This version of the form is not currently in use and is provided for reference only. Download this version of

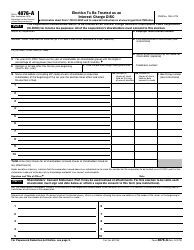

IRS Form 1120-F Schedule I

for the current year.

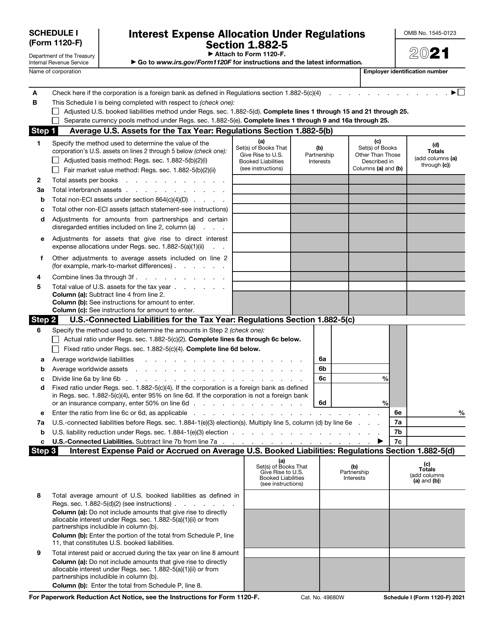

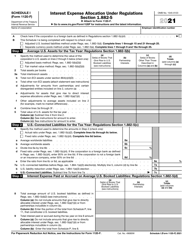

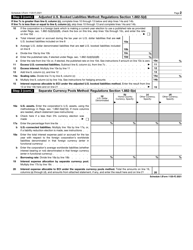

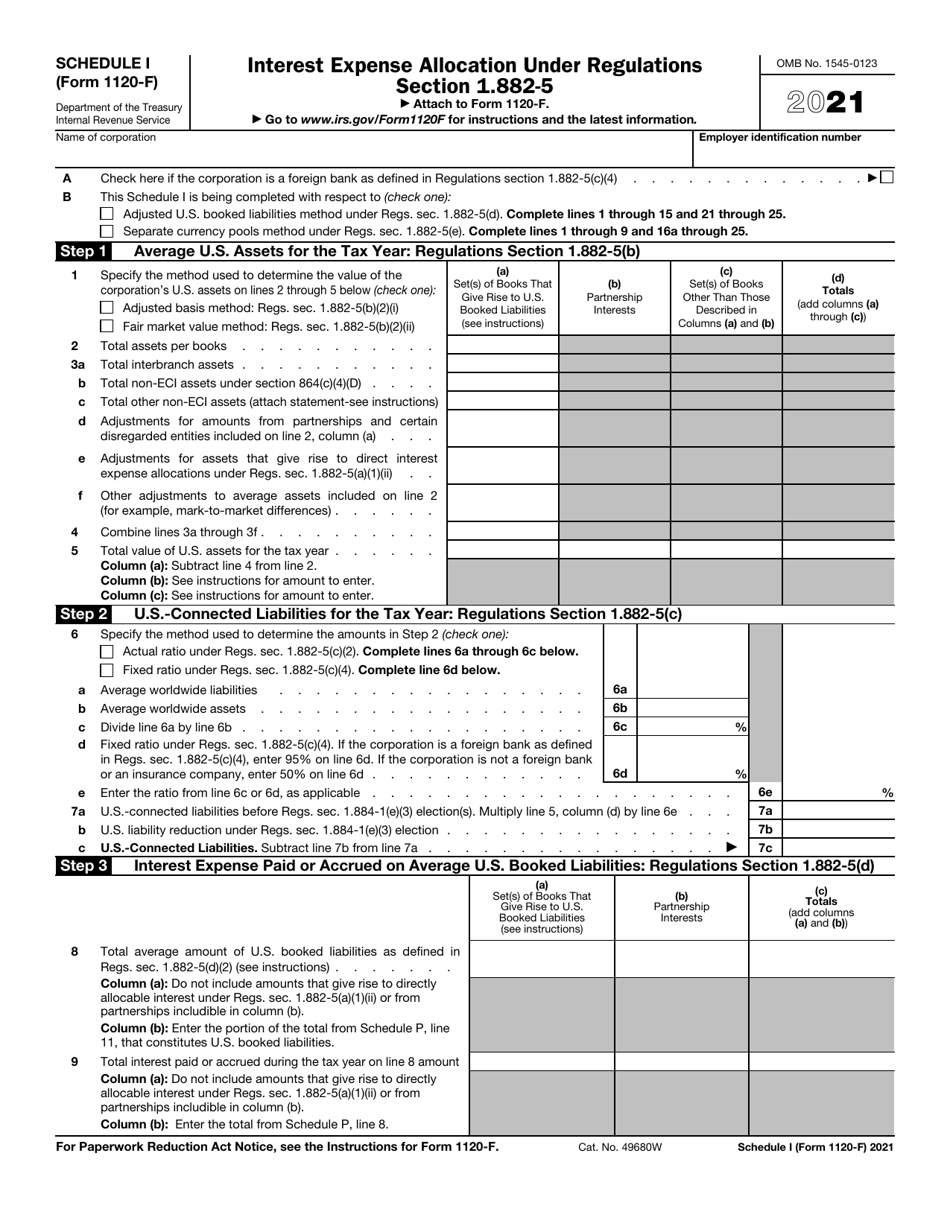

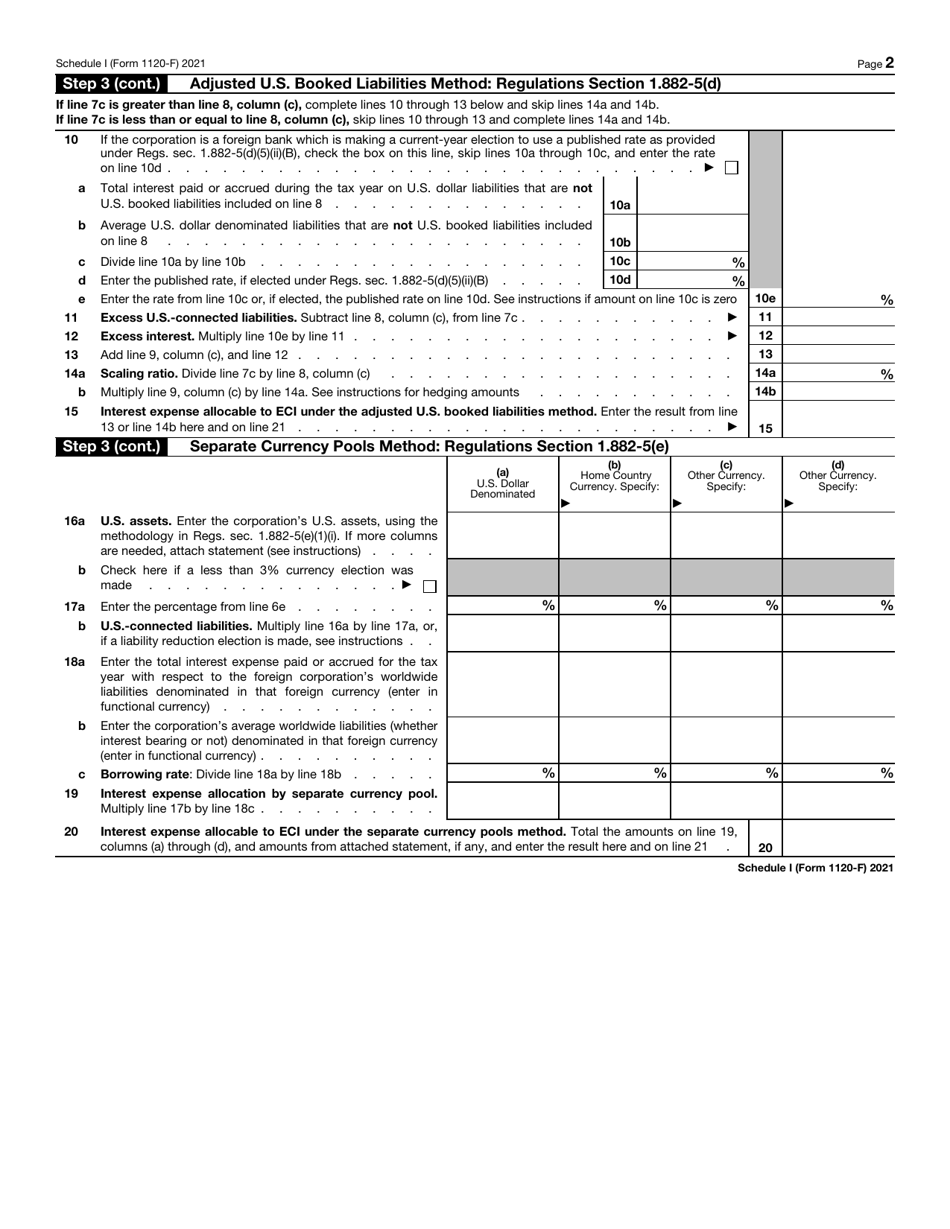

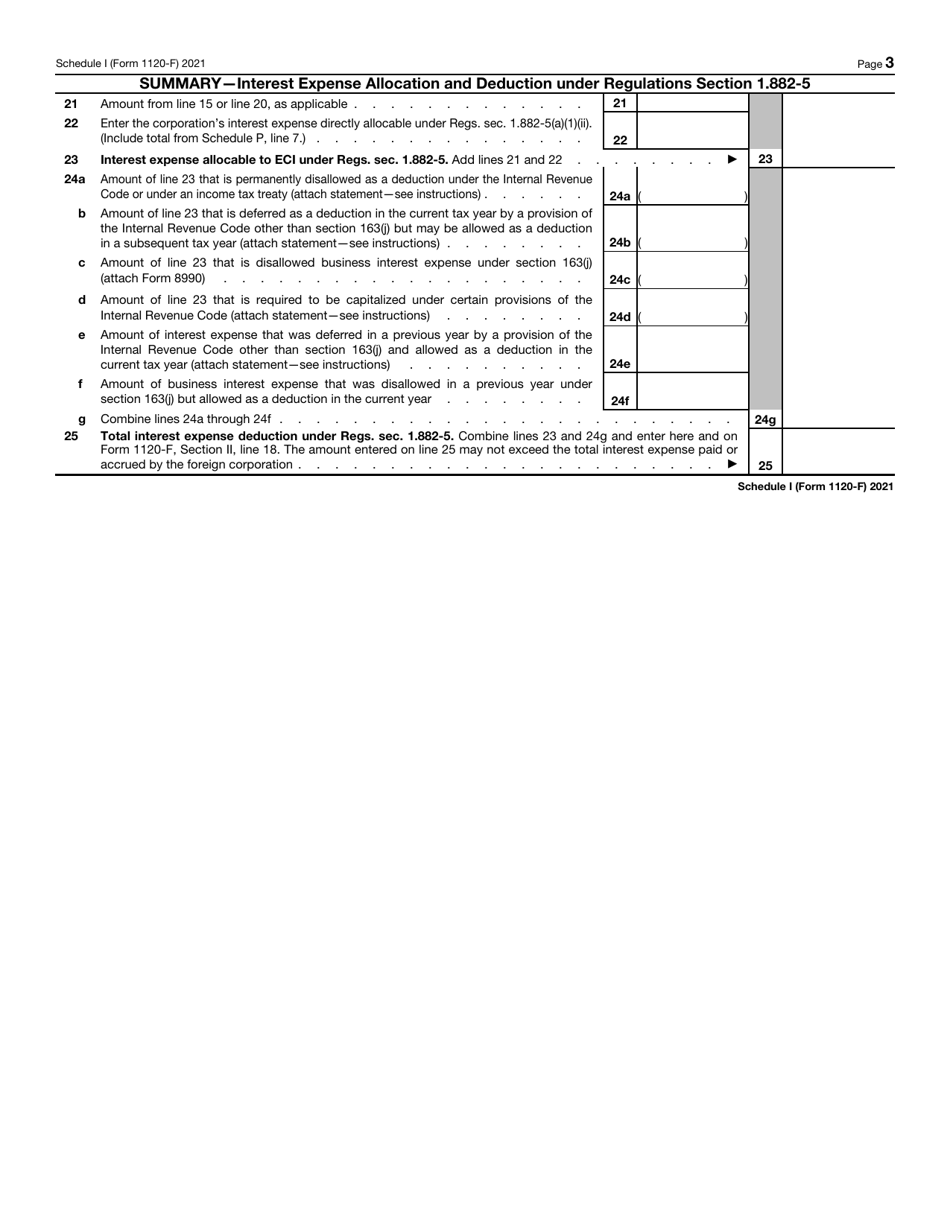

IRS Form 1120-F Schedule I Interest Expense Allocation Under Regulations Section 1.882-5

What Is IRS Form 1120-F Schedule I?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-F, U.S. Income Tax Return of a Foreign Corporation. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-F Schedule I?

A: IRS Form 1120-F Schedule I is a form used to report interest expense allocation for foreign corporations subject to U.S. taxation.

Q: What is the purpose of IRS Form 1120-F Schedule I?

A: The purpose of IRS Form 1120-F Schedule I is to allocate interest expenses between U.S. and foreign sources for tax purposes.

Q: Which regulation does IRS Form 1120-F Schedule I refer to?

A: IRS Form 1120-F Schedule I refers to regulations under Section 1.882-5 of the Internal Revenue Code.

Q: Who is required to file IRS Form 1120-F Schedule I?

A: Foreign corporations subject to U.S. taxation that have interest expenses need to file IRS Form 1120-F Schedule I.

Q: What information is required on IRS Form 1120-F Schedule I?

A: IRS Form 1120-F Schedule I requires information about the corporation's interest expenses and the allocation of those expenses between U.S. and foreign sources.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-F Schedule I through the link below or browse more documents in our library of IRS Forms.