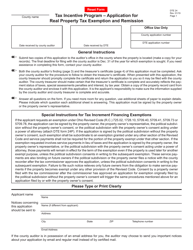

Application Amendment Request - Ohio Historic Preservation Tax Credit Program - Ohio

Application Tax Credit Program is a legal document that was released by the Ohio Development Services Agency - a government authority operating within Ohio.

FAQ

Q: What is the Ohio Historic Preservation Tax Credit Program?

A: The Ohio Historic Preservation Tax Credit Program is a program that offers tax credits to individuals and businesses who invest in the rehabilitation of historic buildings.

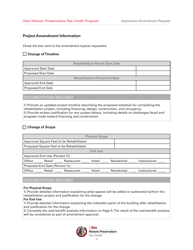

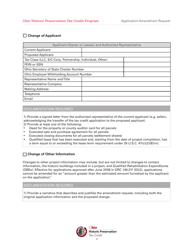

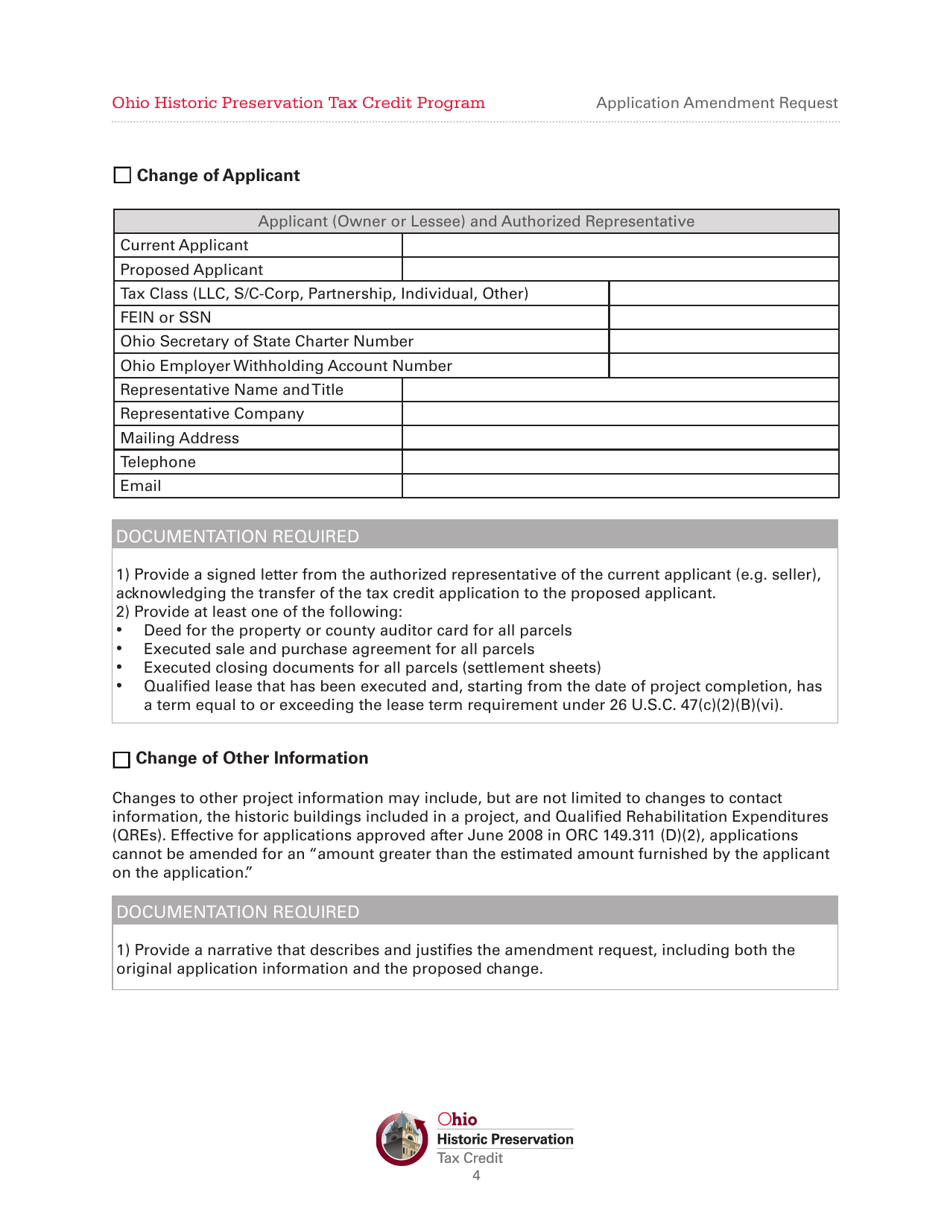

Q: What is an application amendment request?

