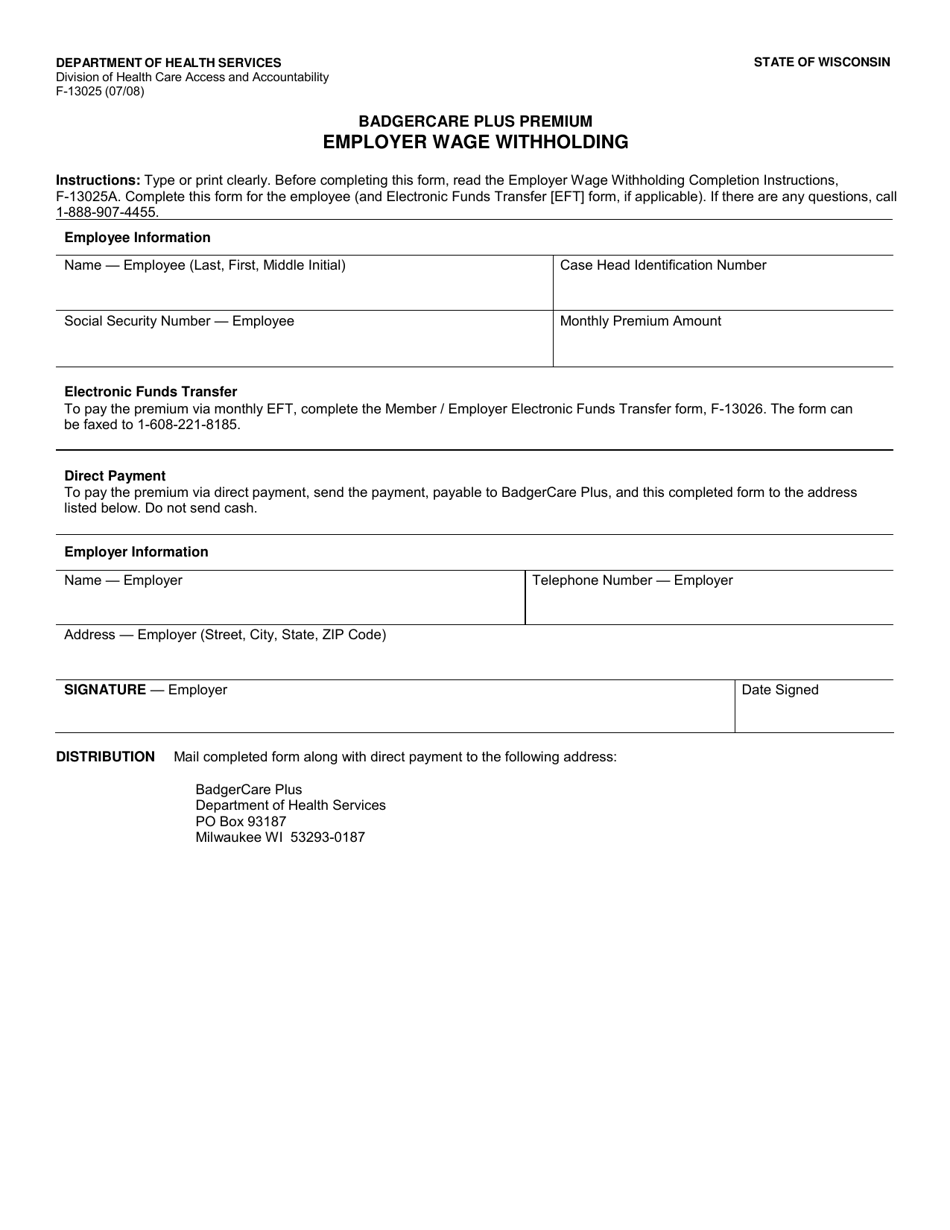

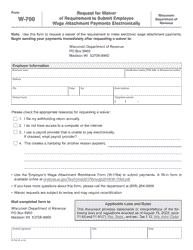

Form F-13025 Employer Wage Withholding - Wisconsin

What Is Form F-13025?

This is a legal form that was released by the Wisconsin Department of Health Services - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-13025?

A: Form F-13025 is the Employer Wage Withholding form for the state of Wisconsin.

Q: Who needs to fill out Form F-13025?

A: Employers in Wisconsin who are required to withhold state income tax from their employees' wages need to fill out Form F-13025.

Q: What is the purpose of Form F-13025?

A: The purpose of Form F-13025 is to report and remit withheld state income tax from employees' wages to the Wisconsin Department of Revenue.

Q: When is Form F-13025 due?

A: Form F-13025 is due on a quarterly basis. The due dates are the last day of January, April, July, and October.

Q: Is it mandatory to file Form F-13025 electronically?

A: Yes, electronic filing of Form F-13025 is mandatory for employers who have 10 or more employees or withhold more than $10,000 in a calendar year.

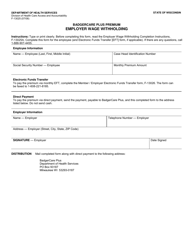

Q: What information do I need to provide on Form F-13025?

A: You need to provide your employer identification number, the total amount of Wisconsin state income tax withheld, and the number of employees.

Q: Do I need to include a copy of Form W-2 with Form F-13025?

A: No, you do not need to include a copy of Form W-2 with Form F-13025. However, you must keep it for your records.

Q: What happens if I file Form F-13025 late?

A: If you file Form F-13025 late, you may be subject to penalties and interest on any unpaid taxes.

Q: Can I amend Form F-13025 if I made a mistake?

A: Yes, you can file an amended Form F-13025 to correct any errors or omissions. Make sure to clearly indicate that it is an amended return.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the Wisconsin Department of Health Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F-13025 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Health Services.