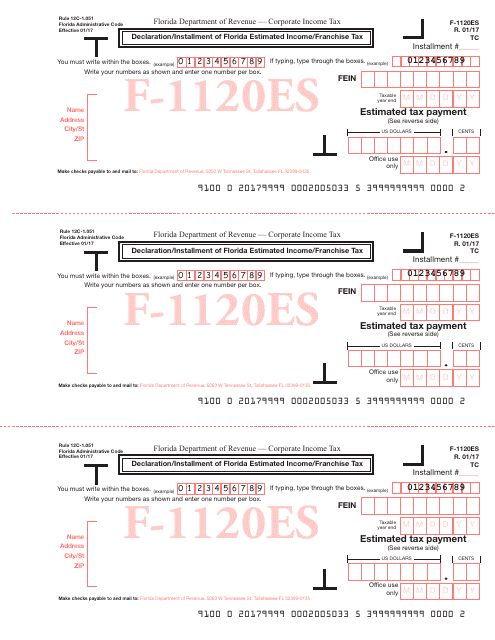

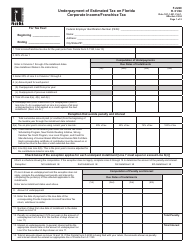

Form F-1120ES Declaration / Installment of Florida Estimated Income / Franchise Tax - Florida

What Is Form F-1120ES?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-1120ES?

A: Form F-1120ES is the Declaration/Installment of Florida Estimated Income/Franchise Tax.

Q: What is the purpose of Form F-1120ES?

A: The purpose of Form F-1120ES is to report and pay estimated income/franchise tax in the state of Florida.

Q: Who needs to file Form F-1120ES?

A: Businesses or individuals who have income or franchise tax liability in Florida and are required to make estimated tax payments.

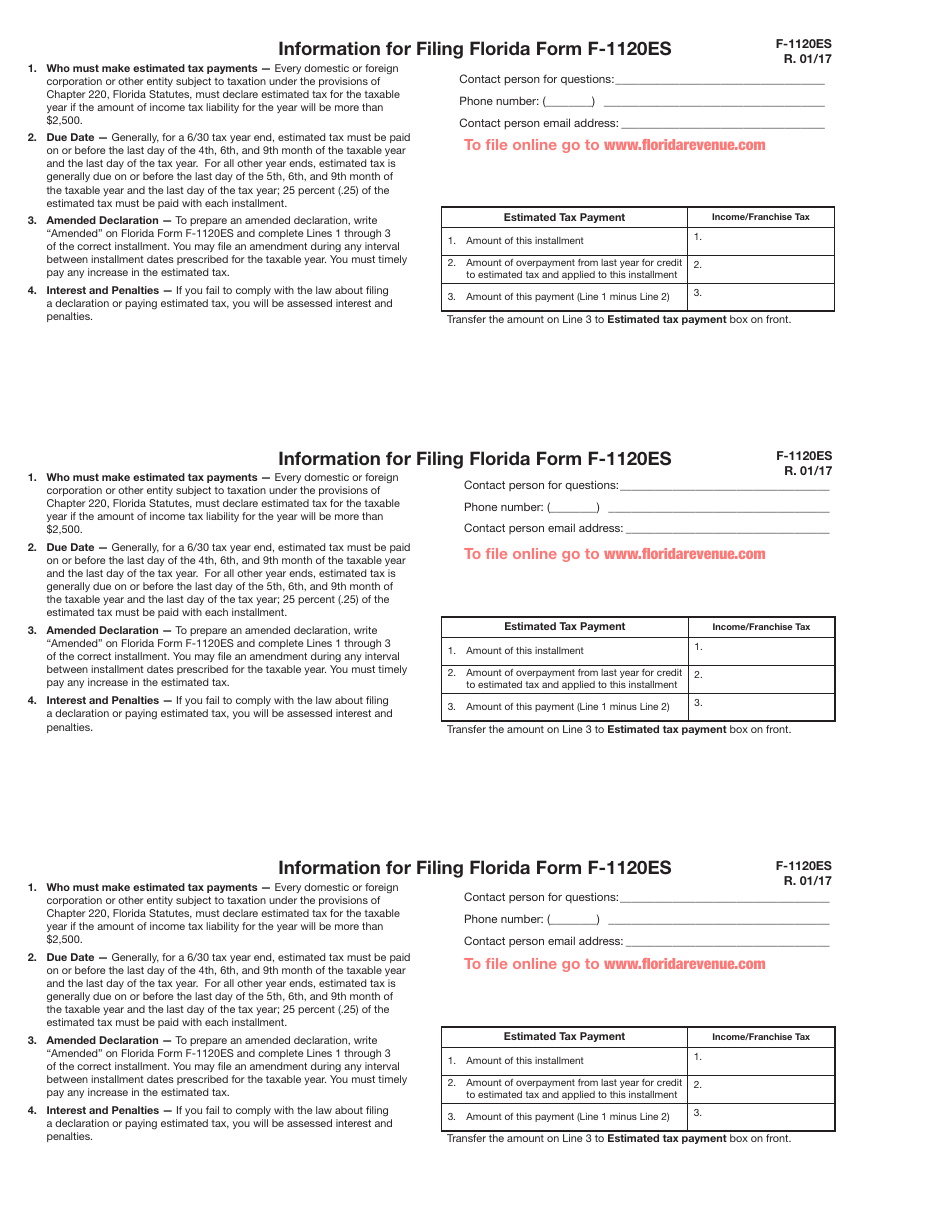

Q: When is Form F-1120ES due?

