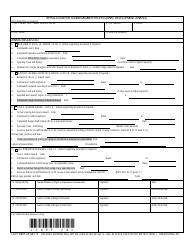

This version of the form is not currently in use and is provided for reference only. Download this version of

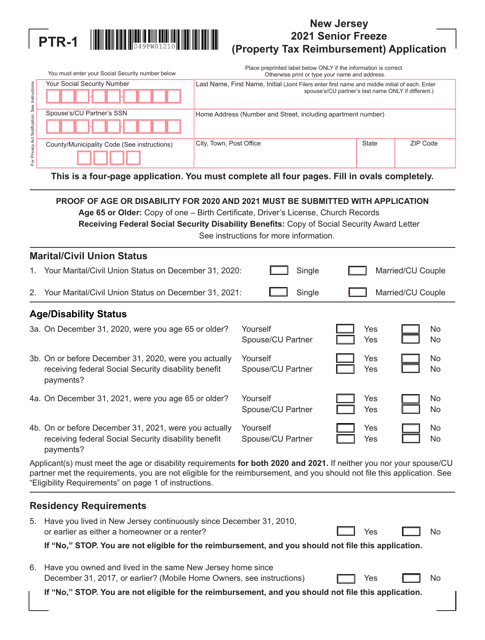

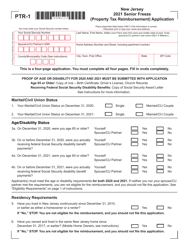

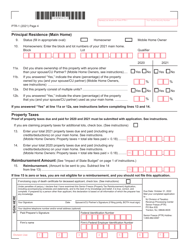

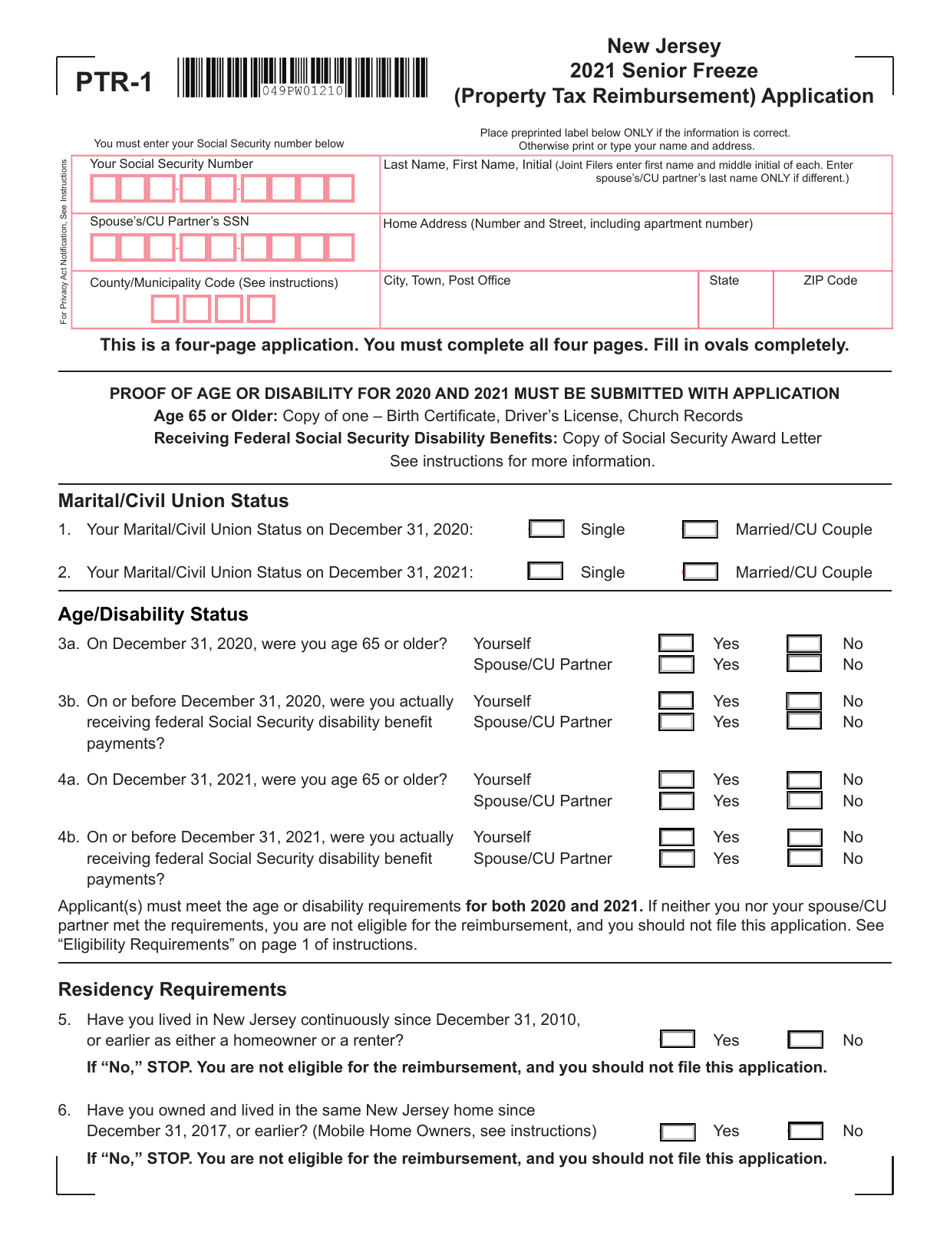

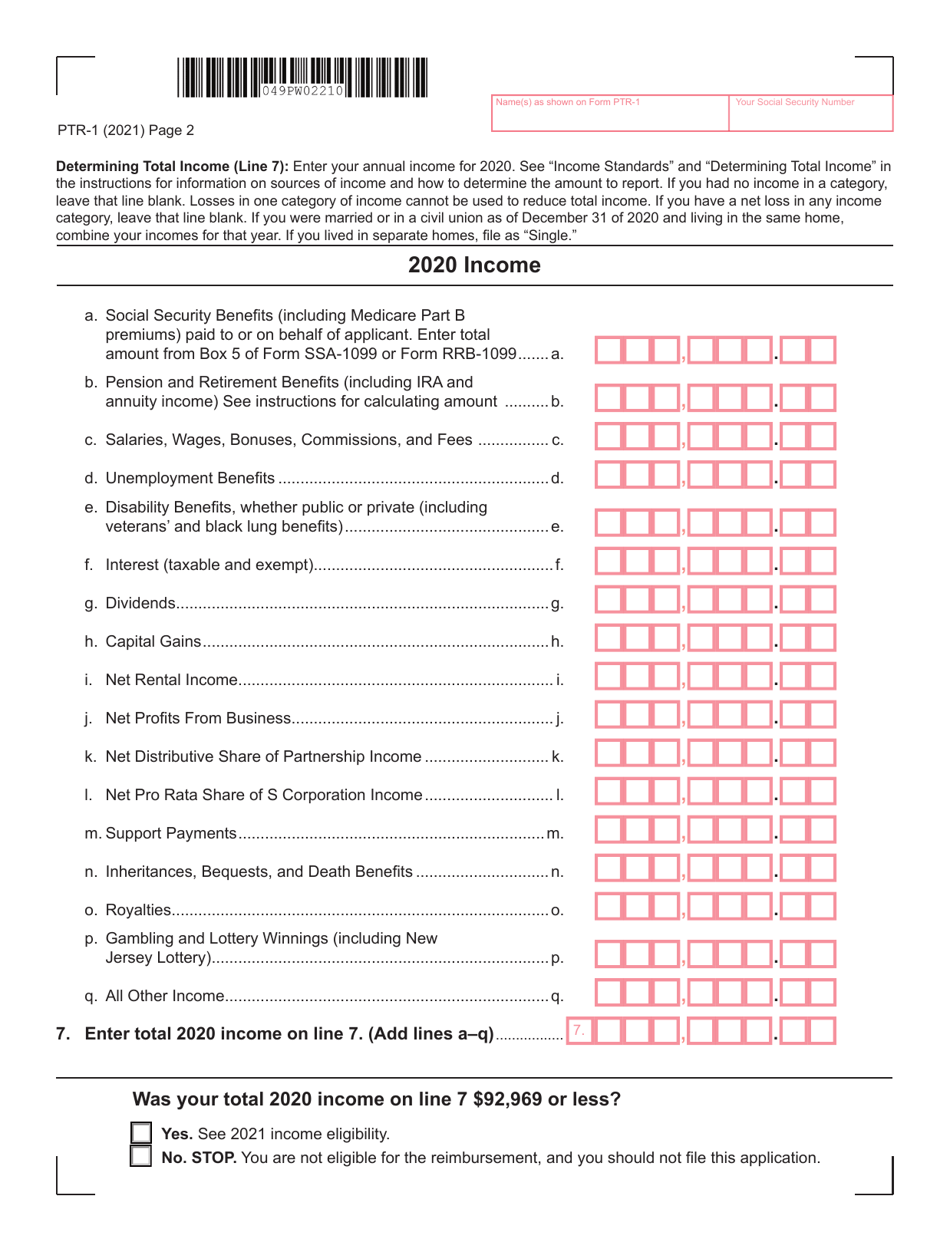

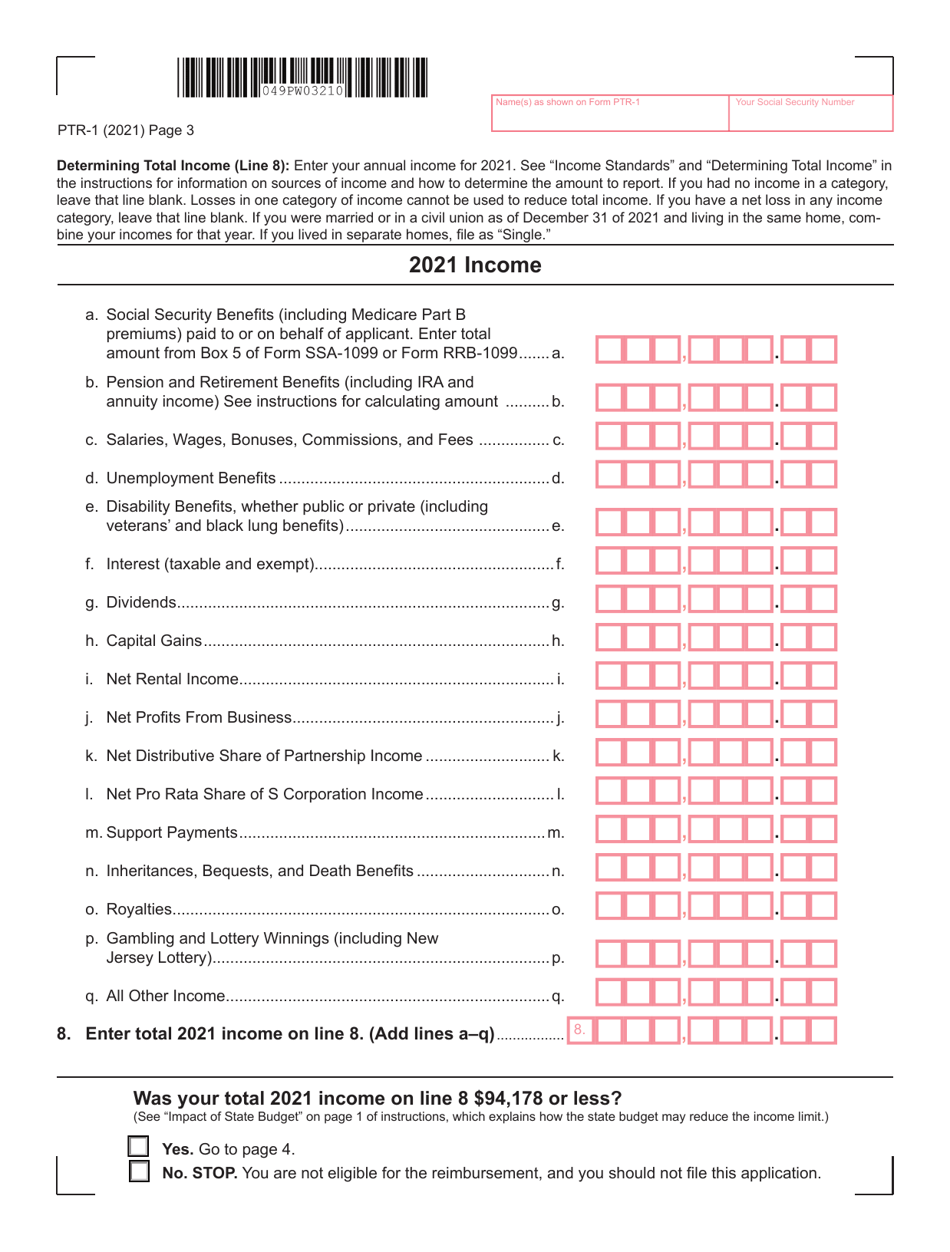

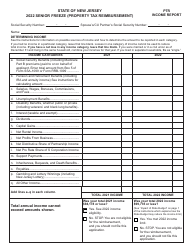

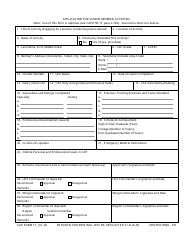

Form PTR-1

for the current year.

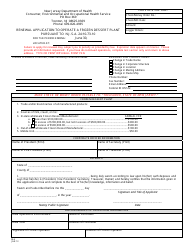

Form PTR-1 Senior Freeze (Property Tax Reimbursement) Application - New Jersey

