This version of the form is not currently in use and is provided for reference only. Download this version of

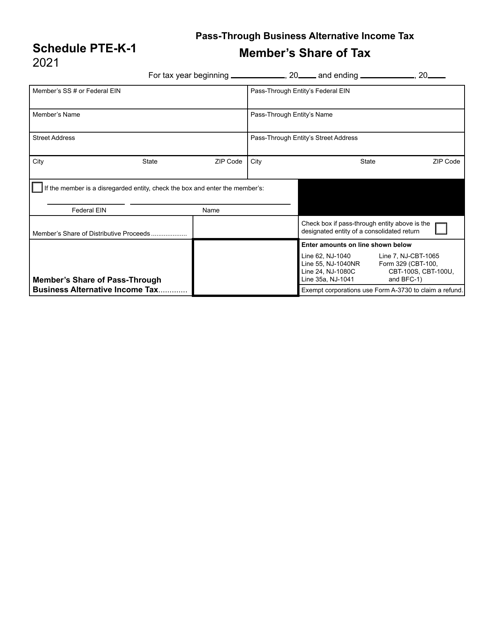

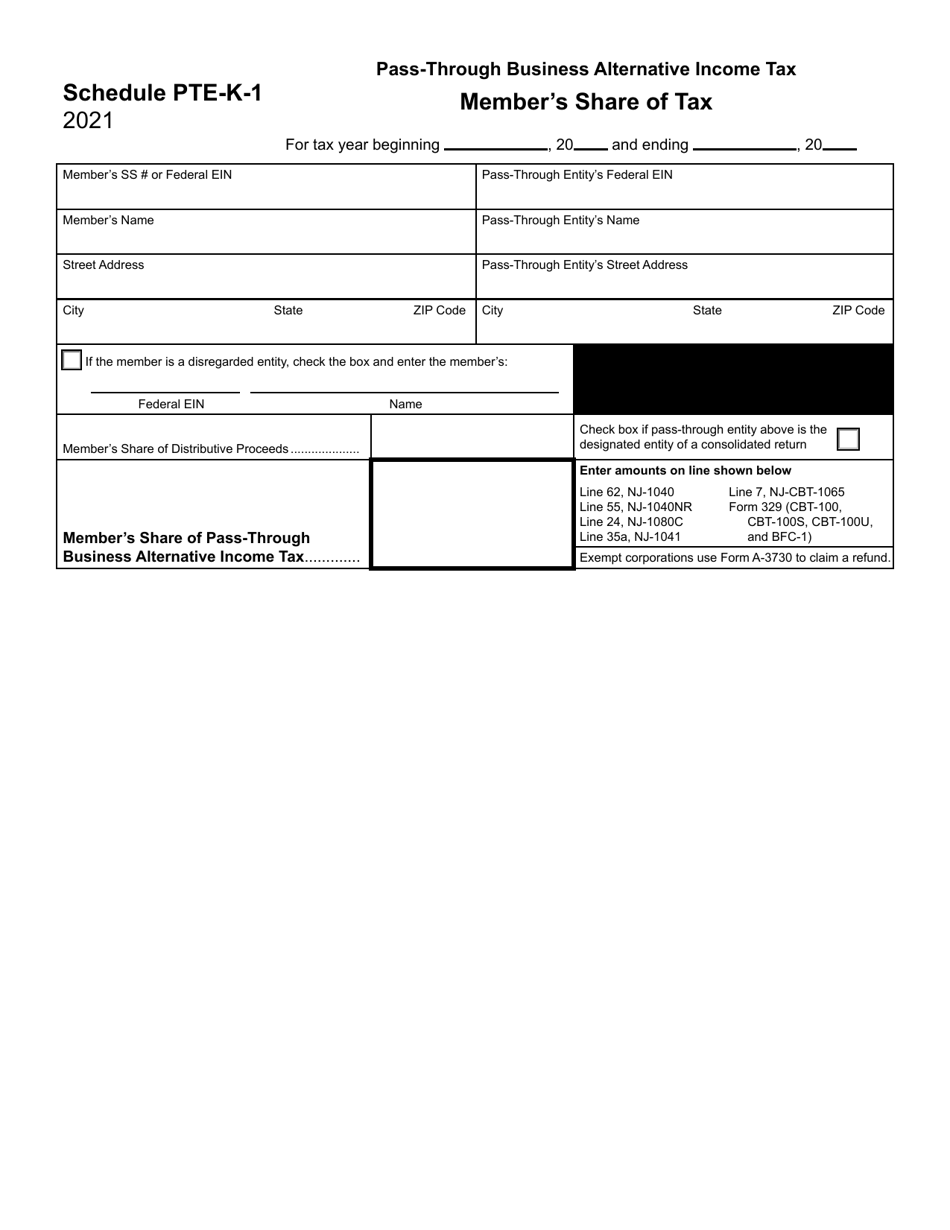

Schedule PTE-K-1

for the current year.

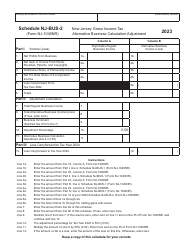

Schedule PTE-K-1 Member's Share of Tax - Pass-Through Business Alternative Income Tax - New Jersey

What Is Schedule PTE-K-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule PTE-K-1?

A: Schedule PTE-K-1 is a form used to report a member's share of tax for the Pass-Through Business Alternative Income Tax in New Jersey.

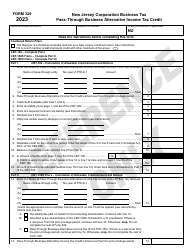

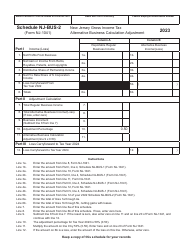

Q: What is the Pass-Through Business Alternative Income Tax?

A: The Pass-Through Business Alternative Income Tax is a tax levied on certain pass-through businesses in New Jersey.

Q: Who needs to file Schedule PTE-K-1?

A: Members of pass-through businesses subject to the Pass-Through Business Alternative Income Tax in New Jersey need to file Schedule PTE-K-1.

Q: What information is required on Schedule PTE-K-1?

A: Schedule PTE-K-1 requires information about the member's share of income, deductions, and the calculation of the Pass-Through Business Alternative Income Tax.

Q: When is the deadline for filing Schedule PTE-K-1?

A: The deadline for filing Schedule PTE-K-1 is the same as the deadline for filing the New Jersey Gross Income Tax return, which is typically April 15th.

Q: Is Schedule PTE-K-1 only for residents of New Jersey?

A: No, Schedule PTE-K-1 is for anyone who has income from a pass-through business subject to the Pass-Through Business Alternative Income Tax in New Jersey, regardless of residency.

Q: What happens if I don't file Schedule PTE-K-1?

A: If you are required to file Schedule PTE-K-1 and fail to do so, you may be subject to penalties and interest on the tax due.

Q: Can I get an extension to file Schedule PTE-K-1?

A: Yes, you can request an extension to file Schedule PTE-K-1, but you must still pay any tax due by the original deadline.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule PTE-K-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.