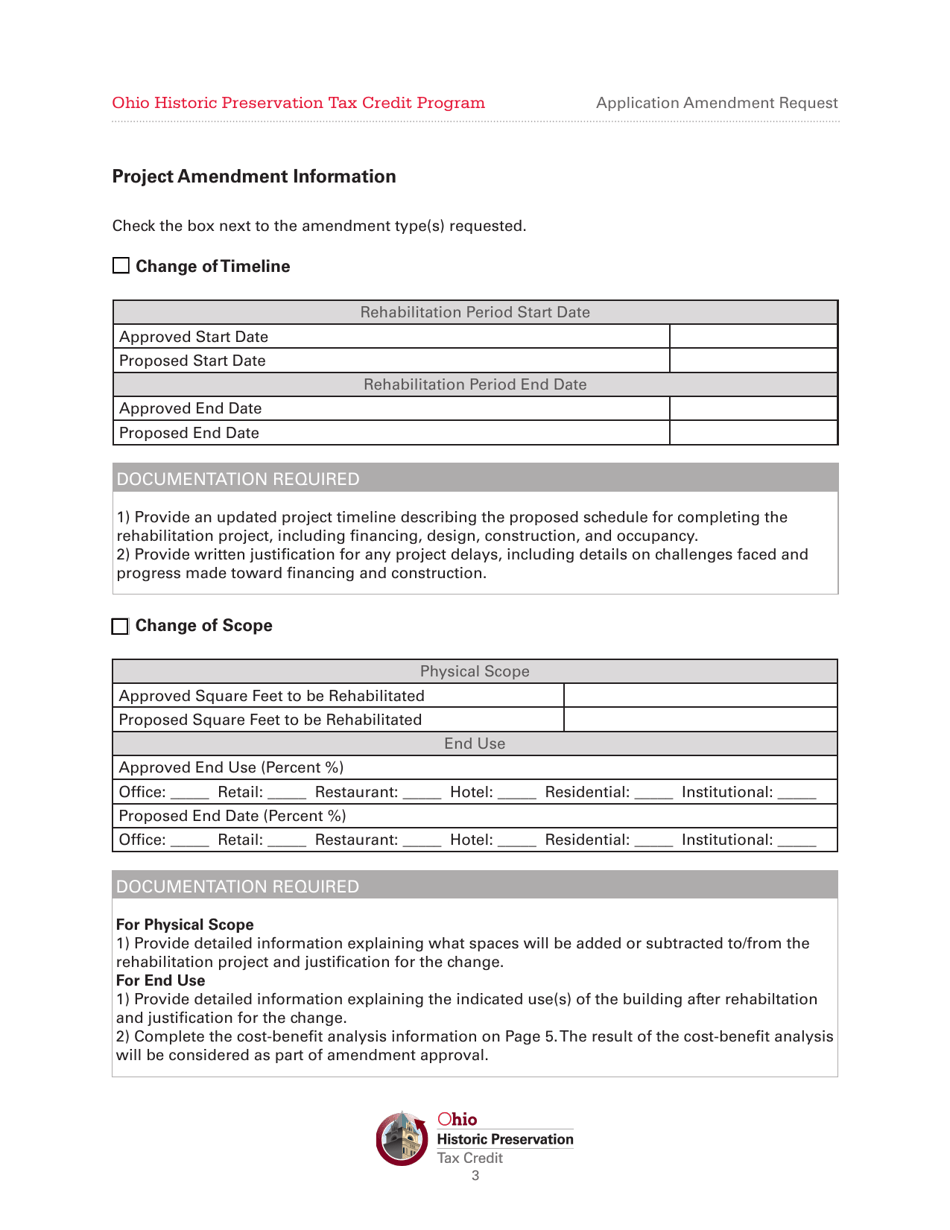

A: An application amendment request is a request to make changes or updates to a previously submitted application for the Ohio Historic Preservation Tax Credit Program.

