This version of the form is not currently in use and is provided for reference only. Download this version of

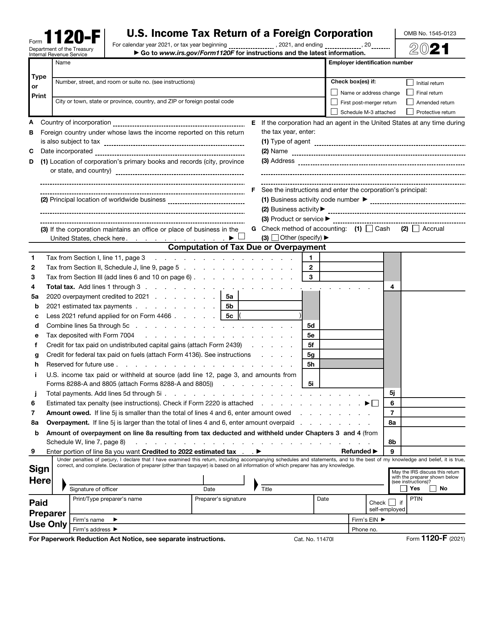

IRS Form 1120-F

for the current year.

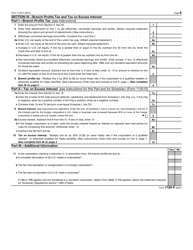

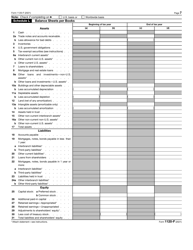

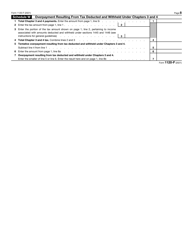

