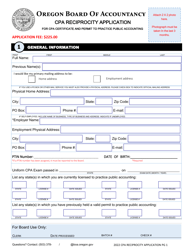

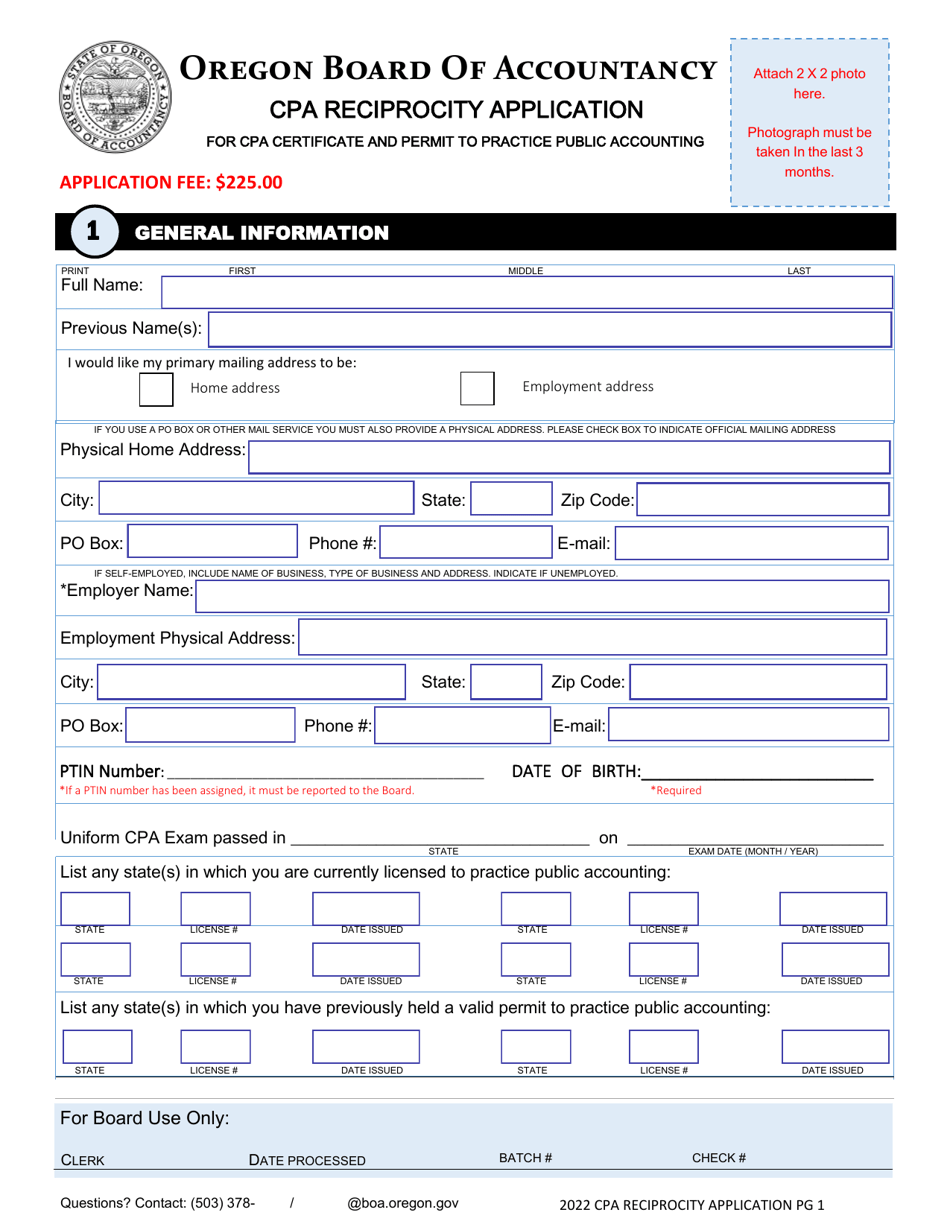

CPA Reciprocity Application for CPA Certificate and Permit to Practice Public Accounting - Oregon

CPA Reciprocity Application for CPA Certificate and Permit to Practice Public Accounting is a legal document that was released by the Oregon Board of Accountancy - a government authority operating within Oregon.

