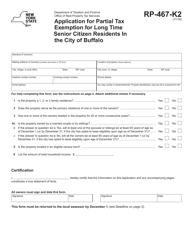

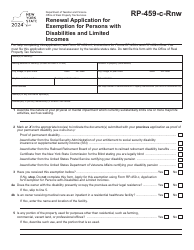

This version of the form is not currently in use and is provided for reference only. Download this version of

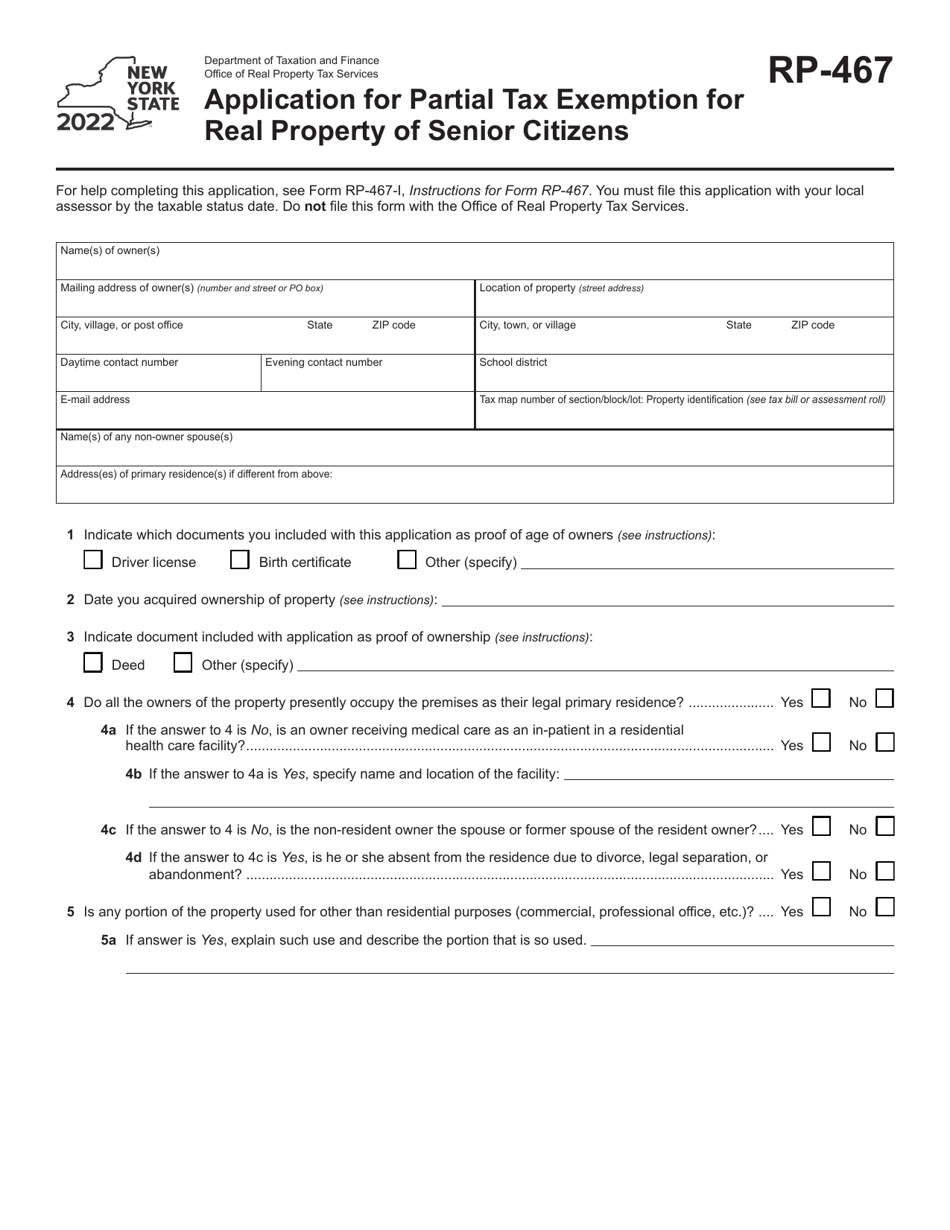

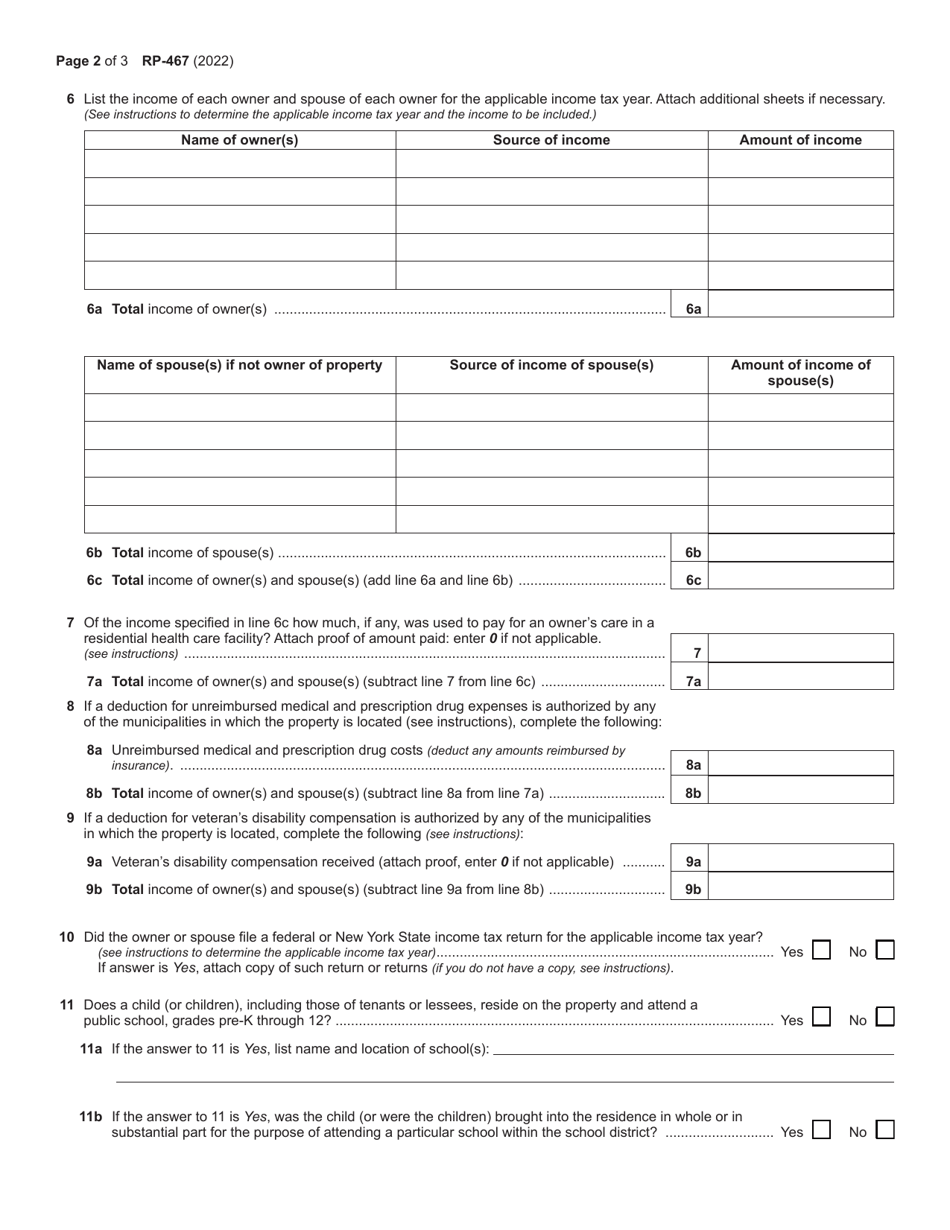

Form RP-467

for the current year.

