This version of the form is not currently in use and is provided for reference only. Download this version of

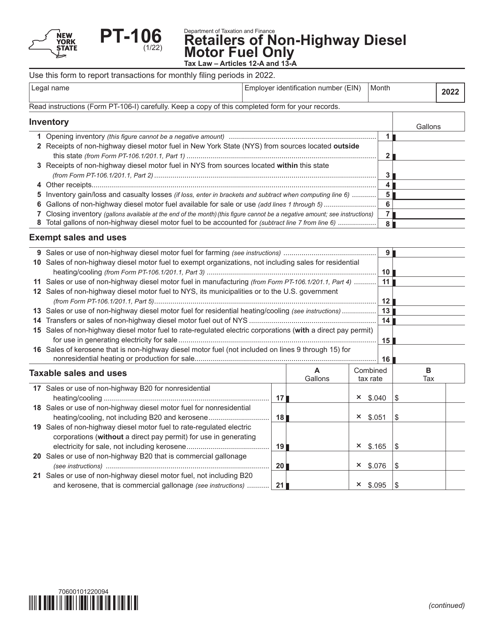

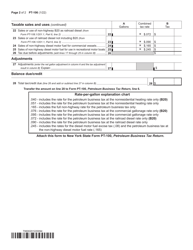

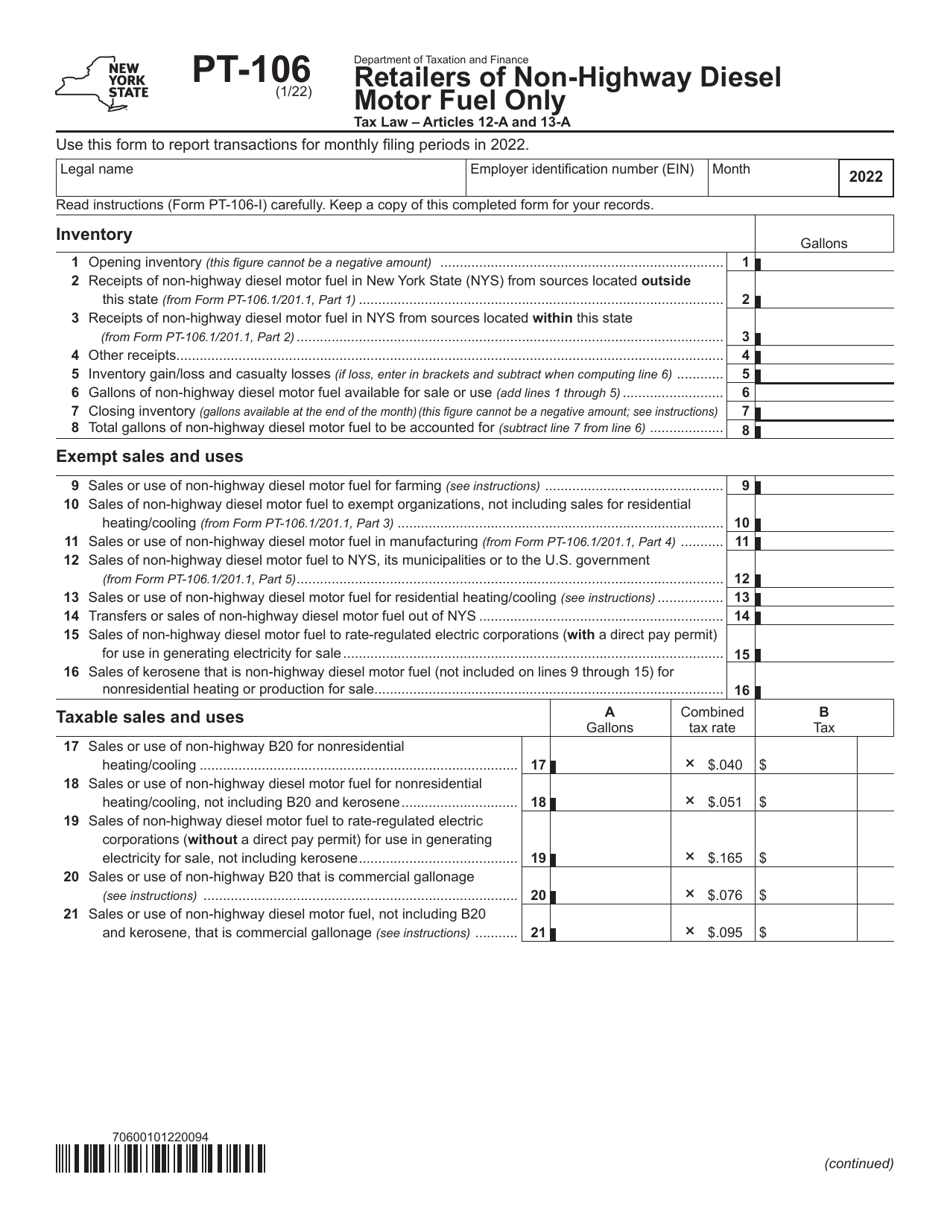

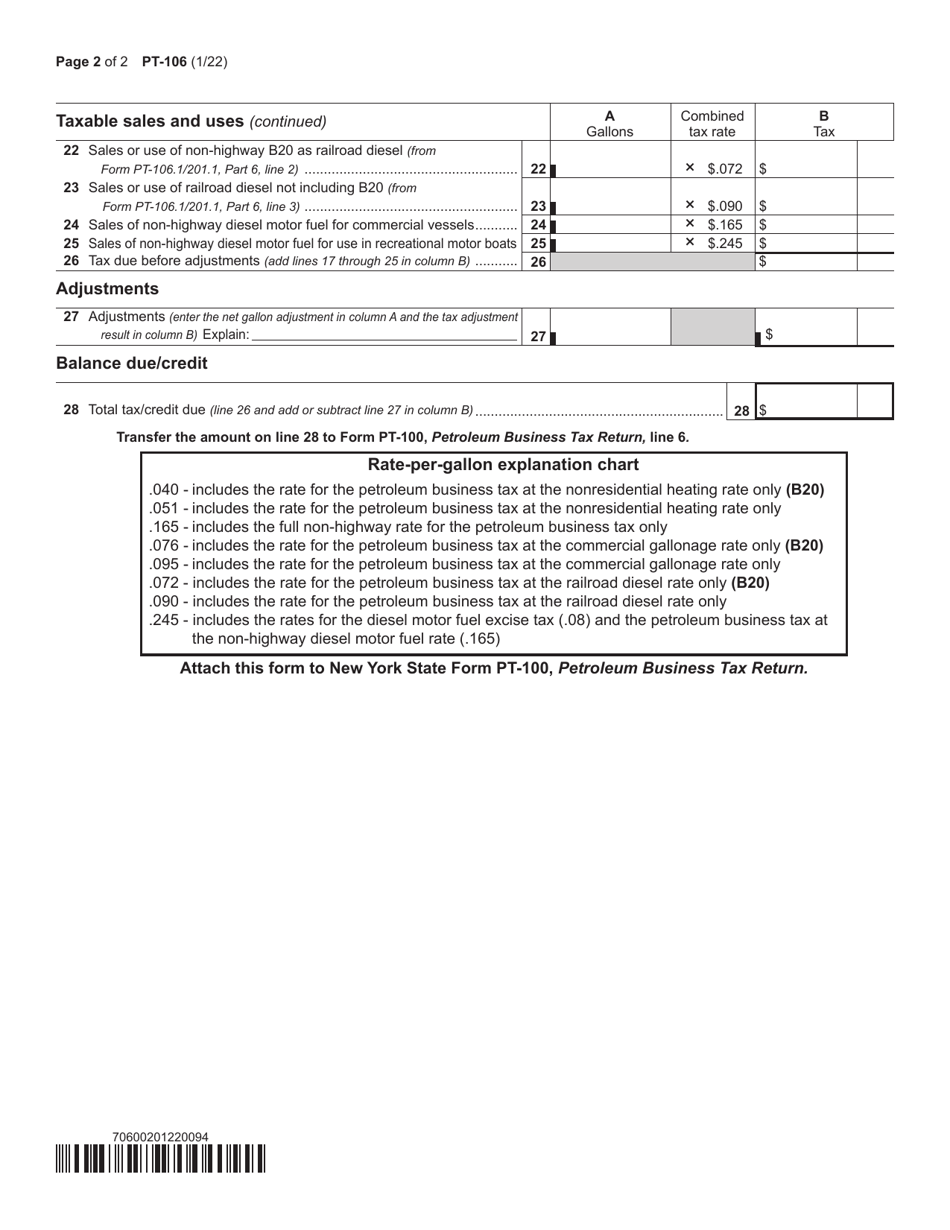

Form PT-106

for the current year.

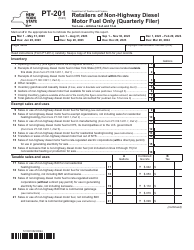

Form PT-106 Retailers of Non-highway Diesel Motor Fuel Only - New York

What Is Form PT-106?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-106?

A: Form PT-106 is a tax form used by retailers of non-highway diesel motor fuel in New York.

Q: Who needs to file Form PT-106?

A: Retailers who sell non-highway diesel motor fuel in New York need to file Form PT-106.

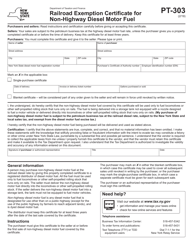

Q: What is non-highway diesel motor fuel?

A: Non-highway diesel motor fuel is diesel fuel that is not used for highway vehicles, such as off-road machinery or equipment.

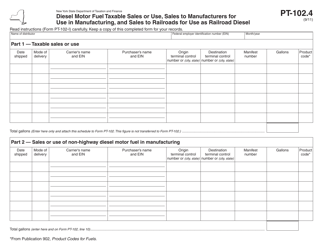

Q: What information is required on Form PT-106?

A: Form PT-106 requires information about the retailer's sales of non-highway diesel motor fuel, including the total number of gallons sold and the amount of tax collected.

Q: When is Form PT-106 due?

A: Form PT-106 is due on a quarterly basis, with the deadline falling on the 20th day of the month following the end of the calendar quarter.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-106 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.