This version of the form is not currently in use and is provided for reference only. Download this version of

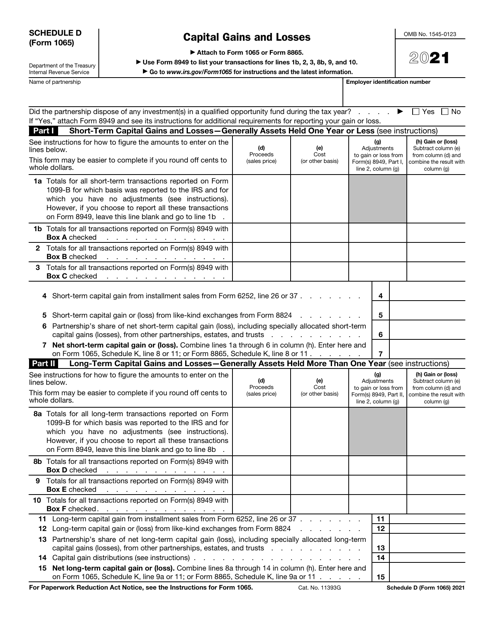

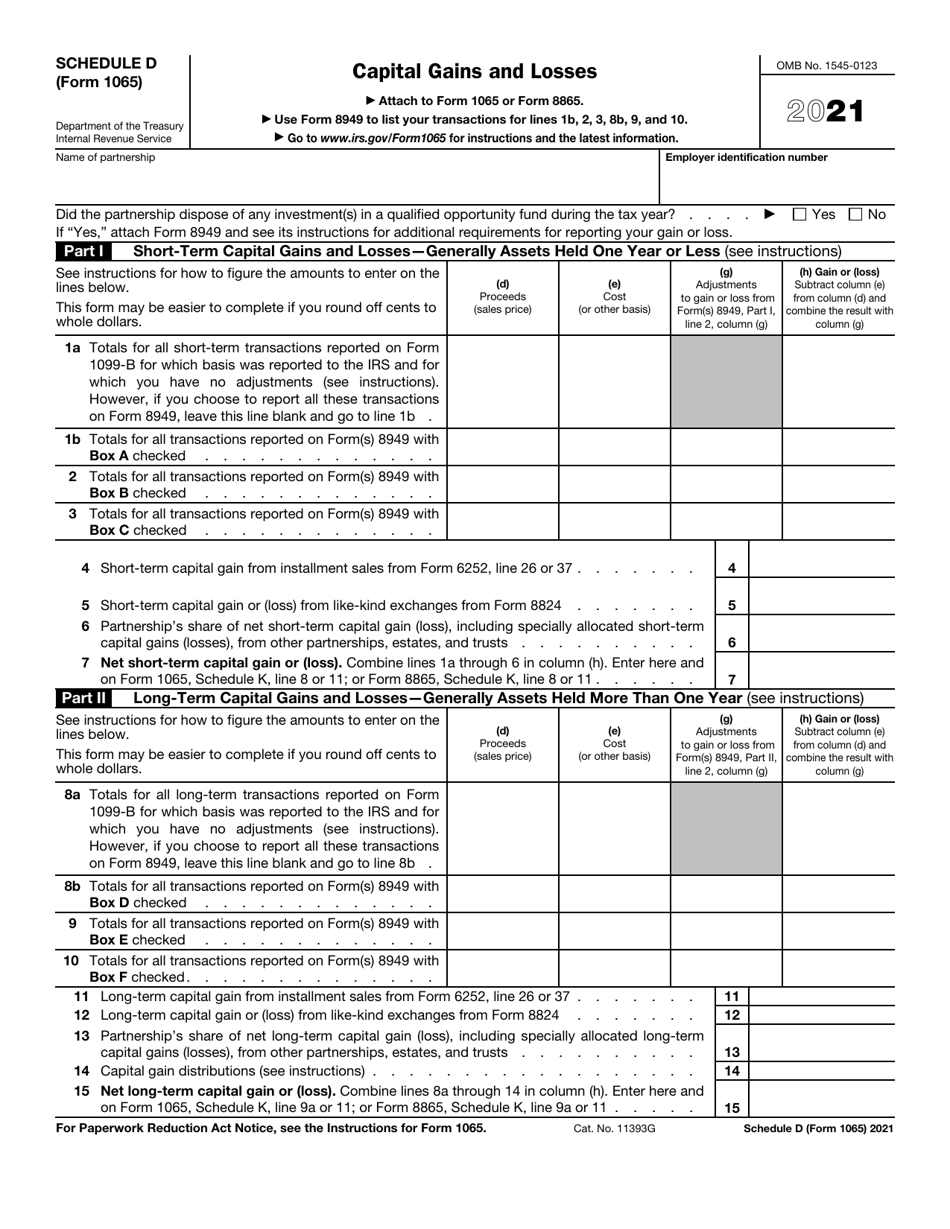

IRS Form 1065 Schedule D

for the current year.

IRS Form 1065 Schedule D Capital Gains and Losses

What Is IRS Form 1065 Schedule D?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1065, U.S. Return of Partnership Income. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1065?

A: IRS Form 1065 is the tax return form used by partnerships to report their income, deductions, and other information to the IRS.

Q: What is Schedule D?

A: Schedule D is a supplemental form to IRS Form 1065 used to report capital gains and losses from the partnership's investments or other activities.

Q: What are capital gains and losses?

A: Capital gains are profits from the sale of investments or assets, while capital losses are losses from the sale of investments or assets.

Q: When do I need to file IRS Form 1065 Schedule D?

A: You need to file IRS Form 1065 Schedule D if your partnership has capital gains or losses during the tax year.

Q: What information do I need to complete Schedule D?

A: To complete Schedule D, you'll need information about the partnership's investments, including the purchase and sale dates, cost basis, and sale price.

Q: Are there any special rules or requirements for reporting capital gains and losses on Schedule D?

A: Yes, there are specific rules for reporting capital gains and losses, including the classification of assets as short-term or long-term and the use of specific tax rates.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1065 Schedule D through the link below or browse more documents in our library of IRS Forms.