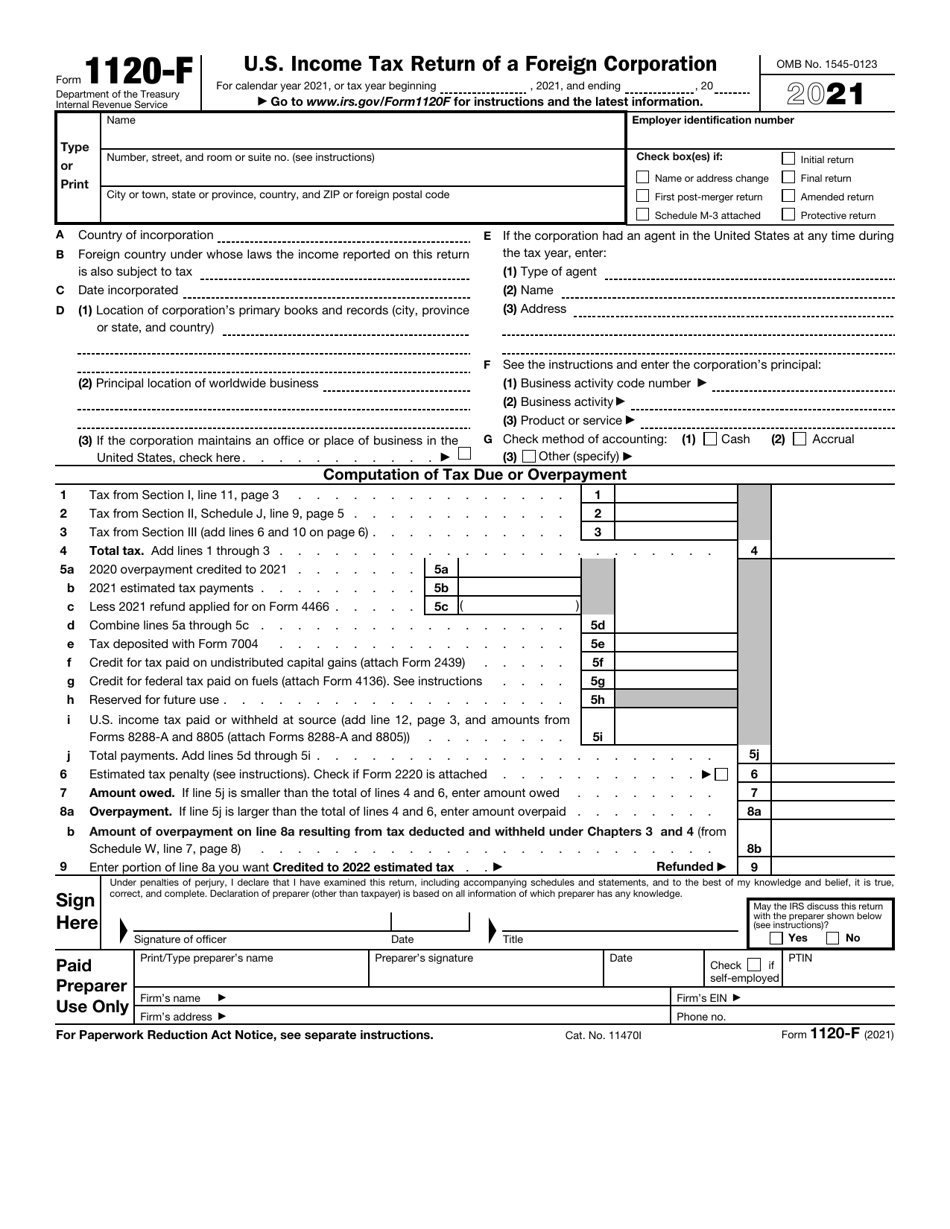

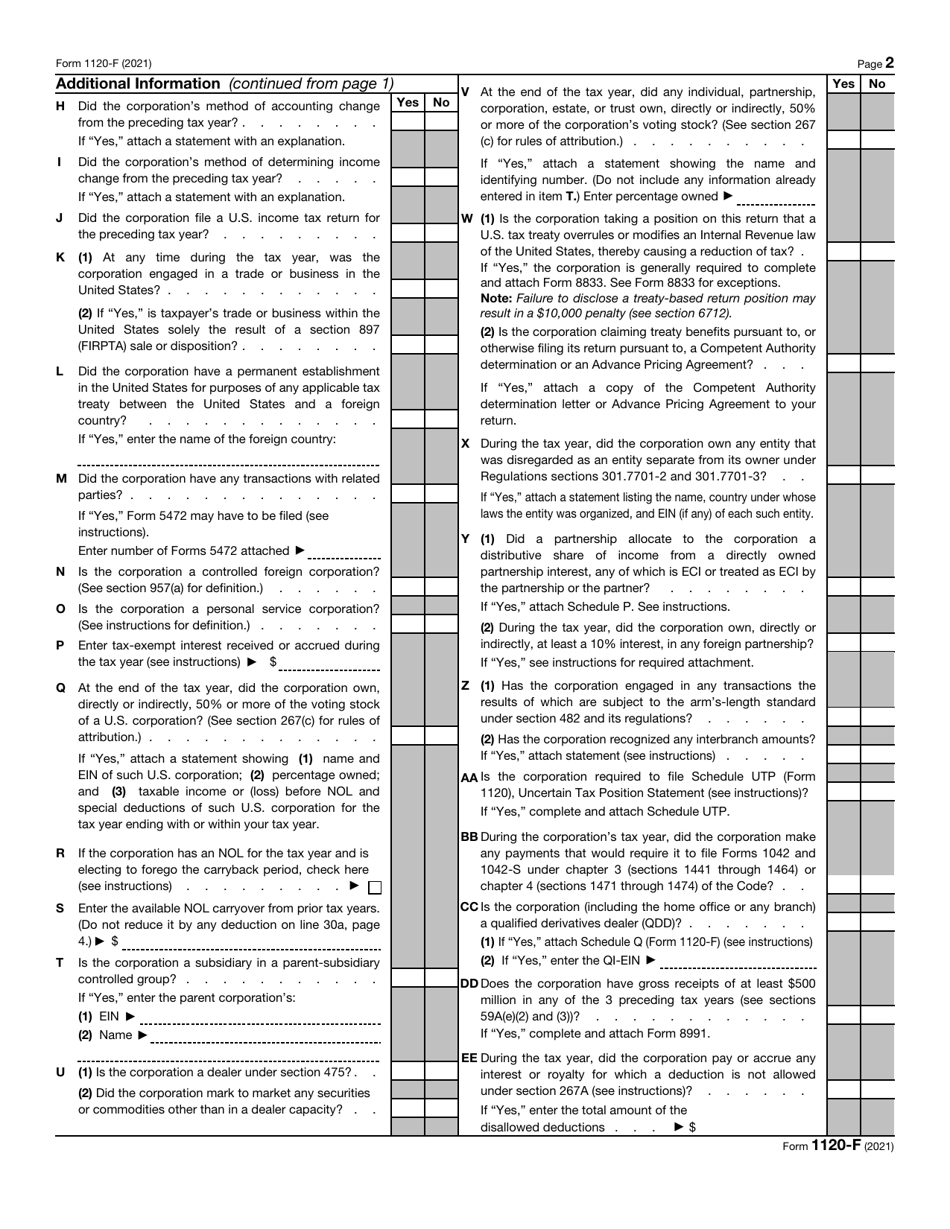

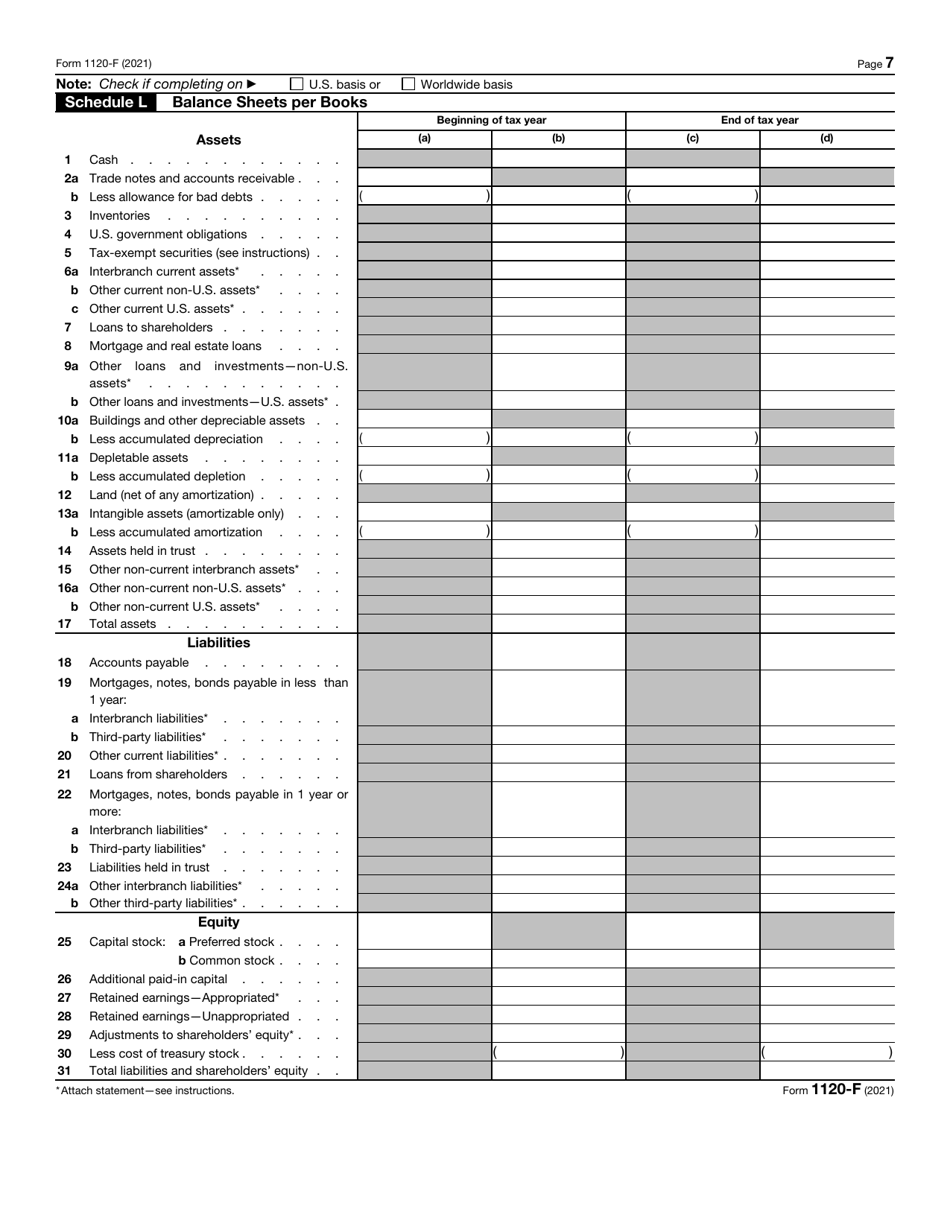

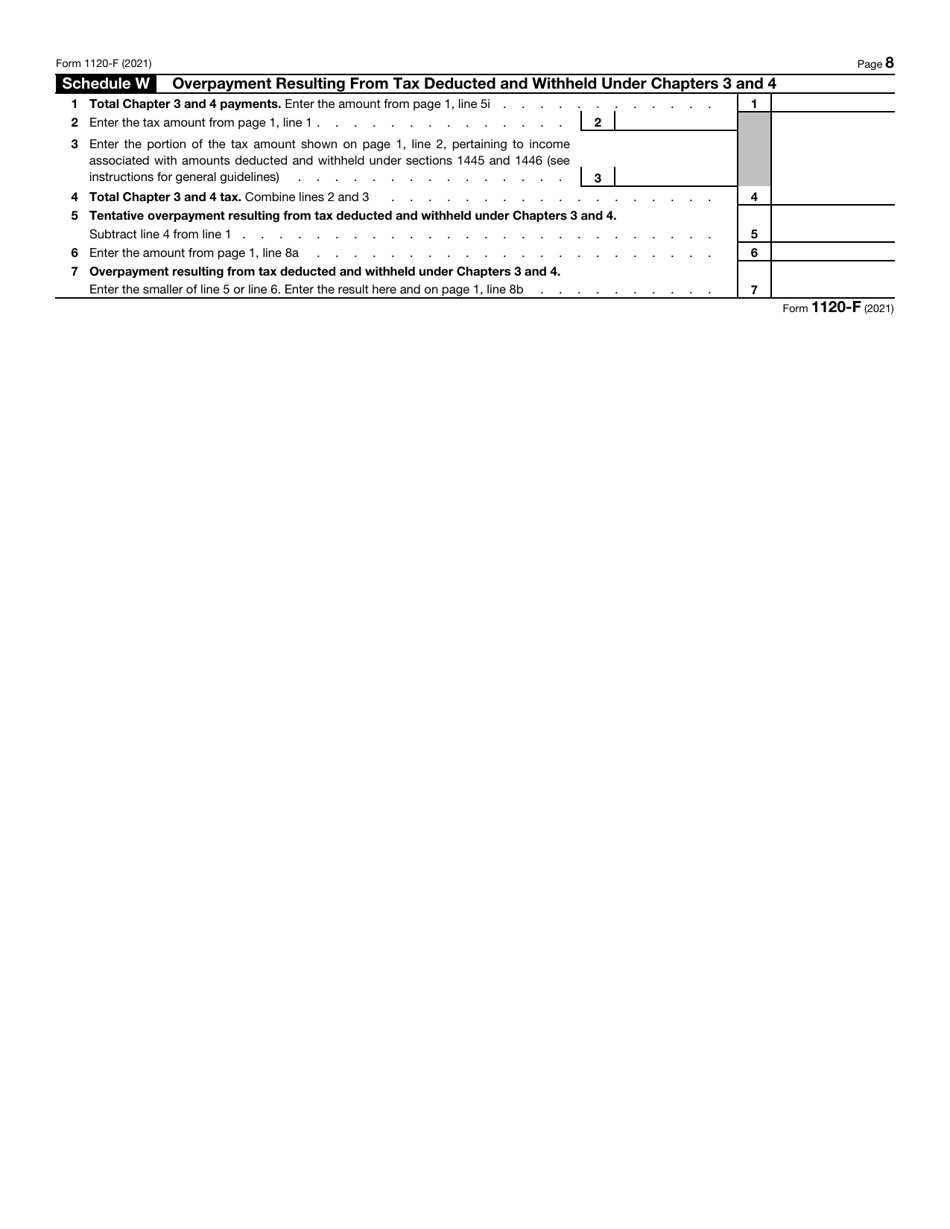

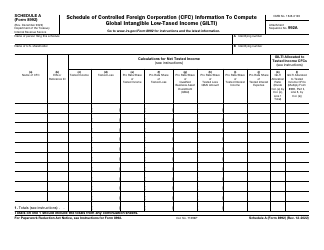

IRS Form 1120-F U.S. Income Tax Return of a Foreign Corporation

What Is IRS Form 1120-F?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-F?

