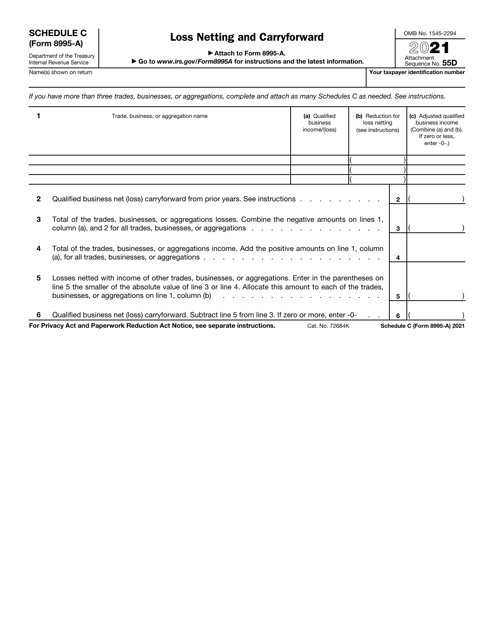

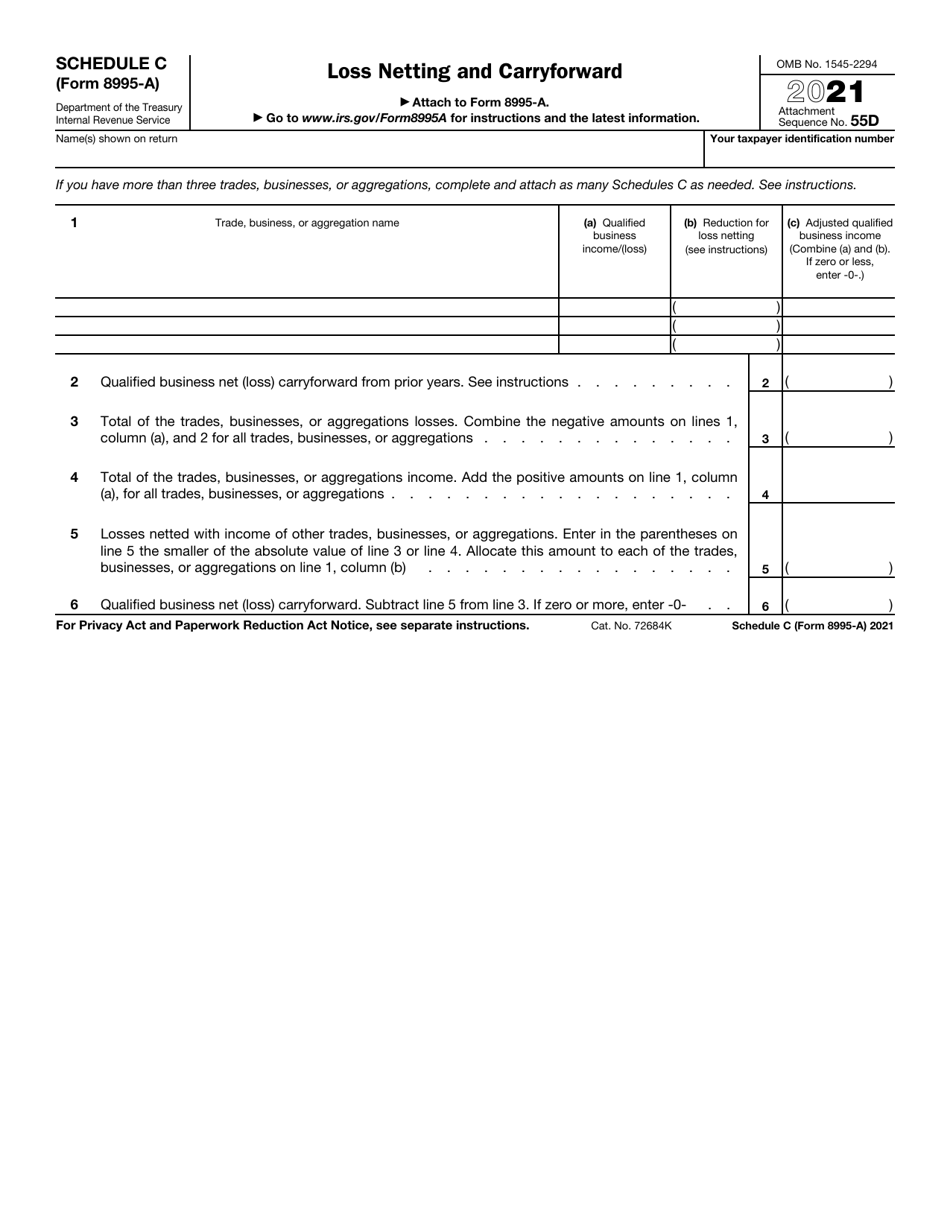

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8995-A Schedule C

for the current year.

IRS Form 8995-A Schedule C Loss Netting and Carryforward

What Is IRS Form 8995-A Schedule C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 8995-A, Qualified Business Income Deduction. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8995-A?

A: IRS Form 8995-A is a schedule used to calculate the netting and carryforward of Schedule C losses.

Q: What is Schedule C?

A: Schedule C is a tax form used by self-employed individuals to report their business income and expenses.

Q: What is netting?

A: Netting is the process of combining income and losses to determine the overall tax liability.

Q: What is carryforward?

A: Carryforward is the ability to offset current or future tax liabilities with losses from previous years.

Q: Who should file Form 8995-A?

A: Individuals who have Schedule C losses and want to calculate the netting and carryforward should use Form 8995-A.

Q: Do I need to file Form 8995-A every year?

A: No, you only need to file Form 8995-A if you have Schedule C losses and want to calculate the netting and carryforward.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8995-A Schedule C through the link below or browse more documents in our library of IRS Forms.