This version of the form is not currently in use and is provided for reference only. Download this version of

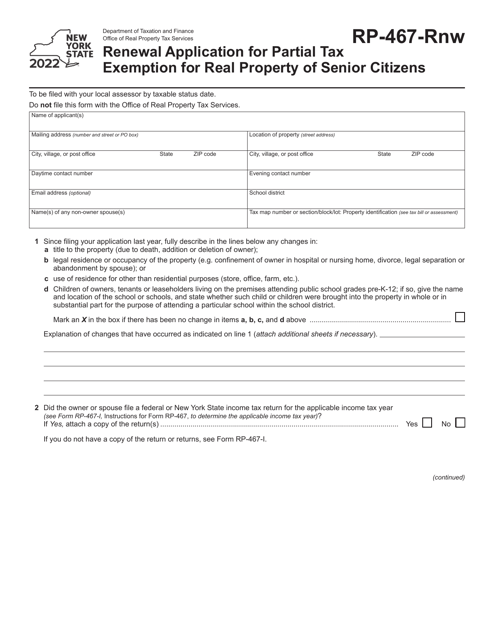

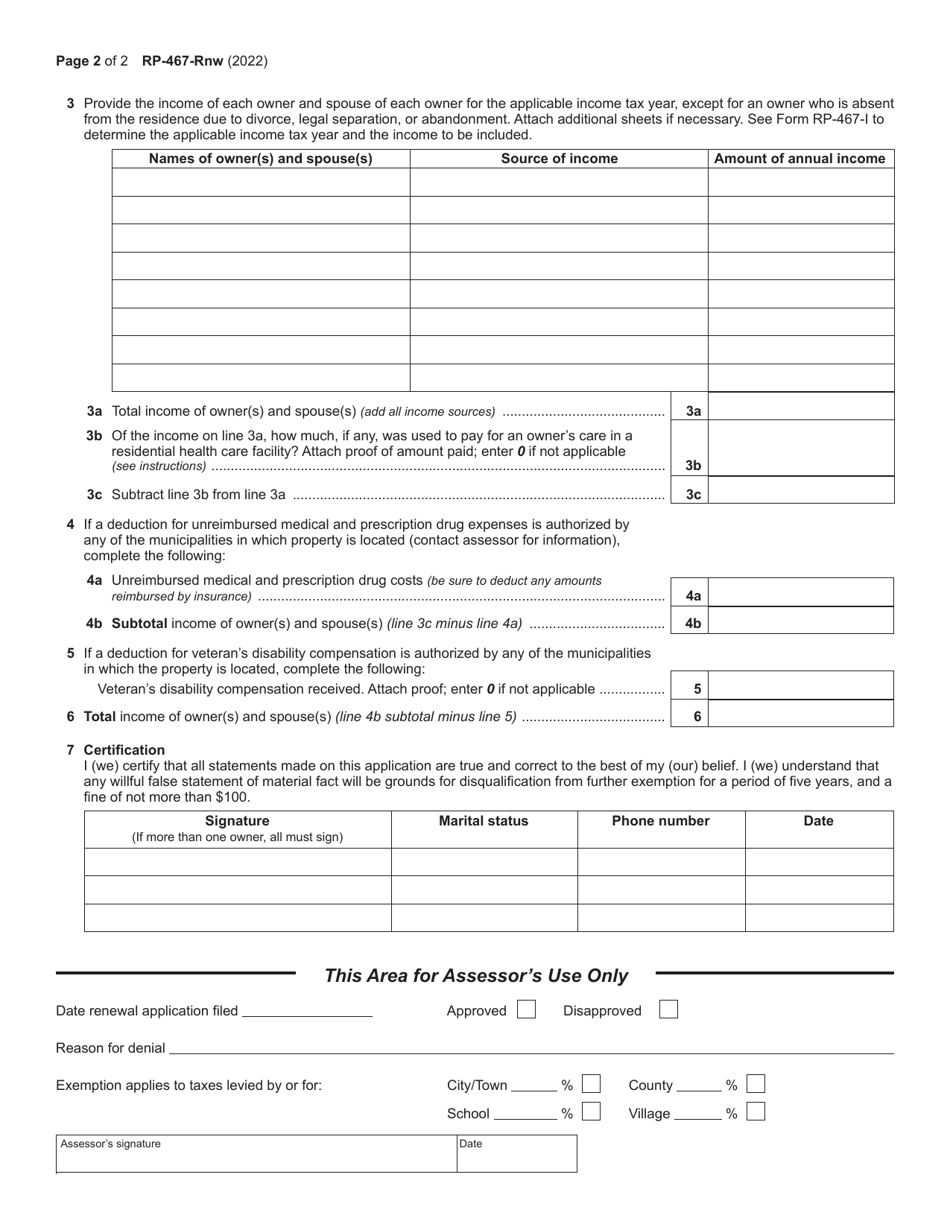

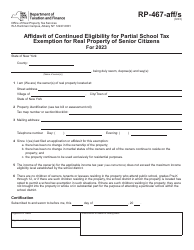

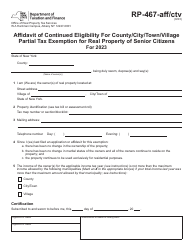

Form RP-467-RNW

for the current year.

