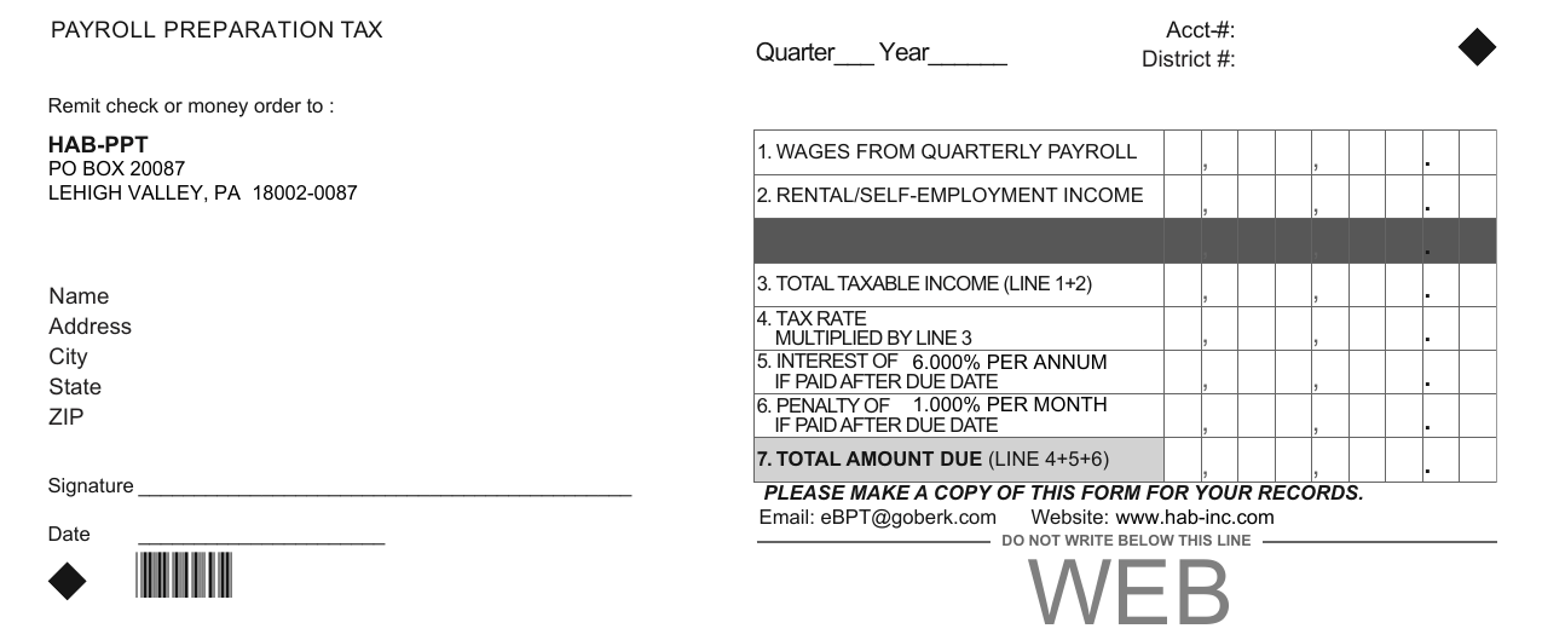

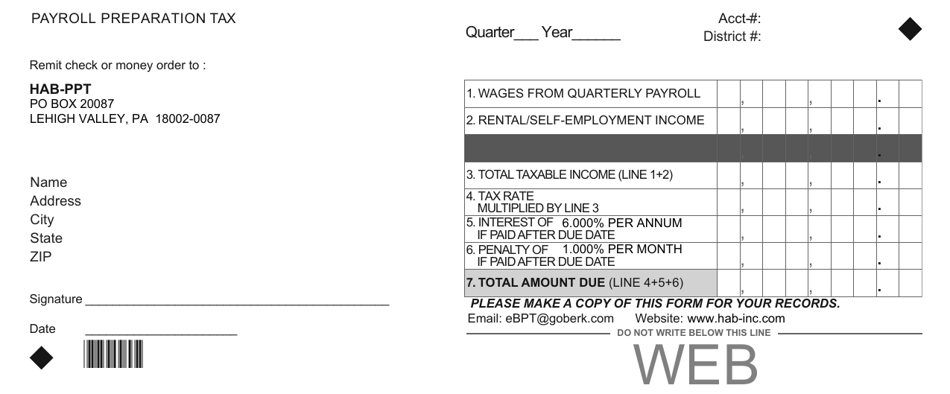

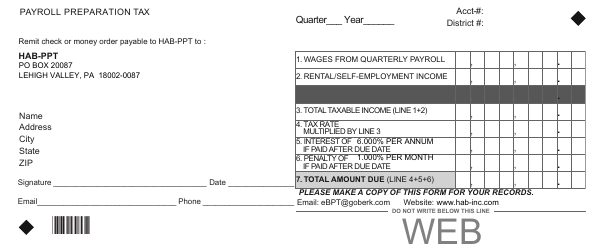

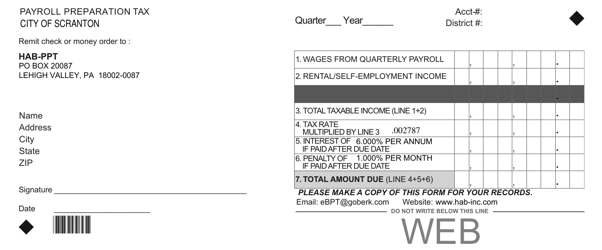

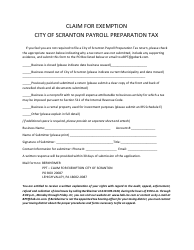

Payroll Preparation Tax Form - Pennsylvania

Payroll Preparation Tax Form is a legal document that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania.

FAQ

Q: What is the payroll tax rate in Pennsylvania?

A: The payroll tax rate in Pennsylvania varies depending on the employee's income and the employer's location.

Q: What is the minimum wage in Pennsylvania?

A: The minimum wage in Pennsylvania is $7.25 per hour, the same as the federal minimum wage.

Q: Are employers required to provide paid leave in Pennsylvania?

A: No, employers in Pennsylvania are not required to provide paid leave to their employees.

Q: Are employers required to provide health insurance in Pennsylvania?

A: No, employers in Pennsylvania are not required to provide health insurance to their employees.

Q: What is the process for filing payroll taxes in Pennsylvania?

A: Employers in Pennsylvania are required to file payroll taxes using Form PA-501, which can be filed electronically or by mail.

Q: Are there any tax credits or incentives available for employers in Pennsylvania?

A: Yes, Pennsylvania offers several tax credits and incentives for employers, including the Keystone Opportunity Zone program and the Work Opportunity Tax Credit.

Q: Is there a state unemployment tax in Pennsylvania?

A: Yes, employers in Pennsylvania are required to pay state unemployment taxes.

Q: Are there any additional payroll tax requirements in Pennsylvania?

A: Yes, employers in Pennsylvania may be subject to additional payroll tax requirements, such as local taxes or local earned income taxes.

Q: Are there any deductions or exemptions available for payroll taxes in Pennsylvania?

A: Yes, Pennsylvania allows certain deductions and exemptions for payroll taxes, such as exemptions for certain types of fringe benefits.

Form Details:

- The latest edition currently provided by the Berkheimer Tax Administrator;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.