FAQ

Q: What is a CPA?

A: A CPA is a certified public accountant.

Q: What is reciprocity?

A: Reciprocity allows a CPA from one state to obtain a CPA license in another state without having to sit for the entire CPA exam again.

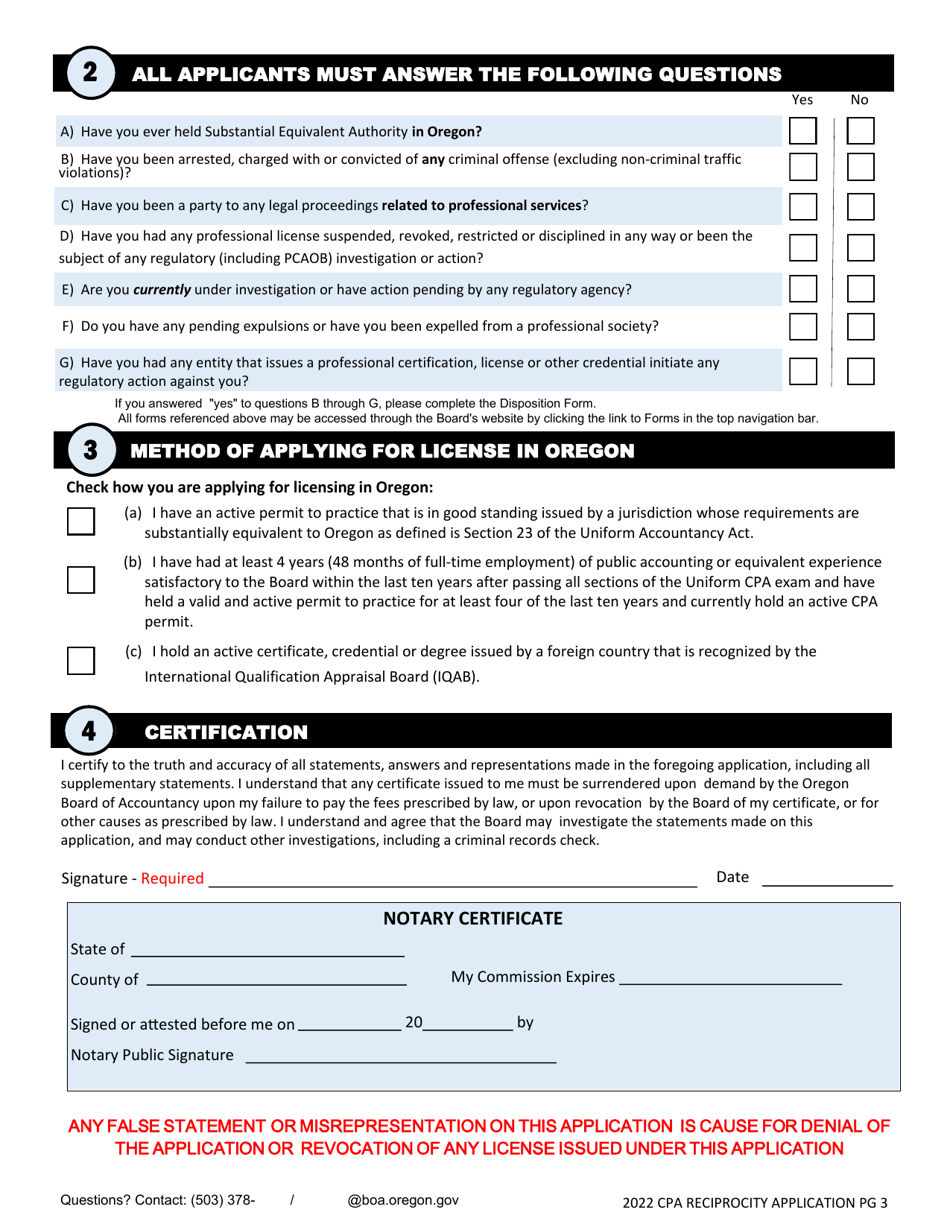

Q: What is the purpose of the CPA Reciprocity Application?

