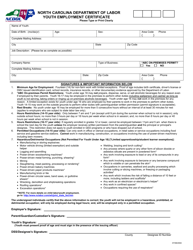

This version of the form is not currently in use and is provided for reference only. Download this version of

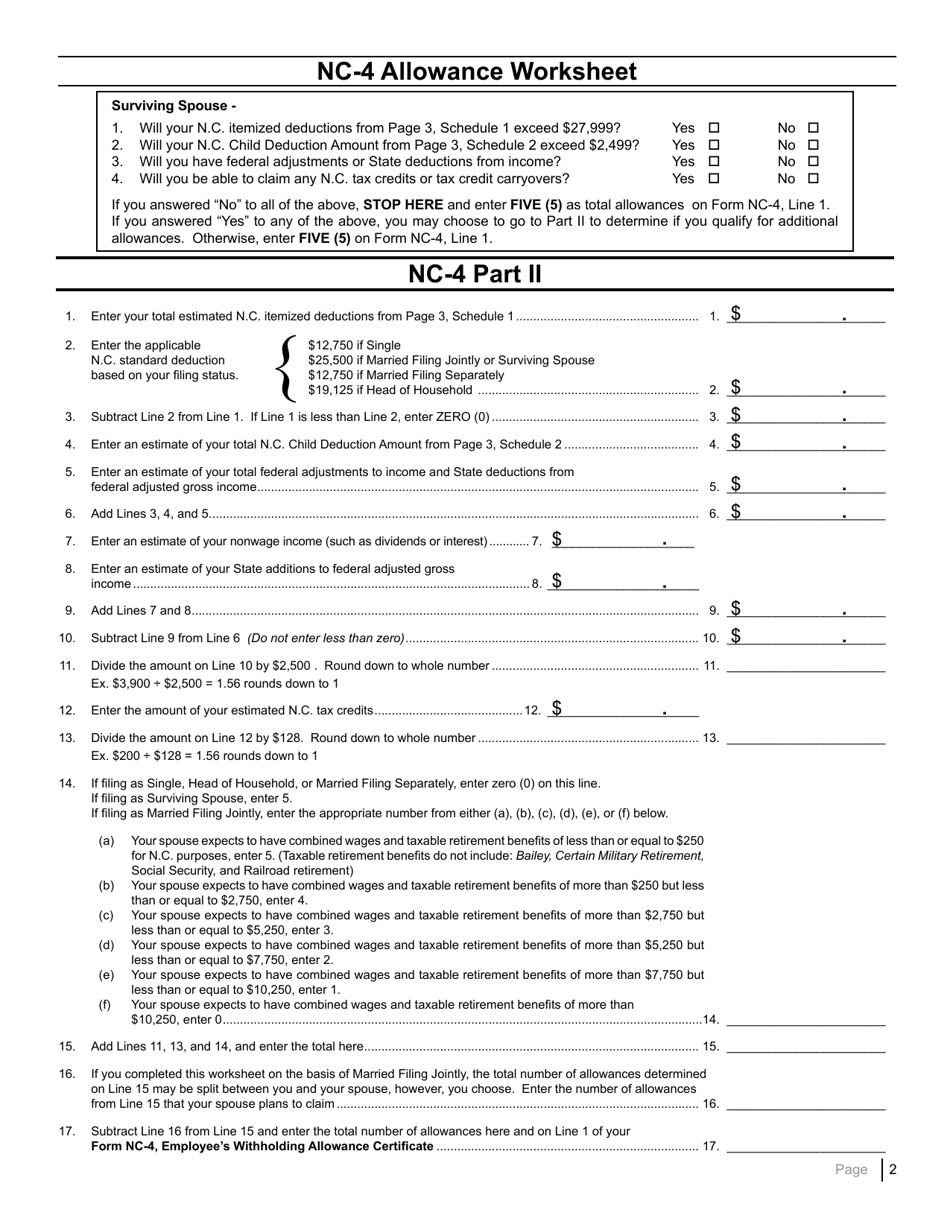

Form NC-4

for the current year.