What Is Form PTR-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

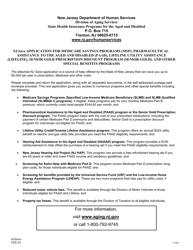

Q: What is the PTR-1 form?

A: The PTR-1 form is the Senior Freeze (Property Tax Reimbursement) Application form.

Q: What is the Senior Freeze program?

A: The Senior Freeze program is a property tax reimbursement program in New Jersey.

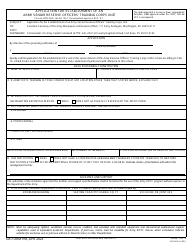

Q: Who is eligible for the Senior Freeze program?

A: Senior citizens and disabled individuals who meet certain income and residency requirements are eligible for the Senior Freeze program.

Q: What is the purpose of the PTR-1 form?

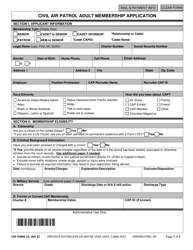

A: The PTR-1 form is used to apply for the Senior Freeze program and claim property tax reimbursement.

Q: What documents are required to fill out the PTR-1 form?

A: You will need documents such as proof of income, proof of age or disability, and proof of property taxes paid.

Q: When is the deadline to submit the PTR-1 form?

A: The deadline to submit the PTR-1 form is generally on or before October 31st of the application year.

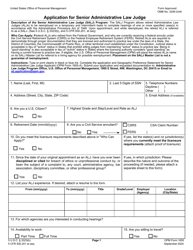

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PTR-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.