This version of the form is not currently in use and is provided for reference only. Download this version of

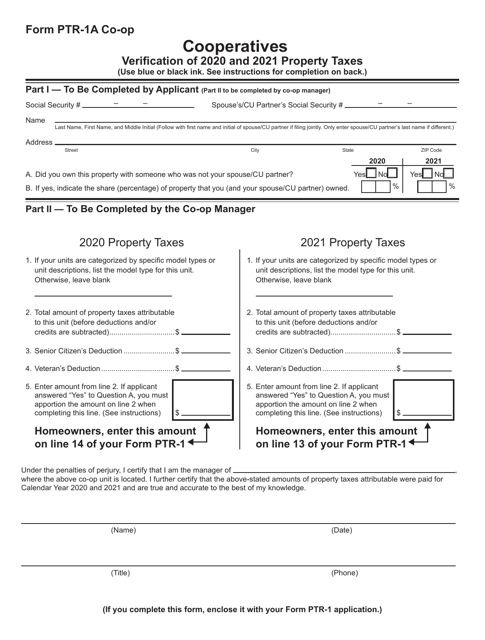

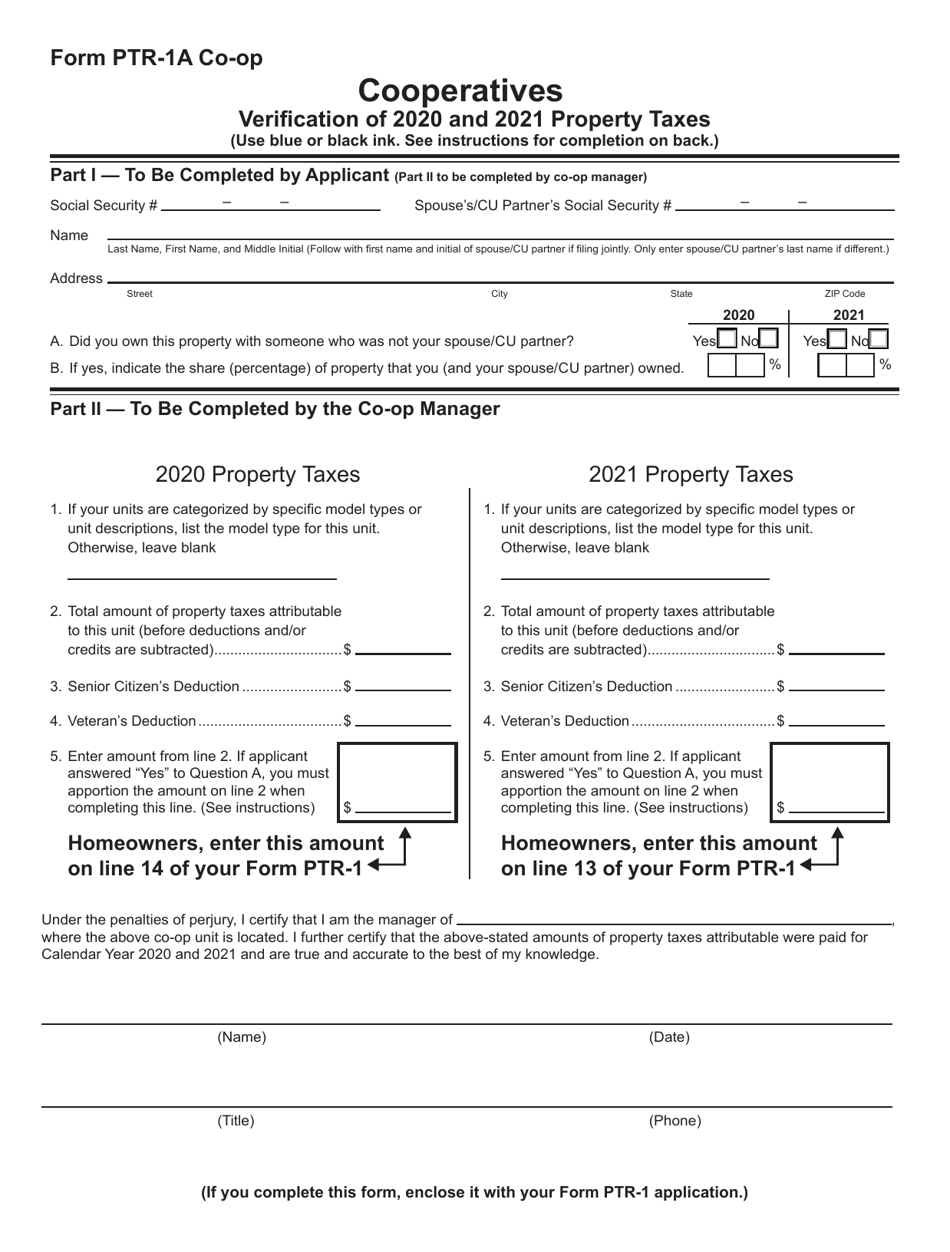

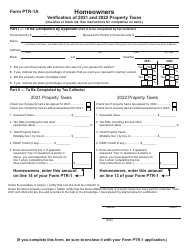

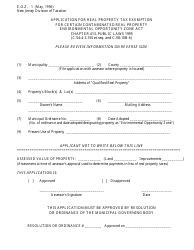

Form PTR-1A CO-OP

for the current year.