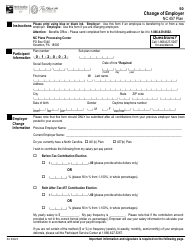

Form NC-4 Employee's Withholding Allowance Certificate - North Carolina

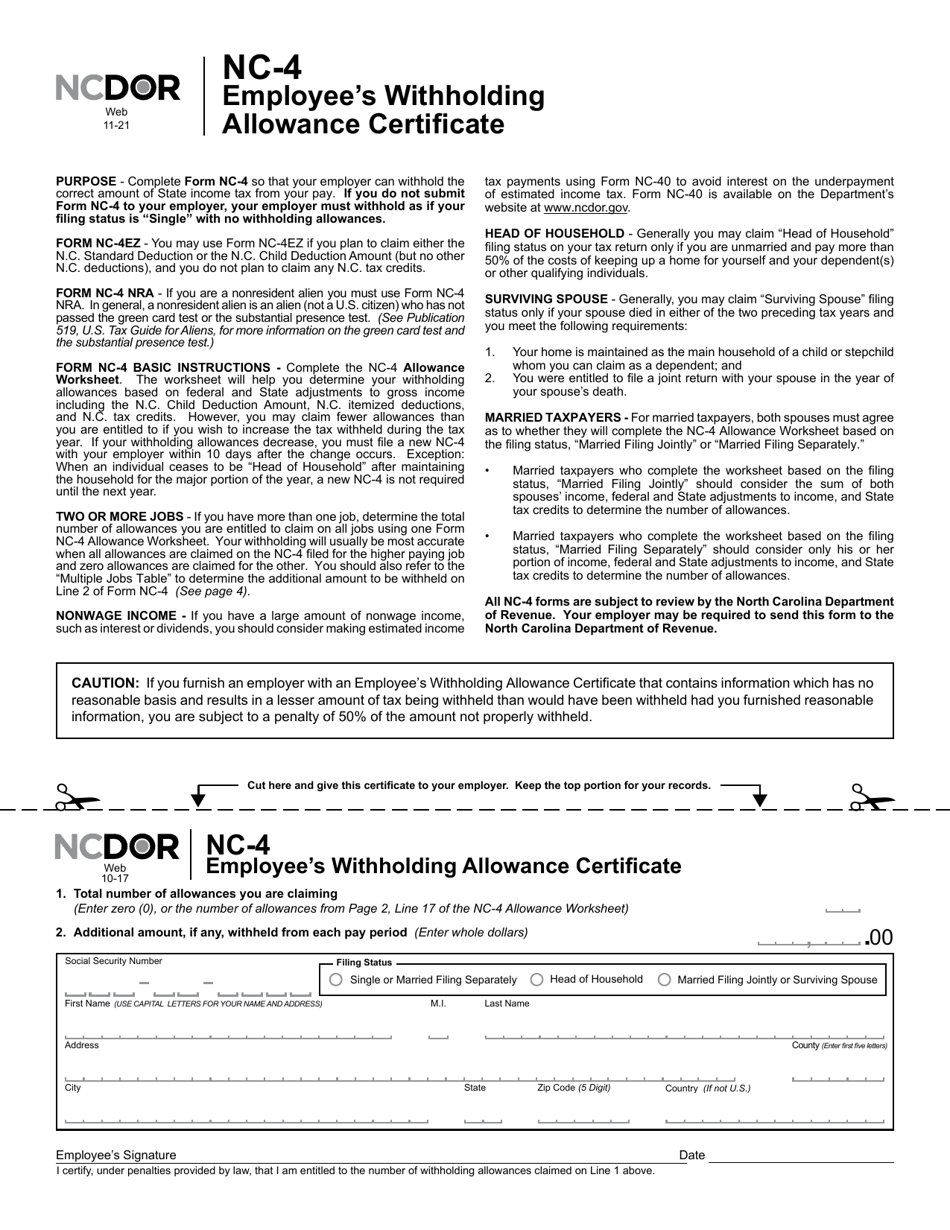

What Is Form NC-4?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-4?

A: Form NC-4 is the Employee's Withholding Allowance Certificate for North Carolina.

Q: Who needs to fill out Form NC-4?

A: Employees in North Carolina need to fill out Form NC-4.

Q: What is the purpose of Form NC-4?

A: Form NC-4 is used to determine how much income tax should be withheld from an employee's wages.

Q: How do I fill out Form NC-4?

A: You need to provide your personal information, such as your name, address, and social security number, and indicate the number of withholding allowances you are claiming.

Q: When do I need to submit Form NC-4?

A: You should submit Form NC-4 to your employer as soon as possible, preferably before you start your job.

Q: Can I change my withholding allowances after submitting Form NC-4?

A: Yes, you can change your withholding allowances by submitting a new Form NC-4 to your employer.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

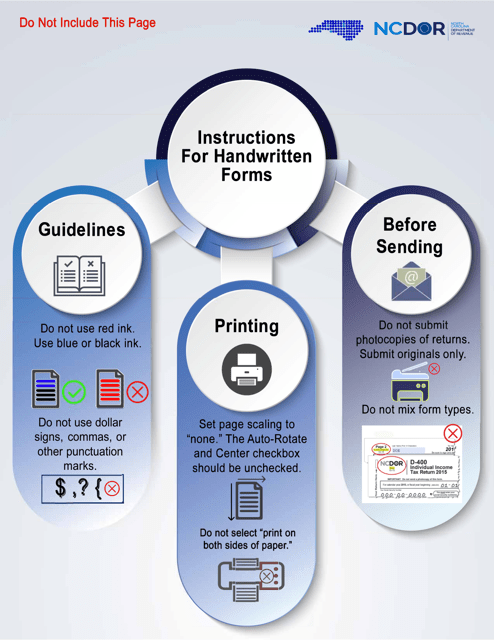

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-4 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.