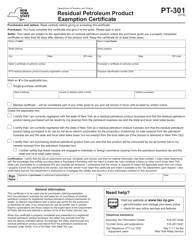

This version of the form is not currently in use and is provided for reference only. Download this version of

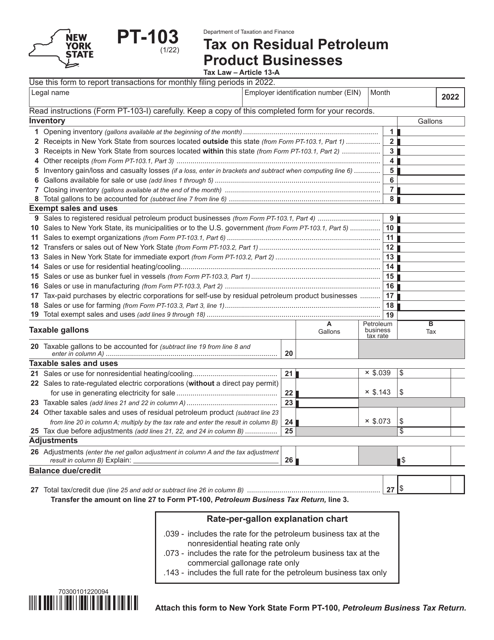

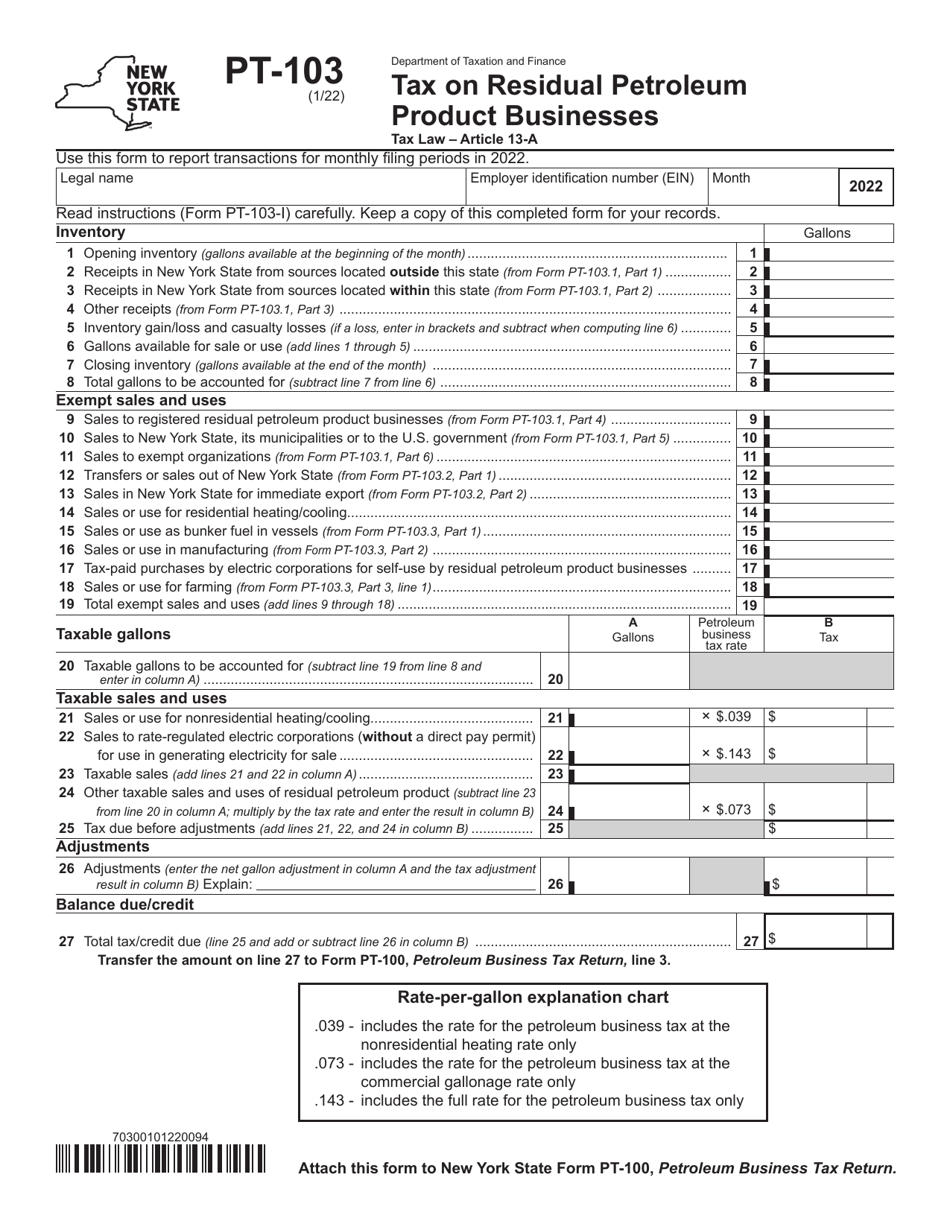

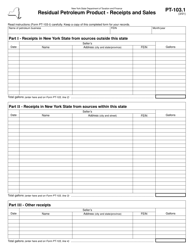

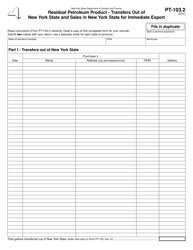

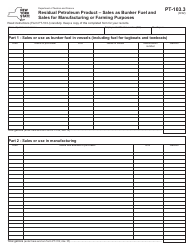

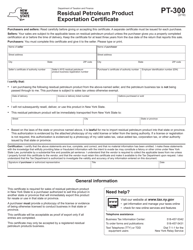

Form PT-103

for the current year.

Form PT-103 Tax on Residual Petroleum Product Businesses - New York

What Is Form PT-103?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-103?

A: Form PT-103 is a tax form used by businesses that deal with residual petroleum products in New York.

Q: Who needs to file Form PT-103?

A: Businesses in New York that are engaged in activities related to residual petroleum products need to file Form PT-103.

Q: What are residual petroleum products?

A: Residual petroleum products are the by-products of the refining process of crude oil, such as residual fuel oil and petroleum coke.

Q: What is the purpose of Form PT-103?

A: The purpose of Form PT-103 is to report and pay the tax that is imposed on businesses engaged in the production, receipt, purchase, sale, or consumption of residual petroleum products in New York.

Q: When is Form PT-103 due?

A: Form PT-103 is due on a quarterly basis, with the due dates falling on the 20th day of the month following the end of each quarter.

Q: How can Form PT-103 be filed?

A: Form PT-103 can be filed either electronically or by mail. Electronic filing is encouraged for faster processing.

Q: Are there any penalties for late or incorrect filing of Form PT-103?

A: Yes, there are penalties for late or incorrect filing of Form PT-103. It is important to file the form accurately and on time to avoid penalties.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-103 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.