A: The purpose of the CPA Reciprocity Application is to apply for a CPA certificate and permit to practice public accounting in Oregon.

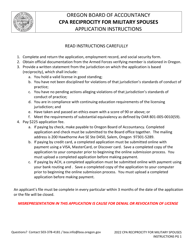

Q: Who can apply for reciprocity in Oregon?

A: CPAs who are currently licensed in another state and meet the eligibility requirements can apply for reciprocity in Oregon.

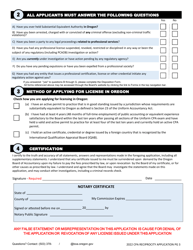

Q: What are the eligibility requirements for reciprocity in Oregon?

A: The eligibility requirements include having an active CPA license in good standing, meeting the education and experience requirements, and passing the Oregon Accountancy Law and Rules (OALR) exam.

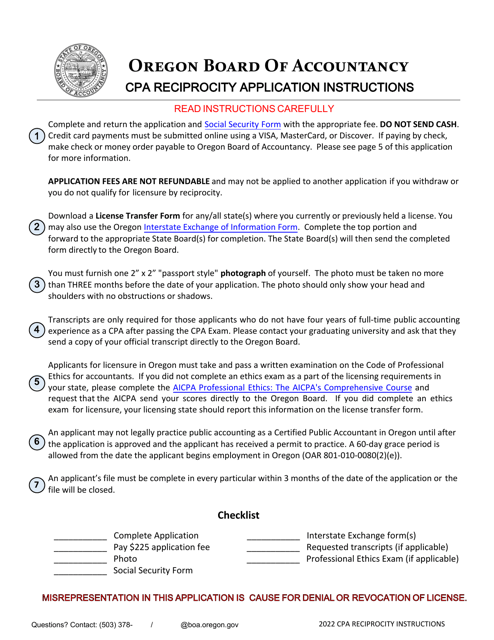

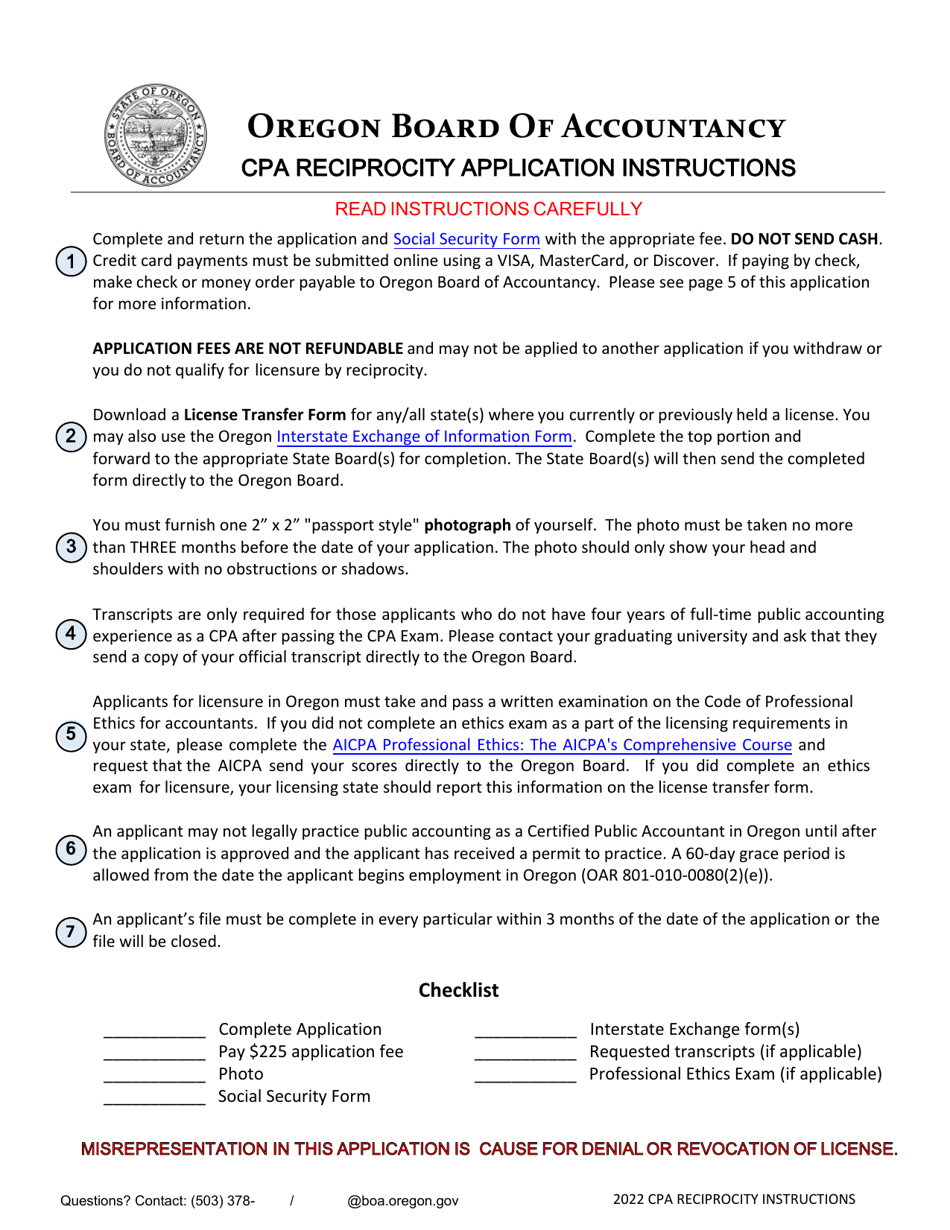

Q: How can I apply for reciprocity in Oregon?

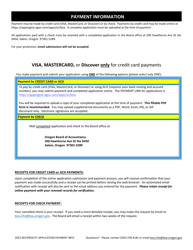

A: You can apply for reciprocity in Oregon by submitting a completed CPA Reciprocity Application form, along with the required documents and fees, to the Oregon Board of Accountancy.

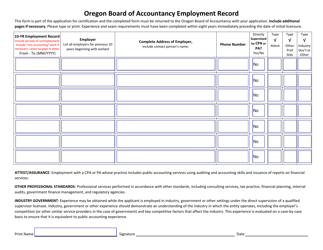

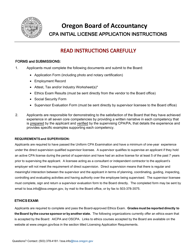

Q: What documents are required for the CPA Reciprocity Application?

A: The required documents may include transcripts, verification of licensure, and letters of good standing.

Q: Is there an exam requirement for reciprocity in Oregon?

A: Yes, applicants for reciprocity in Oregon are required to pass the Oregon Accountancy Law and Rules (OALR) exam.

Q: How long does it take to process the CPA Reciprocity Application?

A: The processing time for the CPA Reciprocity Application can vary, but it typically takes several weeks to a few months.

