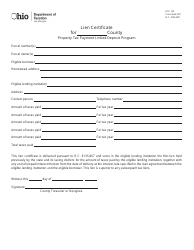

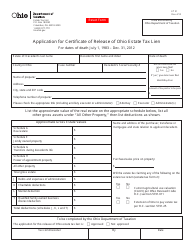

Pipeline Initiative Application - Ohio Historic Preservation Tax Credit Program - Ohio

Pipeline Initiative Application - Ohio Tax Credit Program is a legal document that was released by the Ohio Development Services Agency - a government authority operating within Ohio.

FAQ

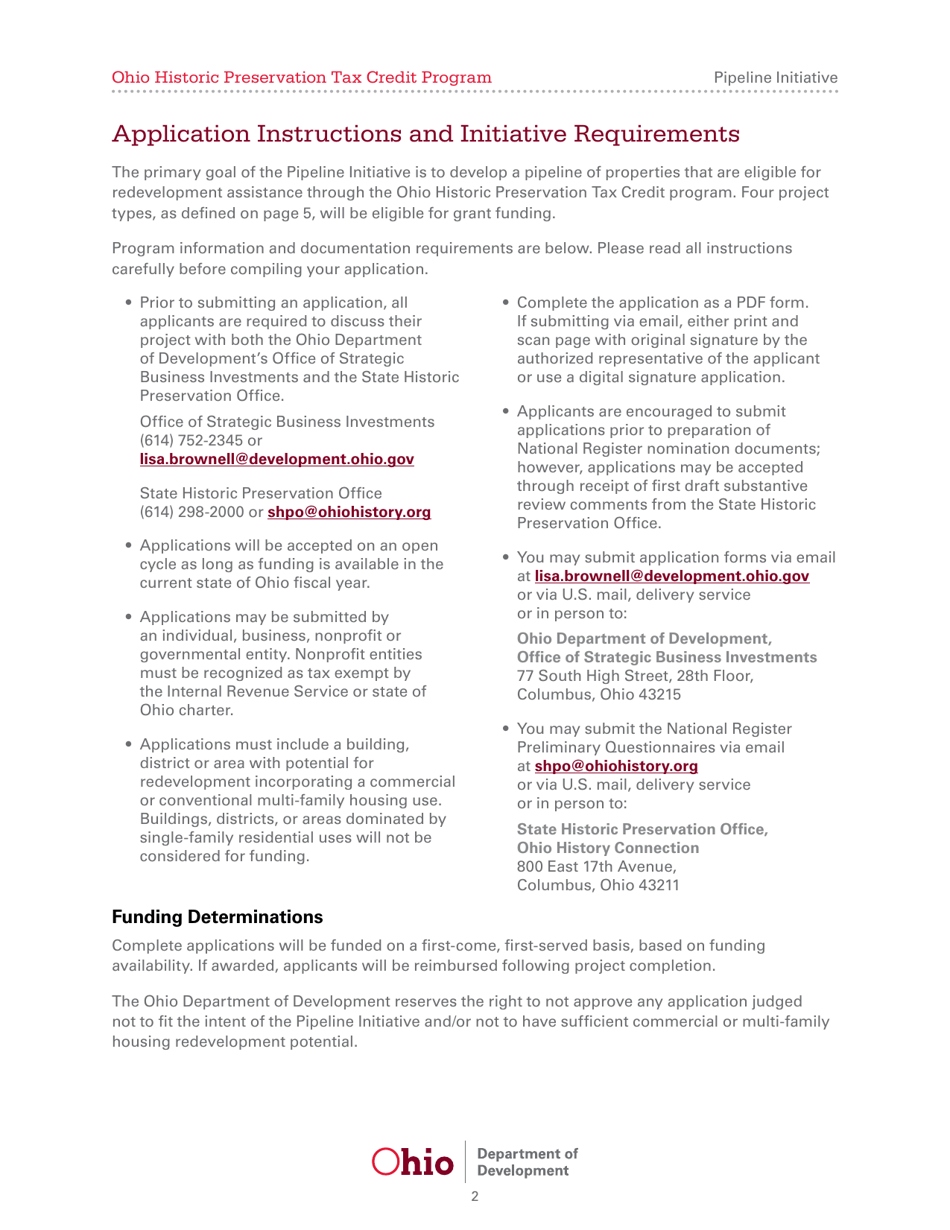

Q: What is the Pipeline Initiative Application?

A: The Pipeline Initiative Application is a part of the Ohio Historic Preservation Tax Credit Program.

Q: What is the Ohio Historic Preservation Tax Credit Program?

A: The Ohio Historic Preservation Tax Credit Program is a program that provides tax credits for the rehabilitation of historic buildings in Ohio.

Q: What is the purpose of the Pipeline Initiative Application?