A: Form F-1120ES is due on a quarterly basis. The due dates are April 30, June 30, September 30, and December 31.

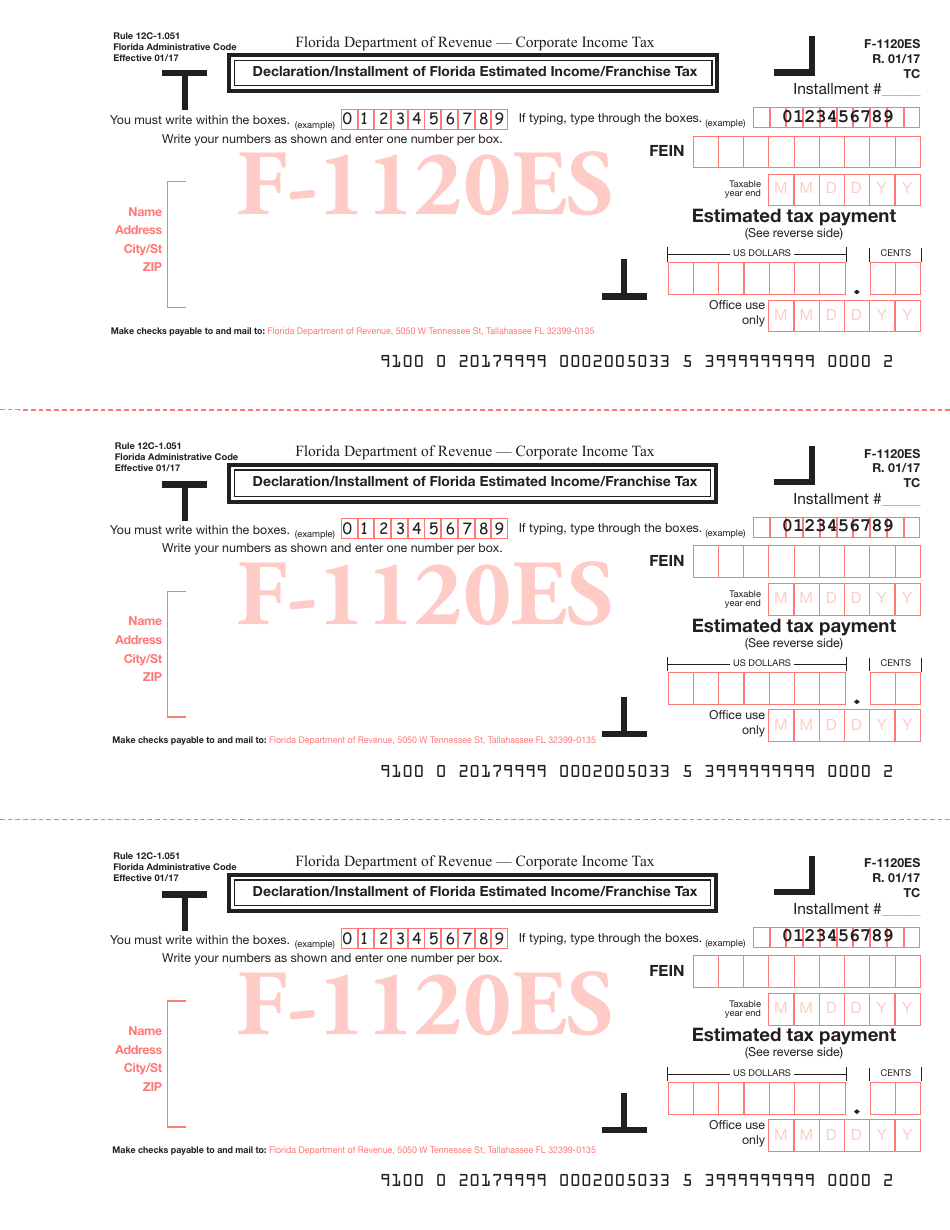

Q: What information is required to complete Form F-1120ES?

A: Some of the information required includes the taxpayer's name, address, federal employer identification number (EIN), estimated tax liability, and payment details.

Q: Are there any penalties for late or incorrect filing of Form F-1120ES?

A: Yes, there are penalties for late or incorrect filing of Form F-1120ES. It is important to file and pay the estimated tax on time to avoid penalties and interest.

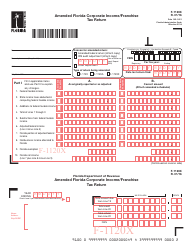

Q: Can I make changes to my estimated tax payments after filing Form F-1120ES?

A: Yes, you can make changes to your estimated tax payments by filing an amended Form F-1120ES.

Q: Is Form F-1120ES only for businesses or can individuals also file it?

A: Both businesses and individuals with income or franchise tax liability in Florida can file Form F-1120ES.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F-1120ES by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.