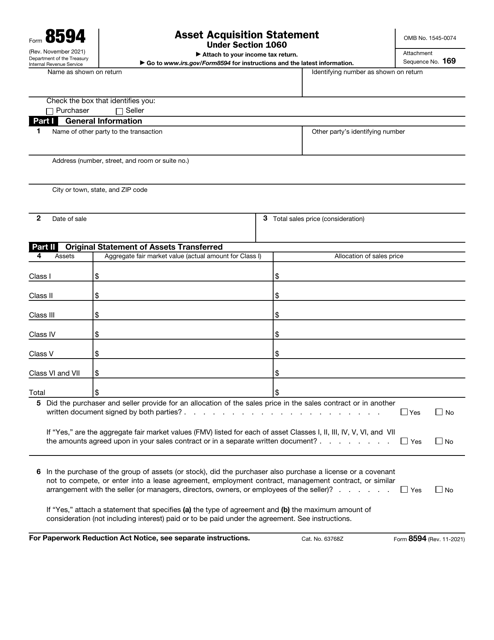

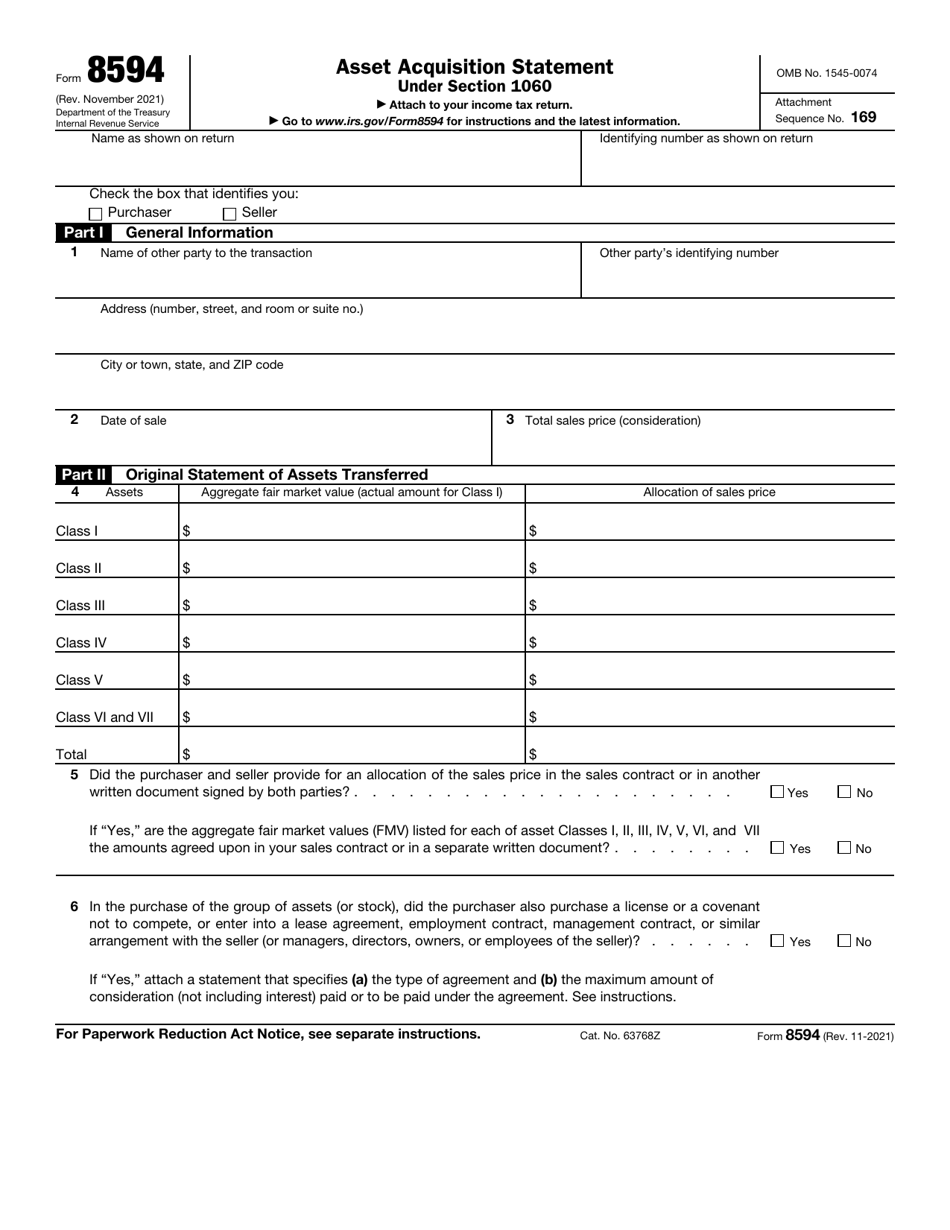

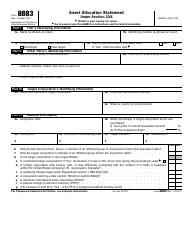

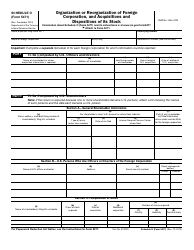

IRS Form 8594 Asset Acquisition Statement Under Section 1060

What Is IRS Form 8594?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2021. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8594?