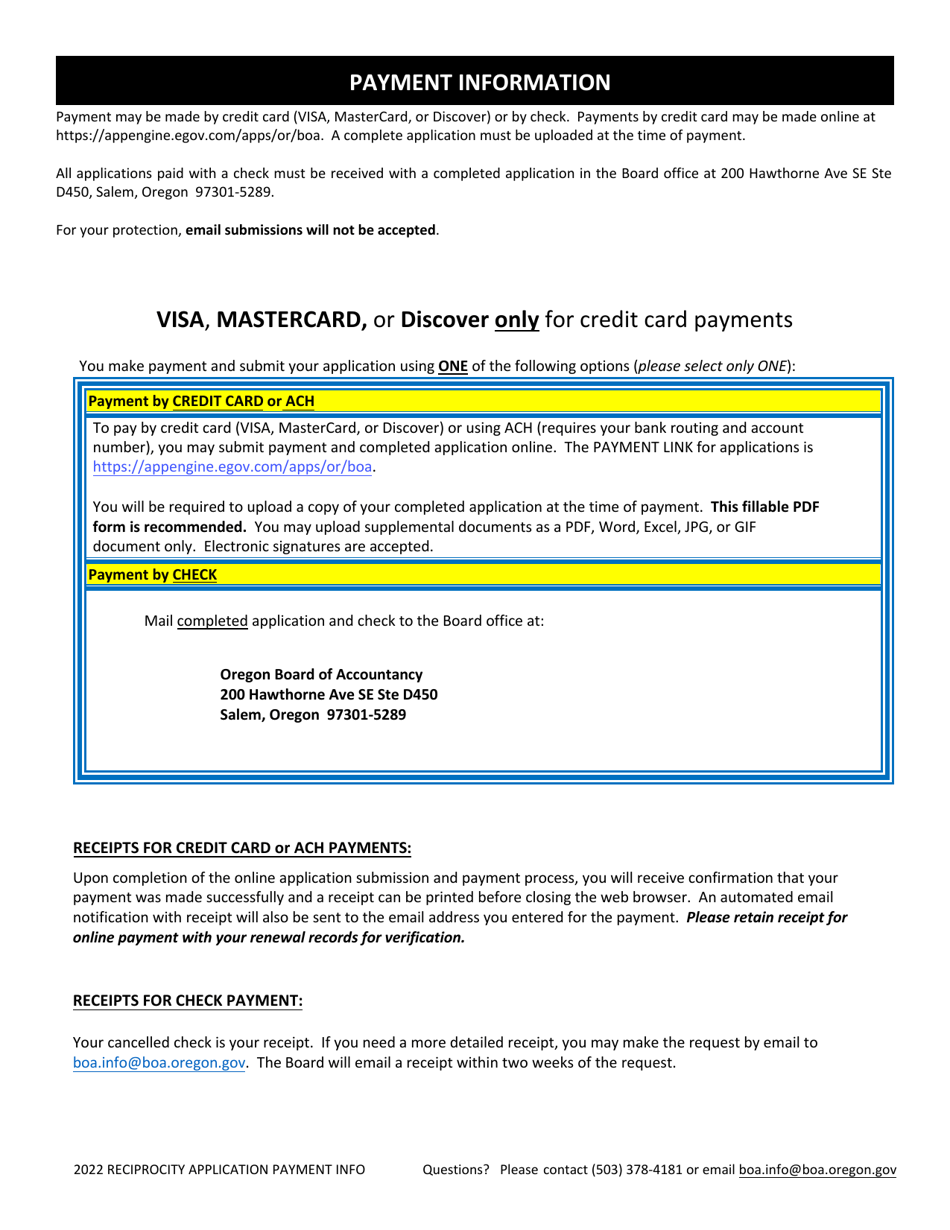

Q: What is the cost of the CPA Reciprocity Application?

A: The cost of the CPA Reciprocity Application in Oregon includes an application fee, examination fee, and initial permit fee, which can vary.

Q: Can I practice public accounting immediately after receiving reciprocity?

A: No, you must wait to receive your CPA certificate and permit to practice public accounting before you can engage in public accounting in Oregon.

Form Details:

- Released on January 1, 2022;

- The latest edition currently provided by the Oregon Board of Accountancy;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Board of Accountancy.