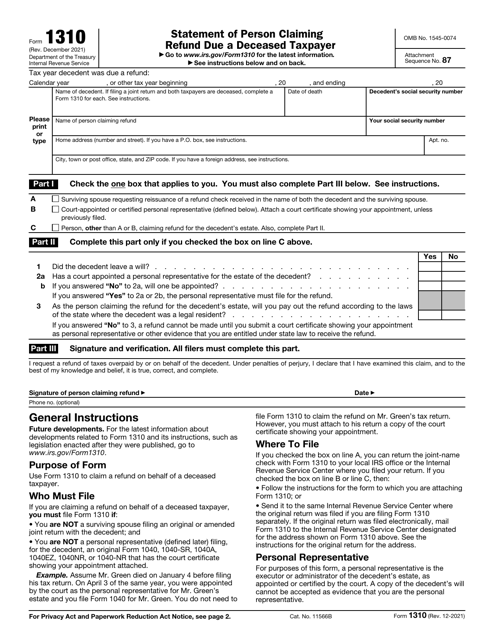

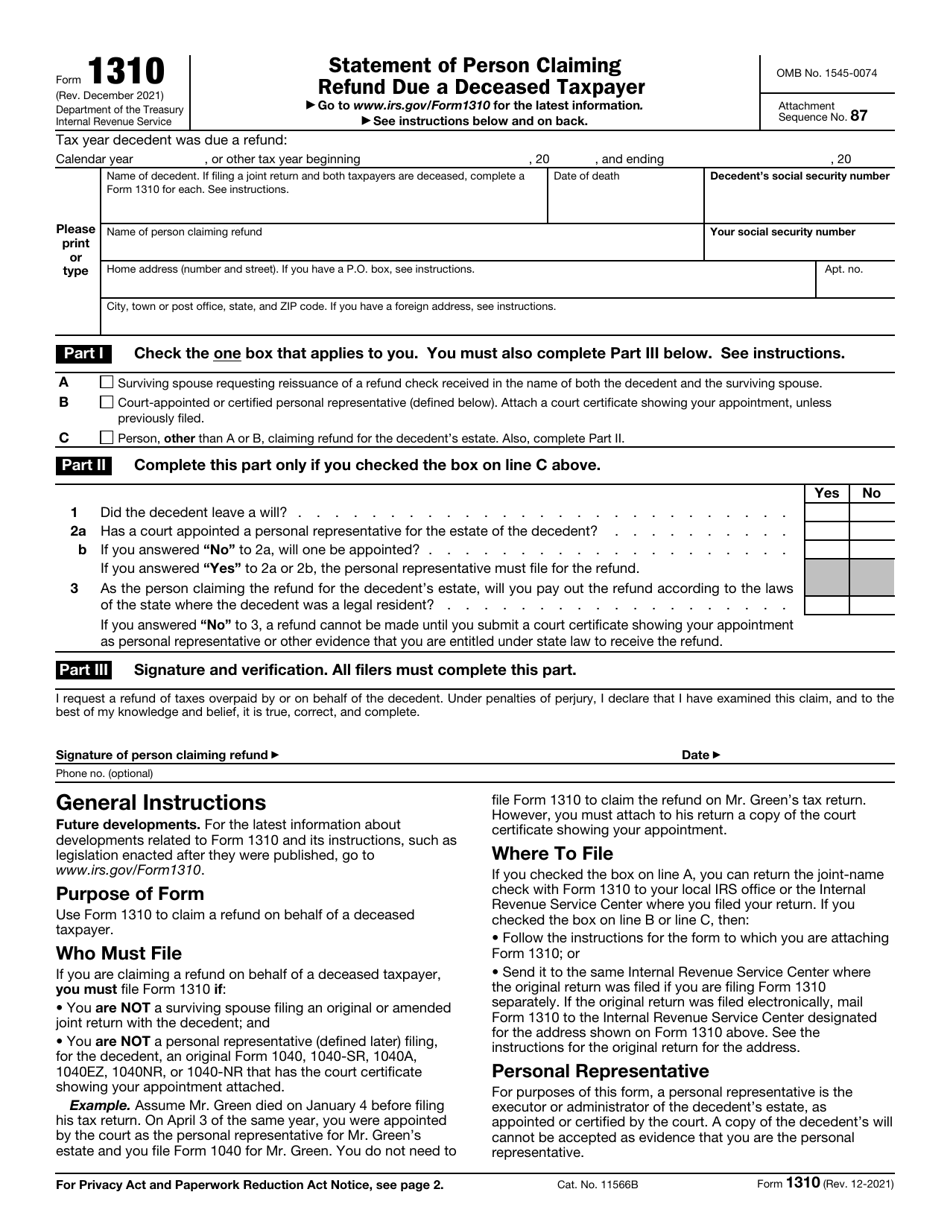

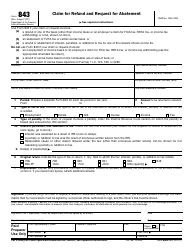

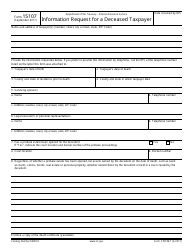

IRS Form 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer

What Is IRS Form 1310?

IRS Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer , is a written document designed to allow an individual to file a claim for a refund in the name of a person that recently passed away.

Alternate Names:

- Tax Form 1310;

- Federal Form 1310.

This form can be filed by the spouse of the decedent, the executor whose name is included in the will of the deceased person, or the individual the court selects as the estate administrator - it may be a family member of the taxpayer or someone else with a direct interest in the estate and the refund.

This statement was released by the Internal Revenue Service (IRS) on December 1, 2021 - older editions of the form are now outdated. An IRS Form 1310 fillable version can be found through the link below.

When Is Form 1310 Required?

Prepare and submit Federal Form 1310 to inform the government about your wish to obtain a tax refund a deceased individual was supposed to receive before passing away. This document informs tax organs the person identified in writing has recently died yet the beneficiary is still owed a refund they would otherwise claim. The claim is a supplementary document filed alongside a tax return (a joint tax return when a spouse chooses to submit the paperwork on behalf of two people) that serves as the last income statement of the decedent.

Tax Form 1310 is typically submitted by beneficiaries of the person that recently died - in the majority of cases, a spouse asks tax authorities for a refund but it is also done by administrators and executors of the estate whether they were related to the taxpayer, had a close relationship with them, or were formally authorized to act in matters related to the estate. It is up to the beneficiary to determine how to receive the money - you can fill out a request for a direct deposit into one of your bank accounts or file a document that asks for a paper check instead (the latter option is recommended since many financial institutions will not send money to an account with a different name).

IRS Form 1310 is not needed if you are submitting documentation as the spouse of the decedent or their personal representative since you will be obliged to file either a joint return or send an original income statement to the IRS - in both instances, you can confirm your request for a refund via the return.

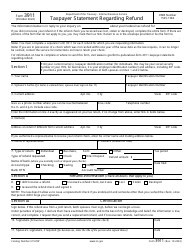

Form 1310 Instructions

IRS Form 1310 instructions are as follows:

-

**Provide information about the tax year when the deceased individual was supposed to receive the refund **- it may be a specific calendar year or a tax year defined by a different timeframe.