A: IRS Form 1120-F is the U.S. Income Tax Return of a Foreign Corporation.

Q: Who should file IRS Form 1120-F?

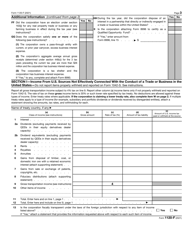

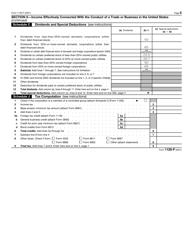

A: Foreign corporations that engage in a trade or business in the United States are required to file IRS Form 1120-F.

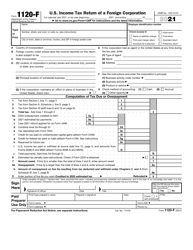

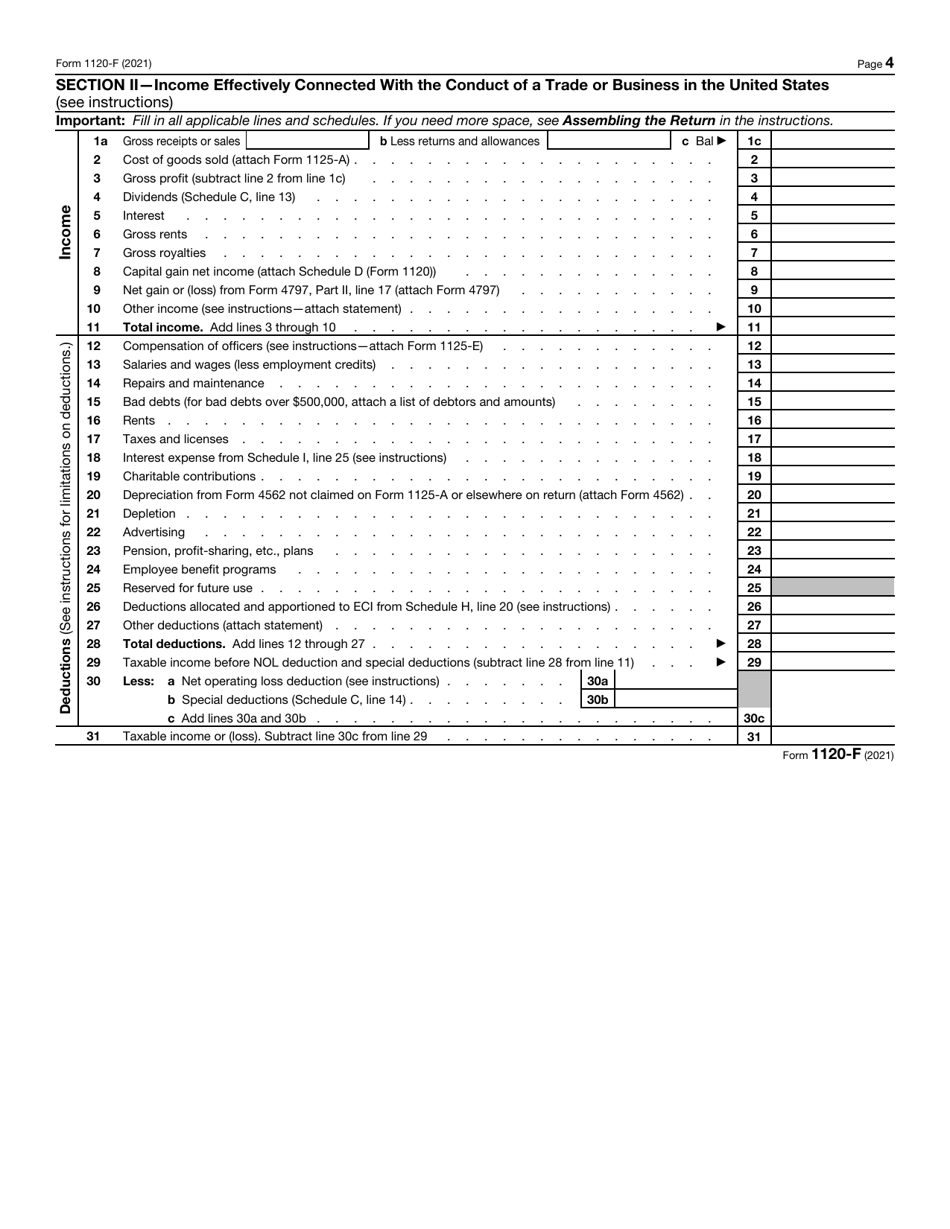

