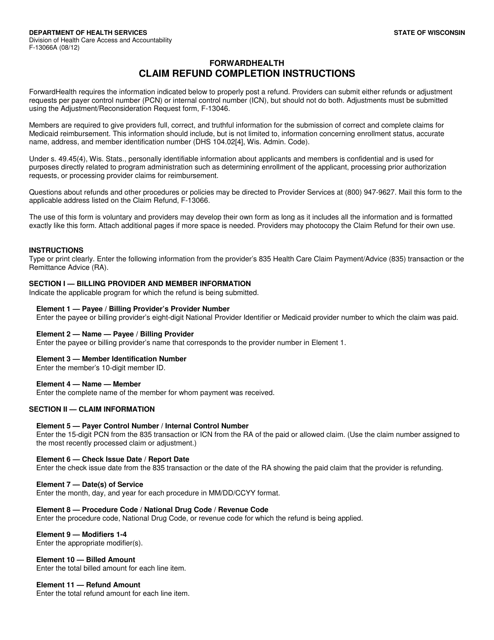

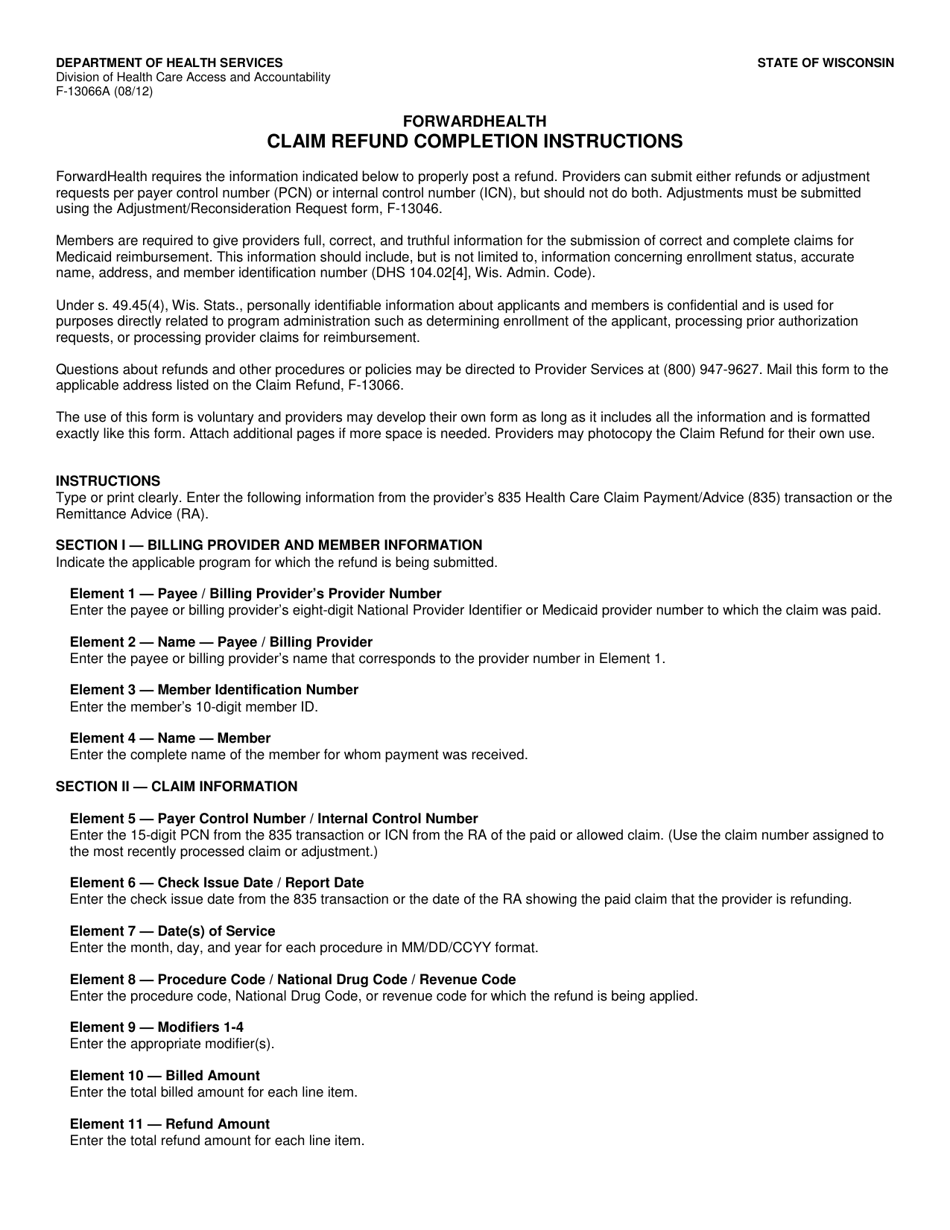

Instructions for Form F-13066 Claim Refund - Wisconsin

This document contains official instructions for Form F-13066 , Claim Refund - a form released and collected by the Wisconsin Department of Health Services. An up-to-date fillable Form F-13066 is available for download through this link.

FAQ

Q: What is Form F-13066?

A: Form F-13066 is a claim refund form for residents of Wisconsin.

Q: Who can use Form F-13066?

A: Form F-13066 can be used by residents of Wisconsin who are seeking a refund.

Q: What is the purpose of Form F-13066?

A: The purpose of Form F-13066 is to claim a refund for overpaid taxes or fees.

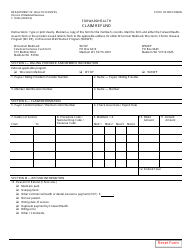

Q: How do I fill out Form F-13066?

A: You need to provide your personal information, details of the overpayment, and supporting documentation.

Q: When should I file Form F-13066?

A: You should file Form F-13066 as soon as you become aware of an overpayment.

Q: Is there a deadline for filing Form F-13066?

A: Yes, there is a deadline for filing Form F-13066. It is generally within four years from the date of the overpayment.

Q: What happens after I submit Form F-13066?

A: The Wisconsin Department of Revenue will review your claim and process your refund if it is approved.

Q: Can I track the status of my refund?

A: Yes, you can track the status of your refund by contacting the Wisconsin Department of Revenue.

Q: Are there any fees associated with filing Form F-13066?

A: No, there are no fees associated with filing Form F-13066.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Health Services.