This version of the form is not currently in use and is provided for reference only. Download this version of

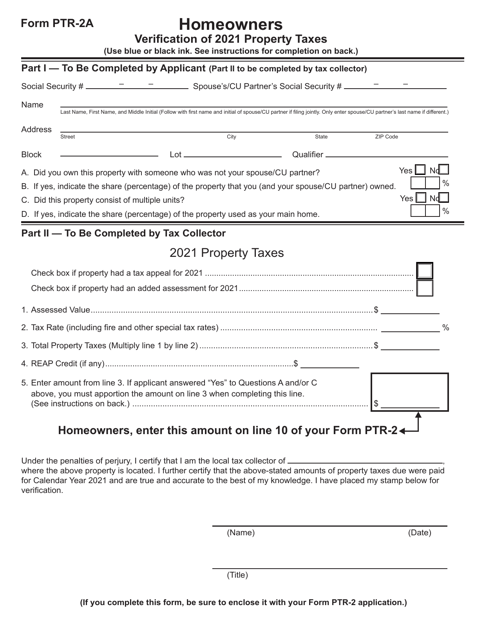

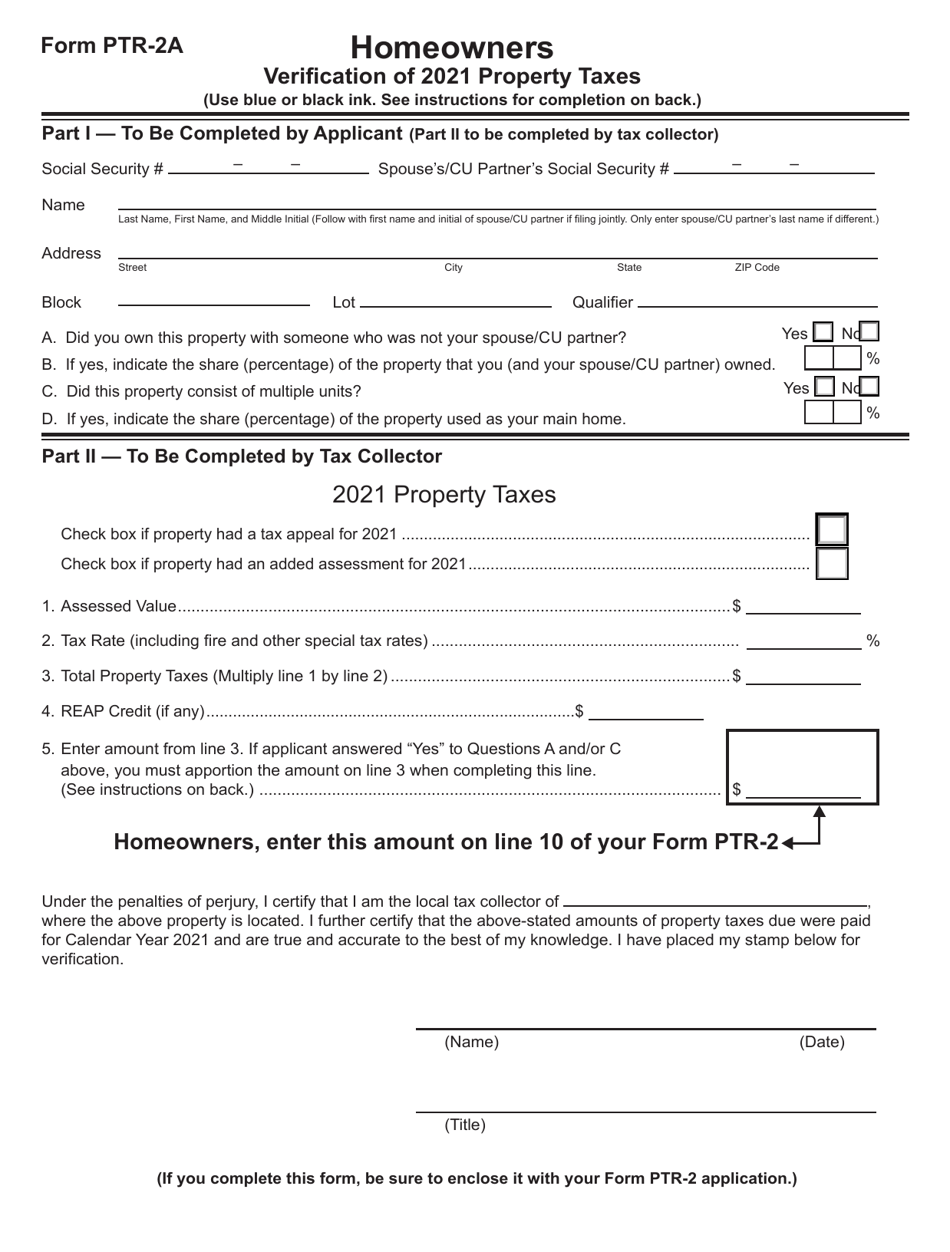

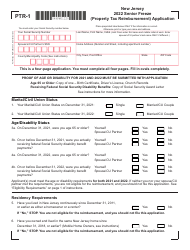

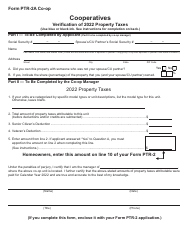

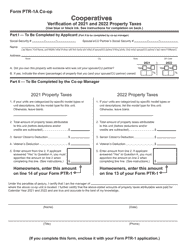

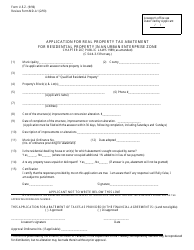

Form PTR-2A

for the current year.