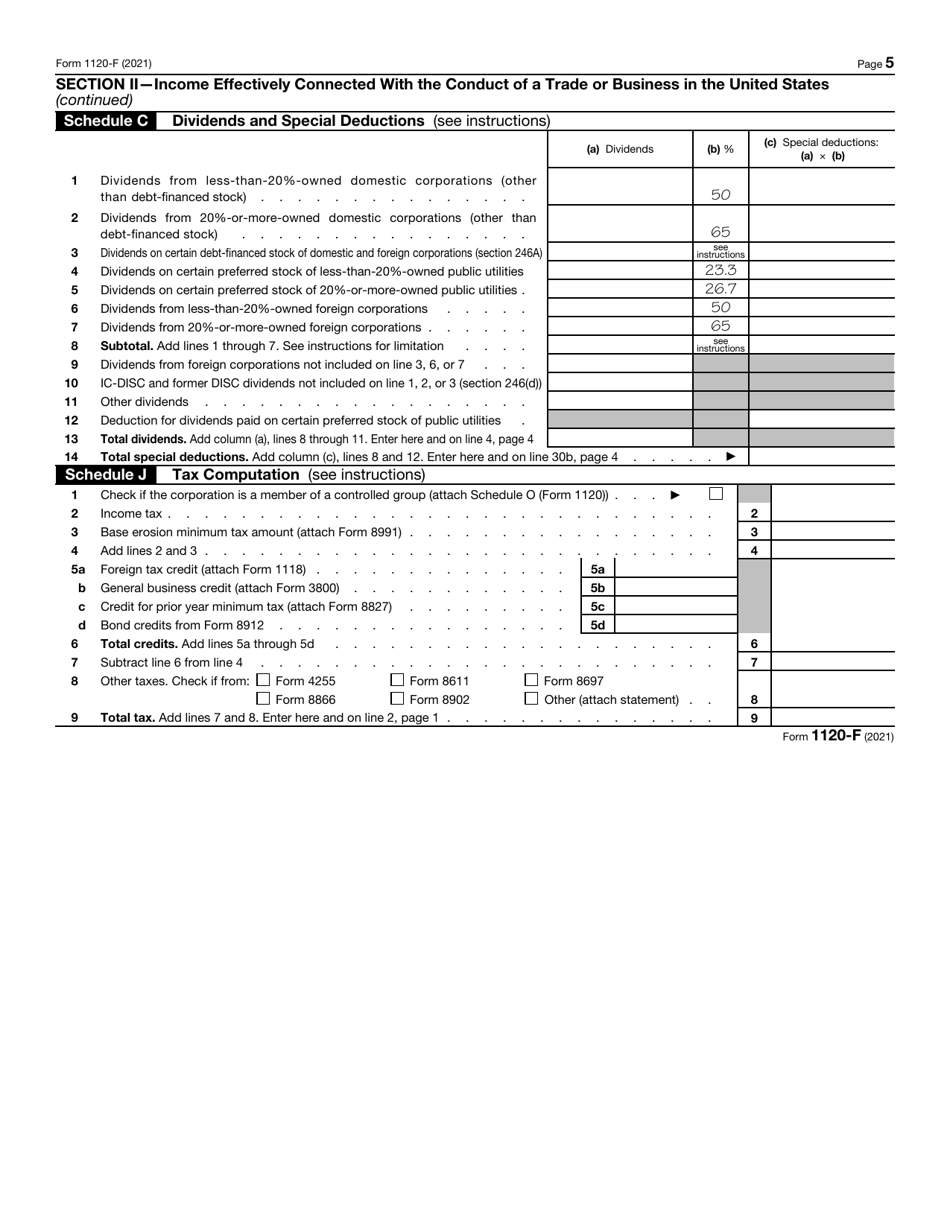

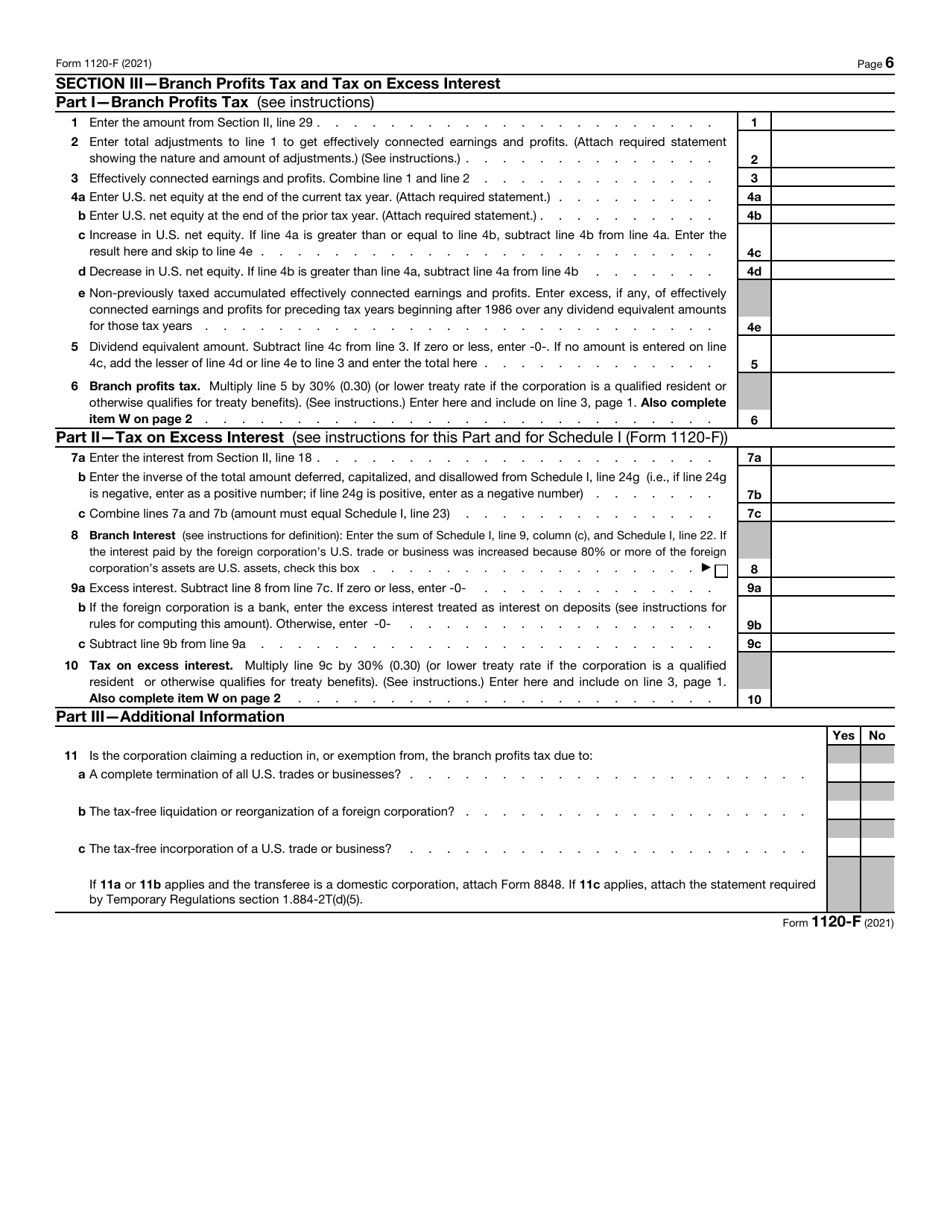

Q: What information is required on IRS Form 1120-F?

A: IRS Form 1120-F requires foreign corporations to report their income, deductions, and credits related to their U.S. trade or business.

Q: When is the deadline to file IRS Form 1120-F?

A: The deadline to file IRS Form 1120-F is generally the 15th day of the 3rd month following the end of the corporation's tax year.

Q: Are there any penalties for not filing IRS Form 1120-F?

A: Yes, there can be penalties for not filing IRS Form 1120-F, including late filing penalties and interest on any unpaid tax amounts.

Form Details:

- A 8-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-F through the link below or browse more documents in our library of IRS Forms.