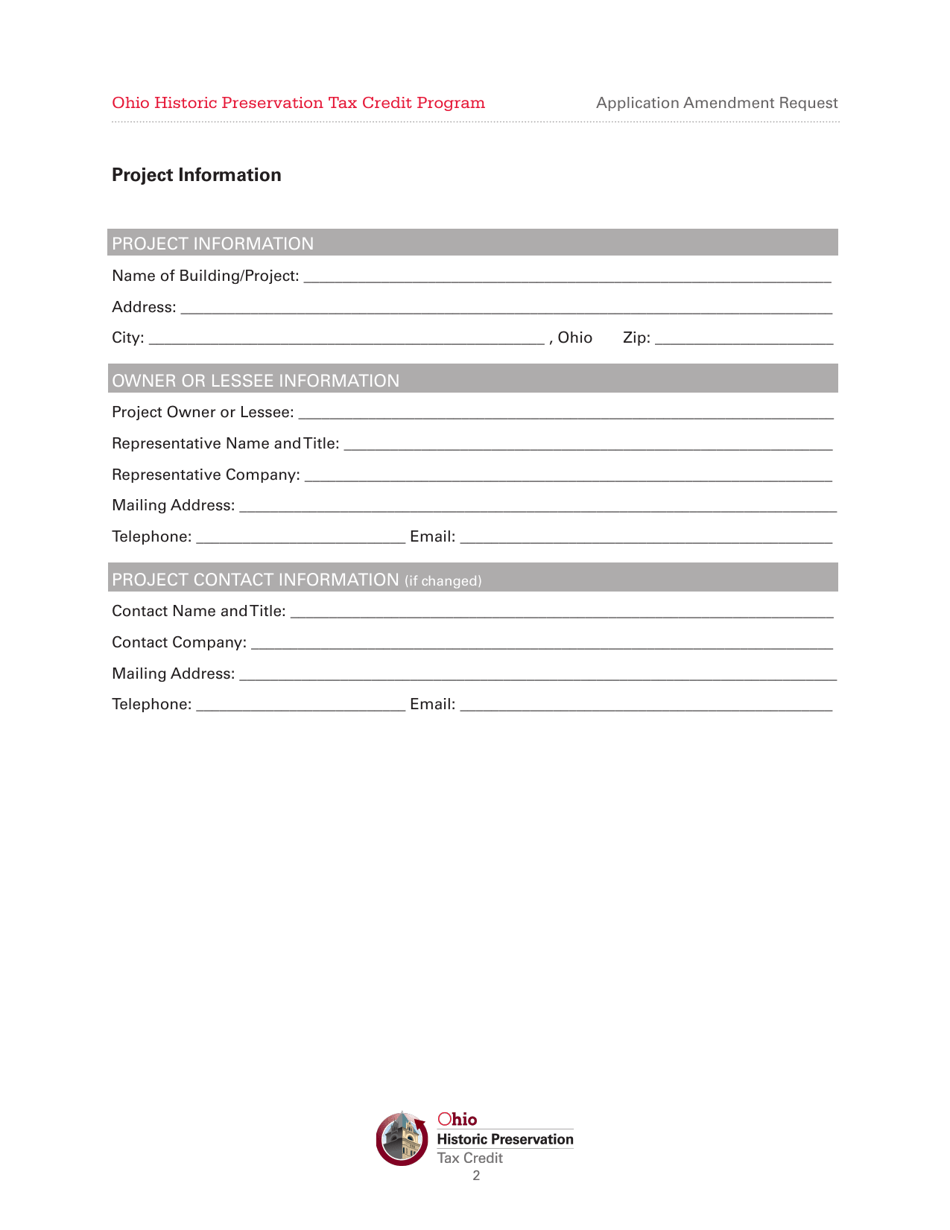

Q: How do I submit an application amendment request?