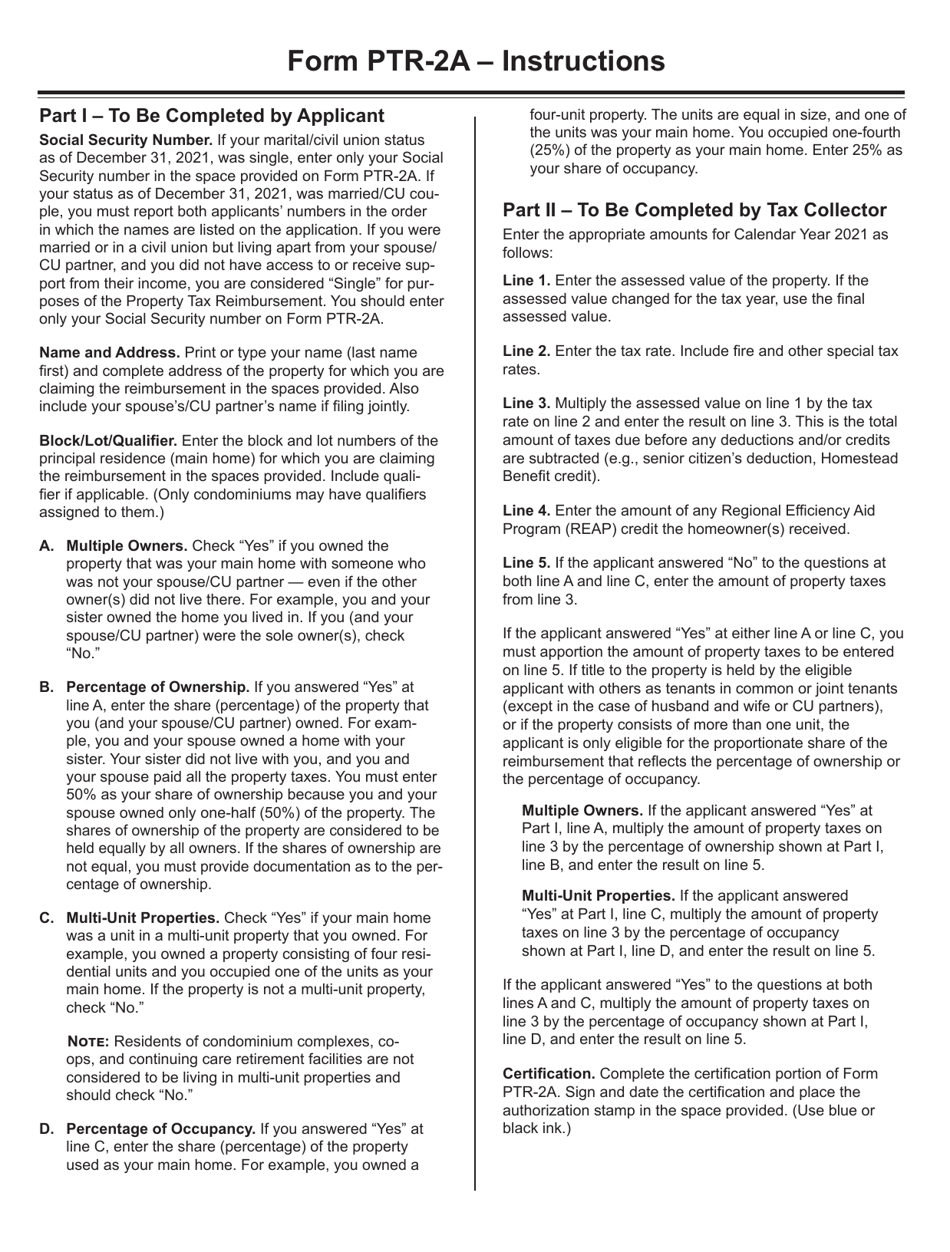

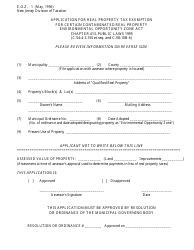

Form PTR-2A Homeowners Verification of Property Taxes - New Jersey

What Is Form PTR-2A?

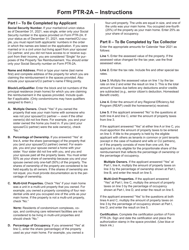

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTR-2A?

A: Form PTR-2A is the Homeowners Verification of Property Taxes form used in New Jersey.

Q: Who needs to fill out Form PTR-2A?

A: Homeowners in New Jersey who are applying for the Homestead Benefit must fill out Form PTR-2A.

Q: What is the purpose of Form PTR-2A?

A: The purpose of Form PTR-2A is to verify property taxes paid by homeowners in order to determine eligibility for the Homestead Benefit.

Q: When is Form PTR-2A due?

A: Form PTR-2A is generally due by November 30th of the benefit year.

Q: Can Form PTR-2A be filed electronically?

A: No, Form PTR-2A cannot be filed electronically and must be submitted by mail.

Q: What documents do I need to submit with Form PTR-2A?

A: Homeowners must submit copies of their property tax bills or statements, as well as any other documentation requested on the form.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PTR-2A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.