This version of the form is not currently in use and is provided for reference only. Download this version of

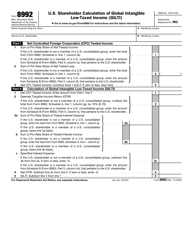

IRS Form 8992 Schedule A

for the current year.

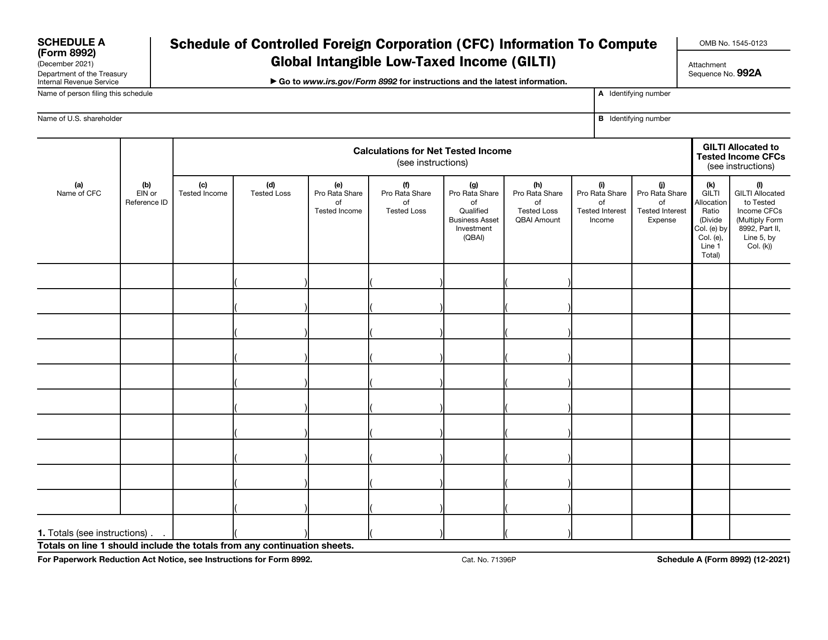

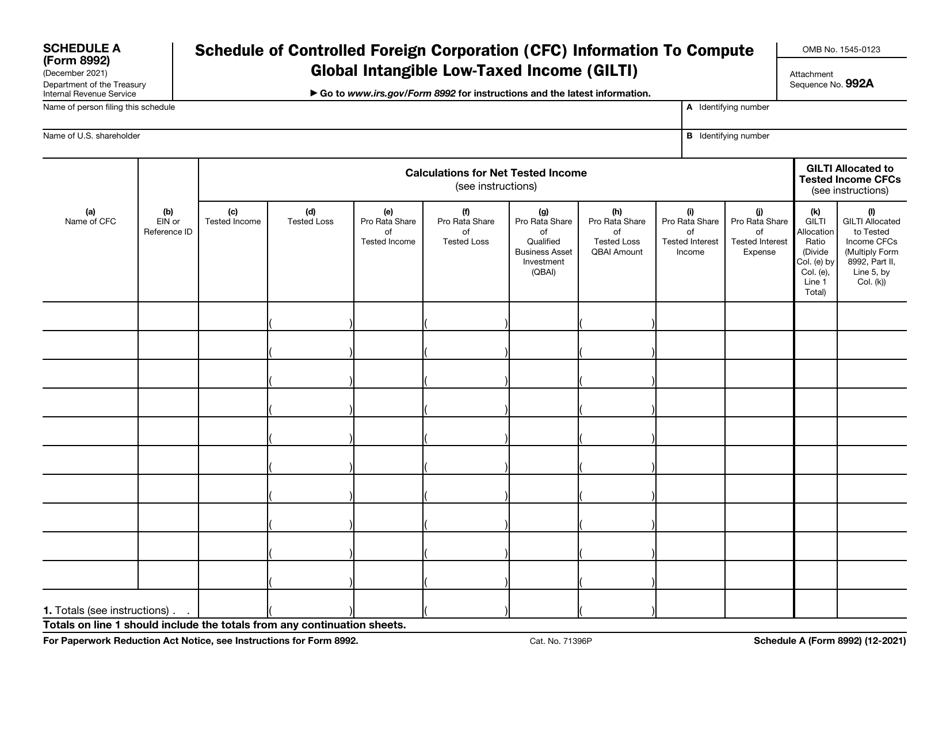

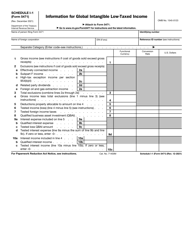

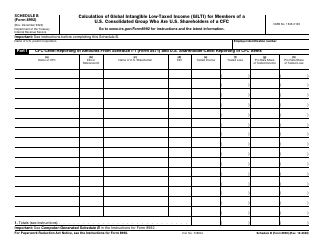

IRS Form 8992 Schedule A Schedule of Controlled Foreign Corporation (Cfc) Information to Compute Global Intangible Low-Taxed Income (Gilti)

What Is IRS Form 8992 Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2021. The document is a supplement to IRS Form 8992, U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (Gilti). As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8992?

A: IRS Form 8992 is used to report Controlled Foreign Corporation (CFC) information and calculate Global Intangible Low-Taxed Income (GILTI).

Q: What is a Controlled Foreign Corporation (CFC)?

A: A Controlled Foreign Corporation (CFC) is a foreign corporation in which U.S. shareholders own more than 50% of the total voting power or value.

Q: What is Global Intangible Low-Taxed Income (GILTI)?

A: Global Intangible Low-Taxed Income (GILTI) is a category of income earned by U.S. shareholders of CFCs, generally related to intangible assets.

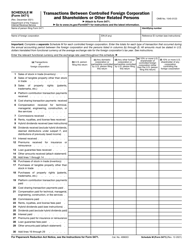

Q: What information is required on Schedule A of Form 8992?

A: Schedule A of Form 8992 requires detailed information about each CFC, including ownership percentages and financial data.

Q: How is GILTI calculated?

A: GILTI is calculated by subtracting a deemed return on tangible assets from the CFC's tested income.

Q: Who needs to file IRS Form 8992?

A: U.S. shareholders of Controlled Foreign Corporations (CFCs) who have GILTI income are required to file Form 8992.

Q: What is the deadline to file Form 8992?

A: The deadline to file Form 8992 is the same as the taxpayer's income tax return due date, including extensions.

Q: Are there any penalties for failing to file Form 8992?

A: Yes, failure to file Form 8992 or reporting incorrect information may result in penalties imposed by the IRS.

Q: Can I e-file Form 8992?

A: No, as of now, Form 8992 cannot be e-filed and must be filed by mail.

Form Details:

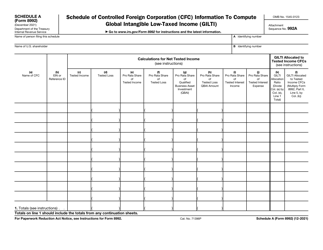

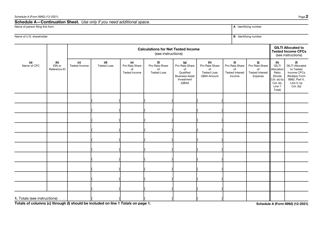

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8992 Schedule A through the link below or browse more documents in our library of IRS Forms.