A: To submit an application amendment request, you need to contact the Ohio Historic Preservation Office and provide the necessary information and documentation for the requested amendments.

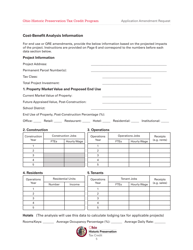

Q: What information and documentation do I need to provide for an application amendment request?

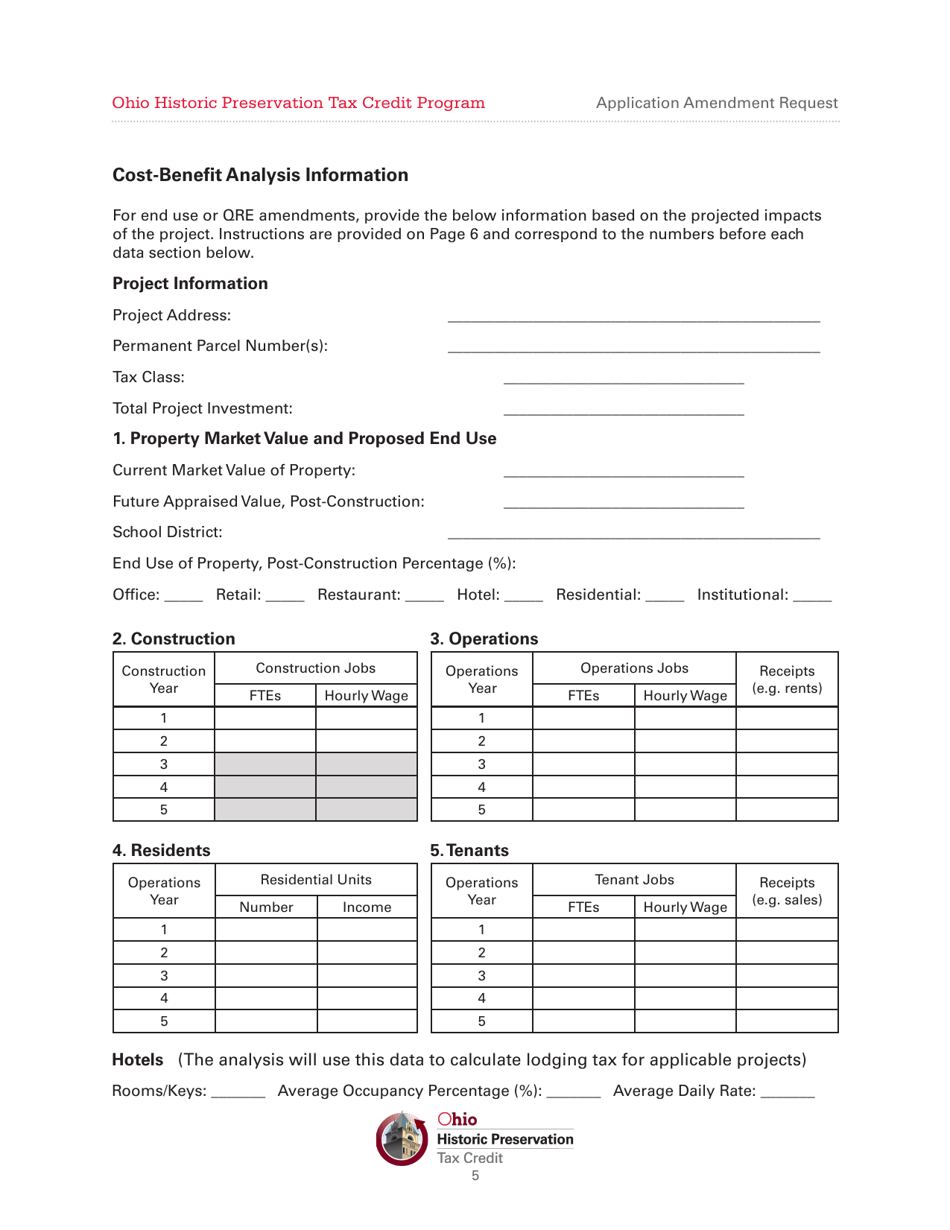

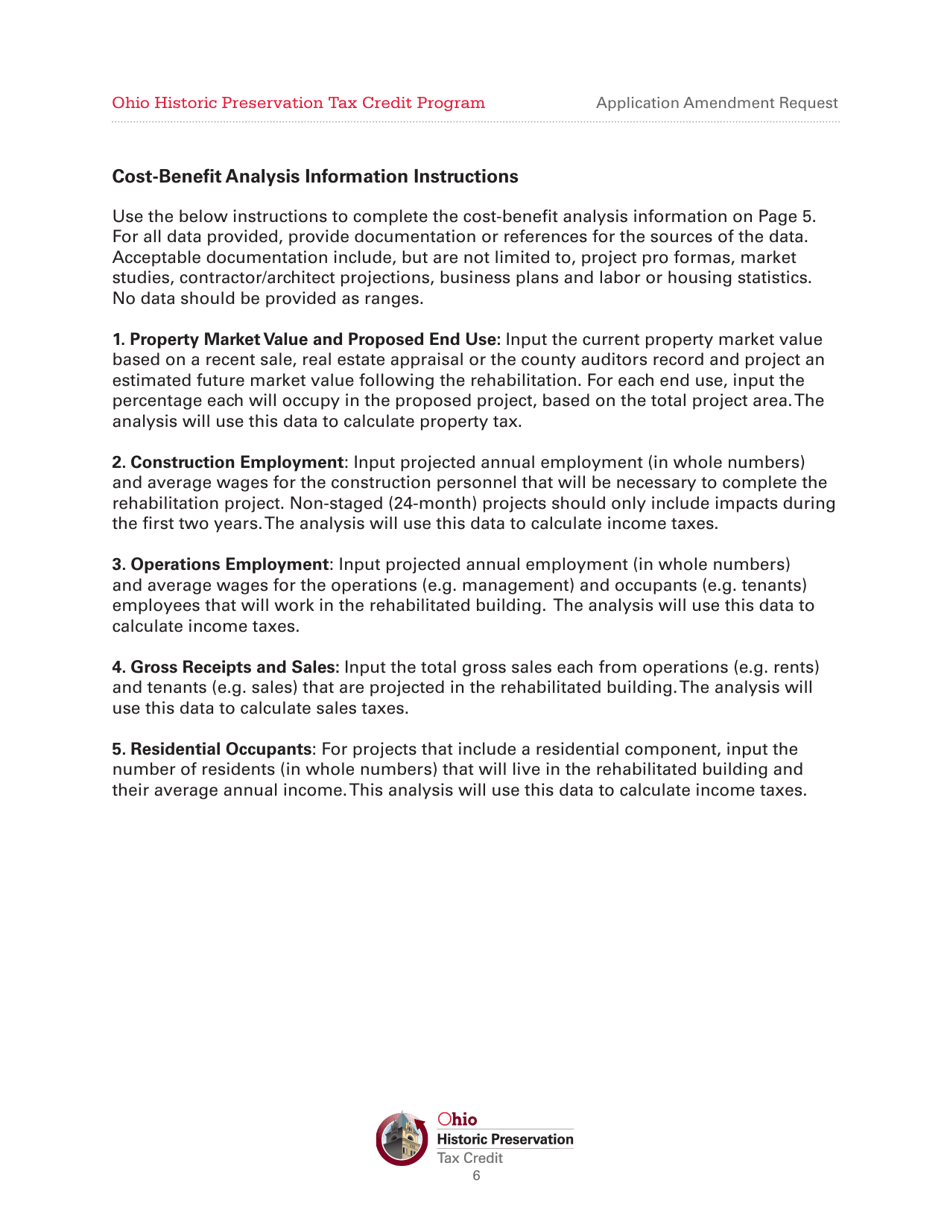

A: The specific information and documentation required for an application amendment request may vary, but you will typically need to provide details about the proposed changes, any additional information that supports the amendments, and any updated financial information.

Q: Are there any fees associated with submitting an application amendment request?

A: Yes, there are fees associated with submitting an application amendment request for the Ohio Historic Preservation Tax Credit Program. The specific fees will be determined by the Ohio Historic Preservation Office.

Q: What is the timeline for processing an application amendment request?

