This version of the form is not currently in use and is provided for reference only. Download this version of

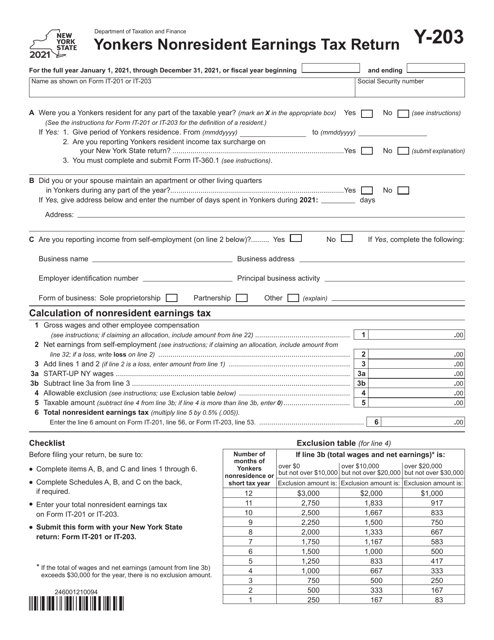

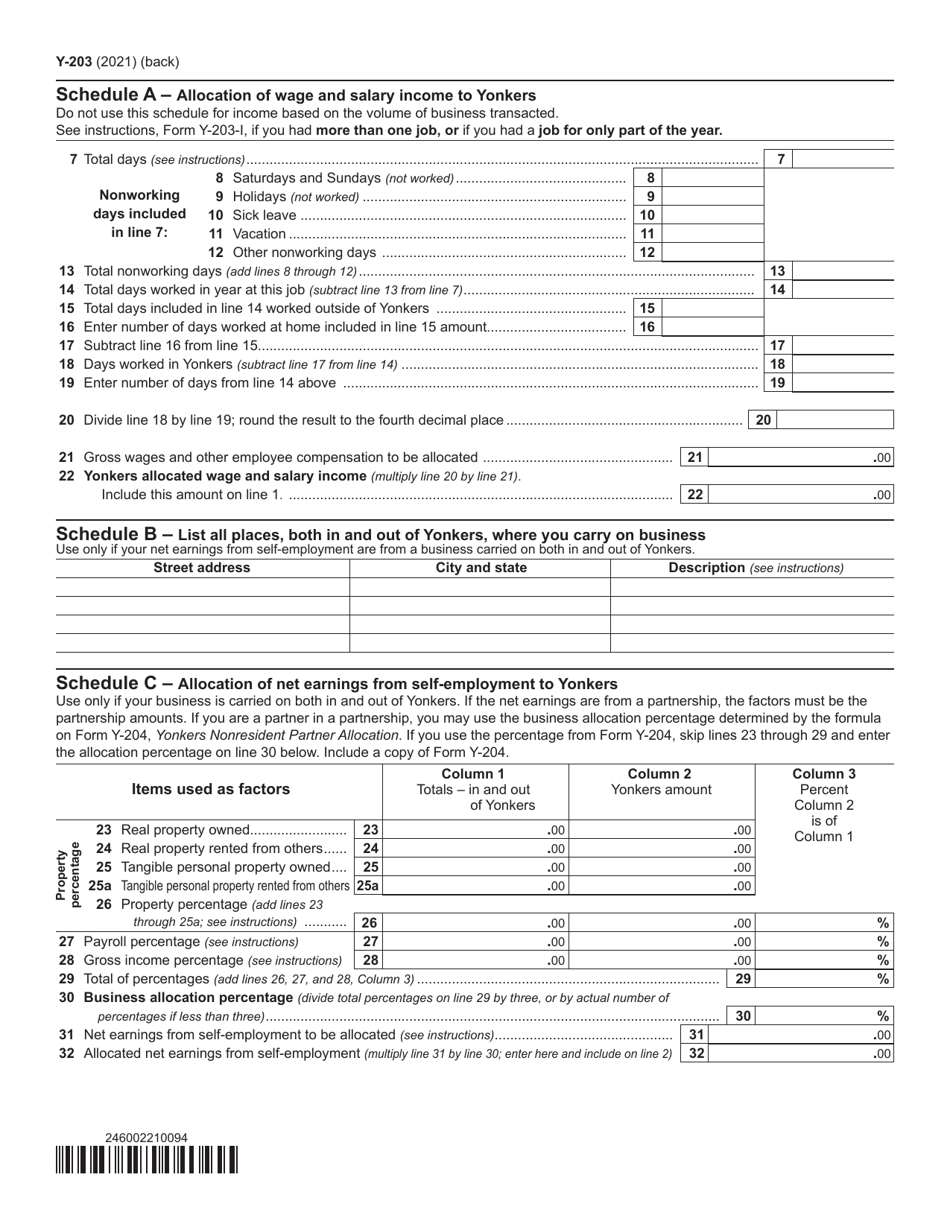

Form Y-203

for the current year.

Form Y-203 Yonkers Nonresident Earnings Tax Return - New York

What Is Form Y-203?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form Y-203?

