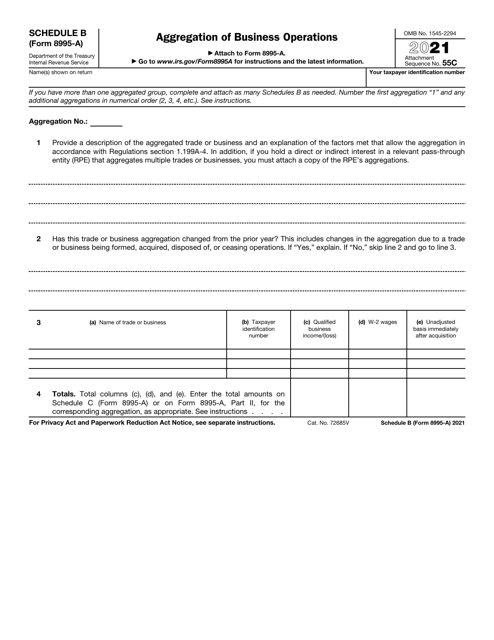

This version of the form is not currently in use and is provided for reference only. Download this version of

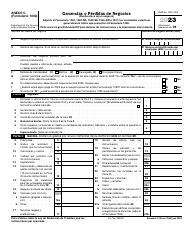

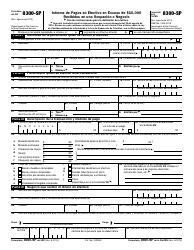

IRS Form 8995-A Schedule B

for the current year.

IRS Form 8995-A Schedule B Aggregation of Business Operations

What Is IRS Form 8995-A Schedule B?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 8995-A, Qualified Business Income Deduction. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8995-A?

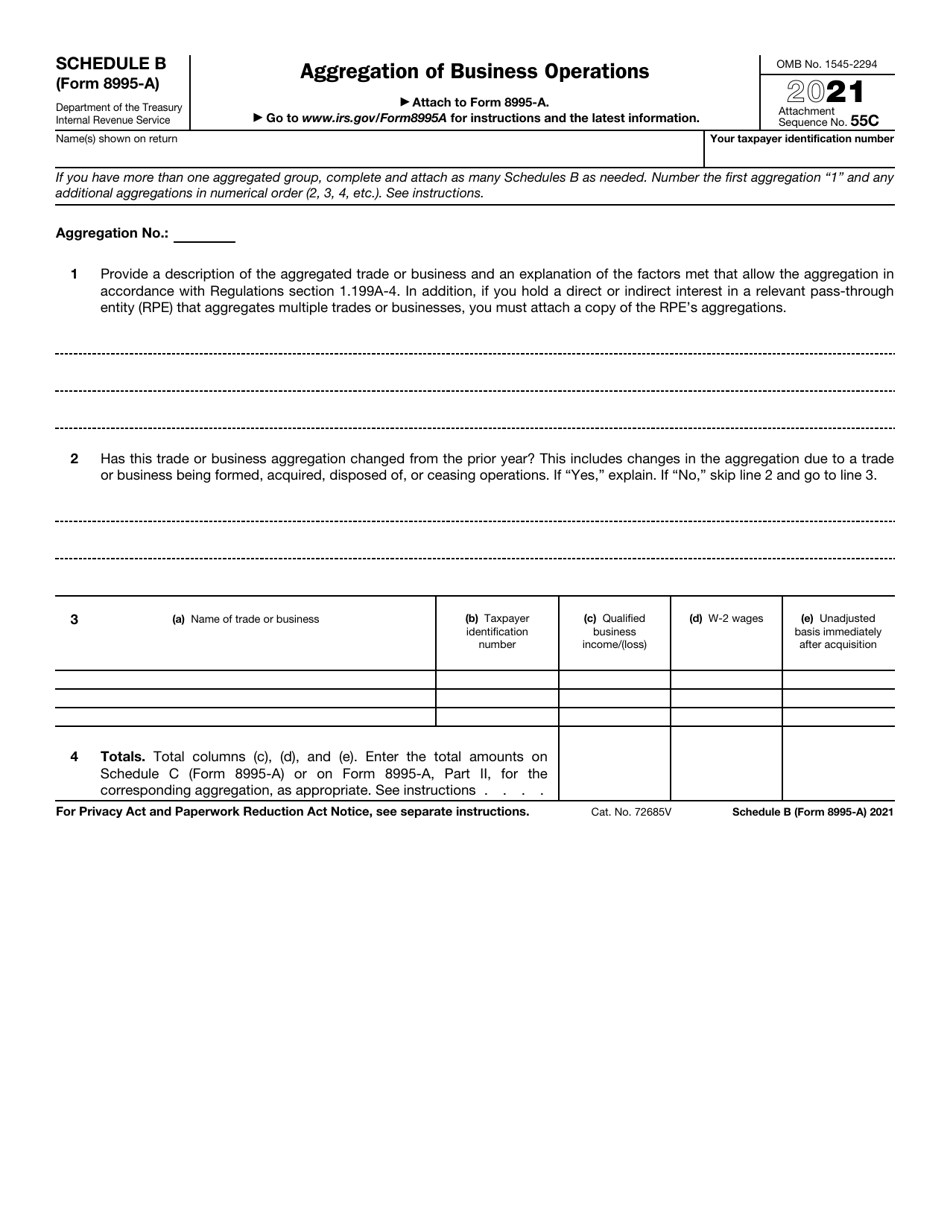

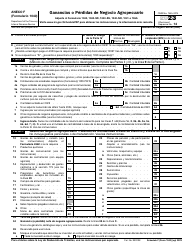

A: IRS Form 8995-A is a schedule used to report the aggregation of business operations for income tax purposes.

Q: What is the purpose of Schedule B on Form 8995-A?

A: Schedule B on Form 8995-A is used to report the aggregation of multiple businesses for the Qualified Business Income deduction.

Q: Who needs to file Form 8995-A?

A: Taxpayers who have multiple businesses and want to claim the Qualified Business Income deduction may need to file Form 8995-A.

Q: What is the Qualified Business Income deduction?

A: The Qualified Business Income deduction is a tax deduction for certain pass-through business income.

Q: What information is required on Schedule B?

A: Schedule B requires you to list each business and provide details such as the trade or business name, employer identification number (EIN), and business code.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8995-A Schedule B through the link below or browse more documents in our library of IRS Forms.