A: The timeline for processing an application amendment request for the Ohio Historic Preservation Tax Credit Program will vary. It is best to contact the Ohio Historic Preservation Office for information on the current processing times.

Q: Can I submit multiple application amendment requests?

A: Yes, you can submit multiple application amendment requests for the Ohio Historic Preservation Tax Credit Program if you need to make multiple changes or updates to your application.

Q: What happens after my application amendment request is approved?

A: After your application amendment request is approved, the changes or updates you requested will be incorporated into your original application for the Ohio Historic Preservation Tax Credit Program.

Q: What happens if my application amendment request is denied?

A: If your application amendment request is denied, the changes or updates you requested will not be incorporated into your original application for the Ohio Historic Preservation Tax Credit Program.

Q: Can I appeal a decision on my application amendment request?

A: Yes, you can appeal a decision on your application amendment request for the Ohio Historic Preservation Tax Credit Program. You will need to follow the appeals process outlined by the Ohio Historic Preservation Office.

Q: What are the benefits of the Ohio Historic Preservation Tax Credit Program?

A: The Ohio Historic Preservation Tax Credit Program provides financial incentives for the rehabilitation of historic buildings, helps to preserve Ohio's architectural and cultural heritage, and stimulates economic development in communities.

Q: Who is eligible to participate in the Ohio Historic Preservation Tax Credit Program?

A: Both individuals and businesses are eligible to participate in the Ohio Historic Preservation Tax Credit Program, as long as they meet the program's eligibility criteria.

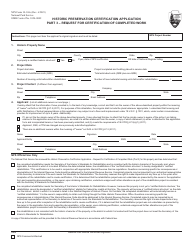

Q: What are the eligibility criteria for the Ohio Historic Preservation Tax Credit Program?

A: The eligibility criteria for the Ohio Historic Preservation Tax Credit Program include the building being eligible for listing on the National Register of Historic Places, the proposed rehabilitation project meeting certain investment thresholds, and the applicant demonstrating financial viability.

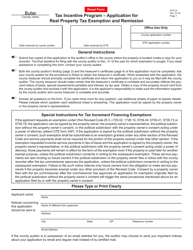

Q: What are the investment thresholds for the Ohio Historic Preservation Tax Credit Program?

A: The specific investment thresholds for the Ohio Historic Preservation Tax Credit Program may vary, but generally, the project must represent a substantial investment in the rehabilitation of the historic building.

Q: Can I use the tax credits from the Ohio Historic Preservation Tax Credit Program to offset my state taxes?

A: Yes, the tax credits from the Ohio Historic Preservation Tax Credit Program can be used to offset an applicant's state taxes.

Q: Can I transfer or sell the tax credits from the Ohio Historic Preservation Tax Credit Program?

A: Yes, the tax credits from the Ohio Historic Preservation Tax Credit Program can be transferred or sold to another taxpayer.

Q: What is the maximum amount of tax credits that can be awarded through the Ohio Historic Preservation Tax Credit Program?

A: The maximum amount of tax credits that can be awarded through the Ohio Historic Preservation Tax Credit Program is determined by the program's annual allocation.

Q: How are tax credits awarded through the Ohio Historic Preservation Tax Credit Program?

A: Tax credits are awarded through a competitive process based on the evaluation of the proposed rehabilitation project and its alignment with the program's goals and criteria.

Q: Are there any other requirements or restrictions for using the tax credits from the Ohio Historic Preservation Tax Credit Program?

A: Yes, there may be other requirements or restrictions for using the tax credits from the Ohio Historic Preservation Tax Credit Program, such as the completion of the rehabilitation project within a certain timeframe.

Q: Can I use the tax credits from the Ohio Historic Preservation Tax Credit Program for any type of building?

A: The tax credits from the Ohio Historic Preservation Tax Credit Program can only be used for the rehabilitation of historic buildings that are eligible for listing on the National Register of Historic Places.

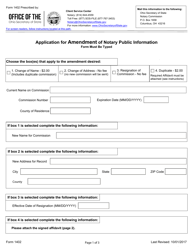

Form Details:

- The latest edition currently provided by the Ohio Development Services Agency;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Development Services Agency.