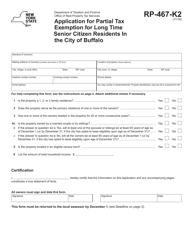

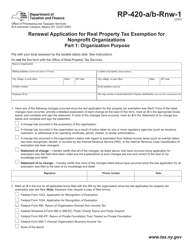

Form RP-467-RNW Renewal Application for Partial Tax Exemption for Real Property of Senior Citizens - New York

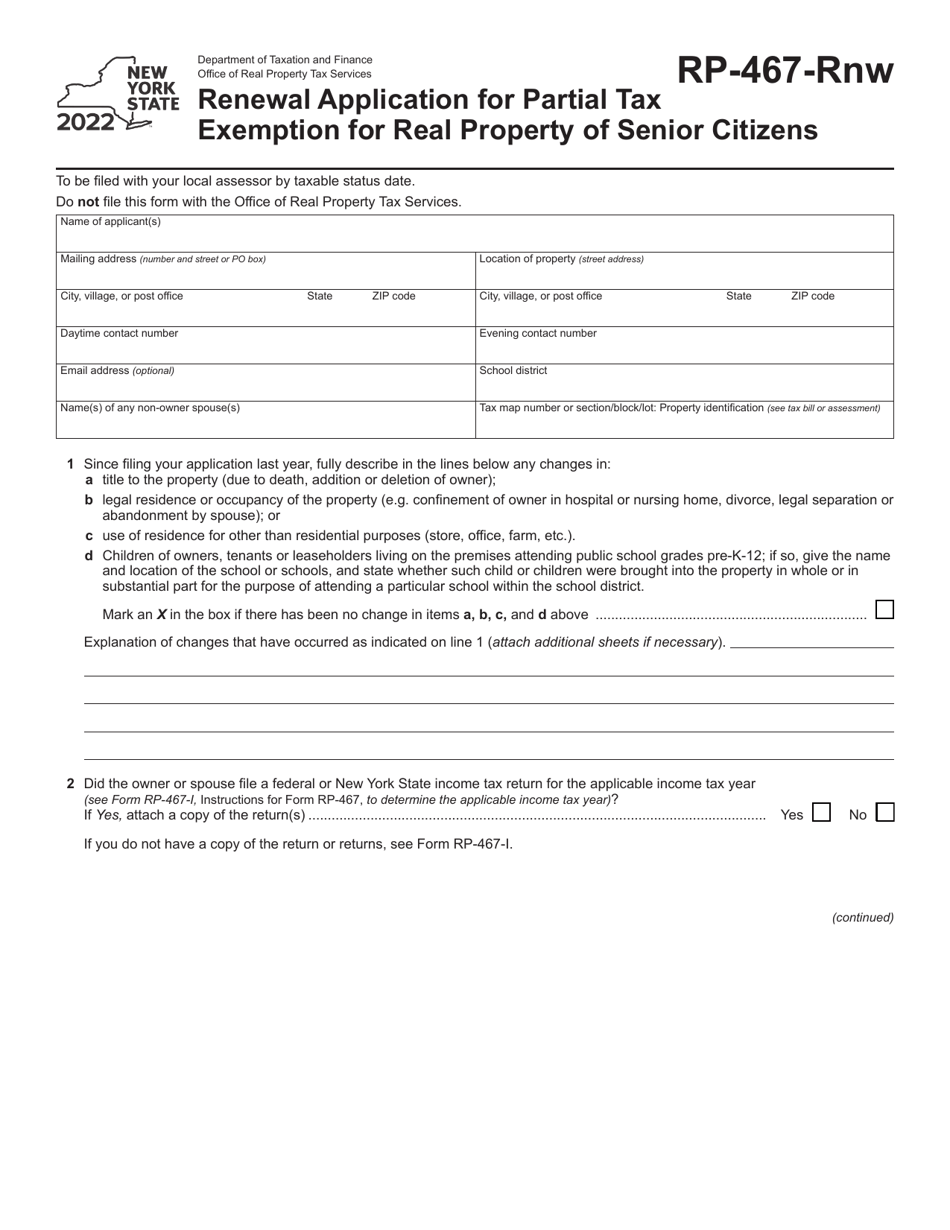

What Is Form RP-467-RNW?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RP-467-RNW Renewal Application?

A: The RP-467-RNW Renewal Application is a form used in New York to apply for a partial tax exemption for real property owned by senior citizens.

Q: Who is eligible for the partial tax exemption?

A: Senior citizens who meet certain criteria, such as age and income requirements, are eligible for the partial tax exemption.

Q: What is the purpose of the partial tax exemption?

A: The purpose of the partial tax exemption is to provide financial relief to senior citizens by reducing their property tax burden.

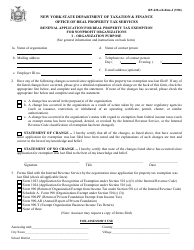

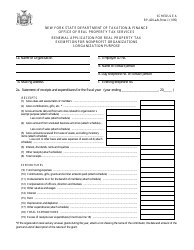

Q: How do I renew my partial tax exemption?

A: To renew your partial tax exemption, you need to complete and submit the RP-467-RNW Renewal Application to the appropriate authorities.

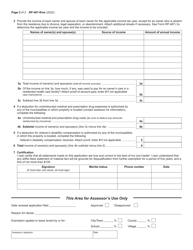

Q: What documents are required for the renewal application?

A: You may be required to provide documentation, such as proof of age and income, along with the renewal application.

Q: Is there a deadline for submitting the renewal application?

A: Yes, there is a deadline for submitting the renewal application. It is usually specified on the form or by the local assessor's office.

Q: What happens if my renewal application is approved?

A: If your renewal application is approved, you will continue to receive the partial tax exemption for the specified period.

Q: What happens if my renewal application is not approved?

A: If your renewal application is not approved, you may lose the partial tax exemption and be required to pay the full property taxes.

Q: Can I appeal the decision if my renewal application is denied?

A: Yes, you have the right to appeal the decision if your renewal application is denied. You should follow the instructions provided on the denial notice.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-467-RNW by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.