-

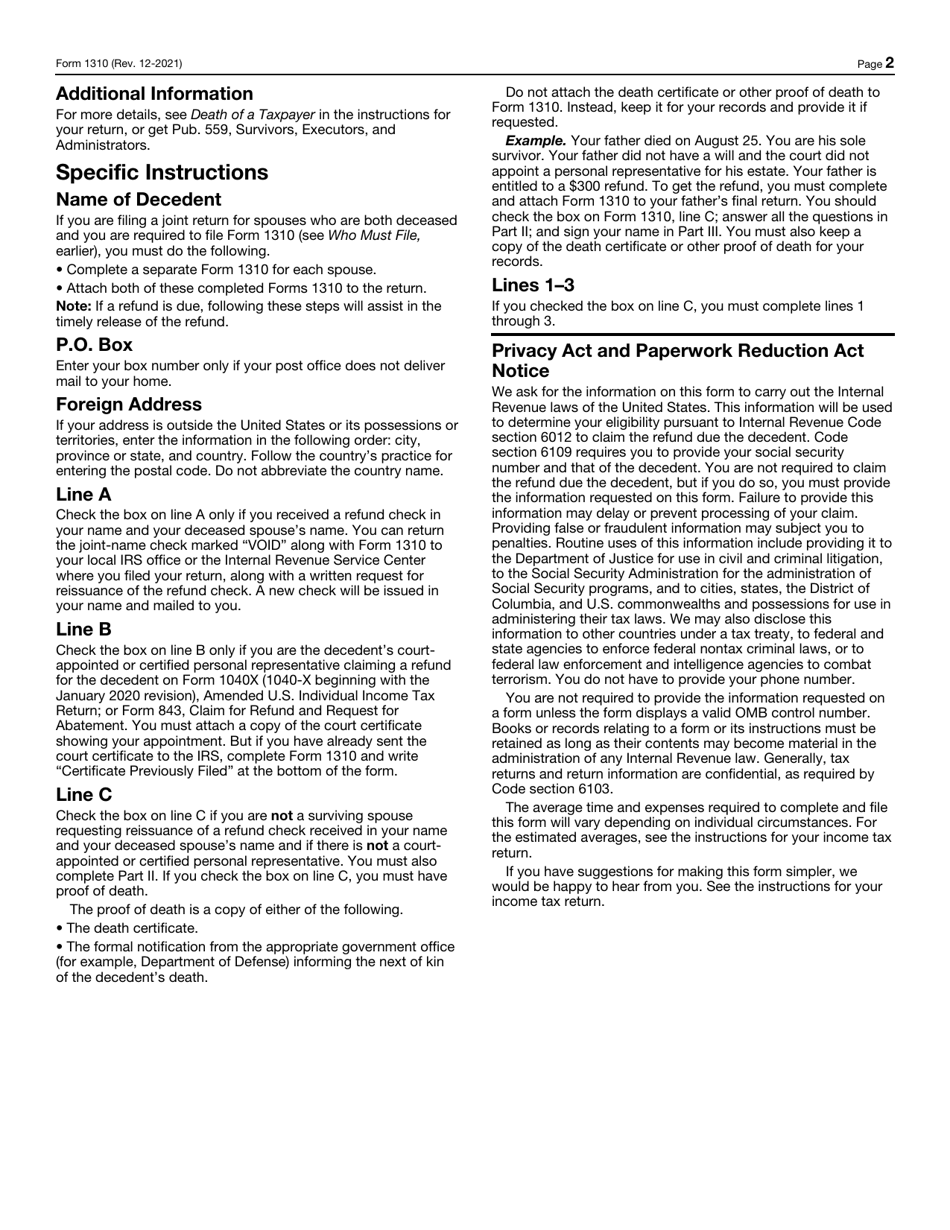

Identify the decedent - write down their full name, the date of their death, and their social security number. Add your own personal details - full name, social security number, and mailing address. In case you are residing abroad, make sure you record the address correctly - first, you need to enter the name of your city, then specify the state or province, and indicate the country last.

-

Check the box to confirm your status - you may be a decedent's spouse with the intention to get another copy of the refund check, a representative of the person that passed away (whether you were appointed by a judge or by a formal authorization of the individual prior to their passing), or someone else who makes a claim for the refund in question.

-

If you are neither the spouse nor an official representative, you must provide answers to several questions before you are permitted to obtain a refund . Specify whether the deceased individual prepared a will, whether there are any arrangements to appoint a representative to deal with the estate, and whether you are planning to handle the refund in line with the state regulations.

-

Certify the document - you have to confirm the claim is true and accurate to the best of your knowledge, sign the form, add your phone number, and date the paperwork.

Where to Mail Form 1310?

There are different rules for people filing Tax Form 1310:

-

If you file tax documentation on behalf of your deceased spouse, you are allowed to file this instrument with the same IRS Center where you submit your annual tax return ; alternatively, it is possible to reach out to the local IRS office and send them the statement instead.

-

If you submit the form as an authorized representative or as a third party interested in receiving and fairly distributing the refund, you have to comply with the guidelines provided for the form you attach to Form 1310 - in most cases, this is a tax return which must be submitted in accordance with the last residential address of the person that passed away. Do not forget to attach a document that proves the decedent appointed you to execute the estate or you were named by the court as the estate administrator - even if you enclose a copy of the will, it will not automatically mean you have the right to carry out the duties of a personal representative.