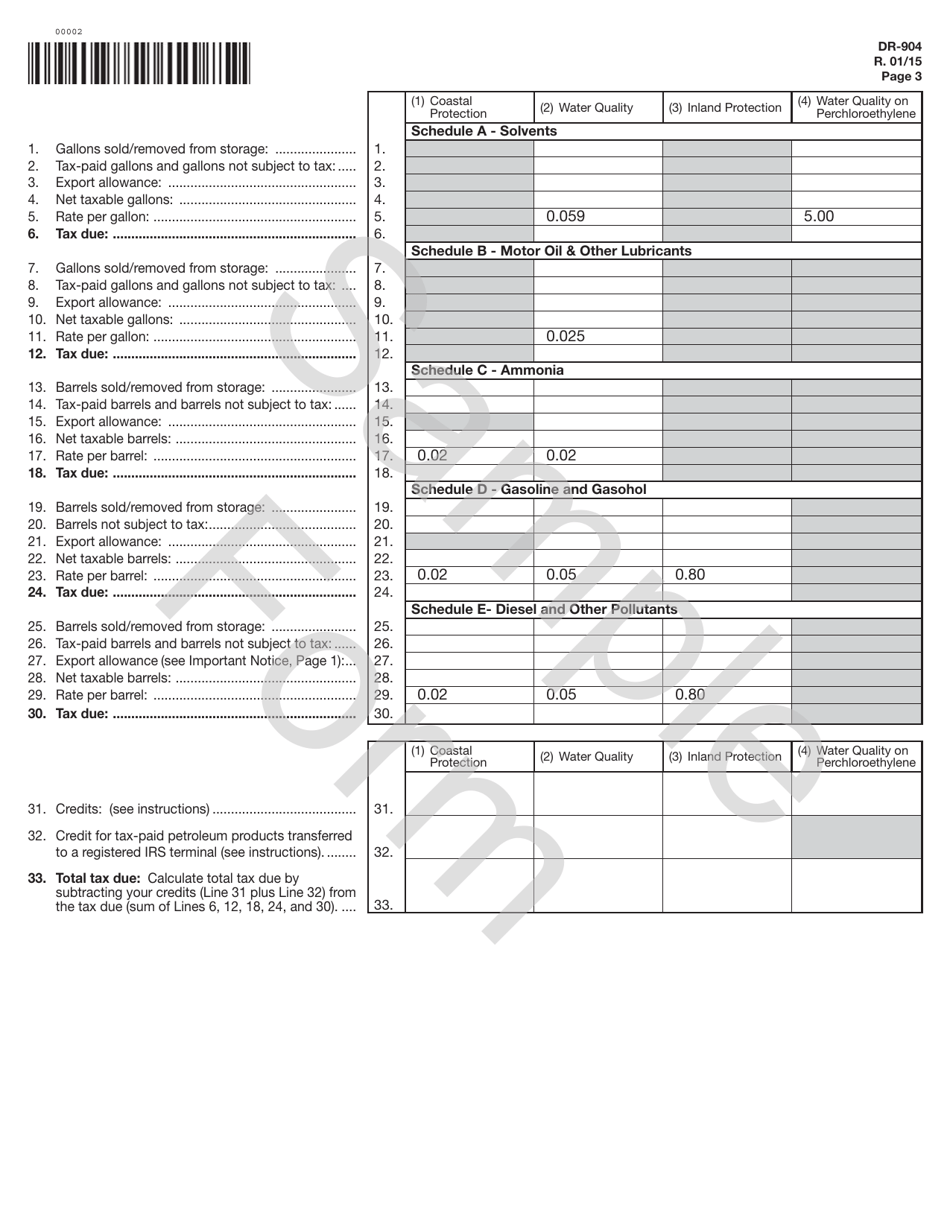

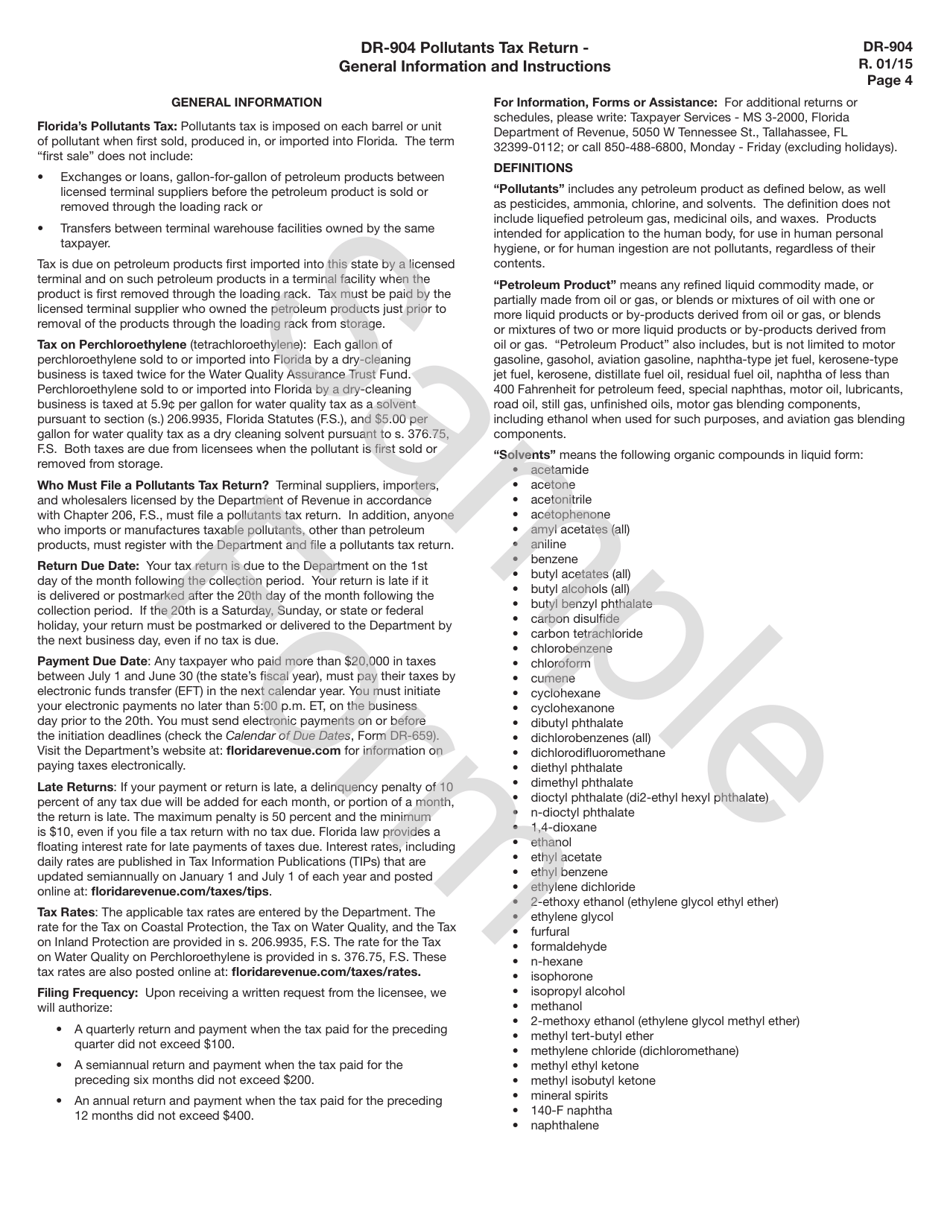

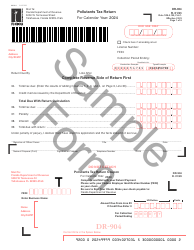

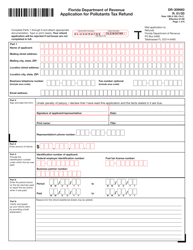

Q: What is Form DR-904?

A: Form DR-904 is the Pollutants Tax Return.

Q: Who needs to file Form DR-904?

A: Entities engaged in activities that generate pollutants in Florida need to file Form DR-904.

Q: What is the purpose of Form DR-904?

A: Form DR-904 is used to report and pay the Pollutants Tax to the state of Florida.

Q: What are pollutants?

A: Pollutants are substances that cause pollution or harm to the environment.

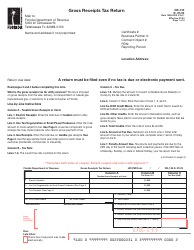

Q: Are there any exemptions or deductions available for the Pollutants Tax?

A: Yes, there are certain exemptions and deductions available. Refer to the instructions provided with Form DR-904 for more information.

Q: When is Form DR-904 due?

A: Form DR-904 is due on or before the 20th day of the month following the reporting period.

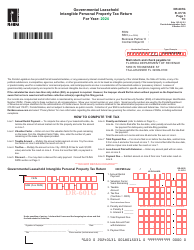

Q: How can I file Form DR-904?

A: Form DR-904 can be filed electronically or by mail. Refer to the instructions provided with the form for details on how to file.

Q: What happens if I fail to file or pay the Pollutants Tax?

A: Failure to file or pay the Pollutants Tax may result in penalties and interest charges. It is important to comply with the filing and payment requirements.

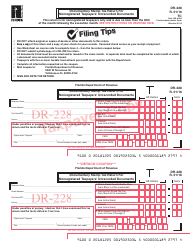

Form Details:

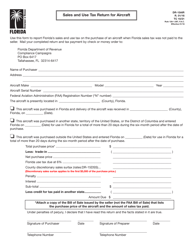

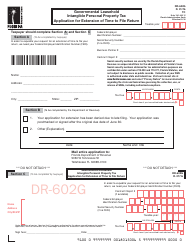

- Released on January 1, 2015;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-904 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.