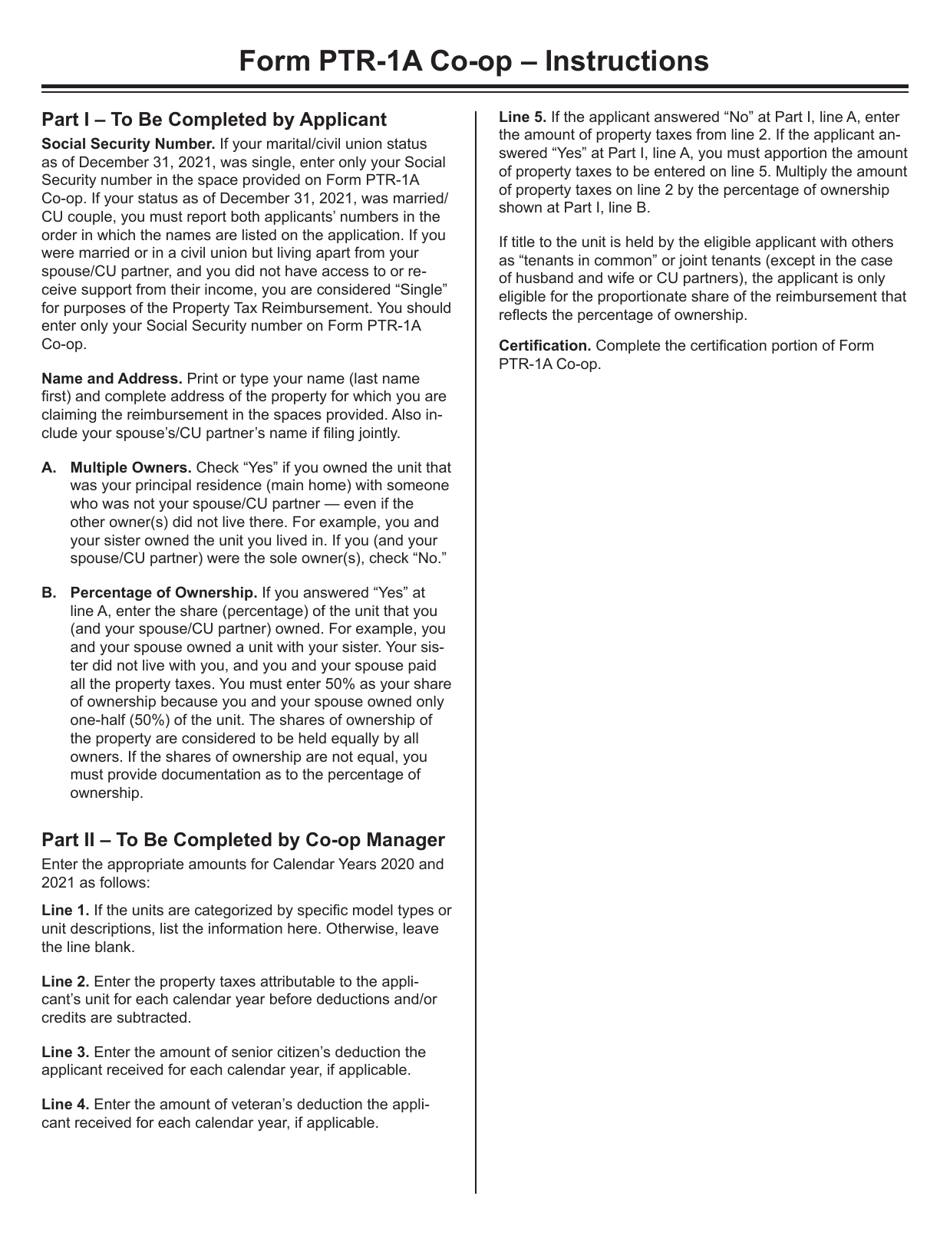

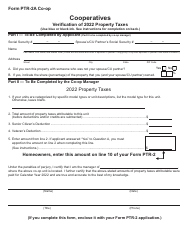

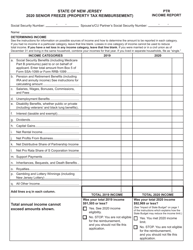

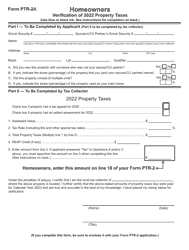

Form PTR-1A CO-OP Cooperatives Verification of Property Taxes - New Jersey

What Is Form PTR-1A CO-OP?

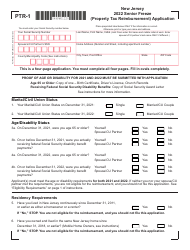

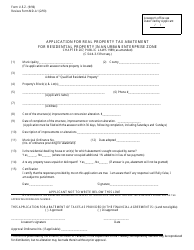

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PTR-1A CO-OP?

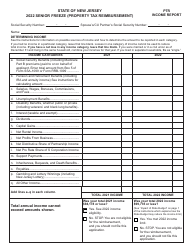

A: PTR-1A CO-OP is a form used for the verification of property taxes for cooperative associations in New Jersey.

Q: Who uses PTR-1A CO-OP?

A: Cooperative associations in New Jersey use PTR-1A CO-OP.

Q: What is the purpose of PTR-1A CO-OP?

A: The purpose of PTR-1A CO-OP is to verify and report property taxes for cooperative associations.

Q: Are cooperative associations required to file PTR-1A CO-OP?

A: Yes, cooperative associations in New Jersey are required to file PTR-1A CO-OP to report their property taxes.

Q: What information is needed to complete PTR-1A CO-OP?

A: You will need information about the cooperative association, property, and property taxes to complete PTR-1A CO-OP.

Q: Is there a deadline to file PTR-1A CO-OP?

A: Yes, PTR-1A CO-OP must be filed by February 1st of each year.

Q: What happens if PTR-1A CO-OP is not filed?

A: Failure to file PTR-1A CO-OP may result in penalties and loss of certain tax benefits.

Q: Is there a fee for filing PTR-1A CO-OP?

A: There is no fee for filing PTR-1A CO-OP.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PTR-1A CO-OP by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.