A: The purpose of the Pipeline Initiative Application is to encourage developers to invest in the rehabilitation of historic buildings by providing additional incentives.

Q: Who is eligible to apply for the Pipeline Initiative Application?

A: Developers who are interested in rehabilitating historic buildings in Ohio are eligible to apply for the Pipeline Initiative Application.

Q: What are the benefits of the Pipeline Initiative Application?

A: The benefits of the Pipeline Initiative Application include additional tax credits and priority consideration for funding.

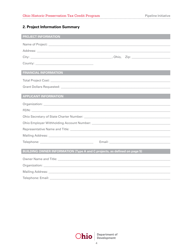

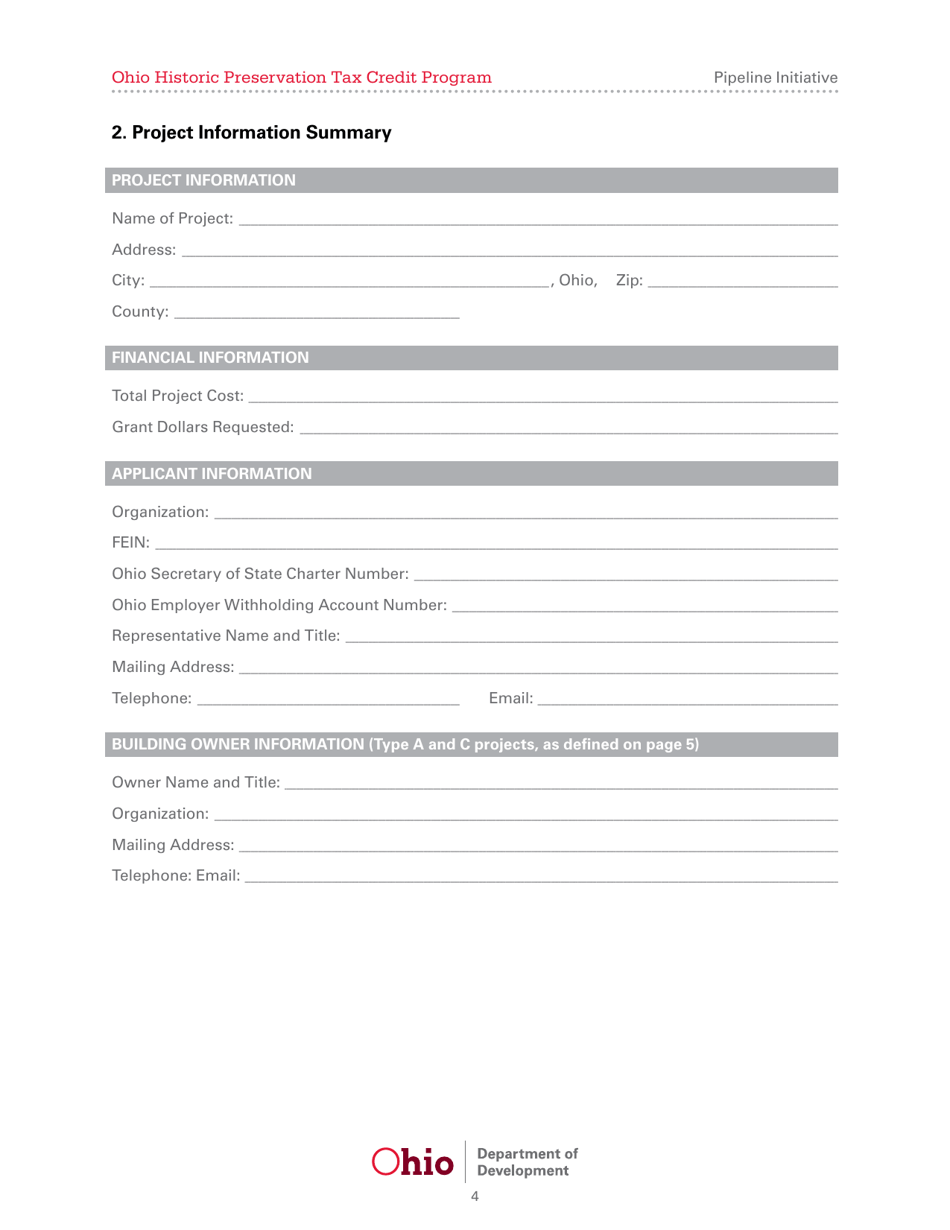

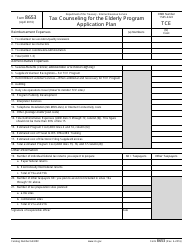

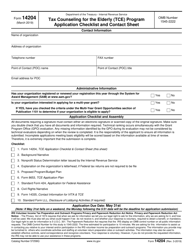

Form Details:

- The latest edition currently provided by the Ohio Development Services Agency;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Development Services Agency.