A: IRS Form 8594 is the Asset Acquisition Statement Under Section 1060.

Q: Who needs to file IRS Form 8594?

A: Buyers and sellers of certain assets, such as businesses or groups of assets, need to file IRS Form 8594.

Q: What is the purpose of IRS Form 8594?

A: The purpose of IRS Form 8594 is to report the sale or purchase of assets that are subject to the allocation of the purchase price under section 1060 of the Internal Revenue Code.

Q: When should IRS Form 8594 be filed?

A: IRS Form 8594 should be filed with the income tax return for the year in which the sale or purchase of the assets occurred.

Q: Are there any penalties for not filing IRS Form 8594?

A: Yes, failure to file IRS Form 8594 or filing an incomplete or incorrect form may result in penalties imposed by the IRS.

Q: What information is required on IRS Form 8594?

A: IRS Form 8594 requires information about the buyer, seller, and transaction details, including the type of business being acquired, the purchase price allocation, and any contingent payments.

Q: Can I submit IRS Form 8594 electronically?

A: Yes, you can submit IRS Form 8594 electronically through the IRS e-file system.

Q: Do I need to attach IRS Form 8594 to my tax return?

A: No, you do not need to attach IRS Form 8594 to your tax return. However, you should keep a copy of the form for your records.

Q: What if I made a mistake on IRS Form 8594?

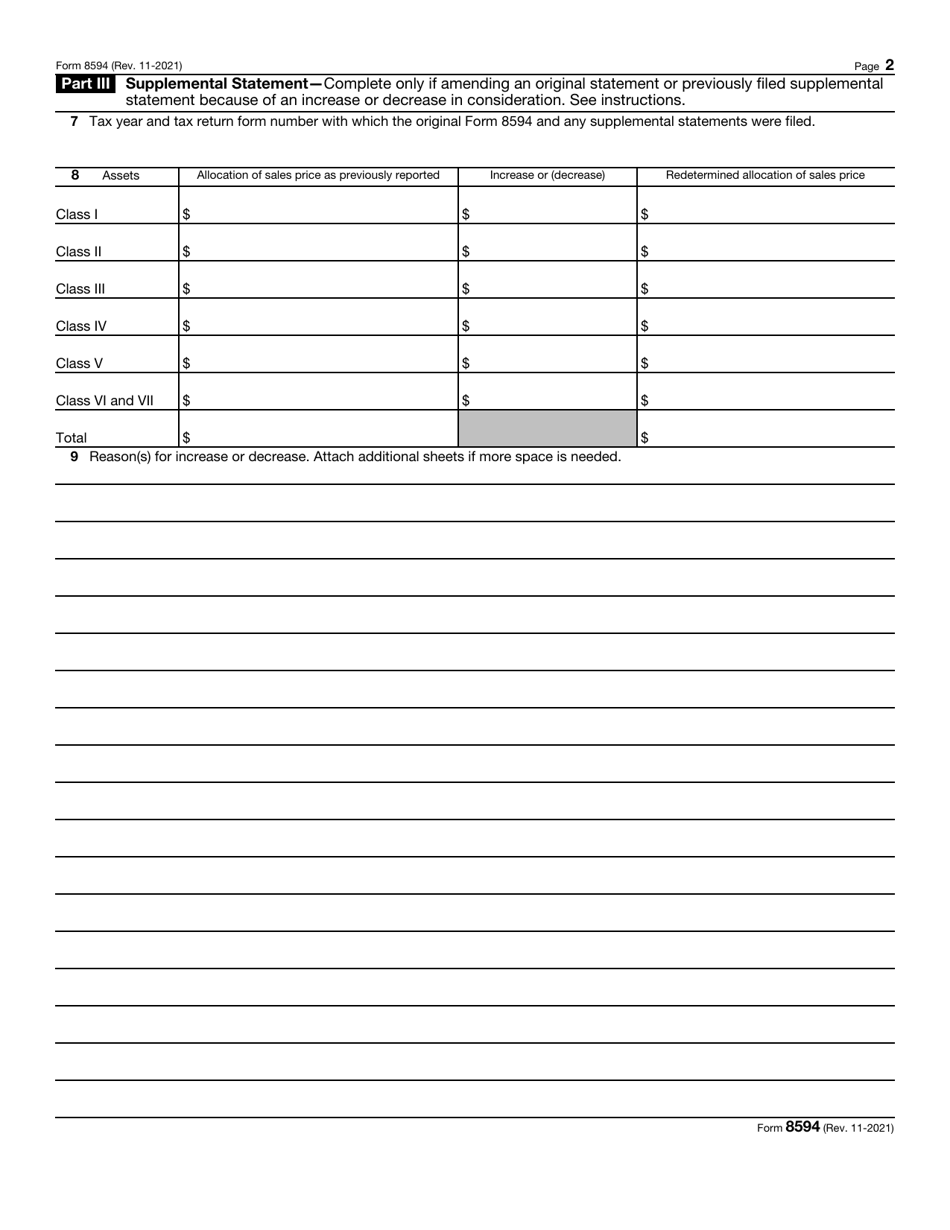

A: If you made a mistake on IRS Form 8594, you should correct it as soon as possible by filing an amended form with the IRS.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8594 through the link below or browse more documents in our library of IRS Forms.