This version of the form is not currently in use and is provided for reference only. Download this version of

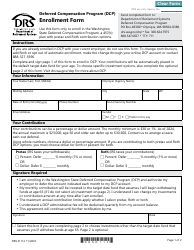

Form DRS D116

for the current year.

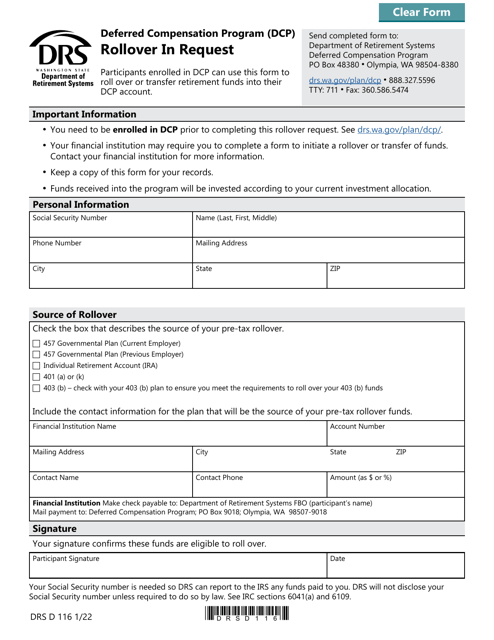

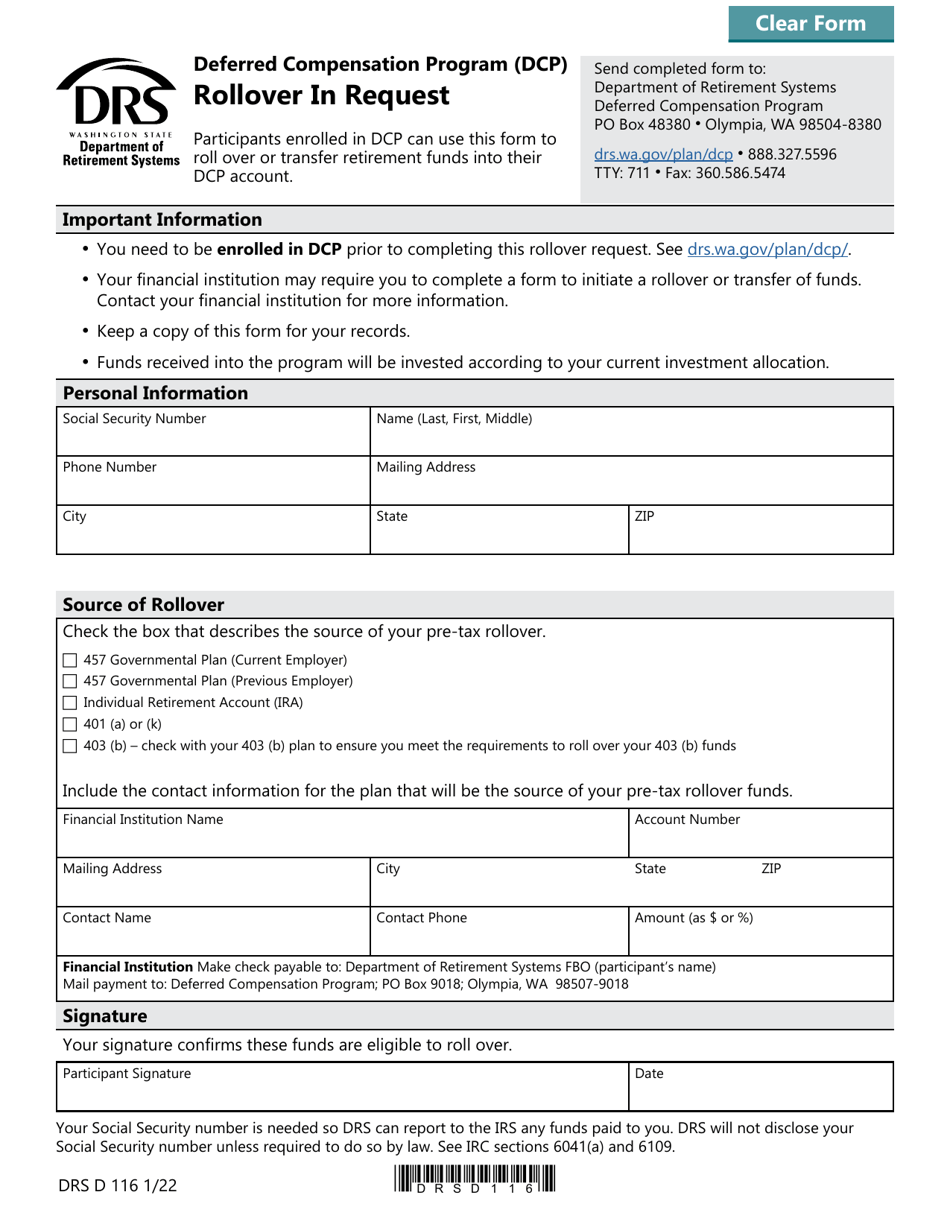

Form DRS D116 Rollover in Request - Deferred Compensation Program (Dcp) - Washington

What Is Form DRS D116?

This is a legal form that was released by the Washington State Department of Retirement Systems - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DRS D116?

A: Form DRS D116 is a document used to request a rollover in the Deferred Compensation Program (DCP) in Washington.

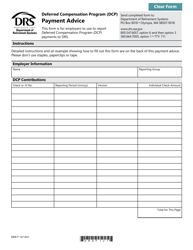

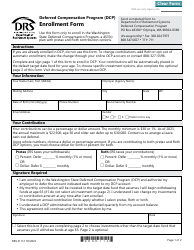

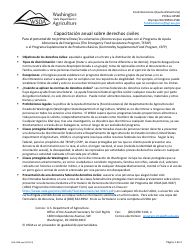

Q: What is the Deferred Compensation Program (DCP)?

A: The Deferred Compensation Program (DCP) is a retirement savings program for Washington state employees.

Q: What is a rollover in the DCP?

A: A rollover in the DCP is the process of transferring funds from one retirement account to another without incurring taxes or penalties.

Q: How do I request a rollover in the DCP?

A: You can request a rollover in the DCP by completing and submitting Form DRS D116.

Q: Are there any taxes or penalties for a rollover in the DCP?

A: No, there are no taxes or penalties for a rollover in the DCP.

Q: Can I rollover funds from another retirement account into the DCP?

A: Yes, you can rollover funds from another retirement account into the DCP.

Q: Is there a deadline for requesting a rollover in the DCP?

A: There is no specific deadline for requesting a rollover in the DCP, but it is recommended to do it as soon as possible.

Q: Who should I contact for more information about the DCP and rollovers?

A: You should contact the Washington State Department of Retirement Systems (DRS) for more information about the DCP and rollovers.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Washington State Department of Retirement Systems;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DRS D116 by clicking the link below or browse more documents and templates provided by the Washington State Department of Retirement Systems.