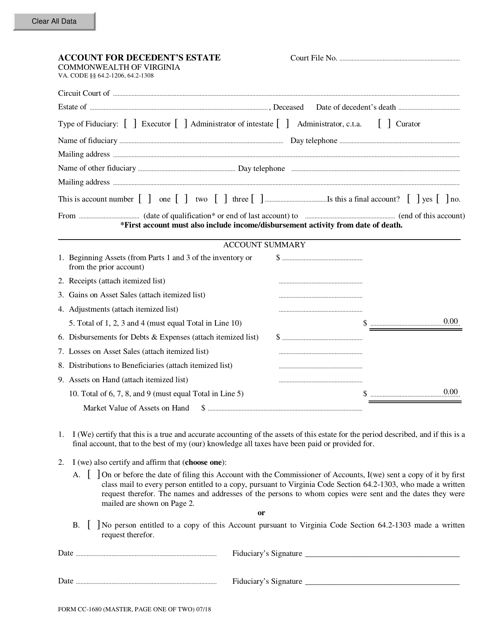

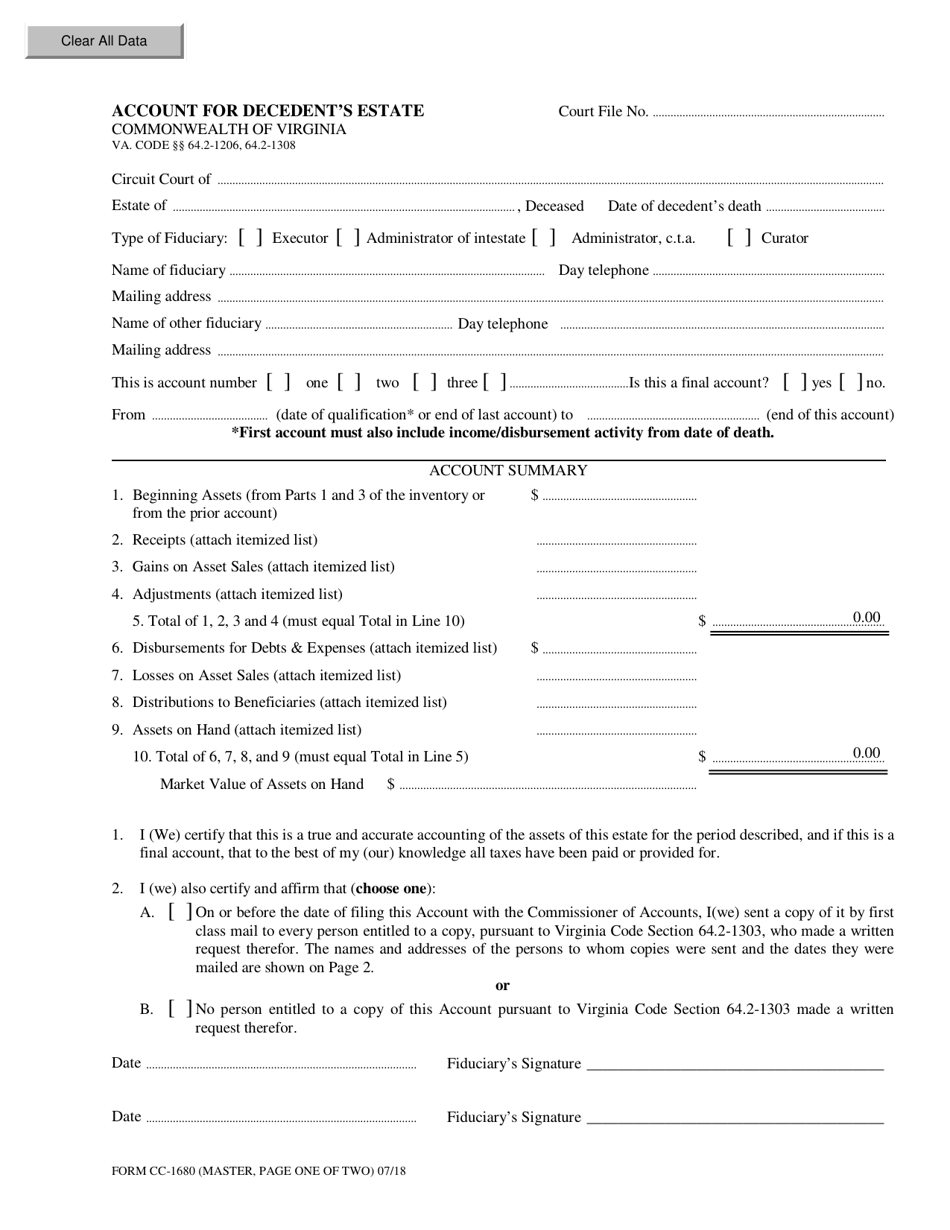

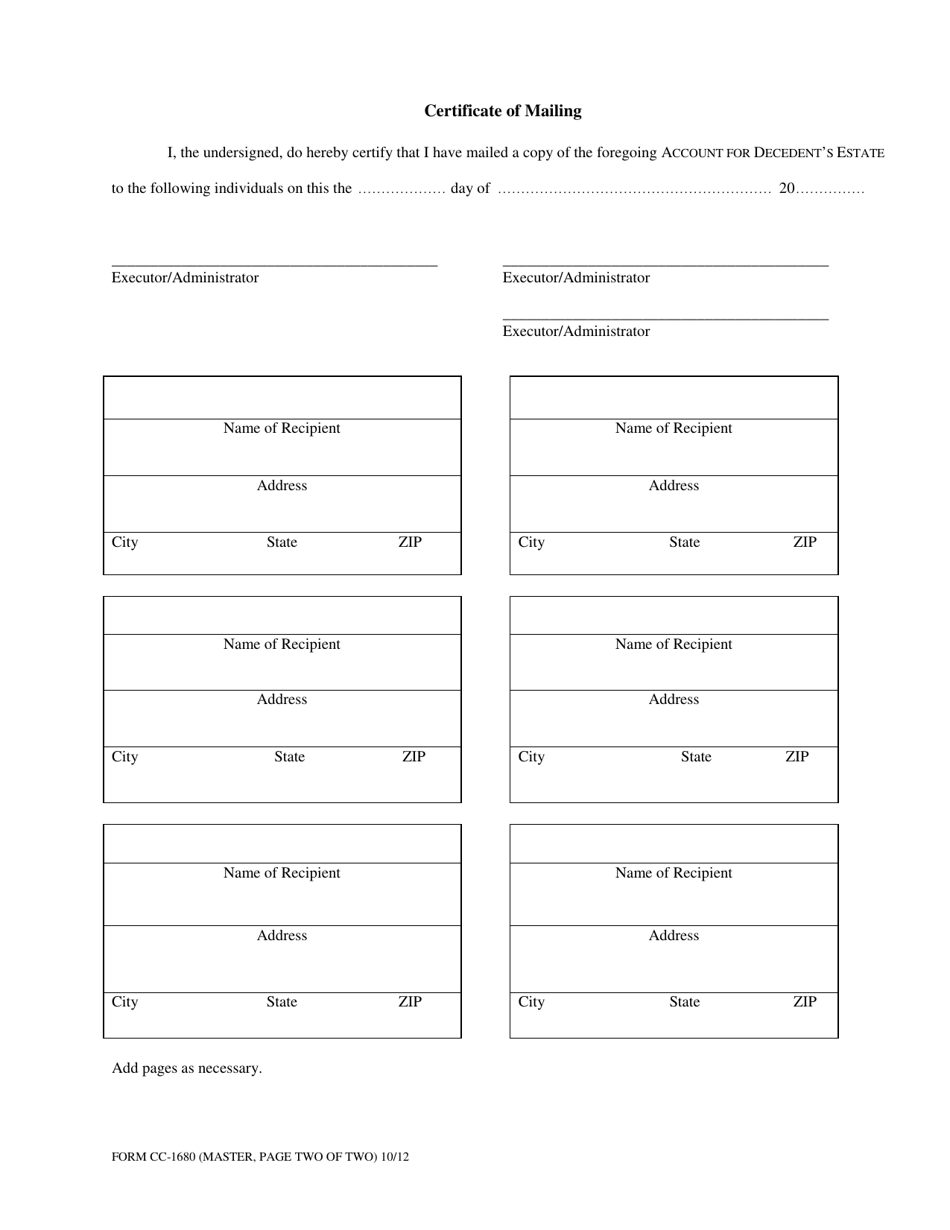

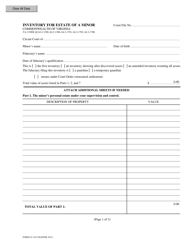

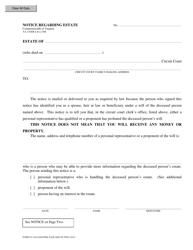

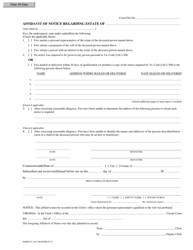

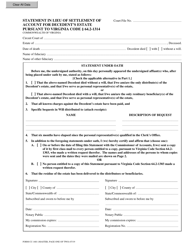

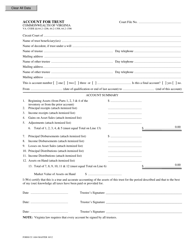

Form CC-1680 Account for Decedent's Estate - Virginia

What Is Form CC-1680?

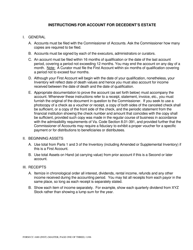

This is a legal form that was released by the Virginia Circuit Court - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CC-1680?

A: Form CC-1680 is an account form used for decedent's estate in Virginia.

Q: Who needs to file Form CC-1680?

A: The personal representative of the decedent's estate needs to file Form CC-1680.

Q: What is the purpose of Form CC-1680?

A: The purpose of Form CC-1680 is to report the assets, income, and expenses of the decedent's estate.

Q: When should Form CC-1680 be filed?

A: Form CC-1680 should be filed within one year from the date of the decedent's death.

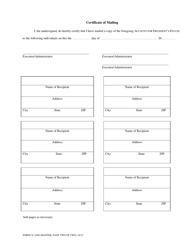

Q: What information is required on Form CC-1680?

A: Form CC-1680 requires information about the decedent's assets, income, and expenses, as well as details about the personal representative.

Q: Are there any fees for filing Form CC-1680?

A: There may be fees associated with filing Form CC-1680. Please refer to the instructions or contact the Virginia Department of Taxation for more information.

Q: What happens after filing Form CC-1680?

A: After filing Form CC-1680, the Virginia Department of Taxation will review the account and may request additional information if needed.

Q: Are there any penalties for late filing of Form CC-1680?

A: There may be penalties for late filing of Form CC-1680. It is important to file the form within the designated time frame to avoid any penalties.

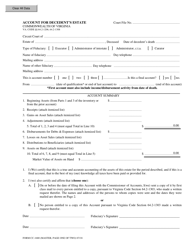

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Virginia Circuit Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CC-1680 by clicking the link below or browse more documents and templates provided by the Virginia Circuit Court.