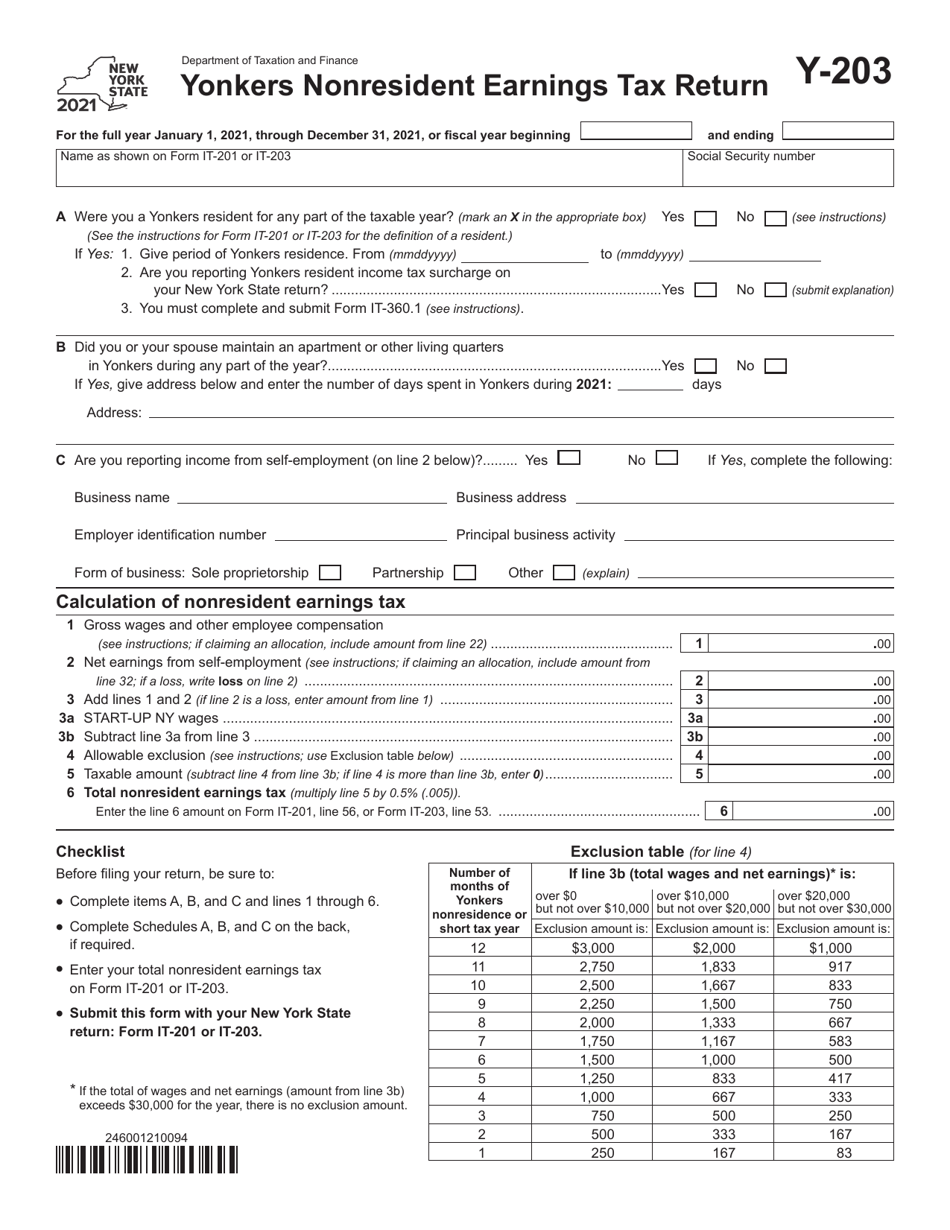

A: Form Y-203 is the Yonkers Nonresident Earnings Tax Return for residents who earned income in Yonkers, New York but do not live in Yonkers.

Q: Who needs to file Form Y-203?

A: Nonresidents who earned income in Yonkers, New York need to file Form Y-203.

Q: What is the purpose of Form Y-203?

A: The purpose of Form Y-203 is to report and pay the Yonkers Nonresident Earnings Tax.

Q: Do I need to file Form Y-203 if I am a resident of Yonkers?

A: No, residents of Yonkers should file Form Y-200 instead of Form Y-203.

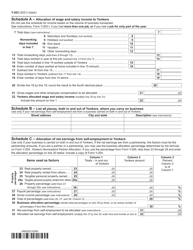

Q: What information do I need to complete Form Y-203?

A: You will need to provide information about your income earned in Yonkers, as well as any applicable deductions or credits.

Q: When is the due date for filing Form Y-203?

A: The due date for filing Form Y-203 is April 15th, or the same due date as your federal income tax return, whichever is later.

Q: Can I file Form Y-203 electronically?

A: No, Form Y-203 can only be filed by mail.

Q: Is there a penalty for late filing of Form Y-203?

A: Yes, there is a penalty for late filing of Form Y-203, which is 1% of the tax due per month, up to a maximum of 25%.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form Y-203 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.