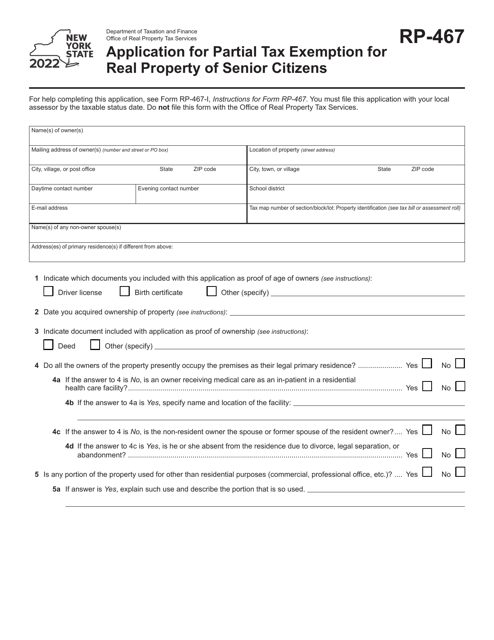

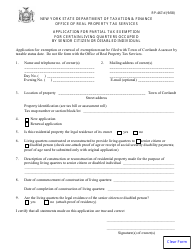

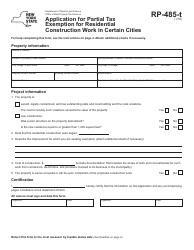

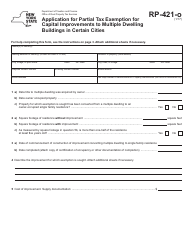

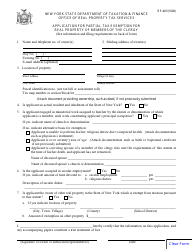

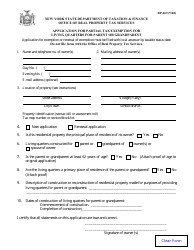

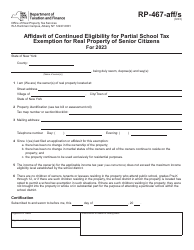

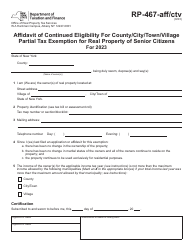

Form RP-467 Application for Partial Tax Exemption for Real Property of Senior Citizens - New York

What Is Form RP-467?

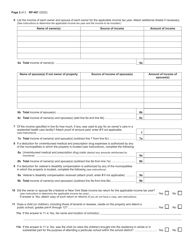

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RP-467?

A: Form RP-467 is an application for partial tax exemption for real property of senior citizens in New York.

Q: Who is eligible to use Form RP-467?

A: Senior citizens who own real property in New York are eligible to use Form RP-467.

Q: What is the purpose of Form RP-467?

A: The purpose of Form RP-467 is to apply for a partial tax exemption on real property for senior citizens in New York.

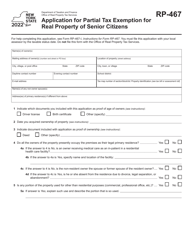

Q: What are the requirements to qualify for the exemption?

A: To qualify for the exemption, the applicant must be 65 years of age or older, own the property and use it as their primary residence.

Q: What documents do I need to submit with Form RP-467?

A: You will need to submit proof of age, proof of ownership, and proof of primary residence along with Form RP-467.

Q: When is the deadline to submit Form RP-467?

A: The deadline to submit Form RP-467 varies by municipality. It is recommended to contact your local assessor's office for specific deadline information.

Q: Is there a fee to file Form RP-467?

A: There is no fee to file Form RP-467.

Q: How long does it take to process the application?

A: The processing time for Form RP-467 varies by municipality. It is recommended to contact your local assessor's office for specific information.

Q: Can I apply for the exemption if I have a mortgage on the property?

A: Yes, you can still apply for the exemption even if you have a mortgage on the property.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-467 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.