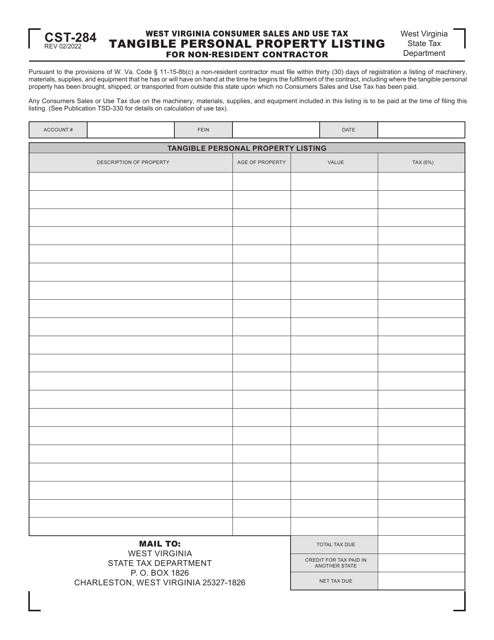

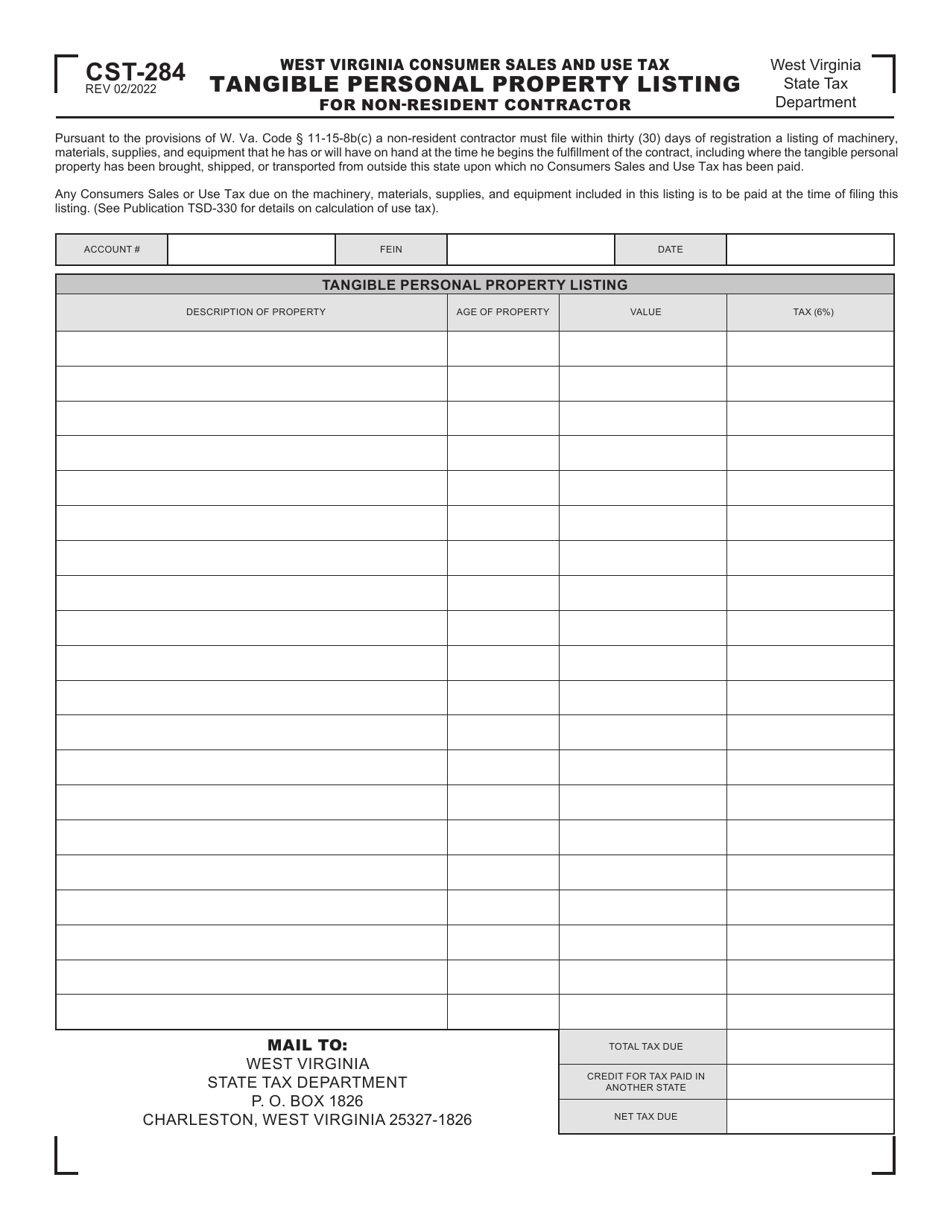

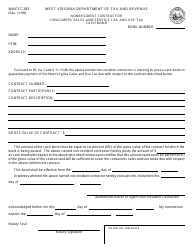

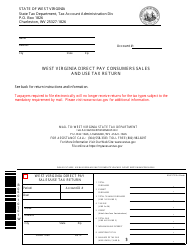

Form CST-284 West Virginia Consumer Sales and Use Tax Tangible Personal Property Listing for Non-resident Contractor - West Virginia

What Is Form CST-284?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CST-284 form?

A: CST-284 form is the West Virginia Consumer Sales and Use Tax Tangible Personal Property Listing for Non-resident Contractor form.

Q: Who needs to file the CST-284 form?

A: Non-resident contractors working in West Virginia need to file the CST-284 form.

Q: What is the purpose of CST-284 form?

A: The CST-284 form is used to report and pay the consumer sales and use tax on tangible personal property used in West Virginia by non-resident contractors.

Q: What information is required in the CST-284 form?

A: The CST-284 form requires information such as the contractor's name, address, tax account number, and detailed listing of the tangible personal property used in West Virginia.

Q: When is the deadline for filing the CST-284 form?

A: The deadline for filing the CST-284 form is the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing the CST-284 form?

A: Yes, there are penalties for not filing the CST-284 form, including late filing penalties and interest on unpaid taxes.

Q: Is the CST-284 form applicable to residents of West Virginia?

A: No, the CST-284 form is specifically for non-resident contractors working in West Virginia.

Q: What other taxes does a non-resident contractor in West Virginia need to pay?

A: In addition to the consumer sales and use tax, non-resident contractors may also need to pay other taxes such as contractor withholding taxes and business franchise taxes.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CST-284 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.